When Someone’s “Too Big To Fail” Plan Fails, Remember Lehman, April 25 '16

Gold Benchmark is Launched In China, and London Gold Vaults Empty

China Launches Yuan Gold Fix To “Exert More Control Over Price of Gold”, Zero Hedge,

April 19, ‘16

Moving To The Post LBMA (London Bullion Market Association) – Era Gold Price Reset –

Watch Out, David Jenson, April 11, ‘16

5 Big Banks

Regulators Warn 5 Top Banks They Are Still Too Big To Fail, NY Times, April 13 ‘16

Agencies Announce Determinations and Provide Feedback on Resolution Plans of Eight

Systemically Important, Domestic Banking Institutions, Federal Reserve, April 13, ‘16

Resolving Globally Active, Systemically Important, Financial Institutions, A Joint Paper by

the FDIC and Bank of England, December 10 ‘12

With more than $60 trillion in global debt added since 2008, and stock and bond prices in

the US still at their highest levels ever, shouldn’t all investors and advisors be paying

attention to risk at the foundation level in the financial world?

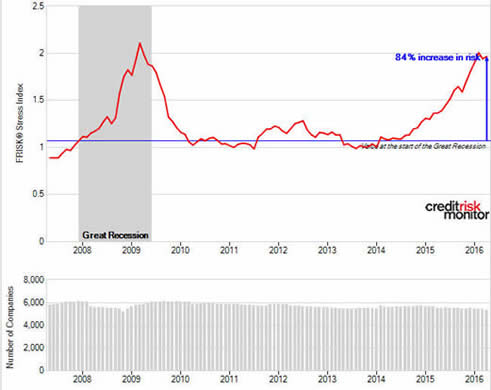

Credit Risk Monitor covers 57,000 companies globally on their credit risk.

The following is their proprietary FRISK Stress Index. The index calculates the collective

probability of failure in a group of companies (such as industry or country), over the next

12 months. Check it out and share.

Is the Federal Reserve Currently In Check On Going Negative?, Feb 25 ‘16

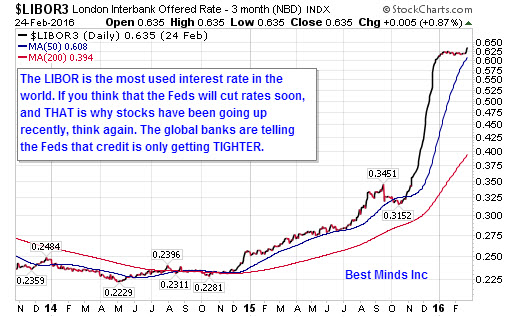

Below is a chart of the 3 month Libor and an article revealing the Federal Reserve's

recent actions toward foreign central banks. Make sure and scroll down to the Feb 2nd

Bloomberg article in the February 4th post.

With many pundits believing that the Federal Reserve is about to go negative, there are

two major problems with that assumption right now. The sharp rise in short term credit

costs since last November AND the money the Federal Reserve is paying foreign

central banks to park their reserves with the Fed. It is clear that the American saver is

not the best "customer" of the Federal Reserve.

As Foreign Central Banks Park $250 Billion in Cash At the Federal Reserve, A Mystery

Emerges, Zero Hedge, Feb 22

Does the historical data support a high probability of a major stock market crash?

A gentleman in Europe sent me an academic paper he developed modeling the

probability of a major crash. He has given me permission to share this with you.

Click the title below to download his research paper for free.

New Stock Market Crash Inevitable, Wim Grommen

And just in case this merely looks like merely some academic topic, Zero Hedge

released charts today, Feb 25th, that support Grommen’s finds.

Why Was It So Important That The S&P 500 Close Above 1950, Zero Hedge, Feb 25

Global NIRP; The Currency Battles Heat Up, Feb 4 '16

The Fed Wants to Test How Banks Would Handle Negative Rates, Bloomberg, Feb 2 ‘16

Bank of Japan Introduces Negative Interest Rates, WSJ, Jan 29

Kuroda Emulates Draghi on Negative Rates as Yield Drop Curbs Yen, Bloomberg, Jan 29

‘There Cannot Be A Limit’ To Stimulus, Says ECB President Mario Draghi, The Telegraph,

Dec 4 ‘15

The Absurdity of Negative Interest Rates, Mises Institute, Dec 16, 2015

Gold and Economic Freedom (1966), Alan Greenspan, Constitution Society

Greenspan's Stunning Admission: "Gold Is Currency; No Fiat Currency,

Including The Dollar Can Match It" (Talk for the Council on Foreign Relations),

Zero Hedge, 11/8/14

Why did it take Greenspan almost half a century to return to this truism? At this stage

in history, everyone needs to understand the critical importance of this statement,

since the levels of debt worldwide backing fiat currencies are at levels never imagined

in the 1960s.

Global Debt Now $200 Trillion, GoldCore, May 14, 2015

Debt and (Not Much) Deleverraging, McKinsey Institute Report, February 2015

Current Federal Reserve Policy Under the Lens of Economic History, A Review

Essay, Stephen Williamson, VP of the Federal Reserve Bank of St. Louis, July 2015

Now even a Federal Resrve Bank, after almost 7 years of the Zero Interest Rate Policy,

admits that QE has not produced the "success" they were expecting in the U.S.

In fact, this strategy has failed in other parts of the world as well.

I only wish they could have hired a few Austrian economists I know to figure this out

before running up debt tabs into the trillions.

"There is no work, to my knowledge, that establishes a link from QE to the ultimate

goals of the Fed inflation and real economic activity. Indeed, casual evidence suggests

that QE has been ineffective in increasing inflation. For example, in spite of massive

central bank asset purchases in the U.S., the Fed is currently falling short of its 2%

inflation target. Further, Switzerland and Japan, which have balance sheets that are

much larger than that of the U.S., relative to GDP, have been experiencing very low

inflation or deflation. " - pg 9

Money Market Fund Reform; Amendments To Form PF, Securities and Exchange

Commission Report, October 14, 2014 [posted on Aug 19 '15]

Are you aware that the nation's 560 money market mutual funds, managing over $3

trillion in assets, have rules in place to slow down a panic of redemptions when another

banking panic and loss of liquidity takes place? I saw WHEN, only because 7 years of

zero interest rate policies by the Fed and no room to cut rates when the next deep

recession gets underway, makes a loss of liquidity and panic built into the cards. It is

merely a question of when this takes place in the future.

Consider these two phrases:

"Heavy redemptions from money markets funds during persiods of financial stress

can remove liquidity from the financial system, potentially distrupting the markets." p28

"Today's amendments will allow a money market fund to impose a liquidity fee of up

to 2%, or temporarily suspend redemptions (also known as "gate") for up to 10 business

days in a 90 day period, if the weekly liquid assets fall below 30% of its total assets and

the fund's board of directors determines that imposing a fee or gate is in the fund's best

interest." p39-40

Are you preparing for system wide challenges in the bust phase ahead? Clearly

other's are thinking ahead. Click here to subscribe to The Investor's Mind, our most

in depth look at markets and system wide risks that we all face.

Market Manipulation Is NOT A Conspiracy Theory: It is a fact ALL investors, traders,

and money managers deal with daily, August 3, 2015

Lawsuit Accuses 22 Banks of Manipulating U.S. Treasury Auctions, Business Insider,

July 23, 2015

In Latest Market Rigging Scandal, Wall Street Now Sued for Treasury Market

Manipulation, Zero Hedge, July 24

Downloaded from the Zero Hedge July 24th post, I have uploaded a copy of the US

District Court, South District of New York case, where the plaintiff, the Boston Retirement

System, has filed a class action suit against various Wall Street financial institutions.

The case references previous major cases completed against Wall Street financial

institutions regarding manipulation of the LIBOR, the most used interest rate benchmark

in the world, and the US/Euro trade, the most traded currency pair in the world.

Click here to download and read.

Five Major Banks Agree To Parent-Level Guilty Pleas, Dept of Justice, May 20 '15

In 2013, the City of Houston filed a lawsuit against 16 Major Banks for LIBOR interest rate

manipulation. Click here to read the cities announcement of the lawsuit.

Everything is Rigged: The Biggest Price-Fixing Scandal Ever, Rolling Stones,

April 25, 2013

With so much information and lawsuits at the highest levels regarding price and market

manipulation, while various markets sit at all time highs for most of 2015, it has

become critical to stay alert to sharp changes that must eventually come.

Click here if you would like to see what constant market research continues to uncover,

and to be alert through the next six months of world changes rather than TRUST that

manipulation will be beneficial.

Bank of International Settlements 85th Annual Report, June 28, 2015

“Interest rates have never been so low for so long. They are low in nominal and real

(inflation-adjusted) terms and low against any benchmark. Between December 2014

and end-May 2015, on average around $2 trillion in global long-term sovereign debt,

much of it issued by euro area sovereigns, was trading at negative yields…. Such

yields are unprecedented. Policy rates are even lower than at the peak of the Great

Financial Crisis in both nominal and real terms. And in real terms they have now been

negative for even longer than during the Great Inflation of the 1970s….

The economies hit by a balance sheet recession are still struggling to return to healthy

expansion… There is something deeply troubling when the unthinkable threatens to

become routine.” – page 5

Rising Yields Should Alert ALL Investors, Central Bankers Are Losing

Control, June 8 '15

Negative Interest Rates Puts World On Course for Biggest Mass Default in History,

The Telegraph, April, 28

The World Is Drowning In Debt Warns Goldman Sachs, The Telegraph, May 26

Why Liquidity Starved Markets Fear the Worse, Wall Street Journal, May 20

Click the nation below, for a chart of its 10 year bond yields. Remember, QE Europe

started in early March this year.

France, Spain, Italy, and Portugal

Germany, Japan, United Kingdom, and United States

Five Year Anniversary of the May 6, 2010 Flash Crash - May 12 '15

Did you, your friends, your family, and/or you financial advisor(s) discuss the history

surrounding the largest intraday move in the Dow on record last week? Did you know

there have been other flash crashes take place in the last 6 months to the largest

sovereign bond market in the world and the world's current reserve currency? Are you

expecting this to happen again to "all time high" markets in the future?

Look at the March 2015 posts and these pieces of information. Do not ignore

this 800 pound gorilla, especially in light of such long periods of herding investors in

the same direction in certain assets.

Film- Money & Speed: Inside the Black Box - a documentary on the May 6, 2010 flash

crash - released in Dec 2012.

SEC/CFTC Report - Findings Regarding The Market Events of May 6, 2010 - 9/30/10

Film - Wall Street: The Speed Traders, CBS 60 Minutes - June 5, 2011

Nanex Research - Einstein and The Great Fed Robbery - Sept 20, 2013

Expect Sudden Wide Swings In Prices; The New Norm, Beware at All Time Highs,

March 25 '15

High Frequency Trading: A Bibliography of Evidence-Based Research, March 2015

"In a 2010 study of the 2010 Flash Crash, the U.S. Securities and Exchange

Commission and the Commodities Futures Trading Commission found that high

frequency traders substantially increased volatility during the event and accelerated the

crash...The Australian Securities and Investments Commission, the stock regulator in

Australia, found in a 2012 study that during volatile markets high frequency traders

reduce their liquidity supply and increase their liquidity demands....The Bank of Int'l

Settlements looked at foreign exchange markets and concluded in a 2011 study that

high frequency traders exacerbate volatility in stressed markets... The UK Gov't Office

for Science published a large 2012 study of capital markets around the world and

concluded that 'HFT/AT may cause instabilities in financial markets in specific

circumstances....

Anyone seriously concerned about their investment business or their investments,

will see from the comments and sources on pages 1-5, that our global markets are

much more fragile today than ten years ago. The entire concept of markets having

plenty of liquidity is erroneous and impossible to attain with HFT and wider reaches

by central banks into the "free markets" than ever before in history.

U.S. Dollar Flash Crash, Nanex Research, March 18 '15

Since last October, we have seen a Treasury Flash Crash, and a US Dollar Flash Crash,

both first in history events. After already producing the sharpest one day stock drop in

US history on what is now known as the May 6, 2010 Flash Crash, why would anyone be

surprised with huge swings in any market at this stage, since it is becoming more and

more evidence, there is no such thing as "unlimited liquidity".

Liquidity Shortage, Not Abundance, March 7 '15

Liquidity Shortage: Houston We Have a Problem, Center for Financial Stability, Feb 25

"Cracks in financial markets from this phenomenon are already evident and sadly

present in a wide range of markets. Specific examples: US Treasury Market:

On October 15, the deepest and most liquid market in the world demonstrated a

six standard deviation move in less than two hours, a move that (in theory only)

happens once in 506,797,346 days!

To be sure, a sustained “flash crash” in the world’s leading fixed income market

could readily unleash a pronounced slowdown of the global economy, or worse."

Treasury Flash Crash, Nanex Research, Oct 15 ‘14

"On October 15, 2014 between 9:33 and 9:45, liquidity evaporated in Treasury futures

and prices skyrocketed (causing yields to plummet). Five minutes later, prices

returned to 9:33 levels.

Trading activity was enormous, sending trade counts for the entire day to record highs -

exceeding that of the Lehman collapse, the financial crisis and the August 2011

downgrade of U.S debt. Treasury futures were so active, they pushed over trade

counts on the CME to a new record high."

Global signs of systemic risks keep coming in, Oct 27 '14

IMF Global Financial Stability Report: Risk Taking, Liquidity, and Shadow Banking:

Curbing Excess While Promoting Growth, Oct 2014

The Dollar Reigns Supreme, by Default, IMF, Finance & Development, Professor

Eswar Prasad, Brookings Institute, March 2014

Chicago Mercantile Exchange Group, Central Bank Incentive Program Questions and

Answers & Modification Letter, January 2014

ECB stress tests vastly understate risk of deflation and leverage: Ignoring the deflation

danger for the banking systems of southern Europe has reduced the latest stress test

to another 'farce', says EU economist Philippe Legrain, UK Telegraph, Oct 27 ’14

Russians and Chinese are ditching the dollar as Europeans start using renminbi in

their reserves, Sovereign Man, Oct 17 '14

BIS 84th Annual Report, June 29, 2014, [posted on 8/12/14]

"Financial cycles differ from business cycles. They encapsulate the self-reinforcing

interactions between perception of value and risk, risk-taking and financing constraints

which translate into financial booms and busts. They tend to be much longer than

business cycles, and are best measured by a combination of credit aggregates and

property prices. Output and financial variables can move in different directions for long

periods of time, but the link tends to re-establish itself with a vengance when financial

booms turn into busts." [Chapter IV. Debt and the Financial Cycle:Domestic and Global,

page 71]

Thinking has never been more critical. Facing reality never more challenged. Apathy

stronger the longer the boom holds on.

How Economies Collapes: Systemic Friction and Debt Are Self-Liquidating,

Charles Hugh Smith @ Of Two Minds Blog, Aug 5

The Media, the S&L Crisis, and the 2008 Financial Crisis, Mises Economics Blog, Aug 11

When Media Mergers Limit More Than Competition, New York Times, July 25

Federal Reserve's vice-chair warns of long-term damage from recession,

The Guardian, Aug 11

Hidden Financial Bombs: Margin Calls Hit Hedge Funds Speculating in Freddie/Fannie

Bonds With High Repo Leverage, David Stockman @ Contra Corner, Aug 11

"Everything seems expensive": Why today's valuations are worse than in 1999,

Yahoo Finance, Aug 11

Resolving Globally Active, Systemically Important, Financial Institutions, A

Joint Paper by the FDIC and the Bank of England, Dec 10 '12 [posted on 7/10/13]

Depositors Beware: Bail-In is Now Official EU Policy, Nation of Change, 7/6/13

Think You Money is Safe in a Bank Insured Account? Think Again, Global Research,

7/5/13

Japan To Become More Like Cyprus - bail-ins for Japan banks, Forex Live, 6/11/13

The Cyrpus Bank 'Bail-In' Is Another Crony Bankster Scam, Forbes, 5/3/13

Could the Banksters Grab Your Bank Deposits? Prof. Jonathan Turley blog, 3/31/13

For those who thought the the tiny nation of Cyprus was just a rare event in our daily

news, think again. The term "bail in" is found in this joint paper between the FDIC and

the Bank of England more than 3 months before Cyprus banks made world news. Now

3 months later, we see that the term "bail ins" is a GLOBAL issue. We should be

asking "Why now, when millions of investors have recently enjoyed 'all time highs' in

various global capital markets? Random or planning ahead?

Office of the Comptroller of the Currency, Quarterly Report on Bank Trading

and Derivatives Activities Q4 '11 [posted 5/25/12]

Look at the chart on page 13 of 38 in this report. Should this massive change be

something to concern every investor or bank depositor?

Federal Deposit Insurance Corporation, Quarterly Banking Profile, Q4 '11

[posted 5/25/12]

Go to page 17 of 26. Compare the balances on 12/08 and 12/11 in the Deposit Insurance

Fund and the total amount on Deposit in the entire FDIC system. Does this look like a

step in the right direction, I mean, just in case there happens to be a rainy day again for

US banks like the fall of 2008.

Reserve Accumulation and International Monetary Stability, Apr 13, '10

Enhancing International Monetary Stability - A Role for the SDR?, Jan 7 '11

International Monetary Fund. --posted on March 23 '11

"From SDR to bancor - A limitation of the SDR (Special Drawing Rights) as discussed

previously is that it is not a currency....A more ambitious reform option would be to build

on the previous ideas and develop, over time, a global currency. Called, for example,

bancor in honor of Keynes, such a currency could be used as a medium of exchange--

an 'outside money' in contrast to the SDR which remains 'inside money'. [see pp 26 -

27 from the April '10 IMF report listed above.]

In case the term "bancor" is one you are unfamiliar with, let me share a piece of history

that I have presented with my own subscribers a few times in the last 5 years:

"In the postwar planning for economic affairs, the State Department was in charge of

commerical and trade policies, while the Treasury conducted the planning in the areas

of money and finance. In charge of postwar international financial planning for the

Treasury was the economist Harry Dexter White...While the White Plan envisioned a

substantial amount of inflation to provide greater currency liquidity, the British responded

with a Keynes Plan that was far more inflationary....The Keynes Plan, moreover, provided

for a new international monetary unit, the 'bancor', which would be issued by the ICU

[ a new international clearing house] in such large amounts as to provide almost

unchecked room for inflation, even in a country with a large deficit in its balance of

payments." [pp 480-481, The History of Money and Banking in the United States:

The Colonial Era to World War II, Dr. Murray Rothbard]

Known Unknowns: Unconventional Strategic Shocks in Defense Strategy

Development posted - Oct 7 '10

If the mammoth amount of intervention into our markets by the Federal Reserve and

their high frequency trading buddies has lulled you into complacency that "the worst is

behind us", you might want to read page 32 in this document. Even the military is

considering its role inside the United States, should such events as an "unforeseen

economic collapse" occur.

The link to the documents takes you directly to the website of the Strategic Studies

Institute, US Army War College. Are we looking for information that supports the way

we desire to see the world around us, or information we need to face?

Quarterly Banking Profile, Q2 '10 - FDIC - posted Sept 3 '10

How long can Wall Street manipulate prices to stay above 10,000? Consider these

factors in determining if the "recovery" [Orwellian doublespeak] is real. Industry assets

(loans) declined by $136 billion in the second quarter, the fifth quarterly decline in the

last six quarters. The number of FDIC institutions that stopped reporting financial

results was 104. This is the first time in ten years the number exceeded 100.

In all fairness, there was some good news. Quarterly profits from the banking sector

was the highest in 3 years, and the the Depository Insurance Fund climbed to a

negative balance of $15 billion.

Quarterly Derivatives Report, Q1 '10 - Office of the Comptroller of the Currency

If money is power, then who are the five most powerful companies in the USA?

How much political influence could this purchase? I would encourage you to have the

courage to download this report, scan the charts, then read Gretchen Morgenson's

piece in the NY Times, Strong Enough for Tough Stains?, released on June 25th.

The Trillion Dollar Gap: Underfunded State Retirement Systems

and the Roads

to Reform. The Pew Center on the States, Feb 2010

"A $1 trillion gap. That is what exists between the $3.35 trillion in pension, health care

and other retirement benefits states have promised their current and retired workers

as of fiscal year 2008 and the $2.35 trillion they have on hand to pay for them."

Now help me here. If you were told to fix a "$1 trillion gap", wouldn't you start by cutting

spending and lowering debt? If not, I guess we could always fix this "gap" by saving

$1 million a day for 2,740 years. (this example assumes that each year is comprised

of 365 days).

Clearly, billions are being spent on economic forecasting that will never come to pass.

For reality, try The Investor's Mind for six months of real time history and trading

commentary.

Quarterly Banking Profile, Q4 '09

At the end of the third quarter, the FDIC report revealed a negative balance of $8.2 billion

in the Depository Insurance Fund (DIF). The FDIC reported that the 4th quarter balance

had fallen to a negative $20.9 billion.

The JOE: Joint Operating Environment, produced by the United States Joint Forces

Command, Released Feb 18 '10

While most investors never think to consider the military's view on the economy, the

following publication reveals that the military has strong concerns about security risks

that face the US because of our economic policies and current financial condition

as a nation. Consider the following, as found on page 21 in the JOE:

"The near collapse of financial markets and slow or negative economic activity has

seen U.S. Government outlays grow in order to support troubled banks and financial

institutions and to cushion the wider population from the worst effects of the slowdown.

...Rising debt and deficit financing of government operations will require ever-larger

portions of government outlays for interest payments to service the debt. ....interests

payments are projected to grow dramatically, further exacerbated by recent efforts to

stabilize and stimulate the economy, far outstripping the current tax base. Interest

payments when combined with the growth of Social Security and health care, will crowd

out spending for everything else the government does, including National Defense."

The Examiner's Report in the chapter 11 proceedings of Lehman Brothers

Need some reading material? Then why not start with the nine volumes found

in Anton Valukas Examiner's Report. For a shorten version, consider comments

about the report found at Zero Hedge.

Q4 '09 Flow of Funds Report, Federal Reserve

If someone has sold you on "the recovery", ask them to explain page 10, Total Net

Borrowing. Credit continues its massive contraction.

OCC's Quarterly Report on Bank Trading and Derivatives Activities

Third Quarter 2009

Credit Derivatives contracted during the third quarter of 2009, the 4th straight quarterly

contraction. At the same time, it is almost surreal to comprehend that JP Morgan and

Goldman Sachs, control 59% of the entire US derivatives markets. Who really runs

this country anyway?

SIGTARP Quarterly Report to Congress, January 30, 2010

"It is hard to see how any of the fundamental problems in the system have been

addressed to date: huge, interconnected, 'too big to fail' institutions contributed to the

crisis... those institutions are now even larger... institutions were previously incentivized to

take reckless risks through a 'heads, I win; tails, the Government will bail me out"

mentality...the markets are more convinced than ever that the Government will step in as

necessary to save systemically significant institutions."

Flow of Funds Accounts of the United States, Q3 '09

Federal debt expanded at an annual rate above 20% in the 3rd quarter, which is the

fifth consecutive quarter of growth above 20%, and household debt contracted at an

annual rate of 2 1/2%, its fifth quarter of decline and the largest on record. [pg 2]

Quarterly Banking Profile, Q3 '09

During the 3rd quarter, total deposits in FDIC banks increased by $79 billion. 100%

of this increase was due to foreign offices. The Deposit Insurance Fund has now

fallen below zero, with at a negative balance of $8.2 billion at the end of Q3 '09.

[pg 14]

OCC's Quarterly Report on Bank Trading and Derivatives Activities,

Second Quarter 2009

The top 5 US banks hold 96.6 percent of all derivatives in the US. Since Wells Fargo

has a smaller percent of credit exposure to risk based capital than the rest, that leaves

the usual suspects: JPMorgan, Goldman Sachs, Bank of America, and Citibank. The

table on page 22 is particularly informative. It shows that JPMorgan has $1.6 Trillion in

total assets and $79.9 Trillion in derivatives contracts. The other top banks show similar

ratios. Derivatives concentrations of this magnitude merit our attention.

Next Phase of Government Financial Stabilization and Rehabilitation Policies,

US Treasury Department, September 2009

Now that we have seen a full blown mania in bank stocks over the last six months,

the boys at the Treasury have just released the "next phase" in the US governments

policy of "stabilization". Considering the price of ignorance when this bubble blows,

either read this piece, or better still, consider subscribing to our research.

FDIC Quarterly Banking Profile, Second Quarter 2009

"During the quarter, the number of institutions on the FDIC’s 'Problem List' increased

from 305 to 416, and the combined assets of 'problem' institutions rose from $220.0

billion to $299.8 billion. This is the largest number of “problem” institutions since June

30, 1994, and the largest amount of assets on the list since December 31,1993."

If you want to see something truly amazing, compare this FDIC report, with a report

produced by NY Attorney General Andrew Cuomo on July 30th titled,No Rhyme or Reason:

The 'Heads I Win, Tails Your Lose' Bank Bonus Culture. The mania continues.

The Tale of Two Depressions, by Professor Barry Eichengreen and Kevin O' Rourke

Recently I learned of this website through Bob Prechter's The Elliott Wave Theorist.

I would encourage each of you to review this website and its many economic

comparisons to the Great Depression.

FDIC Quarterly Banking Profile, First Quarter 2009

Non current loans and leases increased by 25.5%($59 bn).Total assets declined $301

billion during the quarter, the largest percentage decline in a single quarter in 25 years.

21 bank failures, the highest in a quarter since 1992.

Given the fact that these are FDIC numbers, are we really to believe that the worst is

behind us in the banking sector?

President Barack Hussein Obama's speech of outreach to the Muslim world in Cairo

Egypt, June 4, 2009. (Transcript-doc, pdf)

"Islam has a proud tradition of tolerance." - President Obama

"But when the forbidden months are past, then fight and slay the pagans wherever ye

find them, and seize them, beleaguer them, and lie in wait for them in every stratagem

(of war); but if they repent, and establish regular prayers and practise regular charity,

then open the way for them: for Allah is Oft-Forgiving, Most Merciful." - Yusaf Ali

translation of the Quran, Sura 9:5.

If you think this has nothing to do with the world of money, without even considering

the long history between Western financial institutions and Middle Eastern oil, check

out the long list of Sharia compliant companies on the Dow Jones Islamic Market. Our

world is changing rapidly.

Office of the Special Inspector General for the Troubled Asset Relief Program

Quarterly Report to Congress, April 21 '09

“Aspects of the PPIP (Public Private Investment Program, rolled out on March 23 ’09 by

Geithner) make it inherently vulnerable to fraud, waste, and abuse, including significant

issues relating to conflicts of interest facing fund managers, collusion between

participants, and vulnerabilities to money laundering.”

Should we expect anything else from a program that is a coordinated effort between the

FDIC and the Treasury.

Q4 - 2008 Derivatives Report, Office of the Comptroller of the Currency

Pay particular attention to the graphs starting after page 8. For more insight into the

documents and articles found on our website, and how to apply this information to

your own decision making processes, consider subscribing to our research newsletter,

The Investor's Mind.

FDIC, Dec '08, Quarterly Banking Profile

While we hear repeatedly that our national banking system is in trouble, the numbers

directly from the FDIC prove this beyond a shadow of doubt.

Financial Stability Plan, US Treasury, Feb10 '09

After waiting weeks for a plan from the highest levels of financial leadership in the US

government, it would appear that once again either Mr. Geithner and crew believe they

can create another couple of trillion out of thin air as the "positive" solution to the Ponzi

debt schemes that went full throttle once the world heard "credit crisis" in August 2007,

or they are trying to destroy the very foundation of our financial structure. Read and share

with as many individuals as possible. Once the market manipulating gets done at this

level, there will be hell to pay, and "stability" will be moved out even further.

Shariah Finance Film by ACT! for America, Posting on Dec5, '08, Joy Broghton,

Shariah Finance Expert

Ms. Brighton has experience as a Wall Street Trader and a finance professor. While

almost all of our attention has been focused on understanding the roots of the credit

crisis, very few have examined another alarming trend that has been growing for years.

To further your understanding of this trend visit the Islamic Index section of the Dow

Jones website, after you watch this film.

The Final Globalization of the US Banking System by the Federal

Reserve, July 9 '08, Joan Veon, The Women's International Media Group

For many of you, this will be your first contact with Mrs. Veon. With the "All eyes on

Washington" drama since mid September, her comments will most likely overwhelm

you. However, when you consider that she has attended more than 90 global political

conferences over the last 15 years as a member of the press, and has had the

opportunity to ask specific questions directly to world leaders, her journey in life is unlike

the vast majority of the public. No matter what country live in, you need to read her

comments about the US Treasury's Blueprint. She was the first individual to alert me of

this massive expansion of powers by the Federal Reserve.

If you will scroll down this page, you will find an entire copy of The Blueprint for a

Modernized Financial Regulatory Structure, presented by the US Department of the

Treasury to Congress this past March.

Bank of England, Financial Stability Report, April 2008

European Common Bank, Financial Stability Review, June 2008

"As confidence has fallen in the ability of credit ratings to capture all the risks

in complex structured credit products, some investors have been left without

readily available and reliable measures of asset quality." (pg45, BOE) "There are

fears that default rates have been held artificially low over the past couple of years

by an abundance of liquidity in markets for asset backed securities, easy credit

conditions and very low spreads on high-yield bonds." (pg14,ECB)

Whether one reads the Federal Reserve, or the ECB or the BOE, waning

confidence and rising fear all stem from the same root problems that were

ignored for years,"only now" beginning to be understood. But, ignoring the

latent risk of financial schemes for short term profits is nothing new.

Whether one studies the Dutch Tulip Bulb of the 1600s, or the Mississippi

Scheme of the 1700s, or America producing the first middle class

society to embrace consumer credit in the 1920s, a thorough study of history

would have revealed long before we arrived at the "credit crisis" of 07-08

that human nature had not changed. Once we begin to understand

what we never investigated before, the mood of the crowd regarding trust

begins to change.

FDIC, Q2 '08: Quarterly Banking Profile, Aug 29, 2008

“Total assets of insured institutions declined by $68.6 billion during the quarter,

the first time since the first quarter 2002 that industry assets have decreased,

and the largest quarterly decline since the first quarter 1991. Assets of “problem”

institutions increased from $26.3 billion $78.3 billion.”

Since the spring our subscribers have been presented with interviews from

national level managers regarding the safety of their cash reserves.

Q1 2008 Derivatives Report, Office of the Comptroller of the Currency

"Credit risk is a significant risk in bank derivatives trading activities." page 2

"Credit risk in derivatives differs from credit risk in loans due to the more

uncertain nature of potential credit exposure. Because the credit exposure

is a function of movements in market rates, banks do not know, and can only

estimate, how much the value of the derivative contract might be at various points

of time in the future." page 3

"From 2003 to 2007, credit derivative contracts grew at a 100% compounded

annual growth rate. Given current market turmoil, however, credit derivative

growth has eased." page 5

Click here to review a chart taken from page 6. Please note, the numbers you

are reviewing are in the billions.

The Dept of the Treasury: Blueprint for a Modernized Financial

Regulatory Structure, March 2008

If you know of the problems that arise from giving the government more power,

you have got to read this document. With all of the articles and comments in the

public domain warning of the moral hazard of the Fed constantly intervening to

"stabilize" the markets, this plan, from our highest financial government leaders,

can only be seen as a recipe for disaster. They note:

"The market stability regulator should be responsible for overall issues of

financial market stability. The Federal Reserve's market stability role would

be conducted through the implementation of monetary policy and the provision

of liquidity [a constant euphemism for perpetual debt creation] to the financial

system." page 15

Compare this with my March 10, 2007comments in Herb Greenberg's Wall Street

Journal Weekend column: .

"The reason we don't believe markets will crash, is because we do not want to.

Simply put, we enjoy the wealth that easy credit creates. And who wouldn't? With

easy credit, there's no need to work for years and save, no need for politicians to

ever say no, and no need to wait or do without. If the system has a problem,

liquidity is always the answer. If we encounter a slowdown, just add more

liquidity. After all, it has been working for years. And the long this arrangement

persists, the more this belief is reinforced."

David Walker on America's Financial Crisis, Post from Ross Perot's website,

April 29, 2008

"Tough choices are required. We will not be able to grow our way out of this

problem. Anybody who says that, suffers from two problems. Number one: they

have not studied economic history adequately. And number 2: they probably

wouldn't do real well at math, because the number just don't add up."

- Former Comptroller General of the United States, David Walker

A friend of mine, who started his life in Iraq under Saddam Hussein and fled to

America as a boy, notified me of this film.

Triennial and Semiannual survey of positions in Global OTC Derivatives

Bank of International Settlements, November 2007

The highest authority in global central banking notes that the outstanding

amount of OTC derivatives was $516 trillion as of June of 2007. While we agree

with the BIS's statement that, "a single comprehensive measure of risk does not

exists," an annualized growth rate of 33 percent since 2004 and 20 percent since

1995, is certainly disconcerting. We should not be surprised when markets

fall.

Quarterly Banking Profile, Fourth Quarter 2007, FDIC

Most investment trading models are designed with an "everything stays within

this range" mentality. But the statements found in this document reveal a banking

community that is experiencing historic extremes. The clustering continues to

signal that we have moved outside of the normal range." Understanding the

history of fiat money and the science of unstable systems has never been more

crucial. Click here to subscribe to our ongoing research.

Procyclicality in the Financial System: do we need a new macro

stabilization framework? Bank of International Settlements, William White,

Head of Monetary and Economic Development, January 2006

If you've read extensive amounts of history on events such as the 1929 crash,

the months prior to Pearl Harbor, or the Yom Kippur War during the 1973 -74 oil

crisis, you realize that the reason we don't see watershed events in history prior

to their occurrences, is that we have little knowledge of monetary history, and thus

do not understand that some voices carry further in determining the course of

history. White's position at the BIS, places him at the top of the central bankers'

bank. His comments on pages 5 and 20 should be read by every individual who

uses money, and by that I mean everyone. To examine our research on this

paper, and the history of the BIS, read our May 2006 newsletter: Between Two

Worlds.

Fitch Comments on US Operating Funds, January 14, 2007, Riskcenter.com

If you are with a local or state government agency or you do business with the

same, you need to consider the material discussed in this short report. Risks we

never even consider in our day-to-day business transactions, should now move

front and center.

"Fitch's survey of state investments has sought to identify exposure to credit -

impaired and illiquid assets, and the consequent risks to investment principle

should such investments fail to perform. To the extent that state operating funds

are invested in credit-impaired and illiquid instruments, these states face the risk

of delayed access to principal, if not losses of such principal."

Though this primarily addresses the US, individuals from other countries will

likely find this information helpful, as well.

OCC's Quarterly Report on Bank Derivatives Activities Third Quarter 2007

"U.S. commercial banks generated $2.3 billion in revenues trading cash and

derivative instruments in the third quarter of 2007, down 62% from the $6.2 billion

reported in the second quarter. This decline is attributed largely to the difficult

trading environment in credit markets." To see derivatives' exponential growth

and their heavy concentrations in "five large [U.S.] commercial banks," read on.

FDIC Quarterly Banking Profile, Third Quarter 2007, FDIC

"Loan-loss provisions totaled $16.6 billion, more than double the $7.5 billion

insured institutions set aside for credit losses in the third quarter of 2006 and the

largest quarterly loss provision for the industry since the second quarter of 1987.

Loan losses in the third quarter were $3.6 billion (49.9 percent) higher than a year

earlier. The largest increase occurred in loans to commercial and industrial (C&I)

borrowers, where charge-offs were $796 million (91.4 percent) higher than a year

earlier. Charge-offs of consumer loans other than credit cards had the second-

largest increase, rising by $702 million (46.1 percent). Net charge-offs of

residential mortgage loans were up by $676 million (164.8 percent)."

And, this is not just a U.S. problem..

The Risk Outlook for Mortgage Lenders, December 4, 2007,

Clive Briault - Financial Services Authority Managing Director of Retail Markets

"You need to consider contingency plans against the worst outcomes. These

plans might include the very practical issue of how you would cope with an

upsurge in retail deposit withdrawals, both from your branches and over the

internet; how you could access emergency funding; and the circumstances in

which you might need to curtail or wind down your business. Again, any such

plans need to be considered well before you are engulfed by a crisis since by

then it will almost certainly be too late to develop practical responses."

An Investor's Guide to Asset Backed Securities (2004),

The Bond Market Association

Asset Backed Securities will be remembered as one of the most unsound

investment structures of "modern finance." As you read this brochure, recall

what has transpired in the commercial paper markets, in which money market

mutual funds invest. Then you will understand why this brochure is one more

reflection of the credit mania. As more "surprises" surface, complacency

regarding due diligence will become more costly.

August 2nd, 2007 Updates:

First Quarter 2007 Derivatives Report, Office of the

Comptroller of the Currency

"What goes up, must not come down," has become the creed of our

largest banks. As you review these astronomical numbers, consider the

following definitions of risk from the Investment Planning textbook

developed for the College for Financial Planning.

1.Business Risk is the risk associated with the nature of the enterprise

itself.

2.The use of financial leverage is the source of financial risk.

3.Market risk refers to the tendency of security prices to move together.

4.Interest rate risk refers to the tendency of security prices, especially

fixed-income securities, to move inversely with changes in the rate of

interest.

Equipped with these simple definitions of risk, check out pages 12, 16,

22 and 26. Are our largest banks showing any concern for risk?

Personal Income & Outlays, June 2007, Bureau of Economic

Analysis

After reviewing pages 4, 7, 8 and 9, look at pages 6 and 7 in the March

release from the same agency. What gives? Paul Kasriel gives accurately

assesses the damage the "wealth effect" has had on our nation.

Second Quarter 2007 Gross Domestic Product, Bureau of

Economic Analysis

Knowing that very few people ever read numbers outside of the current

financial headlines, our government seems given to excessive revisions

Compare this first quarter GDP report with the revisions made in the 2nd

quarter report. What will the revised 2nd quarter numbers look like in the

3rd quarter report? If you're losing confidence in the BEA, check out John

Williams, who recently notes, "GDP contracted 0.9% net of revisions for the

second quarter."

FDIC Quarterly Banking Profile, First Quarter 2007

If the year-over-year loan loss increases in our banking system continues it's

current trajectory, we may well have cause for concern. From the 1st quarter of

2006 credit card charge-offs have increased 29 percent, individual loan charge-

offs are up 60 percent, commercial and industrial loan charge-offs are up 78

percent, and residential mortgage loan charge-offs are up 93 percent. Noncurrent

loan rates are also trending higher.

SEC to End Short Sale Tick Test on July 6, 2007, SEC News Digest, Issue

2007-124, June 28, 2007

"On June 13, 2007, the Commission voted to remove the tick test of Rule 10a-1

and to amend Regulation SHO to provide that no short sale price test, including

any price test of any exchange or national securities association, shall apply to

short sales in any security." As we discuss in Riders on the Storm, excerpted

here, the tick test rule began in 1938, after the Crash of 1929 and a 47 percent

decline in 1937, and though it has always been ineffective, we have some

concerns about its removal at a market top, before a major decline occurs.

Conclusion to the 77th Annual Report, Bank of International Settlements,

June 24, 2007

"There seems to be a natural tendency in markets for past successes to lead

to more risk-taking, more leverage, more funding, higher prices, more collateral

and, in turn, more risk-taking. Should liquidity dry up and correlations among

assets rise, the concern would be that prices might also overshoot on the down-

side. Such cycles have been seen many times in the past. "

BIS Quarterly Review: International Banking and Financial Market

Developments, June 2007

When the Bank of International Settlements comments that "global issuance of

CDOs (Credit Default Obligations) in the first quarter of 2007, at $251 billion, was

the strongest on record," and that the "bust cycle" in the credit card market begins

with "the recognition of excessive indebtedness amid rising delinquencies" thus

resulting in "tighter lending standards, contractions of credit, and prolonged

balanced sheet adjustments, affecting the real side of the economy," can these

global officials claim surprise at the Bear Stearns debacle? "Strongest on record"

sounds a lot like 1999.

Global Financial Stability Report, Chapter 1, Assessing Global Financial

Risks, April 2007, International Monetary Fund, Washington DC

If you are making long-term investment or business decisions, this report

might alter your view of risk. While couched in the typical conditional phrases,

which act to negate that of which they warn, we find some disconcerting

comments. The following are just two examples.

"The benign external environment and accompanying rise in risk appetite -

reflected in the rapid rise in capital flows to some EM [Emerging Markets]

countries - pose challenges for those authorities and could threaten financial

and economic stability, especially if capital flow reversals were to occur." Or,

"ABX indices, which are indices on ABCDS [Asset Backed Credit Default

Swaps], started trading January 2006." As of April 2007, "Spreads on the BBB-

subindices of the three most recent ABX series have widened sharply since

November 2006, reflecting increasing defaults and stress in the lower quality

home equity loans." And, "the 06-02 series has experienced delinquencies 60

percent higher than those of the 06-01series at comparable seasoning."

I continue to be amazed at the total lack of explanation of how we got here in the

first place, and find it incredible that our own media never refers to this ongoing

commentary of global financial risk presented by one of the most influential

banks in the world.

Are High Foreign Exchange Reserves in Emerging Markets a

Blessing or a Burden? March 2007, Russell Green & Tom Torgerson,

Department of the Treasury, Office of International Affairs

"The practice of preventing upward real exchange rate adjustment can be

harmful by distorting the price signal for resource allocation. Reserve

accumulation may render a false sense of security, delaying necessary

reforms. Large fiscal deficits, for example, may crowd out private sector

investment or create debt overhang problems." These statement are true

for the U.S. as well as the intended audience. Once again, finger pointing

is preferred to addressing the root cause of the problem.

Capitalizing on Sustainable Development: Making Gold out of

Green, Spring 2007, Joan Veon, Women's International Media Group

To those who are new to such discussions, this missive will likely

make more sense after viewing "The Great Global Warming Swindle"

documentary below. As a member of the press who has covered more

90 global government meetings over the last 15 years, though Veon's

views may differ from one's own, they merit a great deal of respect.

The Great Global Warming Swindle, British TV Channel 4,

March 8, 2007

As you form an opinion on this issue, review this film and listen to these

comments of scientists from around the world. When we study various

global government agencies' trends, we begin to see a completely

different set of events developing.

Fiscal Stewardship: A Critical Challenge Facing Our Nation, January

2007, United States Government Accountability Office.

"As of September 30, 2006, the U.S. government reported that it owed

more than it owned by almost $9 trillion. In addition, the present value of

the federal government's major reported long-term "fiscal exposures" -

liabilities, contingencies, and social insurance and other commitments

and promises - rose from $20 trillion to about $50 trillion in the last 6

years ...These structural deficits - which are virtually certain given the

design of our current programs and policies - will mean escalating and

ultimately unsustainable federal deficits and debt levels. Based on

various measures - and using reasonable assumptions - the federal

government's current fiscal policy is unsustainable. Continuing on this

imprudent and unsustainable path will gradually erode, if not suddenly

damage, our economy, our standard of living, and ultimately our domestic

tranquility and national security. "

BIS Quarterly Review: International Banking and Financial Market

Developments, December 2006, Bank of International

Settlements, My Highlighted Version

"This general [optimistic] confidence could also be discerned in the

behaviour of a number of other market indicators. In mid-November,

implied volatilities in bond and stock markets reached their lowest levels

in years, while measures of risk appetite showed that the retrenchment

by investors after the sell-off in May and June had been largely reversed."

History has always shown, that when appetites for risky assets increase,

we're a long way from a market bottom. Review the constant proportion

debt obligations (CPDOs) on page 8, and then review the Moody's piece

we placed on the website in the fall. This will be one for the history books.

Who Predicted the Bubble? Who Predicted the Crash?

Summer 2004, Dr Mark Thornton, Ludwig Von Mises Institute

My Highlighted Version

As 2007 begins and the bullish buzz abounds, some think that, after the

strong equity returns of 2006, maintaining a bearish view is arbitrarily

pessimistic. Yet, Dr. Mark Thornton reminds us that these conditions

must exist in that they are indicative of a market top. On a pragmatic note,

it is also helpful to read the thoughts of those who were able to step

outside of the euphoria of 1999.

Financial Market Update, Monetary and Capital Markets

Department: Global Markets Monitoring and Analysis Division,

December 2006, International Monetary Fund

My Highlighted Version

"Investors continue to move out the risk spectrum in search for yield, and

risky assets continue to perform well. At the same time, volatility has fallen

to generational lows across a wide range of assets, and many investors

appear to have adopted similar trading strategies, in many cases ones

predicated on a continuation of the benign scenario."

Sounds like the IMF has read our research paper, Riders on the Storm:

Short Selling for Contrary Winds. Now may be a good time to do the

same. So, subscribe to The Investor's Mind and obtain access to our

entire 154 page paper. Click here to review samples of both.

How Active is Your Fund Manager? A New Measure that Predicts

Performance August 7, 2006, Martijn Cremers & Antti Petajisto,

Yale School of Management

"Nearly one third of the U.S. mutual fund industry is comprised of 'closet

indexers” – funds that claim to be actively managed but passively invest

most of their assets in the benchmark index – while truly active funds

account for only about a quarter of the market. Furthermore,only the most

active funds outperform their benchmark indexes while all other active

funds underperform after expenses."

FDIC Outlook: Summer 2006

This FDIC report discusses the effects of lending cycles on the business

cycle, provides a good explanation of why credit default swaps have

grown exponentially (page 11), and discusses commercial real estate

lending (page 14). Pages 24 and 25 show growth rates in non-traditional

mortgage loans, which are of particular interest. We have also provided a

non-hi-lighted version for those who would prefer it.

Operational Risk - US Treasury Requests Public Comment on

Securities Lending Facility - April 27, 2006, www.riskcenter.com

"An SLLR [Securities Lender of Last Resort], or repo facility, is a

mechanism for providing an additional, temporary supply of Treasury

securities used on rare occasions when market shortages threaten to

to impair the Treasury and financial markets' functioning."

Global Derivatives Explosion

A few years ago, I came across a 1994 Bank of International Settlements

paper voicing concern over the inherent risks in the derivatives industry

after the conclusion of Carry Trade 1(at that time). To make it easier to

digest, I have highlighted the issues I found alarming. With the plethora of

information available today, I welcome any reader's insights on

subsequent publications on this topic.

When we consider the unsustainable growth rate of the global futures and

options markets, evidenced in the January and February 2006 data,

the concerns addressed in the 1994 BIS paper become even more

pronounced. This May 22, 2006 Market Commentary shows that

these concerns are well founded.

This information was obtained from Risk Centers' Risk Alert services.

Lights out on M3

In our May 2004 newsletter, we discussed inflation and deflation using

historical M3 values from the Federal Reserve. Since March 16, 2006

marks the last public money supply report that contains M3 values,

and March 23, 2006 begins the new report format without M3 values,

you may want to save both of these reports as a reminder of this

period in our nations history.

Shadowing Reality - Welling@Weeden interviews John Williams,

February 21, 2006

"Real unemployment right now - figured the way that the average person

thinks of unemployment, meaning the way it was estimated back during

the Great Depression - is running about 12%. Real CPI right now is

running about 8%. And the real GDP probably is in contraction." To find out

just how distorted our government economic reporting numbers have

become, read on.

BIS Working Paper No 193, Procyclicality in the financial system:

do we need a new macrofinancial stabilisation framework?

William White, Economic Advisor, Head of the Monetary and Economic

Department for the Bank of International Settlements, January 2006

Now don't let the title of this paper fool you. This is not your typical dry

rhetorical economic jargon that leaves you clueless after reading it. It is

probably one of the most accurate pieces written by a central banker on

the current state of the world's economic environment, what central

bankers have learned over the last several decades, and possible

solutions for our current juncture. This is one for the history books.

The January 2006 working paper gives some specific solutions that are

not found in the April 2006 working paper. Let me also encourage you to

read the definition given by Merriam-Webster of inflation before and after

you read these working papers.

White refers to the "Austrian school of economics." If you are unfamiliar

with this school of thought, watch Money, Banking and

The Federal Reserve, by the Ludwig von Mises Institute. You can access

the streaming version of the video at http://mises.org:88/Fed or

download it from http://mises.org/multimedia/video/Fed.wmv.

Bear & Bull Cycles: A 102 Year Look At The Dow , January 31, 2006

The historic record, as displayed in this great chart, makes it painfully

clear that bear cycles have lasted, and therefore can last, for years. To

deny this fact by not altering your investment strategies accordingly, is to

invite the claws of the bear to shred your financial capital.

Same Play, Different Actors, Kevin Duffy and William Laggner,

Bearing Asset Management LLC, December 2005

As memories of the stock market bubble of the late 90s grow dim, we do

well to take the time to review it. These slides show that the same drama

is about to unfold again, only this time with different actors. Click here for

one more reality check.

Will a Bursting Bubble trouble Bernanke? Center for Economic and

Policy Research, November 2005

As Baker and Rosnick point out in this paper, one of the Federal

Reserve's mandate's is to seek price stability. This paper cogently argues

that the policies of the Federal Reserve have fostered price instability in

the housing sector.

A Speech at the Credit Risk Conference, John C. Dugan, Comptroller

of the Currency, October 27, 2005

"One of the striking findings in our 2005 survey was the breadth and extent

to which banks relaxed their lending standards. We readily understand

why these products [interest only loans, ARMS,etc.] have become fixtures

in the marketplace in such a short time. One reason is that they have

helped to sustain loan volume that would otherwise almost certainly be

falling, because rising interest rates have brought an end to the refinance

boom."

Read More...

|