Too Calm: Strength or Seduction June 15, 2012

Doug Wakefield

Isn’t

it nice to have someone bigger than you to look out for your investments? You

know, someone who no matter what happens in the world is always “buying the

dip”; someone who is totally unphased by the events taking place in Europe,

China, Japan, the US or any place on the globe. Certainly, this is a sign of great strength and faith in the

Almighty Dow.

If

you are reading this article, I know you, like myself, try to stay informed. In

many ways, your life is somewhat like my own. I have a wife, three sons and run

a small business in America. I do not

decide the fate of hundreds of millions of people in Europe, nor influence

millions of traders in our capital markets solely by saying the word

“liquidity”. However, I do read every day, and look for major developments in

the world that could impact our capital markets. I also have and continue to

read books written years, decades, of even more than a century before we

arrived at 2012 in order to understand the incredible period of history that is

unfolding around me.

With

this in mind, let me share with you a few items I have read in the last 2

weeks, which reflect trends that have been accelerating for a year or more. As

you read each of these, whether you are managing billions, leading a

corporation, or retired and concerned about your nest egg, do these events

support a Dow that at the close of business today, Friday, June 15, has climbed

732 points in the last 10 trading days, or stands only 4.2% lower than its 38

month high attained on May 1st.

Is this a sign of the strength of stocks in America, or the seduction

created by traders always waiting for the next expansion of power by central

bankers as they ride to the rescue?

Liquidity

Bailout From Central Banks If Greek Elections Wreak Market Havoc, Report Says,

Forbes, June 14, 2012

Greece

EC

Preparing Secret Plans for Greek Euro Exit, UK Telegraph, June 12, 2012

Commission officials confirmed on Tuesday that

"these elements" of contingency planning for a Greek exit from the

single currency have been discussed by the "euro working group" (EWG)

of Treasury officials and junior finance ministers over the last six weeks….

Greek newspaper Ekathimerini reported bank

withdrawals in Greece have hit a rate of up to €500m per day, a level expected

to accelerate in the aftermath of Greek elections on Sunday (June 17)….

Capital restrictions, including limits on

cash-machine withdrawals, are legal under Article 65 of Europe's internal

market rules allowing emergency measures to preserve "public

security" in the event of a Greek exit, said a Commission official.

Egypt

Muslim Cleric:

Jerusalem to be Capital under Mursi Rule, Israeli National News, June 9,

2012

If

Muslim Brotherhood candidate Mohammed Mursi were to become president, Egypt’s

capital would no longer be Cairo, but would be Jerusalem, a prominent Egyptian

cleric said at a presidential campaign rally, which was aired by an Egyptian

private television channel.

“Our

capital shall not be Cairo, Mecca or Medina. It shall be Jerusalem with God’s

will. Our chants shall be: ‘millions of martyrs will march towards Jerusalem,’”

Safwat Hagazy said, according to the video aired by Egypt’s religious Annas

TV.

The

video, which went viral after being posted on YouTube, was translated into

English by The Middle East Media Research Institute (MEMRI).

“The United States of the Arabs will be restored on

the hands of that man [Mursi] and his supporters. The capital of the [Muslim]

Caliphate will be Jerusalem with God’s will,” Hegazy said, as the crowds

cheered, waving Egyptian and Hamas flags….

Mursi will challenge Egypt’s former Prime Minister

Ahmed Shafiq in the upcoming runoff elections, scheduled to take place June 16

and 17.

Spain

Spain’s Bond Yield Hits A Record Near 7% After Moody’s Downgrade to Near Junk Status, The Washington Post, June 14 ‘12

Spain’s

borrowing costs broke through another record Thursday after a credit ratings agency

downgraded the country’s ability to pay down its debt amid rising fears a bank

bailout may not be enough to save the country from economic chaos.

The

interest rate — or yield — on the country’s benchmark 10-year bonds rose to a

record 6.96 percent in intraday trading Thursday, its highest level since Spain

joined the euro in 1999 and close to the level which many analysts believe is

unsustainable in the long term.

The

ratings agency Moody’s downgraded Spain’s sovereign debt three notches from A3

to Baa3 Wednesday night, leaving it just one grade above “junk status”.

Moody’s

said the downgrade was due to the offer from eurozone leaders of up to €100

billion ($125 billion) to Spain to prop up its failing banking sector, which

the ratings agency believes will add considerably to the government’s debt

burden….

Spain

won’t immediately collapse if the rate hits 7 percent, but reaching that point

would affect it at Tuesday’s (June19) scheduled debt auction.

“The

clock is definitely ticking,” said Michael Hewson, an analyst with CMC Markets.

Japan

Russia

Stunned After Japanese Plan To Evacuate 40 Million Revealed, EU Times,

April 15 ‘12

A new report circulating in the Kremlin today prepared by the Foreign Ministry on the planned re-opening of talks with Japan over the disputed Kuril Islands during the next fortnight states that Russian diplomats were “stunned” after being told by their Japanese counterparts that upwards of 40 million of their peoples were in “extreme danger” of life threatening radiation poisoning and could very well likely be faced with forced evacuations away from their countries eastern most located cities… including the world’s largest one, Tokyo….

Important to note,

this report continues, are that Japanese diplomats told their Russian

counterparts that they were, also, “seriously considering” an offer by China to

relocate tens of millions of their citizens to the Chinese mainland to inhabit

what are called the “ghost cities,” built for reasons still unknown and

described, in part, by London’s Daily Mail News Service in their 18 December

2010 article titled: “The Ghost Towns Of China: Amazing Satellite Images Show Cities

Meant To Be Home To Millions Lying Deserted”….

If

this last one sounds too unbelievable to fathom, as it certainly does to me,

you may want to consider the comments of Senator Robert Wyden who visited

Fukushima in April, or the comments of the Japanese Prime Minister Naoto Kan

who spoke at the World Economic Forum in January, as found in the April 27,

2012 Huffington Post article, Two

Meltdowns: Fukushima and the US Economy.

Moving

past these extraordinary world events, we go to statements made by global

political/financial names. Robert Zoellick, President of the World Bank, and

Roger Altman, Chairman of Evercore Partners, former deputy Treasury secretary

under Clinton (93-94) – both attendees

of the May 31-June 2 Bilderberg meeting in Chantilly, Virginia two weeks ago - had comments in the news last week.

Robert Zoellick

‘Beware

of the rerun of the Great Panic of 2008’: Head of World Bank Warns Europe is

Heading for ‘Danger Zone’ as World Markets Suffer Bleakest Day of the Year So

Far, UK Daily Mail, June 1, 2012

The head of the World Bank yesterday warned that

financial markets face a rerun of the Great Panic of 2008.

On the bleakest day for the global economy this

year, Robert Zoellick said crisis-torn Europe was heading for the ‘danger

zone’.

Mr Zoellick, who stands down at the end of the

month after five years in charge of the watchdog, said it was ‘far from clear

that eurozone leaders have steeled themselves’ for the looming

catastrophe amid fears of a Greek exit from the single currency and meltdown in

Spain.

The flow of money into so-called ‘safe havens’ such

as UK, German and US government debt turned into a stampede yesterday…..

He said: ‘Events in Greece could trigger financial

fright in Spain, Italy and across the eurozone. The summer of 2012 offers an

eerie echo of 2008.

‘If Greece leaves the eurozone, the contagion is

impossible to predict, just as Lehman had unexpected consequences.’…

Roger Altman

Euro

Zone on the Brink, Washington Post, June 4 ‘12

Europe

is on the verge of financial chaos. Global capital markets, now the most

powerful force on earth, are rapidly losing confidence in the financial

coherence of the 17-nation euro zone. A market implosion there, like that

triggered by Lehman Brothers collapse in 2008, may not be far off. Not only

would that dismantle the euro zone, but it could also usher in another global

economic slump: in effect, a second leg of the Great Recession, analogous to

that of 1937.

This

risk is evident in the structure of global interest rates. At one level, U.S.

Treasury bonds are now carrying the lowest yields in history, as gigantic sums

of money seek a safe haven from this crisis. At another level, the weaker

euro-zone countries, such as Spain and Italy, are paying stratospheric rates

because investors are increasingly questioning their solvency. And there’s

Greece, whose even higher rates signify its bankrupt condition. In addition,

larger businesses and wealthy individuals are moving all of their cash and

securities out of banks in these weakening countries. This undermines their

financial systems.

Even the Federal Reserve, whose ability to produce debt worldwide has

placed it at the top of the central bankers class over the last century,

released two reports this year, one this week, that were not exactly

“optimistic”. In my opinion, one would have thought this information should

have given traders pause before catching the next “central banks to the rescue”

wave higher, or institutional managers conviction that maybe they should sell a

few shares of those 6 Dow stocks that hit their all time highs (one actually

since 2000) this week as options as June options closed.

Changes

to Family in U.S. Family Finances from 2007-2010: Evidence from the Consumer

Finances, Federal Reserve Bulletin, June 2012, Vo 98, no 2

The Federal Reserve Board’s Survey of Consumer

Finances (SCF) for 2010 provides insights into changes in family income and net

worth since the 2007 survey. The survey shows that over the 2007-2010 period,

the median income of real (inflation-adjusted) family income before taxes fell

7.7%, median income had also fallen slightly in the previous three year period.

The decline in median income was widespread across demographic groups, with

only a few groups experiencing stable or rising incomes….

The decreases in family income over the 2007-2010

period were substantially smaller than the declines in both median and mean net

worth; overall median net worth fell 38.8% and the mean fell 14.7%…Although

declines in the values of financial assets or business were important factors

for some families, the decreases in median net worth appear to have been driven

most strongly by a board collapse in housing prices. …

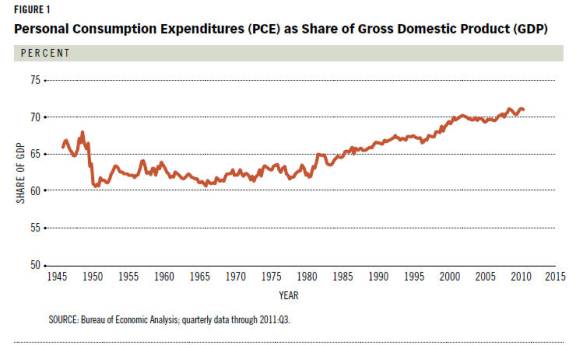

Don’t

Expect Consumer Spending to Be The Engine it Once Was, The Regional Economist,

Federal Reserve Bank of St. Louis, January 2012

Can American consumers continue to serve as the

engine of U.S. and global economic growth as they did during recent decades?

Several powerful trends suggest not, at least for a while. Instead, new sources

of demand, both domestic and foreign, are needed if we are to maintain healthy

rates of growth.

Unfortunately, this won’t be easy because consumer

spending constitutes the largest part of our economy, and replacements for

it—more investment, more government spending or more exports—either can’t be

increased rapidly or might create unwanted consequences of their own.

Finally, when one searches for articles about “money pouring in”, the

collective actions of retail investors and corporate insiders in the last few

months does not confirm that the crowd, either in or out of the know, was the

power behind these 100 plus daily swings that

gave the Dow the image of invincibility.

Insiders are

Selling, Should You?, CNN Money, April 24, 2012

First quarter earnings have been decent, if not

spectacular. And many corporate executives are issuing cautiously optimistic

guidance for the rest of the year.

But while insiders' lips are saying one thing,

their wallets are saying another. The level of insider selling among S&P

500 (SPX)

companies is the highest in nearly 10 years. That is not good.

Guess

Who is Buying all the Bonds? (It’s Not the Feds), CNBC, June 8, 2012

Mom-and-pop

investors, and not the Federal Reserve, have been the ones most responsible for

driving the mad dash to government debt, according to newly released data.

But despite the low

yields, it's been retail investors most responsible for the recent move plunge.

The demand among

average investors has swelled so much, in fact, that they bought more

Treasuries in the first quarter than foreigners and the Fed combined.

Households picked up about

$170 billion in the low-yielding government debt during the quarter, while

foreigners increased their holdings by $110 billion.

US

Flash Crash Measures Suffer Delays, Financial Times, May 6 ‘12

Volume of trading off-exchange has grown since the flash

crash, hitting a record level in the first quarter, at 34 per cent.

Critics have charged that worries about the flash crash, and

the role played by automated trading “algorithms” and high-frequency dealing

have chased individual investors away from equities.

Since May 6 two years ago, retail investors have pulled

$273bn from US domestic equity mutual funds, versus $174bn in the two years

prior to the “flash crash”, according to figures from the Investment Company

Institute.

The average daily trading volume of US equities was

also its lowest in April since December 2007.

So let’s review. From reading a few articles from papers around the

world, listening to the comments from two recent Bilderberg attendees,

examining two powerful pieces by the Federal Reserve that support the

deflationary headwinds the US and global economy is facing, and examining the

actions of retail investors and insiders, I ask you, “Is the current market

rally a display of strength, fearlessness, and confidence, or the seduction and

enticement to believe that U.S. stocks

can overcome any pieces of bad news”?

When I began Best Minds Inc in early 2005, and started

releasing public articles that summer at the top of the Philly Housing

Index (HGX), it was clear from the massive explosion of debt underneath, and

the research showing the hysteria to get in, and the distortion of prices back

over centuries, that this was a turning point in history, not just a market

top.

When I arrived at the top of the American and Chinese markets in late

October/early November 2007, having been influenced by men and women who were

examining history and seeking to be realists, not bearish for bearishness sake,

I released an article, Fear and

Perception. It was especially obvious I was watching a mania in the Chinese

equity markets, which like the American real estate bubble two years earlier,

would be a turning point in history, not just a trading top.

[Chart

from Fear and Perception, released on Nov 1 ‘07]

[Chart

from Fear and Perception, released on Nov 1 ‘07]

So how do US

stock markets stay removed from these extremely negative world events even now?

It this a mania like the other two cited above, or is this one somehow

different?

The answer is

simple. It is the same, and yet different. The current environment contains instant

money “newly created debt” by central bankers, only at levels never seen before

in history, the ability for computers to trade in milliseconds, giving the

illusion of a crowd leaping into stocks when in reality smaller sums of capital

are being used to purchase futures which provide the leverage without the need

for the cash to purchase an index ETF or stock, and America’s denial to believe

that our corner of the world could face changes as serious as those living in

other corners of the world. However, I believe the combination of “unlimited

money”, the fastest trading in human history, and the ability to choose the

version of the news you wish to hear, has created what is right now, the most

powerful mania of all time. However, would it not make sense that if “wealth”

can be created in seconds, it could also be destroyed as quickly?

High

Speed Trading: Profits – and Danger – in Milliseconds, CNBC, May 14 ‘12

Eric

Scott Hunsader has gone completely down the rabbit hole, and he doesn’t like

what he’s finding there.

Hunsader is the CEO of a Chicago-based market

analytics firm that specializes in high-frequency trading — super

fast trades executed at the speed of light that can alter asset prices faster

than human beings can react to the changes.

Based on his own analysis, Hunsader has come to a

startling conclusion: Markets today are even more susceptible to sudden failure

than they were two years ago during the “flash crash,”(May 6 ’10) which brought

the stock market down by about 1,000 points in mere minutes.

That’s because a new breed of trader armed with

hundreds of millions of dollars to deploy is trading so fast—and with such

spikes in volume—that he can dry up liquidity in an instant, causing

severe price swings….

On May 4, Hunsader says, he spotted those traders

just before the April number was released. At 8:29:20 and about 200

milliseconds, he says, someone — he has no way of knowing who — executed a

trade in the five year T-note futures market worth about $150 million.

A chart of that single second in the market shows

that prices are relatively stable until the trade. And just after that, for the

rest of the second, prices spike, and gyrate up and down as other automated

high speed computers react to the trade.

Hunsader says he doesn’t know exactly how the

traders make money off the volatility that they create, but he suspects they’re

making other trades in the milliseconds following their market moving trade

that take advantage of the relationships between this market and others that

are impacted by it.

The traders that move first, and fastest, win, he

says.

“It’s

like two guys running in the woods, and they see a bear and one guy drops down

and puts his shoes on and the other guy says, ‘what are you doing that for, you

can’t outrun a bear,’” Hunsader says. “And the guy goes, ‘I don’t have to

outrun the bear, I just have to outrun you.’” [Italics mine. See also my Oct

2011 article, Darwin’s Deceptive and Dangerous Devices).

In the next few weeks, the most powerful financial leaders of the

world will meet at various places for meetings that were arranged weeks, if not

months ahead. It is so easy to believe that “more liquidity” will always be

fired from the cannons of the central bankers, and that as we learned from

2008, they can stop a decline. Yet, if we all reflect on world events just 4

years ago, we know this is not true.

I am confident, that someday, future generations around the world will

understand that we sold our futures to a small group of people who would give

us the illusion we were strong and powerful today, or that their actions would

leave our corner of the world unimpacted by those facing monumental challenges

in other corners of the world. At some

point, we will all desire friendships based on the openness and transparency to

discuss information like that contained in this article realizing that we are

all watching the same world changes, rather than posturing with people who help

us forget about reality for the sake of our own desire to feel

comfortable…today. Success is still achievable. We just may need to redefine

how it is done.

“It is obvious: the future is open to manipulation.

Who will do the manipulating? Will it be the new elite on the side of an

establishment authoritarianism or another elite? Whoever achieves political or

cultural power in the future will have at his disposal techniques of

manipulation that no totalitarian ruler in the past has ever had. None of these

are only future; they all exist today waiting to be used by the manipulators….

I hate being an alarmist, and I do not

think I am. Anything I have said that is alarmism I hope you will simply

forget.” [The Church at the End of the Twentieth Century (1970), Francis

A. Schaeffer, pg 78 & 86]

If you are interested in our most comprehensive research

and trading commentary, consider a subscription to The Investor's Mind:

Anticipating Trends through the Lens of History. You don’t need a bailout

to be a subscriber, and I cannot think of a better time to be using our minds.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a

registered investment advisor that looks to the best minds in the world of

finance and economics to seek a direction for our clients. To be a true

advocate to our clients, we have found it necessary to go well beyond the norms

in financial planning today. We are avid readers. In our study of the markets,

we research general history, financial and economic history, fundamental and

technical analysis, and mass and individual psychology.

Disclaimer:

Nothing in this communiqué should be construed as advice to buy, sell, hold, or

sell short. The safest action is to constantly increase one's knowledge of the

money game. To accept the conventional wisdom about the world of money, without

a thorough examination of how that "wisdom" has stood over time, is

to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of

individuals, and at any time may or may not agree with those individual's

advice. Challenging one's thinking is the only way to come to firm conclusions.