When Everyone Sees

January 23, 2013

Doug Wakefield

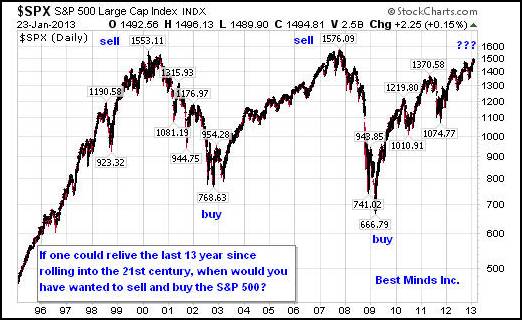

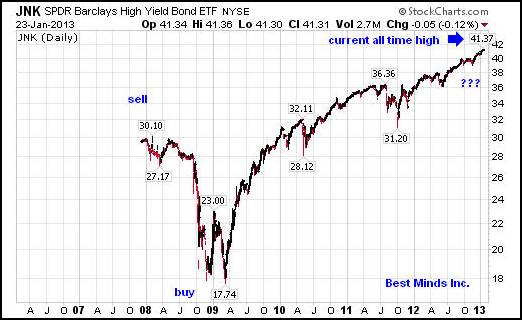

We

have all been told that the objective of investors is to buy low and sell high,

and that what goes up must come down. If these two platitudes make common sense

to you, then what action would we expect from investors, based on the two

charts below of the S&P 500 and low grade (high yield) bonds?

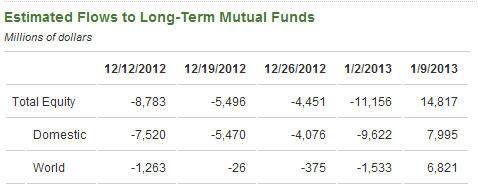

However,

as one can see from the article below, this is the exact opposite behavior we

have seen in the first four weeks of 2013.

Fund Manager’s Risk Appetite Nears Record, Financial Times, Jan 15 ‘13

“Risk appetite among fund managers has hit its highest level in nine years and is hovering near all-time highs, in a sign that bulls have returned to equity markets after years in hiding.

The surge of confidence comes as investors pumped $22 billion into equity funds last week, the largest amount in five years.”

The Great Rotation: A Flight To Equities in 2013, CNBC, Jan 23 , ‘13

“One of the big investment shifts of our day may be at hand — regardless of how global markets actually perform this year….

The gist of the argument is that investor holdings of now expensive, ultra-low yielding government debt — following a virtually unbroken 20-year bull market in bonds — are ripe for rebalancing. The attraction of relative and absolute valuations in equity will coax the outflow to stocks.”

Shouldn’t

investors of all levels be concerned with headlines like, Japan

Enters Recession Before Election (FT, 12/10/12), It’s

Official: Eurozone Enters Second Recession in Three Years (Time World,

11/15/12), or As

China’s Economy Slows, Real Estate Bubble Looms (Washington Post,

10/2/12)? Has the delusion of “unlimited easing”(debt), removed the reality

that GLOBAL equity markets can turn down as fast as they have exploded up?

Should this not be troubling those who have been in a rush to “get in”?

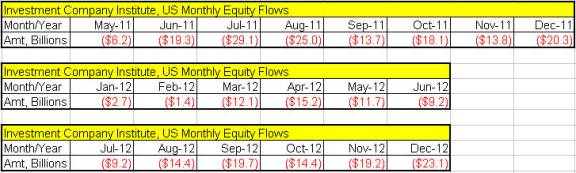

Is

it possible that managers are being forced to leap into the top of a mania, in

an attempt to bring back retail investor’s who have produced net outflows from

US equity mutual funds for 20 straight months?

Investment

Company Institute, Jan 16 ’13 – Long Term MF Flows

Anyone

looking at the net outflows from US equity funds for more than a year and a

half – an event that took place BEFORE the Financial Times and CNBC articles

were released in the last two weeks - and who have examined the September 30, 2010 report by the US

Securities and Exchange Commission and the US Commodity Futures Trading

Commission regarding the May 6, 2010

Flash Crash; the 60 Minutes report, Wall Street: The Speed

Traders (Jun 5 ’11); or a public article I released on October 27, 2011, Darwin’s

Deceptive and Dangerous Devices, understands that over the last 20 months,

the daily movements of equity markets

have become even more dependent on a small group of speed trading platforms

with no long term objective, and less dependent on those managers who are

suppose to have long term objectives. That is, until January 2013.

Can

We in 2013 Learn From 1928 & 1929?

Since

releasing Riders

on the Storm: Short Selling in Contrary Winds seven years ago this month, I

have read dozens of works that examined the history of money written over the

last century, and some even from the 1800s.

In this next section, we will return to another previous market top, the

1928-1929 period, seeking to understand the rise of RISK that develops right

alongside the rise of PRICES.

Question #1 - Is it possible that a great deal of

herd following, whether in the realm of ideas or market prices, took place then

like it does today?

Answer

#1 – Our first historical reference is Edward L. Bernays’ work Propaganda,

published in 1928. When Bernays died in 1995, his obituary referred to him as

“the father of public relations.” He served the Wilson administration during

WWI with the Committee on Public Information. He was a nephew of Sigmund

Freud. The following was taken from

chapter one, Organizing Chaos. Remember, this was released 10 years after the

close of WWI, and 1 year before the 1929 crash.

“The conscious and intelligent manipulation of the

organized habits and opinions of the masses is an important element in a

democratic society. Those who manipulate this unseen mechanism of society

constitute an invisible government which is the true ruling power of the

country.

We are governed, our minds are molded, our tastes

are formed, our ideas suggested, largely by men we have never heard of. This is

the logical result of the way in which our democratized society is organized.

Vast numbers of human beings must cooperate in this manner if they are to live

together as a smoothly functioning society.”

Pg 9

Question

#2 – Today, we find “the news” provides little time to trace back similar

patterns in history, or connect the dots. We can see from the example of weekly

flows into equity funds, there is a big difference between providing

information, and using that information in a larger context in an attempt to

understand what it could mean. However,

in our fast paced lived, would taking time to understand information in a

larger, even historical, context have any real value?

Answer

#2 - We turn now to a recent work, This

Time It Is Different: Eight Centuries of Financial Folly (2011), by Carmen

Reinhart and Kenneth Reinhart, both professors at Harvard, who formerly served

as economists with the International Monetary Fund. The following is an

illustration in their book, and was from the Sept 14 ’29 issue of the Saturday

Evening Post (Black Tuesday took place on Oct 29 ’29):

“Famous

Wrong Guesses in History, When All Europe Guessed Wrong

‘The date – October 3rd 1719. The scene

– Hotel de Nevers, Paris. A wild mob – fighting to be heard. “Fifty shares!”

“I’ll take two hundred!” “Five hundred!” “A thousand here!” “Ten thousand!”

Shrill cries of women. Hoarse shouts of men.

Speculators all – exchanging their gold and jewels or a lifetime’s meager

savings for magic shares in John Law’s Mississippi Company. Shares that were to

make them rich overnight.

Then the bubble burst. Down – down went the shares.

Facing utter ruin, the frenzied populace tried to “sell”. Panic-stricken mobs

stormed the Banque Royale. No use! The bank’s coffers were empty. John Law had

fled. The great Mississippi Company and it's promise of wealth had become but a

wretched memory.’

Today we need not guess. History sometimes repeats itself – but not invariably. In 1719

there was practically no way of finding out the facts about the Mississippi

venture. How different the position of the investor in 1929!

Today, it is inexcusable to buy a “bubble” – inexcusable because unnecessary. For now every investor – whether his capital consists of a few thousands or amounts into the millions – has at his disposal facilities for obtaining the facts. Facts which- as far as is humanly possible – eliminate the hazards of speculation and substituted in their place sound principles of investment.”

Question #3 – Is it possible that the big banks, after never having more than $60 billion in excess reserves between 1957 (oldest date I could find on a Federal Reserve website) and the end of 2008, are sitting on more than $1.5 trillion at the end of 2012 (a level reached by April ’11) because they are preparing for a massive DEFLATION of asset prices in the future? What about big corporations, who are recently reached their largest amount of cash on record?

Answer #3 - We wrap up by examining Eustace Mullins’ work - a researcher at the Library of Congress - The Secrets of the Federal Reserve (1952), in an attempt to understand why someone ALWAYS knows to exit before the current speculation goes into a severe decline. You will find that this information did not require access to “secrets”, but a skeptical mind, the tenacity to keep watch for events taking place that most dismiss as purely another days news item, and a passion to read and understand events in a larger context.

· March 1929 - “In his annual report to the stockholders of his International Acceptance Bank, in March 1929, Mr Warburg said, “If the orgies of unrestrained speculation are permitted to spread, the ultimate collapse is certain not only to affect the speculators themselves, but to bring about a general depression involving the entire country.” [3935 or 5504 in the Kindle Edition, If you are unfamiliar with the name Paul Warburg, the following is presented at the Federal Reserve Bank of Minneapolis, on a page titled, Paul Warburg’s Crusade To Establish a Central Bank in the United States:

“Paul Warburg was an advocate for a central bank in the United States and was chosen by President Woodrow Wilson to serve as one of the first members of the Federal Reserve Board.”

· March 1929 - “A friendly organ, The New York Times, not only gave the report two columns on it's editorial page, but editorially commented on the wisdom and profundity of Mr Warburg’s observations. Mr Warburg’s concern was genuine, for the stock market bubble had gone much farther than it had been intended to go, and the bankers feared the consequences if the people realized what was going on. When this report in The New York Times started a sudden wave of selling on the Exchange, the bankers grew panicky, and it was decided to ease the market somewhat. Accordingly, Warburg’s National City Bank rushed twenty-five million dollars in cash to the call money market, and postponed the day of the crash.” [3942 of 5504 in the Kindle Edition]

· April 1929 - “On April 20, 1929, the [New York] Times headlined, Federal Advisory Council Mystery Meeting in Washington: ‘Resolutions were adopted by the council and transmitted to the board, but their purpose was closely guarded. An atmosphere of deep mystery was thrown about the proceedings both by the board and the council. Every effort was made to guard the proceedings of this extraordinary session. Evasive replies were given to newspaper correspondents.’” [3946 of 5504 in the Kindle Edition]

Mullins provides his own commentary on Warburg’s remarks at the stockholders meeting as stated in the annual report of the International Acceptance Bank as well as what took place between April and October 1929. He then concludes with remarks by Colonel Curtis B. Dall, son-in-law of Franklin D. Roosevelt, who was a broker on Wall Street at the time of the crash:

“Only the innermost council of ‘The London Connection’ knew that it had been decided at this ‘mystery meeting’ to bring down the curtain on the greatest speculative boom in American history. Those in the know began to sell off all speculative stocks and put their money in government bonds. Those who were not privy to this secret information, and they included some of the wealthiest men in America, continued to hold their speculative stocks and lost everything they had.

In FDR, My Exploited Father-in-Law, Colonel Curtis B. Dall, who was a broker on Wall Street at that time, writes of the Crash, ‘Actually it was the calculated “shearing” of the public by the World Money Powers, triggered by the planned sudden shortage of the supply of call money in the New York money market.’” [3953 of 5504 in Kindle Edition]

Could excessive leverage in the financial markets cause global banks to change the level of credit that is currently being allowed? Could a sudden sell off in any of the major equity markets, or low grade bond markets, around the globe trigger such an event? Could history repeat?

Hedge Fund Leverage Rises to the Most Since 2004 in New Year,

Bloomberg, Jan 14 ‘12

“Hedge

Funds are borrowing more to buy equities just as loans by New York Stock

Exchange brokers reach the highest in four years, signs of increasing

confidence after professional investors trailed the market since 2008.

Leverage

among managers who speculate on rising and falling shares climbed to the

highest level to start any year since at least 2004, according to data compiled

by Morgan Stanley. Margin debt at NYSE firms rose in November to the most since

February 2008, data from NYSE Euronext show.

The

rising use of borrowed money shows that everyone from the biggest firms to

individuals are willing to take more risks after missing the rewards of the

bull market that began in 2009.”

Conclusion

The noted Nobel Prize winning economist Hyman Minsky has a lesson all market participants should understand with the current obsession of “more loans and more leverage available now for speculation” by Wall Street banks; the LONGER a period of stability, the HIGHER the potential risk for greater instability when the crowd changes their behavior.

The title of this article, When Everyone Sees, came from a collection of essays on character and its critical importance in a society titled, When No One Sees: The Importance of Character in an Age of Image, by Os Guinness. The surreal aspect of living through the last year and a half, is that everyone can see that the “solution” for a declining market (yet to see a 10% drop in the Dow since October 2011) appears to be to announce that you are facing a currency crisis, need more “liquidity” until more debt turns into more jobs, or that you have entered a recession again. As long as the next image (“the conscious and intelligent and manipulation of the organized habits and opinions of the masses”) that is presented to the public is higher stock prices (“orgies of unrestrained speculation”) as a RECOVERY, why will anyone be surprised when these words by a founding member of the Federal Reserve in 1929, Paul Warburg, come true… again( “the ultimate collapse” and “a general depression involving the entire country(ies)”).

It would appear that the age of image is coming to an end, and the age of character through pain is rising. The rally periods are getting shorter, and the problems from supporting MORE speculation by central bankers continue to mount. Soon, the can will refuse to be kicked any further down the road.

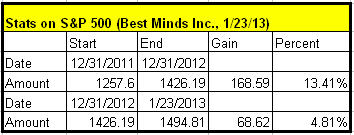

* The S&P 500 has made 36%

of the entire 2012 gain in the first 16 trading days of 2013. Does anyone

remember what happened after the 2007 top?

To subscribe to my most comprehensive research and trading

commentary, consider a subscription to The

Investor's Mind: Anticipating Trends through the Lens of History. Using our own minds has never been

more crucial. If you

have ready to look over the top of this mountain in preparation for the next

major decline, and you have never read Riders

on the Storm: Short Selling in Contrary Winds (Jan ’06), I would

encourage you to click

here to download it for free.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a registered investment

advisor that looks to the best minds in the world of finance and economics to

seek a direction for our clients. To be a true advocate to our clients, we have

found it necessary to go well beyond the norms in financial planning today. We

are avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.