To Create Unlimited Liquidity or Not; That Is the Question Jan 29, 2015

Doug

Wakefield

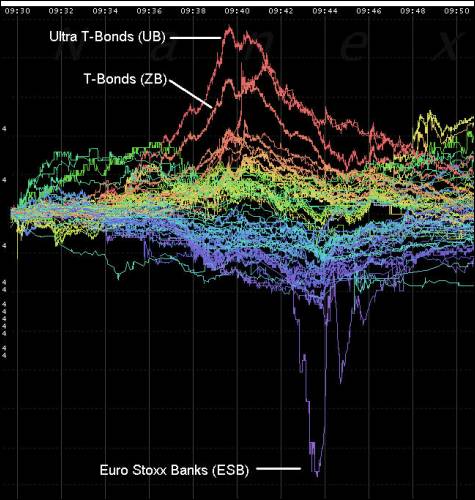

“On

October 15, 2014 between 9:33 and 9:45, liquidity evaporated in Treasury

futures and prices skyrocketed (causing yields to plummet). Five minutes later,

prices returned to 9:33 levels.

Trading

activity was enormous, sending trade counts for the entire day to record highs

- exceeding that of the Lehman collapse, the financial crisis and the August

2011 downgrade of U.S. debt. Treasury futures were so active, they pushed

overall trade counts on the CME to a new record high.”[Underlined text my own, Nanex Research, Oct 15 ’14,

Treasury Flash Crash]

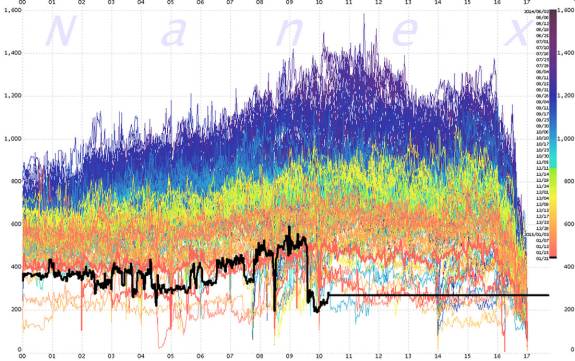

“In

what is likely an effort to comprehend whether the market is satiated with a

mere EUR 50 billion per month in printed money, this morning's leaked ECB QE

announcement (due tomorrow) sparked

total chaos in FX markets and, as Nanex notes, sending market liquidity to

near record lows. This is a problem. With the 'real'

volatility event not arriving until tomorrow, everyone has pulled out of the

market already... setting the scene for a gappy Swissnado replay tomorrow

morning.”[Underlined text my

own, All

Liquidity Disappears From Euro FX Market Day Ahead of ECB Announcement,

Zero Hedge, January 21, 2015]

Two

powerful ideas collide in our heads. The most dominant by the financial media

and central banks, is the relentless pursuit of “overcoming deflation” with

“unlimited money”.

The

other is a lesser known idea, that the more trades are pushed in the same

direction and the longer this takes place, the more apt markets are to reach a

point when either the demand to get in or get out produces a lack of liquidity

in that market.

History

has already left us a highly studied event that took place on May 6, 2010, that

most know today because it became the ultimate example of a new term known as

the “flash crash”, a topic I have mentioned in several articles.

“I.3. A LOSS OF LIQUIDITY - Since the E-Mini and

SPY both track the same set of S&P 500 stocks, it can be expected that

prices of these products would move in tandem during their rapid decline.

However, a detailed examination of the order books15 for each product reveals

that in the moments before prices of the E-Mini and SPY both hit their

intra-day lows, the E-Mini suffered a significant loss of liquidity during

which buy-side market depth16 was not able to keep pace with sell-side

pressure. In comparison, buy-side liquidity in SPY reached its low point for

the day a few minutes later, after prices in both the E-Mini and SPY began to

recover.” [

Securities and Exchange Commission’s joint paper with the Commodity Futures

Trading Commission, Findings Regarding the Market Events of May 6, 2010, released

Sept 30, ’10, pg 11]

Most

individuals, living their daily lives outside the world of trading and

financial systems, have probably never considered this critical question, must

less even know it is a question to ask.

Yet

think about it. If you continue to tell a crowd of people, “here comes another

bucket of QE (cheap money)”, why would the experience of the last 3 years tell

us anything but, “there is plenty of liquidity to speculate, and central

bankers want us to ‘feel wealthier, so we will go out and borrow and spend’, so

why worry?

A massive loss of liquidity during times of

extreme stress in markets is actually a consequence of creating too much

liquidity. The more people chase

the same trend, the higher the leverage and the larger the trade, the more

likely that at some point, the movements of the herd overwhelm the system.

If

this happens over a few minutes, like those seen in US Treasuries on October 15th,

or the euro on January 21st, then the public probably never even

knows anything happened.

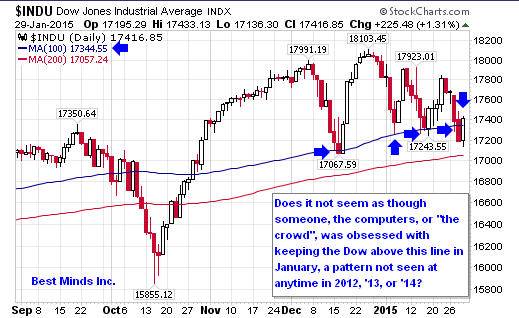

If

the event makes history and brings about the most volatile day in US stocks on

record to date, the May 6, 2010 Flash Crash, thus creating documentaries and

investigations from the highest regulatory bodies in the US, then the public is

made aware that there is a problem. However, we forget quickly as long as

things return to “normal”, i.e., computers keep bouncing stock indices upwards

repeatedly at their “nirvana lines”?

But

what happens if the idea of “risk on/risk off” becomes so dominant in the

trading world, that an event escalates over several weeks into a crash, such as

the 3,000-point drop from the high on Friday, Oct 3 ’08 to the low on Friday,

Oct

10’ 08, or the largest percentage decline in a day (22%) on record, Black

Monday, October 19, 1987? I know, we have learned from those mistakes.

What

was seen as very good for rising stock markets, ever larger amounts of capital

pouring in, now becomes a very nasty part of creating the inverse as stocks

capital flows out, and the shift begins in earnest. Eventually, a critical

week, day, or even few minutes can be reached, where all that liquidity is not

available.

Eventually,

all that massive amount of additional liquidity creates enormously lopsided

trades in the largest markets in the world. A shift from one side of the boat

to the other, impacts the entire global business world.

So

while political and financial central planning leaders love to espouse the

power of the “liquidity bazooka”, we need to remember that there is a much

larger story developing, and it most certainly is not how a bunch of global

bureaucrats can make life and trading easier for the rest of humanity.

“In all, a massive bond buying bazooka of 1.1

trillion euros.

Markets were tipped off on the direction, but not

the scale, of the program thanks to French President, Francois Hollande: ‘On

Thursday, the ECB will take the decision to buy sovereign debt, which will

provide significant liquidity to the European economy and create a movement

that is favourable to growth.’” [ECB

Money Printing Now Expected to Top 1 trillion Euros, ABC News, Jan 21 ‘15]

I

still remember researching the archives of The

Investment Company Institute for capital flows into and out of stock funds

when I first started tearing apart the markets at the system level in 2004,

looking for patterns from the wild ride to the top and back to the bottom

between the late 90s and 2003. What I noticed was that the capital flows into

US based stock funds hit their highest on record in February 2000, the month

before the NASDAQ’s all time high that March, and the largest outflow the

summer of 2002.

Record

$36.5 billion flows into US- based funds in week: Lipper, CNBC,

Dec 27 ‘14

“Investors in U.S.-based funds poured $36.5 billion

into stock funds in the latest weekly period, marking the biggest inflows on

record as U.S. stocks surged to record highs, data from Thomson Reuters Lipper

service showed on Friday.”

“Money has been flowing out of the major ETFs

tracking the S&P 500. Over the past three weeks, more than $20 billion has

left the funds, the 2nd highest amount in the past four years.”

[Jason Goepfert’s Daily Sentiment Report, Jan 27 ’15, www.sentimentrader.com]

The question should have never been about the

“right” amount of liquidity, but why a system we espouse as “free markets”

continues to need so much constant intervention, now in its 7th year

since hearing the term “bailout”.

I guess some things will never change….until put

under enough pressure.

Being a Contrarian

I

have found that using the “nirvana trade”, one has been able to profit from

being a contrarian as volatility has picked up greatly since mid 2014.

January’s extreme volatility should be a warning to everyone. Change is always

inevitable, as demonstrated by centuries of market history.

The

Investor’s Mind was started in 2006, believing that asking questions was a good

thing. 2015 seems set to prove why once again, like 2008.

The

cost for procrastination continues to rise. The value for good research is

extremely low in comparison to the speed in which wealth can be destroyed. Click here to start the next

six months reading the newsletters and trading reports as we come through

this incredible year.

On a Personal Note

I

have recently started a blog called, Living2024.

It is a personal blog, not business. I wanted to have a place to write some

personal stories about where this entire drama seems to be taking us all. I

hope you will check it out.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that

looks to the best minds in the world of finance and economics to seek a

direction for our clients. To be a true advocate to our clients, we have found

it necessary to go well beyond the norms in financial planning today. We are

avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.