The Last 1,000 Marker, Nov 21

Dec 5 '14 Dow almost reaches 18,000 (17,991 high) for the first time. 506 trading days

later the Dow closed at 17,888 on Nov 4 '16. Now 11 trading days later, the Dow closes

at 18,956, right at its 19,000 level.

With the headlines - or should I say headwinds - below, would it really be that surprising

if after taking almost 2 years to reach Dow 19,000, that this was the final 1,000 marker

in the central bankers' bubble?

Janet Yellen Says Interest Rates Could Rise "Relatively Soon", Fox Business, Nov 18

Saudis, China Dump Treasuries; Foreign Central Banks Liquidate A Record $375 Billion

in US Paper, Zero Hedge, Nov 17

"Big Short" Investor Steve Eisman is Worried About European Bank's Non-Performing

Loans, Business Insider, Nov 18

Italy's Referendum Holds The Key To The Future of the Euro, FT, Nov 20

Gold Price Skyrockets in India After Currency Ban, Jayant Bhandari, Acting Man, Nov 9

Treasury Yields, Mortgage Rates Rising At Record Pace, The Street, Real Money, Nov 19

What Will Investors Do When Suppression of Risk Doesn’t Hold?, Sept 28

1>40, Dana Lyons' Tumblr, Sept 12

Deutsche Bank in Free Fall, Shares, CoCo Bonds Plunge. Merkel Gives Cold Shoulder

on Bailout. Bank Denies Everything, Wolf Street, Sept 26

Chart Shows China Debt Bubble Larger Than Subprime Bubble, MarketWatch, June 1

State Street: "Move Over Zero Hedge, There is a New Bear In Town", Zero Hedge, 9/23

Some of the world's largest institutions - World Trade Organization, United Nations, and

Bank of International Settlements - keep sending out warnings that don't match the "no

fear here" U.S. stock markets.

Global Trade To Grow At Slowest Pace Since Financial Crisis, Zero Hedge, Sept 27

UN Fears Third Leg of the Global Financial Crisis with Prospect for Epic Debt Defaults,

Ambrose Evans- Pritchard, Uk Telegraph, Sept 22

China facing full-blown banking crisis, world's top financial watchdog warns, UK

Telegraph, Ambrose Evans-Pritchard, Sept 19

Click here to join those gaining specific market insight from the ongoing paid research

found in The Investor’s Mind. Deception has never been higher. Constant vigilance and

critical thinking never more needed when change is a constant at the trading and system

level.

Will the Federal Reserve and Bank Of Japan Turn Markets Back To Calm?, Sept 14

The signals are coming from everywhere now. The showdown between who is stronger,

central bankers or history, is once again on the block. A time to stay alert for big changes.

Stocks Trading Range Now Beyond Compare, Dana Lyons' Tumblr, Sept 6

JPM Explains Why Everything Is Dumping:"The Market Has a BoJ Problem", VaR Shock

Returns, Zero Hedge, Sept 12

Paul Singer: 'It 's a Very Degernous Time in the Global Economy', Business Insider, 9/13

Click here to join those gaining specific market insight from the ongoing paid research

found in The Investor’s Mind. Deception has never been higher. Constant vigilance and

critical thinking never more needed when change is a constant at the trading and system

level.

High Level Warnings; Is Main Street Listening or Trusting Central Banks?, Aug 31

With 5 major US equity markets reaching all time highs this month, yet none even 3%

above their 2015 all time highs,are Main Street investors exiting now or developing a sell

strategy with their advisor? Why would anyone sail into these dangerous waters without

a plan for the next big bust phase like 2008?

Many European Banks Have Lost Half Their Value, CNN Money, Aug 2 ‘16

US Bank Stocks Surge To 2016 Highs Despite Collapse in Yield Curve To 9 Year Lows,

Zero Hedge, Aug 29

Bill Gross: The Fed Has Mastered Market Manipulation, CNBC, Aug 31 '16

[Stanley] Drunkenmiller: Get Out of the Stock Market, Own Gold, CNBC, May 4 ‘16

Carl Icahn is Betting Big on Stock Market Crash, Fortune, May 16

Jim Grant (Grant’s Interest Rate Observer): “This Will Turn Out To Be Very Bad For

Many People”, Zero Hedge, Aug 23 ‘16

Deutsche Bank’s Shocking ECB Rant: Warns of Social Unrest and Another Great

Depression, Zero Hedge, June 9 ‘16

Citigroup is About To Relive Its 2008 Derivatives Nightmare, David Stockman, Aug 22

Bank of Japan Prepares for Crash Triggered by Fed Tightening, Wolf Street, Aug 26

“It’s Gone”: Why Foreign Demand For US Treasuries Has Disappeared, ZH, Aug 23

Former Fed President: All My Very Rich Friends Are Holding A Lot of Cash,

Forbes, June 9

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level

Unlimted Rescues Brings Limited Ethics, July 29 '16

If We Can't Be Honest, No Solution Is Possible, Charles Hugh Smith, July 21

Denial of the Obvious, Praise For Lies, Mish Shedlock, July 24

It would seem that the theme among the big global central banks right now is to keep the

US stock indices at “all time highs”, and global equity markets from stalling again no

matter what it takes to keep up this view of “investment utopia”. Is this a monetary policy

or political? Is the problem financial or ethics?

Japan Sees Weaker Consumer Spending, manufacturing in June, The [Japan] Mainichi,

July 29

Nikkei Whipsaws After BoJ Disappointment; Yen Surges Against Dollar, CNBC, July 29

GDP Shocker: US Economy Grew Only 1.2% in Second Quarter; Q1 Revised to 0.8%,

Zero Hedge, July 29

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level

Could Too Much "Assitance" Be a Bad Thing?, July 14 '16

Look at the two articles below, the two charts, and my most recent article, The Soaring

Risk of Flying in Bernanke's Helicopter. Do you see a big problem?

The Market Should Not Be At Record Highs - CEO of World's Largest Asset Manager

CNBC, July 14

"It's Prohibited By Law" - A Problem Emerges for Japan's "Helicopter Money " Plans,

Zero Hedge, July 14

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

Brexit Deflationary Bear Begins, June 27, '16

The Brexit contagion: How France, Italy, and the Netherlands now want their

referendum too, UK Telegraph, June 23

Brexit cost investors $2 trillion, the worst on day drop ever, CNBC, June 26

'This is the Worst', Alan Greenspan Says of British Breakup Events, CNBC, June 26

Looking to Hike? Yellen Finally Admist Stocks ARea Overpriced, Daily Bell, June 23

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

World Records, S&P 500, and Global Financial Organizations: Peak Warnings Of The

Switch From Risk On To Risk Off, June 13 '16

Is the 10- Year German Bund Yield About To Turn Negative, MarketWatch, June 9

“Everything’s still on the road for deflation,” said Hideo Shimomura, the chief fund investor

at Mitsubishi UFJ Kokusai Asset Management in Tokyo, which oversees about $106

billion. “Investors are forced to buy. There are no other options.”

German 10-Year Sovereign Bond Yields Turn Negative For First Time, CNBC, June 14

El-Erian Yen Nightmare Helps Send Japan Bond Yields To New Lows, Bloomberg,

June 9

Ultimate Market Timer Sam Zell: “Know What the Problem Is?”, Wolf Street, May 27

World Bank Cuts Global Growth Forecast on Weak Demand, Commodity Prices, Financial

Express, June 7

Act Now, Or Risk Another Deep Downturn, OECD Warns Policymarkets, Yahoo Finance,

June 1

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

Algo Games Can Stall, Not Stop Decline, May 17 ‘16

The clock is ticking down on how many games can be played to stall the largest bust on

record. Once again, we find no shortage of warnings.

Bull Market Losing Biggest Ally As Buybacks Fall Most Since 2009, Bloomberg,

May 15

Soros Fund Outlines New Allocations, CNBC, May 17

Goldman: The Median Stock Has Never Been More Overvalued, Zero Hedge, May 15

“Markets Have No Purpose Any More” Mark Spitznagel Warns “Biggest Collapse In

History” Is Inevitable, Zero Hedge (from Financial Times), May 16 ‘16

If someone tells you, “they” have things in place to protect your investments, tell the

individual to read the article below.

High Frequency Trading: ‘Circuit Breaker’ Remedy Aimed At Avoiding Flash Crash

Debacles Caused Market Mayhem In Sell-Off, Int’l Business Times, Aug 26 ‘15

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

The “Assisted” Dow 18,000 Bubble, April 25 ‘16

Eric Hunsader: The Financial System is “Absolutely, Positively Rigged”, An Interview with

Chris Martenson, Peak Prosperity, April 18, 2016

If you have received a $750,000 whistleblower award from the SEC and have over 74,000

followers on twitter and are recognized as a world authority on high frequency trading, you

don’t need to listen to this interview. Otherwise, make time to listen to this interview soon.

Other world issues that the 2600 point, 10 week rally in the Dow is currently not reflecting.

Why should we take advice from a president who has surrendered the world to chaos?

UK Telegraph, April 25 '1

Saudis threaten to sell $750 Billion US Assets If Congress Passes Bill That Would Let

9/11 Victims Sue Saudi Arabia, Business Insider, April 16,’16

China Debt Load Reaches Record High As Risk To Economy Mounts, Financial Times,

CNBC, April 24 ‘16

In a Shocking Finding, The Bank of Japan Is Now A Top 10 Holder In 90% of Japanese

Stocks, Zero Hedge, April 25 ‘16

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

Nosebleed US Stock Levels Meet Buyback Blackout Period, March 23 '16

Buyback Blackout Period Leaves U.S. Stocks On Own Prior To Earnings, Bloomberg,

March 23 '16

Bullish or bearish for stocks as we head toward April? I keep looking across all markets

at various time intervals. The story only grows louder.

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

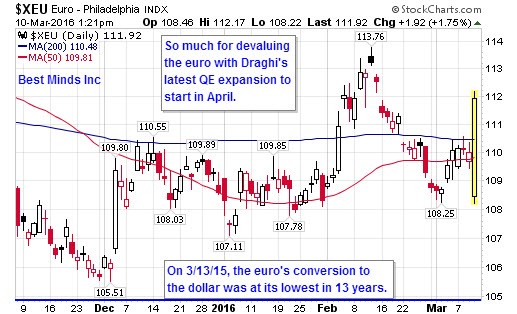

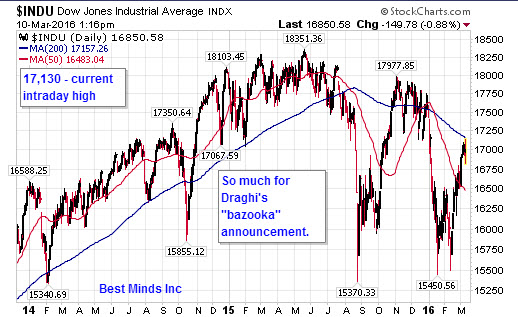

Draghi’s “Bazooka” Fizzles Out As Dow Reaches 200 Day, March 10, 2016

The image of “King” central banker met strong headwinds today, and this was anticipated

as a big positive for stocks. Of course, anyone looking across world markets at various

timeframes would have known already the central bankers are losing out to financial

reality the longer this game continues.

When looking at the charts above and the articles below, does this look more like the

last state supported rally at these levels, or the start of another major bull?

As Foreign Central Banks Quietly Park $250 Billion In Cash At The Fed, A Mystery

Emerges, Zero Hedge, Feb 22

Deutsche Bank Declares War on Mario Draghi, Any Further QE Will Push Stocks Lower,

ZH, Jan 22

Someone Isn’t Buying This Rally: The “Smart Money” Sells For Five Consecutive Weeks

As Buybacks Soar, ZH, March 1

Failed Trades in 10-Year Treasury Soar as Note Stays “Special”, Bloomberg, March 8

China February Exports Post Worst Fall Since 2009, Reuters, March 8

Moody’s Sees Junk Defaults Reaching Highest Since 2009, Bloomberg, March 1

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

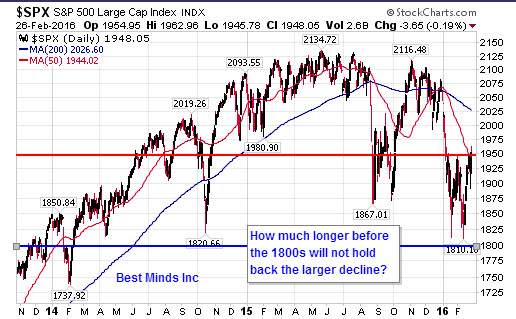

The Thin Line Between Reality & Fiction, Feb 26 ‘16

This week has been one of the most intense weeks I have watched since I started

tracking and providing commentary on major market moves in 2007. Price movements

between major global markets have been almost surreal, as though finding the bullish or

bearish pea in the shell game were being played out right before our eyes. This is so

much larger than US stocks.

Sound a little over the top. Then read the headlines below, and ask yourself, “Why after 4

rallies at or back up through the August 24, 2015 bottom in the S&P 500 is the index

down less than 10% today from its all time high last May, now 9 months ago? YET the

very same index was down 12.5% at the August 2015 low and September 2015 low?

What is really taking place to keep the illusion of “strength” when we examine articles like

these?

Citi: Risk of Global Recession Rising, CNBC, Feb 25

It’s All A Short Squeeze – Goldman Expects a 20% Drop Before Markets Rally, Zero

Hedge, Feb 24

Fed’s Lockhart Says Rising Rates to Create Risk for U.S. Banks, Bloomberg, Feb 25

Don’t Expect “Crisis Response” From G-20, Treasury Secretary Lew Says, Marketwatch,

Feb 24

China’s Commercial Banks Face HK $1.45 Trillion in ‘Non-Performing’ Loans; Bad

Debts Rise to Highest Level Since 2009, South China Sea Post, Feb 16

Fantasy and Magic: A New Central Bank Approach, WSJ (Fidelity link), Feb 23

Click here to join those gaining specific insight from the ongoing paid research found in

The Investor’s Mind. Deception has never been higher. Constant vigilance and critical

thinking never more needed when change is a constant at the trading and system level.

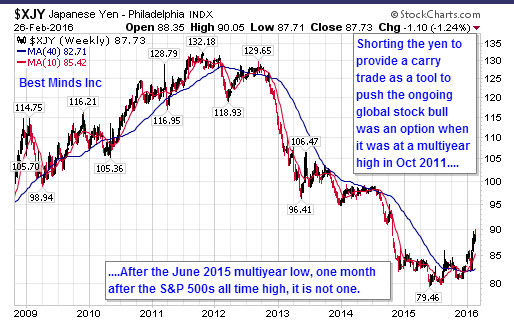

Dow 16,000 Being Fought, Seeks To Ignore Currency War Reality - Feb 4 '16

Pictures of the Financial Cliffs

US Dollar, Dow, Channels in Russell and Transports, and Money Velocity - Spans Century

Tom Lee – No Recession, It Just Feels Like It, CNBC, Jan 4 ‘16

It would seem we would all be wise to do our own thinking, rather than look for headlines

to merely make us feel good now.

Toxic Loans Around the World Weigh on Global Growth, NY Times, Feb 3 ‘16

Why BofA Remains A Seller Until "A Coordinated And Aggressive Global Policy Response"

Emerges, Zero Hedge, Feb 4

Stocks Are Getting Riskier, Because Consumers Are Spending Less, World Financial

Digest, Feb 4

DAX Plunges To 1 Year Lows As Deutsche Bank CoCos Crash, Italian Bank Stocks Slide,

ZH, Feb 5

Click here to join those subscribing to The Investor’s Mind, where watching for change

at the trading and system level is a constant. 2015 is over. 2016 is unleashed.

The Global Bear and Roller Coaster Are On; Time For Another Delay? Jan 20 '16

A "One World" Rally Since 2011. A Global Decline Since Q2 '15. Now a "Team" Bounce?

Is China's "National Team" Now Bailing Out US Markets, Zero Hedge, Jan 20

Most Shorted Stocks Suddenly Spike As Biotech Soar, ZH, Jan 20

Harry Reid Urges "Calm" Despite Stock Drop, ZH, Jan 20

ECB's Mario Draghi Hints At More Stimulus in March, WSJ, Jan 21

What Should Really Concern Investors and Politicians?

Saudi Arabia Severs Ties With Iran, Expels Iranian Diplomats, CBC News/ World, Jan 3

China Shakes The World Again, For What It Is Worth; Evergreen/Gavekal, Jan 15

RBS Is Telling Traders To "Sell Everything", The Independent, Jan 12

Amazon And The Fantastic FANGs __ A Bubblicious Breakfast Of Unicorns And Slippery

Accounting , David Stockman, Jan 13

Click here to join those subscribing to The Investor’s Mind, where watching for change

at the trading and system level is a constant. 2015 is over. 2016 is unleashed.

Stay Awake: The Global Liquidity and Currency Devaluation Panic Is On As The S&P

500 Seeks To Squeeze out 2015 Gain, Dec 30

How much credit panic will it take to hit the algorithms playing artificial games with US

stocks attempting to produce a gain for the year? 2016 starts in a credit crisis, not a

recovery.

Algorithmic picture of the “calm” S&P 500 - December 30, 2015

Last day of 2015 could not hold above 12/31/14 close.

Global credit stress points:

The Bail-Ins Are Back! Portugal Slaps Senior Note Bondholders With € 2 Billion Loss,

Zero Hedge, Dec 30

Something Just Snapped in Saudi Arabia, ZH, Dec 29

Puerto Rico To Default on $37 Million Bond Payments Due Jan 1, Bloomberg, Dec 30

The Russia Ruble Just Tumbled To A Record Low, Business Insider, Dec 17

China capital Outflows To Top $500 Billion In 2015; Institute of International Finance,

Reuters, Dec 12

Get Your Money Out Of Italian Banks Now! Austerity and Bailins Fan Populist Flames,

Mish’s Global Economic Analysis, Dec 29

No Investment Grade Corporate Bond Issuance Due To Rate Hike, Market Realist,

Dec 22

Investment Grade Bonds Funds Witnessed Record Outflows Last Week, Market Realist,

Dec 22

The Dollar Shortage Has Arrived: Africa Runs Out of Dollars, ZH, Dec 23

The Credit Crunch Is Back: Banks Scramble To Collateralize Loans To Record Levels,

ZH, Dec 27

Click here to join those subscribing to The Investor’s Mind, where watching for change

at the trading and system level is a constant. 2015 is over. 2016 starts next week.

Liquidation Problems, Start Raising Rates, Big Options Friday – Don’t Expect Calm

Dec 12

When traders or writers focus on what started the 2007 credit collapse, I have found

the most common event mentioned is the problem two Bear Stearns hedge funds had

with liquidating assets before going under. I still remember writing about this event

that summer.

Anyone looking at options expiration week knows that this is a critical week for the big

financial institutions backing these highly leveraged trades.

Now throw in the fact the short end of the credit markets are reflecting Yellen’s “Ripe

for a Raise” dialogue, and the week is set for the possibility of yet another flash crash.

The Eerie Echo of 2007: It Really Is Bear Stearns All Over Again, Zero Hedge, Dec 12

Is This What Happens On Monday?, Zero Hedge, Dec 11

Janet Yellen Says Economy is Ripe For Fed Interest Rate Increase, NY Times, Dec 2

Make sure and read my latest public article, The Investor’s Great Divide; Crossing the

200.

Click here to join those subscribing to The Investor’s Mind research, where watching for

changes in "the crowd" at the trading and system level is a constant.

A Perfect Market; What Could Go Wrong In December?, Nov 24 '15

A Wall Street Journal Survey finds 92% of economists believe the Federal Reserve

will raise interest rates for the first time hike in 7 years since the Fed Funds rate went to

0-0.25% on Dec 16, 2008. The S&P 500 still hangs less than 2% from its all time high

on May 20, 2015. So what could possibly break this almost perfect centrally planned

nirvana?

Economists Overwhelmingly Expect Fed to Raise Rates in December, WSJ, Nov 12

Insiders Sending an Ominous Market Signal, CNBC, Nov 23

David Stockman Interview: Central Banks Are Out Of Dry Powder, Another Financial

Crisis Is Unavoidable, Contra Corner, Nov 23

Global Trade Just Snapped: Container Freight Rates Plummet 70% in 3 Weeks, Zero

Hedge, Nov 21

The 1% Is Rolling Over, John Rubino, Dollar Collapse, Nov 17

China Imports Fall 19%, Financial Tribune, Nov 9

Japan Economy Contracts 0.8%, Returning to Recession, NY Times, Nov 15

BofA Looks At Europe’s Record € 2.6 Trillion in Negative-Yielding Debt, Is Shocked by

What It Finds, Zero Hedge, Oct 29

“Sell in December and Go Away” – Why Goldman Sees The Market Going Nowhere in

2016, Zero Hedge, Nov 24

Goldman Says US Corporates Have Re-leveraged, Oxford World Financial Digest, Nov 11

Gold Drops Toward 6 Year Low on Dollar, US Rate Hikes, Yahoo Finance, Nov 23

Stocks Close Higher; NASDAQ 100 at Record, CNBC, Nov 3

If you believe that the "perfectly calm" markets will continue into the next Fed meeting on

December 16th as a sign that we can dismiss any “negative” economic and financial

headline, stop here. However, since you are reading this post, you, like myself, must

see something very wrong with this picture.

Sign up for The Investor’s Mind, as we navigate the ever widening world of financial

illusion and economic reality.

We Did IT! NASDAQ 100 Makes New Closing High! Only Takes 15 years and 7

Months To Recover Its 83% Loss While National Debt Increases 230%.

Success? Sustainable?

Should Everyone Be Listening to Warnings Like These?, Nov 5, 2015

Fed Williams: Low Neutral Interest Rates A “Warning Sign”, CNBC, Oct 30

Carl Icahn Warns of a Fed Minefield Ahead, CNBC, Nov 3

The Unsuspecting Public is Being Lead Into Immense Financial Destruction, John

Embry, Kings World News, Nov 4

The S&P 500 Buyback Index Signaled A Market Top In 2000 and 2007 – And Its Falling

Again, David Stockman’s Contra Corner, Nov 3

Bernanke Says Economy Needs To Crash Periodically So We Can Be Sure We’re

Pushing Hard Enough, Zero Hedge, Oct 23

The Ominous Chart Pattern Lurking In the S&P 500 Index, Marketwatch, Nov 2

One Analyst Says China’s Banking Sector Is Sitting on $3 Trillion Neutron Bomb,

Zero Hedge, Nov 2

This Is The Worst U.S. Earnings Season Since 2009: Biggest Quarterly Drop Since The

Aftermath of the Financial Crisis, Bloomberg, Nov 4

Bank of America Looks At Europe’s € 2.6 Trillion in Negative Yielding Debt, Is Shocked

At What It Finds, Zero Hedge, Oct 29

Relatively Few Big Stocks Bearing Weight of This Rally, Dana Lyons’ Tumblr, Oct 30

Global Trade In Freefall; China Container Freight At Record Low; Rail Traffic Tumbles,

Trucking Slows Down, Zero Hedge, Nov 4

While recent headlines like the one below feed the addiction for more central banking

intervention to “save our rally”, the fact that it took more than 15 years and 7 months for

the NASDAQ 100 to close above its March 27, 2000 level should have millions of

investors and advisors questioning their sanity to sit complacent at the height of the

largest financial bubble in history rather than EXITING the casino at these algo driven

levels.

Stocks Have Best Month In 4 Years, Time/Money, Oct 30

What will you do when THE final top in US equities rolls over? Subscribe now as

the NASDAQ 100 is in the 83rd month of its bull market that began in November 2008.

Remember, someone is going to make money on the next big shift toward reality, and

away from "all time high".

Wave 1 Down Is Over. When Wave 2 Up Ends, Wave 3 Down Begins, October 20, 2015

Since the NASDAQ Composite reached its highest level in history on July 20th, the entire

global picture has shifted. The fight to convince the public that this old bull will never die,

has the public about as unprepared as ever for the reality shock that is coming soon.

QE schemes, algorithmic games, and constant market interference have created the

ultimate disconnect from the global economic reality. However, over 79 months have

passed since the March 6, 2009 bottom. The tech bubble bull burst in March 2000

after 72 months, and the October 2007 was after a 60 month bull run. We are way into

this bull's overtime.

Here are more warnings that a bust phase comes after the boom. They can be delayed,

NOT stopped. The economic picture continues to slow as the NASDAQ 100 climbed 10%

in 14 trading days.

As World “Recovers”, China’s Economic Weakness Spreads Wider & Deeper in

September, Zero Hedge, October 9

At US Ports, Exports Coming Up Empty, Wall Street Journal, Oct 13

Corporate Layoffs Surge to Q3 2009 Level, Stock Buybacks At Record Levels, David

Stockman’s Contra Corner, October 3

Comptroller: Springfield Stalemates Puts Pension Payments on Hold,

Chicago Tribune, Oct 14

If the majority of the public are still not considering a powerful phase where financial

assets deflate like the previous two busts since 2000, what warning are they waiting for

to prove that we have a serious problem in front of us?

Click here to subscribe to BMI's most up to date research as we watch the global markets

daily in seeking to separate illusion from reality.

If you are a financial advisor or fiduciary, make certain you read this recent release on

the use of spoofing to mislead other investors in our markets. As I continue to say,

manipulating markets is not a conspiracy theory, it is an ongoing fact.

SEC Charges Firm and Owner With Manipulative Trading, US Securities and Exchange

Commission, Oct 8

Moving From FOMO (Fear of Missing Out) to FOBI - "Fear of Being In", Sept 26

FOMO, Urban Dictionary

Do You Have FOMO: Fear of Missing Out, Forbes

FOMO Addiction: The Fear of Mising Out, Psych Central

We have been trained to HOPE that more central banking intervention will always lead

to more artificially inflated assets prices, and debt will have no consequences.

This is why I believe that "FOBI" could become even more powerful in the near future.

September 25th - Chart of the Dow Jones Industrials & Dow Jones Global

Japan Falls Back Into Deflation For First Time Since 2013, Financial Times, Sept 25

"Everyone Is Praying But No One Is Believing" - The 'Fed Put' Is Dead, ZH, Sept 25

China Slowdown Is Already Hurting Europe, CNN Money, Sept 3

As Xi Jinping Visits The United States, China's Economy is At A Tipping Point,

The Economic Times, Sept 26

Click here to tap into the paid research found in The Investor's Mind newsletter and

daily trading reports.

Waiting for OZ to Raise Rates or Leave Them the Same; Forget the Fed, the REAL

World Continues Pulling Back the Curtain on Central Bankers, Sept 10.

Charts - Death Cross In German DAX, Hanging at the 200 in QQQ

Suddenly The Bank of Japan Has An Unexpected Problem on Its Hand, Zero Hedge,

Sept 3

David Stockman Sums It All Up in 3 Minutes, Zero Hedge, Sept 9

Chart of the Day: Distribution of $12.5 Trillion Global Stock Market Loss Since June 14,

Stockman’s Corner, Sept 8

PBOC Governor Admits China Bubble “Burst” at G20 Meeting, Want China Times, Sept 6

Brazil Cut To “Junk” Credit Rating By Standard & Poor’s, BBC News, Sept 10

Import Price Plunge Gives Yet Another Reason For Fed to Delay Hikes, Marketwatch,

Sept 10

"The bell curve fits reality very poorly...Theory suggest that over time there should be 58

days when the Dow moved more than 3.4%; in fact, there were 1,001...And index swings

of more than 7% should come every 300,000 years; in fact, the 20th century saw 48 such

days. Truly, a calamitous era that insists on flaunting all predictions. Of perhaps, our

assumptions are wrong." - The (Mis) Behavior of Markets: A Fractal View of Risk, Ruin,

and Reward (2004) World famous mathemetician, Dr. Benoit Mandelbrot, pg 13

Click here to tap into the paid research found in The Investor's Mind newsletter and

trading reports.

This is History, Not a "Pullback", Sept 1

The Dow and S&P 500 have now produced clear signals, that we are coming off

the top of the largest financial bubble in history. Click the links and review the "new

normal".

Are you growing or losing money as the bust sets in? Most individuals and the majority

of investment platforms were not designed to grow money during the bust phase

from the greatest central banking debt schemes in history. Click here, to learn how big

AND small investors can grow money as globally assets deflate, and the global

economy slows in the weeks and months ahead.

"A crash is a collapse of the prices of assets, of perhaps of assets, or perhaps the

failure of an important firm or bank....The system is one of positive feedback. A fall in

prices reduces the value of collateral and induces banks to call loans or refuse new

ones, causing mercantile houses to sell commodities, households to sell securities,

industry to postpone borrowing, and prices to fall stll further." - Manias, Panics, and

Crashes: A History of Financial Crises(2000), Charles Kindleberger, pg 105-106

Crosing the 200 Day Moving Average, August 20 [Click Each Link for Chart]

United States - Dow Industrials, S&P 500, NASDAQ Composite, & Russell 2,000

United Kingdom, Germany, China Shanghai, China Hong Kong

Japan [Below 200 on Aug 24]

How Much Longer Can West Ingore China? August 19

“A currency war, fought by one country through competitive devaluations of its currency

against others, is one of the most destructive and feared outcomes in international

economics.” Currency Wars: The Making of the New Global Crisis (2011) James

Rickards, p37

China’s devaluation of the yuan this month has started a new chapter in the battle to

“make the S&P 500 look stable”. How much longer can "assistance" avoid reality?

Take a look at these challenges facing China, the US...and the world.

What China’s Devaluation Means to the US Economy, Wall Street on Parade, Aug 11

Import and Export Prices Back to Deflation, Even Before China Devalued,

24/7 Wall Street, Aug 13

Currency Wars and the Threat of Deflation, Al Jazeera America, Aug 19

China’s Richest Traders are Rushing to Dump Their Stocks To Retail Masses,

Just Like in US, Zero Hedge, Aug 18

Largest Chinese, Russian Naval Exercise Kicks Off This Week, US Naval Institute, Aug 1

Are you preparing for the future or trusting in more slumber US stock experiences like

we have seen so far in 2015? Click here to subscribe to The Investor’s Mind, as history

changes markets and our plans. Time continues running out on trusting the bubble.

The “Death Cross” Forms on the Dow Chart, Bloomberg Business, August 11

More Warnings As Dow 18,000 Fights for Its Life, July 31

Kimble Charting Solutions: Chart of Dow From 1890 to 2015;

Chart of Dow from 1970 to 2015; Commodities at Critical Line, July 2015

IMF’s Christine Lagarde: Global Downside Risks “On the Horizon”, CNBC, July 29

These Six Stocks Are Doing All The Heavy Lifting For the Market Right Now – And

Experts Are Nervous About It, Business Insider, July 27

Bill Gross Explains (In 90 Seconds) How Its All A Big Shell Game, ZH, July 29

The Bankruptcy of the Planet Accelerates – 24 Nations Are Currently Facing A Debt

Crisis, The Economic Collapse, July 16

Click here to subscribe to The Investor’s Mind and trading reports.

Nothing Can Stop Manipulators & Decline, July 10 ’15/Updated July 15

Is it possible, that speed of light computer trading and news algorithms are totally

misleading "the sheep" until “nirvana” is broken? You decide.

Equity Markets7/15/15 - China, UK, Japan, Germany, US, Wilshire 5000/1 hour intervals

"Is The Unthinkable Becoming Routine?", Abstract from the 85th Annual Report

by the Bank of International Settlements, June 28, 2015

"Short term gain risks being bought at the cost of long - term pain."

Greece, Problems Almost Over or Dead Ahead?

Greece Debt Crisis: IMF Attacks EU Over Bailout Terms, BBC, July 15

Even the Economists Is Mocking Central Planning, ZH, July 9

What Happens If Greece Defaults On Its IMF Loans, UK Telegraph, June 30

U.S., IMF Step Up Calls for Europe to Restructure Greece’s Debt, WSJ, July 8,

Default Seen Averted In Swaps By Greek Failure To Pay IMF, Bloomberg, June 30

Greece Shuts Markets Through July 13 As Officials Debate Bailout, Bloomberg, July 9

Germany Crushes All Hope of Greece Getting Debt Relief, ZH, July 8

IMF Bolsters Greek “No” Vote, Says Country Needs Much Bigger Debt Haircut, ZH, July 2

Tsipras Sells Out Referendum ‘No’ Vote Ahead of Weekend Deadline, ZH, July 10

Greek Banks Prepare To Raid Deposits To Avert Collapse, FT, July 4

Cyprus. Greece and Beyond,: The “Bail-In” and Confiscation of Bank Deposits: The

Birth of the New Financial Order, Global Research, July 8

China, Problems Almost Over or Dead Ahead?

The Really Worrying Financial Crisis Is Happening in China, Not Greece,

UK Telegraph, July 9

China Stocks Plunge As State Support Fails to Revive Confidence, Bloomberg, July 7

China Makes Selling for Big Investors Illegal, ZH, July 8

China Soars Most Since 2009 After Government Threatens Short Sellers With Arrest,

Global Stocks Surge, July 9

The Latest Thing In China: Brokers Refusing To Sell, ZH, July 10

China’s Real Economic Problem Is Way Bigger Than The Stock Market, Vox World, July 9

What Does The Most Recent BIS (Central Bankers' Bank) Annual Report See?

World Defenseless Against Next Financial Crisis, Warns BIS, UK Telegraph, July 28

Never has vigilance and skepticism been needed in the minds of investors, advisors,

and frankly, everyone. Sadly, it would appear that the headlines above are still being

ignored by the majority as mere noise, as long as another algorithm driven rally presents

the image of “there is no risk, go back to sleep.”

Click here to subscribe to The Investor’s Mind and trading reports.

Greece: Could Weekend Bring Capital Controls?/ Texas: Bring Home

The Gold, June 18

Greek Capital Controls Baked In As Firms Store Cash Abroad, Bloomberg, June 16

Greek Bank Bonds Plunge To Record Lows, As ELA Haircut Looms, ZH, June 17

Greek Debt Committe Just Declared all Debt to The Troika, "Illegal, Illegitimate,

and Odius, ZH, June 17

"Lehman Weekend" Looms For Greece As Europe Readies "Emergency" Sunday

Meeting , ZH, June 16

Lagarde Warns No Leeway for Greece on June 30 Payment, Bloomberg, June 18

Tsipras to Meet Putin Over Bailout Loan As Fears of Greek Exit From EU Mount,

The Guardian, June 17

Writing's On The Wall: Texas Pulls $1 Billion in Gold From NY Fed, Makes It

"Non-Confiscatable", ZH, June 14

Governor Abbott Signs Legislation To Establish State Bullion Depository, Office of

the Governor Greg Abbott, June 12 '15

Gold Bullion Worth $1 Billion To Be "Repatriated" From NY Fed To New Texas

Bullion Depository, GoldCore, June 16

How much longer can the "Dow 18,000" image hold?

Click here to subscribe to The Investor's Mind newsletter & trading reports, as we watch

the clash between market intervention and the natural lessons from history unfold.

Cracks Widen as Central Banks Juggle Between Stock & Bond Bubbles, June 8

Click each title. The charts are unreal, especially as a group.

Retail Money Market Assets Divided by S&P 500_35years, Eric Horne, Apr '15

China markets plunge in record turnover as margin traders take fright, Reuters, May 28

“Go East, Young Firm’: Chinese Companies Drop New York and Return Listings,

Return Home, Zero Hedge, June 7

NYSE Margin Debt Hits A New Record High, Doug Short, May 29,

Corporate Profits Tanked, Business Insider, May 29

Dow Jones Transports and Utilities Are At Critical Point, Chris Kimble, June 8

Greek Banks On Verge of Total Collapse: Bank Run Surges "Massively" As Depositors

Yank 700 Million Today Alone, Zero Hedge, June 5

Comparing Bubble Bursting Potential, Alhambra Investment Partners, June 6

Percent of Unprofitable IPOs in Last 6 Months Reaches Record, Sundial Capital

Research and Sentimentrader May 2015

Investors In Hot IPOs are Overlooking Serious Risks, Bloomberg, May 1

Click here to subscribe to The Investor's Mind newsletter & trading reports, as we watch

the clash between market intervention and the natural lessons from history unfold.

Liquidity Crisis and Slowdown Do Not Equal Dow 18,000, May 12, 2015

Question One – Is there any proof of a liquidity problem in global markets after over six

years of “unlimited liquidity” was suppose to solve this problem?

The $900 Billion Influx That’s Wreaking Havoc In U.S. Bills, Bloomberg, May 10

The Treasury Market’s Legendary Liquidity Has Been Drying Up, Bloomberg, Feb 1

ECB Faces Liquidity Challenge in Bond Buying, Financial Times, Jan 26 ‘15

Central Banks Warn: Liquidity May Evaporate When Investors Finally Remove Blindfolds,

Wolf Street, March 27

Kuroda Approaching Limit on JGB Buying, Says Ex-BOJ Official, Bloomberg, March 1

Japan Bond Market Liquidity Dries Up As BOJ Holding Hits 200 Trillion Yen, Reuters,

April 15 ‘14

Why Liquidity Is Drying Up In the Currency Market, MarketWatch, March 25

Question Two - Are there signs of a global slowdown in the REAL global economy, which

continues to be totally disconnected from the FOMO (fear of missing out) by investors

in global stocks and bonds?

Is Current Commodity Glut a Transitional Aberration?, The Desert Sun, March 13

Baltic Dry Index Plunges At Fastest Pace Since Lehman, Hits New 29 Year Low, Zero

Hedge, February 2

U.S. GDP Gained a Sluggish 0.2% in First Quarter 2015, Forbes, April 29

Japan’s Inflation Gauge Halts At Zero In February, Bloomberg, March 26

Why China’s Economy Is Slowing, The Economist, March 11

So, how does the Dow stay above 18,000 since its first attempt in history at this level

on December 5, 2014? Not even Chairwoman Janet Yellen at the Federal Reserve

can break the obsession that the computer algos have over equity markets…for now.

Yellen Says Stock Valuations ‘Quiet High’, Bond Yields Low, Bloomberg, May 6

What a train wreck is coming when the algos hit the sell signal. They will then join the

lack of liquidity AND real global slowdown that we have been watching build for almost

a year, and this, after 6 years of unprecedented “liquidity” (i.e. debt) schemes.

Click links below to view charts of these markets:

Dow Jones Industrial – 5 Day, 3 minute intervals – May 12, 2015

TLT- US Treasury Prices – 5 Day, 3 minute intervals – May 12, 2015

Dow Jones Industrial – 7 month look – 18,000 level – May 11, 2015

US Macro Data Has Never Collapsed This Fast, Zero Hedge - May 6 '15

US Macro Surprise Chart; US Macro vs S&P 500 - ZH - May 6 '15

Click here to subscribe to The Investor's Mind newsletter and trading reports.

Look Who Is Warning Of The Slowdown and Declining Asset Values, March 25 ‘15

Chart of NASDAQ Composite, Chart of FTSE 100 - March 25, 2015

Philly Fed Suffers Worst Run in 3 Year, All Sub-Indices Collapse, Zero Hedge, Mar 19

“Market Is Hyper-Overpriced” Warns Retiring (Dallas) Fed President; “Significant

Correction Coming”, Zero Hedge, Mar 20

Mortgaging the Future?, Federal Reserve Bank of San Francisco, Mar 23

Atlanta Fed’s Forecasting Model for US GDP, Signaling Sharp Slowdown, Ambrose

Evans Pritchard @ Twitter, and GDP Now, Federal Reserve Bank of Atlanta, Mar 7

Richmond Fed Manufacturing Survey Collapses to 2- Year Lows, Zero Hedge, Mar 24

Raise Rates or Face "Devastating Bubbles", Says Fed Official, Financial Times, or Fed

Warns of "'Devastating Bubbles", Oxford Financial Digest, Mar 24

Alan Greenspan Warns Stocks Are “Without Doubt, Extremely Overvalued”, Zero

Hedge/CNBC, Mar 6 ‘15

Bank of England Warns of Further Financial “Short Sharp Shocks”, The Guardian, Mar 13

ECB Warns of Market Froth, Insufficient Grip on Shadow Banks, CNBC/Reuters, Feb 13

Central Bank Prophet Fears QE Warfare Pushing World Financial System Out Of Control:

Former BIS Economist Warns that QE Europe Is Doomed To Failure, and May Draw the

Region into Deeper Difficulties, UK Telegraph, Ambrose Evans Pritchard, Jan 20 ‘15

"They (central bankers) have created so much debt that they may have turned a good

deflation into a bad deflation after all." – Former BIS Economist William White

Are you constantly watching for a massive shift across global markets, or trusting in more

intervention by central banks to keep things “normal”? Click here to subscribe to The

Investor’s Mind newsletter and trading reports, and join us as we come through the next

six months of history.

Two 15 Year Double Tops Meet QE Europe: Who Will Win? March 11 '15

The NASDAQ 5000 Composite broke above 5,000 on March 2, 2015 for the first time

since March 10, 2000. The FTSE 100 broke past its Dec 30, 1999 high on March 2, 2015.

Both finished last week back under their respective 2000 and 1999 highs. Based on

more and more signs that the financial bubble and the economic slowdown grow closer

to collision with every passing week and central banking scheme, these two markets

should be watched closely as we continue through March.

Are these warnings to advisors, managers, and investors; “Have you been preparing for

change?” The Charts That Matter post (3/6/15) on Zero Hedge is great. Make sure you

go over the charts and share with others

Mark Cuban: We Are In a Tech Bubble and It Is Worse Than 2000, Bloomberg, Mar 5

Lord Rothschild Warns Investors: “Geopolitical Situation Most Dangerous Since WWII”,

Zero Hedge, Mar 7

Are Central Banks Creating Deflation? (Citi’s Matt King), Zero Hedge, Mar 1

Raise Rates of Face ‘Devastating Bubbles’, Says Fed Official

Maersk (World’s Largest Container Shipping Group) Warns Of Slowdown in Global

Trade, Financial Times, Mar 1

Lew To Congress: US Hits Ceiling March 16, Needs To Be Raised ASAP, CNBC, Mar 7

Click here to sign up for a 6 months subscription to The Investor’s Mind newsletter

and trading reports if you are a skeptical thinker and looking toward the next financial

trends, seeking to protect assets and grow capital.

Deflation Coming; Monetary Inflation Failing, Feb 6‘15

QE III was closed on October 30th. The Federal Reserve’s assets, according to the H.4.1

release, stood at $4,450 billion on Oct 29, '14. 3 months later, on Jan 29, '15, it was

slightly higher at $4,468b. 1 year earlier, on Jan 30, '14, this balance was $4,058b.

Three quarters averaged $130 billion as QEIII came to an end in Oct ’14. The first quarter

without QE, ending Jan '15, increased asets by only $18 billion.

Can equity markets continue to inflate without the addiction for more debt from the

Federal Reserve?

If your trading, investment, and business strategy is not factoring in this rare economic

development across global business and financial markets, something Americans have

no experience with nationally over the last 40 years other than 2007-2009, wouldn’t it

make sense to start thinking about it now?

US Deflation Surges to Level Last Seen in October 2008, Zero Hedge, Feb 2 ‘15

Why Is Wage Growth So Slow? The Big Picture, Jan 9 ‘15

The Global Economic Challenge: Slow Wage Growth, BBC News, Dec 5 ‘14

US Oil Rigs are Shutting Down Like Crazy, Business Insider, Dec 29 ‘14

German Economy Succumbs to Slowdown, The Telegraph, Nov 11, ‘14

Debt Mountain Sparks Fear of Another Crisis, Financial Times, Feb 5 ‘15

“Equities Markets Will Be Devastated”, Crispin Odey Warns, Looming Recession Will Be

“Remembered for 100 Years” ZH, Contra Corner, Jan 27 ‘15

Bankruptcies Caused by Weakening Yen Set New Record in November, The Japan

Times, Dec 5 ‘14

Baltic Dry Index Freight Index Plummets Amid Commodities Slump, Index Hits Lowest

Level Since July 1989, Wall Street Journal, Feb 5 ‘15

Why Investors Accept Negative Yields, Oxford World Financial Digest, Jan 29 ‘15

ECB Pulls The Trigger: Blocks Funding to Greece Via Debt Collateral, ZH, Feb 2 '15

So while the Dow has provided a wild party for day traders since December 5th, these

800 to 1,000 point swings in just days are not building confidence for long term investors.

I continue to believe that independent thinking has never been more valuable, after so

many have placed so much trust in unlimited money and stock rallies by central bankers.

Click here to sign up for a 6 months subscription to The Investor’s Mind newsletter and

trading reports.

Deflation and Inflation Schemes Collide, Jan 20 '15

“Most normal individuals believe these basic truths:

We cannot borrow our way out of debt,

We cannot spend our way into prosperity,

We cannot tax ourselves into wealth.

Gary Christenson, The Korelin Economics Report, Jan 6 ‘14

The public at large somehow seems convinced today that given enough debt, academic

and central banking planners, and constant intervention into what we use to call “free

markets”, they will keep markets from "deflating " again. Feb 9th will be 71 months since

the March 9, 2009 bottom in the S&P 500, tying with the 1994-2000 run.

Their next and greatest challenge since the great monetization experiment began in

2009 comes up on Thursday, January 22nd. As shown below, QE Europe is seen as

a done deal.

Europe on Brink of Deflating, Needs Stimulus – Larry Summers, Reuters, Jan 20 ‘15

QE Is Coming, But On German Terms, The Economist, Jan 20

Draghi Will Win on Economic Stimulus, Bloomberg, Dec 15 ‘14

Whatever is announced on Thursday, the battle by central financial socialist planners to

overcome the three basic truths listed above by Christenson, continues to grow weaker

with each passing scheme.

Headwinds to consider past the hype of "We CAN borrow our way out of debt" CB plans:

Swiss Franc Soars As Switzerland Abandons Euro Cap, BBC News, Jan 15 ‘15

China Shares Dive As Regulators Claim Down on Margin Trading, ABC News, Jan 19

U.S. Rig Count Falls By Most In 6 Years as Oil Stays Below $50, Zacks, Jan 19

IMF Cuts Forecasts, Says Slowdowns in Europe, Japan, BRICS, Outweigh Boost from

Cheap Oil, Fox News, Jan 19

The Biggest Problem for European Stocks in One Chart, Zero Hedge, Jan 20

The Stock Market Is Overvalued Any Way You Look At It, MarketWatch, Jan 13

China Economy Grows At Slowest Pace in 24 Years, CNBC, Jan 20

World Economy Worst In Two Years, Europe Darkening, Deflation Lurking, Global

Investor Poll, Bloomberg, Nov 13 ‘14

Central Banks Create Deflation, Not Inflation, Charles Hugh Smith, Dec 8 ‘14

If you are not a subscriber of The Investor's Mind, 2015 is the year to start. Click here

to sign up. The recent extreme volatlity continues to warn us all, that contrarians

are rewarded when long trends come to an end, and new ones start.

Watch the Wilshire 5,000, Listen to the Best Minds, Nov 12 '14

The Wilshire 5000 has already leaped more than 2,300 points in 20 trading days from

the Oct 15th bottom. It clocked in 2,040 points in the final 23 trading days to the top of

the 2000 bubble on March 24th.

Click here for a chart of the Wilshire 5,000 found in my latest public article, Destroy

A Currency, Extend A Rally (Nov 7). Check out these two charts of the Wilshire as of

Nov 12th. Last 6 months. Last four days.

I sincerely hope you are sharing this information with others. This is HISTORY!

The reasons for acting like a true contrarian keep coming in.

UBS To Settle Allegations Over Precious Metals, Financial Times, Nov 10

The Great Volatility Crush, Mauldin Economics, The 10th Man, Nov 6

European Bank Deals Nearly Double, Financial Times, Nov 9

Six Banks to Pay $4.3 Billion in First Wave of Currency-Rigging Penalties,

Bloomberg, Nov 12

China's Replica of Manhattan Is A Ghost Town, NBC News, Nov 10

Former Goldman Banker Reveals The Path To The Next Depression And Stock Market

Collapse, Zero Hedge, Nov 11, Submitted by Nomi Prins.

Books released this year I have read and would recommend to everyone:

The Big Reset: War on Gold and The Financial Endgame, Willem Middelkoop, Jan '14

The Death of Money: The Coming Collapse of the Monetary System, James Rickards,

April 2014

All The President's Bankers: The Hidden Alliance that Drive American Power,

Nomi Prins, April 2014

Money: How The Destruction of the Dollar Threatens The Global Economy,

Steve Forbes, June 2014

If you are not a subscriber of The Investor's Mind, I can not think of a better time to sign

up. The first issue was released in January 2006, and I still refer back to lessons

learned over the last decade. Best Minds Inc started in 2005.

.

QE Ends. Markets Face Real Risks Without QE "Assistance", Oct 29 '14

"The Committee judges that there has been a substantial improvement in the outlook for

the labor market since the inception of its current asset purchase program. Moreover,

the Committee continues to see sufficient underlying strength in the broader economy

to support ongoing progress toward maximum employment in a context of price stability.

Accordingly, the Committee decided to conclude its asset purchase program this month."

[Federal Open Market Committee Press Release, Oct 29 '14]

The following is a chart from a Zero Hedge article, shows the "improvement in the

outlook of the labor market".

Labor Participation Rate Drops to 36 Year Low; Record 92.6 Million Americans Not In

Labor Force, ZH, Oct 3 '14

Can the Dow 17,000 "wealth effect" hold much longer?

If you have yet to read my latest public article, The Gallery of Crowd Behavior: Goodbye

All Time Highs (Oct 24), I would encourage you to take 10 minutes and read it now.

What is your investment strategy, when central planners and political leaders can not

protect this global house of cards that looks ready to deflate?

The Chart That Crushes All the ECB's Latest Stress Test, Zero Hedge, Oct 24

"ECB avoided modelling a deflation scenario for southern Europe which explains why

the capital shortfall was so small for many banks." Hans-Werner Sinn, head of

Germany’s IFO Institute, speaking of the recent European Central Bank stress tests

on European banks.

25 European Banks Set to Fail Health Checks, Yahoo, Oct 24

Burst Chinese Housing Bubble Leads to First Annual Price Decline Since 2012;

Price Drop in Record 69 Cities, Zero Hedge, Oct 24

China "Ghost Town Index" - Here are China's "Ghastliest" Cities, ZH, OCt 28

Junk Market Stressed by Fed Stress Test as Banks Cut Debt, Bloomberg, Oct 27

Jim Rickards: Coming Economic Depression by Money Morning, August 27

[* Investment comments by Rickards are his own, and may or may not reflect those

of Best Minds Inc.] Chart of dollar of US GDP growth per US dollar of debt.

Have you made changes in your investment strategies? Are you ready to shift when

world markets shift? Click her to subscribe to The Investor’s Mind newsletter and trading

reports, and download the October 23, '14 Special Edition: At The Top of the World.

If you find individuals who don't believe they are living in a full blown

mania, ask them if they know how to make $700,000 in a day!

Kim Kardashian's Game Makes $700,000 a Day, CNN Money, July 31 '14

US Stocks in Holding Patterns, Risk Overload Lights Flashing, Sept 5

The following is one more collection of the contrast between US stock indices in

holding patterns, seducing the public that higher prices are ALWAYS ahead, while “risk

overload” warnings continue pouring in.

Of course, maybe it is I who is reading all of this wrong, still remembering ever so faintly

the year 2008. Seems so long ago, yet so destructive.

Prices Chart of the Dow Over the Last Two Weeks

10:57 EST, Friday, September 5, 2014

End of Day, Friday, September 5, 2014

Spain Sells First 50-Year Government Bonds, Bloomberg, Sept 1

[Chart of 10 Year Spanish Government Bonds over the last 5 years, Bloomberg, Sept 5]

[Chart of rising Spanish Debt levels since 2008, Contra Corner, Sept 2]

Italy, Spain, Irish yields at record lows on fresh ECB largesse, Reuters, Sept 5

[Chart of 10 Year Italian Government Bonds over the last 5 years, Bloomberg, Sept 5]

[Chart of rising Italian debt levels since 2008, Contra Corner, Sept 2]

Argentina Defaults on Its Debt…Again, Forbes, Aug 1

Argentina’s Abnormal Default Still Hurts as Losses Swell, Bloomberg, Aug 29

[Chart of Argentina stock market. Note period after default, Stockcharts, Sept 5].

Russia Blasts NATO’s “Pre-Emptive Deployment” Plan For Undermining Peace Process,

Zero Hedge, Sept 5

NATO Approves Plans For Rapid Response Force Aimed At Deterring Russia, Fox

Sept 5

Europe's Fantastic Bond Bubble: How The Central Banks Have Unleashed

Monumental Speculation, Contra Corner, Sept 2

Icahn, Soros, Druckenmiller, And Now Zell: The Billionaires Are All Quietly Preparing

For The Plunge, Zero Hedge, Sept 3

The Most Gated Rally Ever? Zero Hedge, Sept 3

What Could Possibly Go Wrong Now?, Aug 14, 2014

When you have the highest value in US publicly traded stock wealth (Wilshire 5,000)

attained on the same day the oldest fear indicator (VXO) hit its lowest fear/highest

complacency reading on record, every manager, trader, advisor, and investor, should be

EXPECTING change, instead of hoping for even more extreme behavior.

By the way, that date was July 3, 2014.

Dow 17,000 is critical moving forward.

So as traders wait for guidance from the high speed computer games, pictures in "The

Gallery " continue to reveal that cheap credit and bureacratic planning has totally

disconnected financial markets from economic and business reality, thus producing

highly unsustainable conditions.

Amazon's Operating Profits and Net Income Have Declined for 5 Years

[Source -Zero Hedge,7/24]

Amazon Stock Moved up 285% between 2010 Low and 2014 High

[Source - BMI, 8/11]

Argentina Stock Market Goes Parbolic. Climbs 208% in Year Before Debt Default

[Source- BMI, 8/7]

Argentina Defaults on Its Debt...Again

[Source - Forbes, Aug 1]

Italy's GDP (Gross Domestic Product) Has Declined Steeply Since 2007

[Source - Zero Hedge, 8/7]

Dow Jones Italy Stock Index - 2 and 4 Year View, and 15 Year View

Italy to Include Cocaine And Prostitution Revenue In Its GDP

[Source - European CEO, 5/23/14]

High Yield Bond Funds Smashed With Record $7.1 Billion Outflows

[Source - Zero Hedge, 8/7]

High Yield Bond Issuance Hits Record in June, As Yields Reach New Lows,

[Source -Forbes, July 2]

S&P 500 Exchange Traded Fund Outflows Soar To Biggest Since 2008

[Source - Zero Hedge, 8/6]

Have you prepared your investment strategies for the next major shift? Bulls become

bears and bears become bulls. Click here to subscribe to The Investor’s Mind for the

next 6 months, where the study of computer & human herding is followed weekly

through the lens of world markets. Specific market commentary is provided as we

navigate the most intervened markets of our lives.

Hoping for no change in direction is not an option. What is artificially inflated, must

come down.

Even Central Bankers Are Now Warning Investors and Managers. Are We Listening?

July 14, 2014

The mesmerizing trance of Dow 17,000 holds millions in mental lockdown. Yet, even the

global and central banking community have started warning about excessive risk taking

in recent weeks.

Should one consider selling now, or continue placing faith in Draghi’s asset

backed securities scheme scheduled to start in September?

BIS Chief Fears Fresh Lehman From Worldwide Debt Surge, UK Telegraph, July 13

"Credit spreads have fallen to wafer- thin levels. Companies are borrowing heavily to

buy back their own shares. The BIS said 40 % of syndicated loans are to sub-investment

grade borrowers, a higher ratio than in 2007, with fewer protection covenants for

creditors."

Yellen: Seeing Pockets of Increased Risk Taking, CNBC, July 2

Yellen: Fed Could Raise Rates to Pop Bubbles, USA Today, July 2

IMF Tells Britain to Act on Housing Bubble Risk, Reuters, June 6

World Bank Cuts Global Economic Forecast, The Guardian, June 20

I See Speculative Bubbles Like in 2007 [Interview with former BIS Chief Economist

William White], Finanz and Wirtschaft, April 11

BIS Slams “Market Euphoria” Finds “Puzzling Disconnect” Between Economy and Market,

Zero Hedge, June 29

“As history reminds us, there is little appetite for taking the long-term view. Few are ready

to curb financial booms that make everyone feel illusively richer. Or to hold back on

quick fixes for output slowdowns, even if such measures threaten to add fuel to

unsustainable financial booms. Or to address balance sheet problems head-on during

a bust when seemingly easier policies are on offer. The temptation to go for shortcuts is

simply too strong, even if these shortcuts lead nowhere in the end.” [Bank of International

Settlements' 84th Annual Report, June 29, 2014]

And of course, there are a variety of dominoes teetering on the edge even now that just

may kick-start a change from the illusory “feeling richer” picture that has been

produced worldwide for over 5 years now.

Portugal Banking Crisis Sends Tremors Through Europe, UK Telegraph, July 10

As Deadline Looms, Argentina Moves Closer to Another Default, Reuters, June 30

Hottest Five Stock Markets in the World, From Argentina to Dubai, CNN Money, July 1

The Dubai Market Dropped 25 Percent. It’s Still Overvalued, Bloomberg Businessweek,

June 27

Behind the Leviation, Powerline, June 30

Chart of the Day: “Holy $340 Billion in Quarter-End Window Dressing, Batman”, Zero

Hedge, June 30

Chinese Bad Loans Rise Most Since 2005 as Economy Slows, Bloomberg, May 15

Let me encourage you to share this information with others, and invite you to subscribe to

The Investor's Mind as use lessons from history as we come through the rest of 2014.

Do You See Any Warnings That Millions of Investors are Still Ignoring? May 23, '14

Click the pictures in the gallery below and share with anyone who will listen.

Social Benefits As a Percentage of Real Disposable Income is the Highest on Record.

Rare Extremes in Complacency (low volatility) versus All Time High in S&P 500.

Consensus Forecast of GDP (Growth) Over the Last Two Quarters and Reality.

Margin Debt 1990-2014 – Third Peak in Borrowing in 15 years. Highest on Record.

Four Major World Stock Indices – All Squeezed into the Same Corner As of May 2014China’s Economy in Sharp Contraction, As Is Japan’s.

Coming Into May Retailers Were Buying US Equities As Institutions Continued Selling

When the S&P 500 Have Been This Short Before, Stocks Have Crashed.

If you have to read my latest two public articles, Two World’s Collide: Financial and

Political Manipulation Accepted (May 8), and Two World’s Collide, The Financial/Political

Elephant (May 19), I would strongly encourage taking the time to do so.

Manipulation is a limited game. To embrace it and bury our heads in the sbecomes more dangerous with each passing week.

The Dow few investors ever see. Click here.

Economic Takeoff or Take Down: One is Wrong - May 5 '14

Fed to Keep Trimming Stimulus As Economy Shakes Off Stall, Bloomberg, April 30

Retail Store Closures In 2014: At Highest Pace Since Lehman, ZH, April 21

US Economy Grows Just 0.1% in Last Quarter, The Guardian, April 30

If It Wasn’t for Obamacare, Q1 GDP Would Be Negative, ZH, April 30

Flood of Students Demanding Loan Forgiveness Forces Administration Scramble,

ZH, April 22

The American Middle Class Is No Longer the World’s Richest, NYTimes, April 22

Existing Home Sales Fall To Lowest Rate Since July 2012, Fox Business, April 22 Overseas events that are NOT positive for the “recovery” Fed view

The Richest Man in Asia is Selling Everything in China, Sovereign Man, April 16

China's 'Property Bubble' Is Financial At A Bursting Point, Malaysia Chronicle, April 9

Abenomics Agony: Japanese Based Wages Tumble By Most In 2014 (22nd

Consecutive Monthly Drop), ZH, April 29

EU Commisioner Warns 'Any Sensible' Person Should Oppose Further Russia

Sanctions, May 2, 2014

IMF: Ukraine Crisis Could Slow Down Growth In Eastern Europe, Hispanic Business,

April 29

What will it take to change the religiously held view of "buy and never sell"?

The Great(est Fool) Rotation: Who's Buying, And Who's Selling?, ZH, May 1

If you know someone - manager, advisor, or investor - sitting on a large stock position,

you might encourage them to review this chart. Then encourage them to subscribe

to The Investor's Mind, the cost of which is less than 1 hour of college credit at

their nearest university. Six months from now, it may prove to be the best money they

ever spent.

"I pledge to artificially inflate stocks markets, until everyone believes the economy

is good...or I am forced to admit our policies of unlimited money failed as stocks

collapse under the weight of so much debt" - Central Bankers' Pledge - April 9 '14

Socialism and the State: A Good Long Term Investment Strategy?

What's next for the Fed? A hint comes (came 4/9) this week, CNBC, 4/6

“Because at the end of the day, the Fed is still in complete control of the S&P 500.”

CEO of a money management firm

I thought we needed free markets for capitalism to flourish? Who will take over,

when the Fed loses “complete control of the S&P 500”? This statement is nuts.

Cracks in the Fed Pledge & Europe Moves Toward Chinese Yuan

When Even Goldman Complains About HFT (High Frequency Trading), ZH, 3/21

Triple Whammy Shocker: Goldman Shutting Down Sigma X?, ZH, 4/8

This Time Better Be Different, ZH, 4/7

It’s Not Just the Stock Market That is Rigged: the Entire Status Quo is Rigged, of two

minds, 4/3

Russia’s Secret Weapon: Crashing US Economy by Collapsing Petrodollar,

Voice of Russia, 3/28

Bank of England Signs Yuan Clearing Agreement with China’s PBOC, Bloomberg, 3/31

Germany, China Say Renminbi Hub in Frankfurt will Boost Trade, Yahoo, 3/29

More pictures from "the gallery" revealing extremes as of April 9, 2014.

Tale of Two Dows, of two winds, 4/3/14

Comparing Stock on Credit at 1/00, 10/07, and 2/14, dshort.com, March 2014

Pressure Continues to Build on the "All Time High " Illusion - Mar 25 '14

United States -

Wealthy Chinese Home Buyers Boost Suburban LA Housing Markets, LA Times, Mar 24

Dot.Com 2.0 Visualized (or Peak Greater Fool), Zero Hedge, Mar 11

China -

What a Bank Run in China Looks Like: Hundreds Rush To Banks Following Solvency

Rumors, Zero Hedge, Mar 25

The Music Just Ended: “Wealthy” Chinese Are Liquidating Offshore Luxury Homes in

Scramble for Cash, Zero Hedge, Mar 19

Russia -

Ousted by G-8, Russia Determined to Prove It Can Thrive Without West, Washington

Post, Mar 25

World Leaders Gather for Hague Nuclear Summit, Washington Post, Mar 23

General Dempsey: US Ready for Military Response to Russia if Crimea Conflict

Escalates, KyivPost, Mar 12

Israel -

Israel Has Two Billion Pound Fund for Possible Attack on Iran, Jewish Chronicle, Mar 25

Israel Closes Embassy Around the World As Diplomats Strike, Reuters, Mar 23

United Kingdom -

IMF’s Property Tax Hike Proposal Comes True with UK Imposing ‘Mansion Tax’ As

Soon as This Year, Zero Hedge, Mar 22

With this many variables to juggle, is it really possible for a small group of central

banking bureaucrats to keep stock markets levitated as we go into Q2, 2014?

A few more thoughts outside the mainstream financial industry as we close out March.

The Incompetence of the Federal Reserve and Deep State is Unavoidable, Economist

Charles Hugh Smith, Mar 25

Fisher Outs Bubbles Ben: QE Was a Massive Intended Gift to the 1%, David Stockman's

(former White House OMB Director) Contra Corner, Mar 24

FDIC Sues 16 Large Banks for Allegedly Rigging Global Interest Rate,

The Spokesman – Review, Mar 15

Jeremy Grantham: The Fed is killing the recovery, Fortune, Mar 24

How Much Longer Can US Markets Ignore the Global Economic/Political Picture?

- Mar 13 '14

Yen-Pinching Undercuts Japan's Push Against Years of Deflation, NYTimes, Mar 10 '14

Rickards:The China Bubble is Bursting, Darien Times, Feb 22 '14

Russia Warns Could 'Reduce to Zero' Economic Dependency on US, Yahoo, Mar 4 '14

US and China Stand In Agreement on Ukraine - And That Is Very Bad News for The

United States, The Economic Collapse, March 3 '14

To Understand What's Really Happening in Ukraine, Follow the Gas Lines on This

Map, PolicyMic, Mar 10 '14

The U.S. Has Installed a Neo-Nazi Government in Ukraine, Michel Chossudovsky,

Global Research, Mar 2 '14

EU and US Poised to Implement Sanctions on Russia, Irish Times, Mar 12 '14

US, G-7 Allies Won't Recognize Crimea Election Results, The Hill, Mar 12 '14

G7 Not To Recognize (March 16) Crimea Referendum, Xinhua News, Mar 12' 14

Chairman of Joint Chiefs: US Ready for "Military Response" in Ukraine, Zero Hedge,

Mar 12 '14

Change Course in Crimea or Face Costs, West Warns Russia, CNN, Mar 13 '14

Why Is so much history being Ignored? Click here to see what we all lived through in

March 2000, and click here to compare a recent snapshot of the same US index in

March 2014.

Could speed of light computer trading have anything to do with this alternate reality?

The Holy Grail of Trading Has Been Found: HFT Firm Reveals 1 Losing Day in 1238

Days of Trading, Zero Hedge, March 10 '14

Do you have an exit plan for when this bubble blows?

Parabolic move: $1.3 trillion made in 13 trading days to new "all time high". Time to

take casino chips off the table? - February 25, 2014

Are things getting better, or worse? Pick your media source.

Home Prices in 2013 Notch Biggest Annual Gain Since 2005, WSJ, 2/25/14

Case Shiller Has Second Consecutive Decline, Warns of "Bleaker Picture for Housing",

Momentum Gone, Zero Hedge, 2/25/14

Budget Cuts to Slash US Army to Smallest Since WW II, Fox Business,2/25/14

$3,000 Hike Slated for Military Family Grocery Bills, CNN Money, 2/25/14

Europe Futures Slide with Metals as China's Yuan, Shares Plunge, SF Gate, 2/24/14

Russia Will Withhold Loans to Ukraine for the time being,LA Times,2/23/14

Is the 14 YEAR picture from widely used financial data warning us? You bet it is.

Stock Wealth vs US National Debt - 14 years

US Publcly Traded Stock Wealth (Wilshire 5,000) - 2000 to 2007 top

US Stock Wealth - 2000 top to 2009 bottom

US Stock Wealth - 2000 top to Feb 2014

US Stock Wealth - Last 3 months - $1.3 trillion in 13 trading days. 6 TIMES the monthly

average since March 6, 2009...

...and the tapering of QE (quick and easy) money has begun.

Fed Cuts Bond Buying to $75 (down $10) Billion, CBS Market Watch, Dec 18, '03

Federal Reserve Continues to Taper, Cuts Monthly Purchases to $65 Billion, US News

and World Report, Jan 29 '14

Yellen Sees Few Risks to Divert Fed From QE Tapering Strategy, Bloomberg, Feb 11 '14

No Taper; Oz Has Spoken. Leave Your Brain at Home - September 18, 2013

Today, The Federal "Oz" announced to the world, "We will not slow down fueling the

stock market Ponzi scheme. When it blows, it will blow, risk be damned".

Forget headlines like the ones below. Real world risk have no bearing...today.

Jerusalem Post, Aug 29

- Obama: Syria Chemical Attack “A Challenge to the World”, CBS News, Aug 30

- Toxic Leaks At Fukushima Reach Lethal Levels of Radioactivity, Forbes, Sept 3

- China Sends Warships To The Coast of Syria, Infowars, Sept 5 '13

- 10- Year Treasury Yield Tops 3% For the First Time Since July 2011, CBNC, Sept 5

- US, Russian Naval Deployment Near Syria - Update, Zero Hedge, Sept 9

- Syria 'Welcomed ' Russian Proposal to Destroy Chemical Weapons, ABC

News, Sept 9

Sept 15

Daily, Sept 16

to Raise Debt Limit, CBS News, Sept 17 ‘13

Fortunately, we know that our financial leaders, who failed to see the 2008 collapse, are

still at the helm and are our "heroes".

- “There is bound to be volatility,” Paulson said in an interview with Tom Keene on Bloomberg Television today. “When you have a big, ugly, messy problem, there is never going to be a perfect, elegant solution.”… Paulson praised Bernanke for bringing the U.S.economy back to growth while reducing the level of household debt and stabilizing the financial system. “I believe that Ben Bernanke has been a hero,” Paulson said [Source, Paulson Says QE Exit Causes Volatility With Bernanke Hero, Bloomberg, Sept 12 ‘13]

Change is coming. I agree with Paulson; “There is bound to be volatility”. I don’t

agree that Bernanke or he are heroes. Click here to subscribe to The Investor’s Mind;

independent thinking, not propaganda.

Watching Debt Signals, Not Just Stock Prices: When Nirvana Breaks - August 16 ‘13

On July 24, 2013, I released my latest public article, The Nirvana Trade. Today, the Dow

closed again right at its 100 day moving average. Will it go up next week? Will it go

down? Frankly, this is NOT the big question. The bigger questions are: Where are we

when right now, when looking back over the last 20 years in US stocks? Where are we

when looking at various risk indicators through the lens of newly created debt that has

been used as the fuel to foster the rally since early 2009? How will rising borrowing

costs, as reflecting in rising bond yields since early May impact the larger economy?

Once you move away from the daily game, a very different view from “this could go on

much longer” starts to set up. The older the rally; the weaker the rally. In fact, the

monster rally since 2009 may be over, and history has already started the next major

destructive bear decline, whether we start next week with a US stock rally or not.

Deutsche Bank Hopes “Not All Margin Calls Come At Once In Case of a Sell Off”, ZH,

8/13/13

Stock Market Bubbles and Record Margin Debt: A (Repeating) History of Ignoring All

Warnings, ZH, 8/9/13

Mortgage Applications Fall by 4.7% (off May high by 53%), The Motley Fool, 8/14/13

Treasury Yields At Two-Year High; Stocks Head for Weekly Loss, Reuters, 8/16/13

If you are seeking insights on how to navigate the major bear market ahead,

click here to subscribe to The Investor’s Mind. A subscription takes you through a

six-month period, and conditions are ripe for some of the largest up and down moves

across global markets that we have seen yet.

US Stocks Markets Don't Like Fed Releases - July 31 '13

Maybe it is time for investors and advisors to start developing a plan of action AFTER

the omnipotent Fed can not levitate US stocks? Oh that's right, they can only make us

believe they are gods.

Review these pictures of the S&P 500 on May 22nd, June 19th, and July 31st. Then

take a look at the movements of the S&P 500 over the last 3 months. Does this

inspire confidence in the crew that brought you the "we can always print more debt "

scheme?

If you are preparing for a sea change in global financial markets, consider a

6 month subscription to The Investors Mind.

Always keep reading and thinking.

Economics Can Not Trump Mathematics, Zero Hedge, 7/27/13

Bankers Own The World (And Are Ulimately Destroying It), Chris Martenson, 7/24/13

The Astonishing Collapse of Work in America, American Enterprise Inst., 7/10/13

Up, and ...Away?, July 10 '13

Am I crazy, or does there seem to be a disconnect from the financial world, as seen

through the eyes of these investment pros, and those making financial decisions

outside of the U.S. stock markets?

Bernanke: Highly Accomodative Policy Needed for 'Foreseeable Future', July 10 '13

Up, Up, and Away for Stocks, Acampora, CNBC, July 9 '13

Equities To Move Higher, Despite Fed Taper Talk: Pros, June 20 '13

A Weak U.S. Economy Means Fewer Babies (At Least For Now), July 9, '13

Only 47% of Adults Have a Full time Job, July 5 '13

Student -Loan Default Rates Rise Above Graduation Rates, July 8 '13

The evidence continues to reveal that stock values, built on high levels of debt for

"investing" (more accurately, daily speculating) are the illusion, and these larger

trends OUTSIDE the U.S stock markets continue to tell the REAL financial story.

Recommended Readings: Bull: A History of the Boom:1982-1999(2003), When

Genuis Failed: The Rise and Fall of Long Term Capital Mngt (2000),or

Infectious Greed: How Deceit and Risk Corrupted the Financial Markets(2003).

Films: Inside Job, & Wall Street: The Speed Traders.

If you desire to understand the changing financial world and markets, and you believe

as I do that being a true contrarian still has value, click here to subscribe to The

Investor's Mind. "All Time Highs" are the best time for thinking rather than

following the crowd.

Fed's Speak, US Stocks Drop, Week 25, June 19 '13

Since the spring of 2009, market participants have grown to believe that there is only

one factor one needs to know. If the almighty Federal Reserve announces they

are starting or continuing a "stimulus" program, then you can count on higher

stock prices, no matter what takes place in the real world.

Wednesday, May 22nd and Wednesday, June 19th, have placed a severe crack in this

thesis. Click below for daily charts of these two "Fed speak" days.

Chart of the Dow on May 22, 2013; Chart of the Dow on June 19, 2013.

When we place both of these days in context of a larger view of the Dow, one can see

that computer selling could change the mood of the markets very quickly at current levels.

It would also seem that central bankers are having problems discerning how to

discuss financial markets that differ wildly from their underlying economies.

IMF: World Markets Upbeat Compared to Slow Economy, Yahoo News, 6/4/13

World Bank Cuts Global Outlook as Europe Contracts, China Slows, Live Mint, 6/13/13

Fed Keeps $85 Billion Pace of Bond Buying, Sees Risks Waning, Bloomberg, 6/19/13

Breaking 15,000: Up Then Down, Week 23, June 5 '13

The mainstream financial media is always touting the next 1,000 mark in the Dow on

the upside, celebrating this arrival as though "this time it is different". However, with all

the excitement of "you have to get in now!", why is the commentary on the rapidly rising

RISKS much more sparse until we have experienced declining markets?

This chart of the Dow was released on my April 15, '13 post.

This chart of the Dow was developed for my post today, June 5 '13.

In order to keep from being completely blindsided in the weeks ahead, we must

remember that unlimited debt for more speculation is a limited game. We must also

remember what while high speed computers can give the impression that everything

has become more stable as US equity markets rose steadily, when markets rise and

decline rapidly, the probably of a panic is rising quickly too.

Financial Markets Are At Risk of a 'Big Data' Crash, Financial Times, May 20, '13

The following are books I have read recently. Never stop learning, and never trust

your thinking to the mainstream media.

Broken Markets: How High Frequency Traders and Predatory Practices on Wall Street

are Destroying Investor Confidence and Your Portfolio (2013) Sal Arnuk & Joe Saluzzi

Currency Wars: The Making of the Next Global Crisis (2011) James Rickards

Dark Pools: The Rise of the Machine Traders and the Rigging of the U.S. Stock

Market (2012) Scott Patterson

Bailout: An Inside Account of How Washington Abandoned Main Street While

Rescuing Wall Street (2012) Neil Barofsky

To enjoy a wide range of opinions and sources as the easy options leave the

investment landscape, click here for a 6 month subscription to The Investor's Mind.