The Troika Loan Shark Stock Rally July 31, 2015

Doug Wakefield

July

has turned out to be a very volatile month for stocks, whether Asia, Europe,

US, or worldwide. Every time it appeared that something from the real world of

finance and economics might create at least another 10% “correction” from all

time high readings in US stocks, “someone” was there to make certain that

investors and traders - especially in Europe, Japan, and the US - saw no

lasting impact from the events in China and Greece with their own investments.

For a society that has been groomed to believe that

experience is far more important than history, doing nothing has become the

ultimate investment strategy. Trusting “the state” to make sure that risk is never

reflected in markets more than a few days, has lead the public at large to

totally miss out on incredible lessons from history. July was yet one more for

the books.

It

was also a month that rewarded investors for NOT considering how those of us

living outside Greece or China could go through similar events or worse in the

future.

June

28th; Start at the Top of the Global Financial System

Before

we examine critical lessons that most assuredly have been missed by the general

public, believing that “if you don’t

think about it, you will be fine”, let’s start beyond Greece, China, and the

rest of the global markets.

Let’s

return again to the 85th

annual report from the Bank of International Settlements, and what their

research saw across the global financial landscape as we started the second

half of 2015.

“Globally,

interest rates have been extraordinarily low for an exceptionally long time, in

nominal and inflation-adjusted terms, against any benchmark. Such low rates are

the most remarkable symptom of a broader malaise in the global economy: the

economic expansion is unbalanced, debt burdens and financial risks are still

too high, productivity growth too low, and the room for maneuver in

macroeconomic policy too limited. The unthinkable risks becoming routine and

being perceived as the new normal.

This

malaise has proved exceedingly difficult to understand. The chapter argues that

it reflects to a considerable extent the failure to come to grips with

financial booms and busts that leave deep and enduring economic scars. In the

long term, this runs the risk of entrenching instability and chronic weakness.

There is both a domestic and an international dimension to all this. Domestic policy

regimes have been too narrowly concerned with stabilizing short-term output and

inflation and have lost sight of slower-moving but more costly financial booms

and busts. And the international monetary and financial system has spread easy

monetary and financial conditions in the core economies to other economies

through exchange rate and capital flow pressures, furthering the build-up of

financial vulnerabilities. Short-term gain risks being bought at the cost of

long-term pain.”

In order that we

don’t miss the significance of what the central bank to the central banks of

the world stated, let’s review a few points from the paragraphs above that

every money manager, advisor, and investor should consider as we start August

2015. The events that brought us up to this summer will help us understand why

the FUTURE direction of financial markets must change.

·

Global interest rates

have been at extraordinarily low levels for an exceptionally long time.

·

This was not seen as

a good thing for the global economy, but a malaise which has already increased

debt burdens and financial risks.

·

The illusion that

high debt, high risks, and ultra low interest rates have left global investors

with the experience that “all time high is good, especially when central banks

constantly intervene and keep promoting ‘one more run to the top’”, has lead to

a failure of the public to have little to no understanding regarding the long

history of booms AND busts. At the end of the boom, busts come, leaving

“enduring economic scars”…or might I say, worse.

·

The spread of easy

monetary conditions has gone from core economies to other economies of the

world, thus making the entire system - both economic and financial - more

vulnerable to the next bust phase.

·

Finally, maybe the

most important thing for us all to remember, is that the rewards from short

term gains built on unsustainable long term policies, are wiped out during the

subsequent bust phase. “Short-term gain risks being bought at the costs of

long-term pain”. At some point, pain always shows up. A riskless world

never has existed, and the evidence is clear, it most certainly is not the

world ahead. The 2002 to 2009 period should have taught us this, but it did

not.

Greece – The

Loan Shark Wins Today, But at What Costs?

Do you think the

financial events surrounding Greece were a success or a failure?

Let’s examine the

elephant by looking at the last few weeks from different angles.

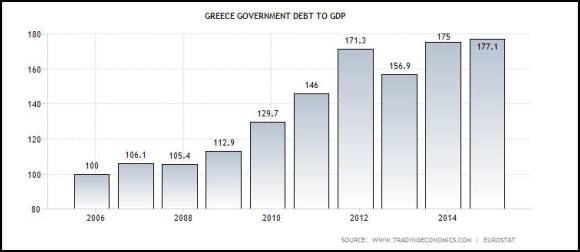

Question – Did the unsustainable debt levels that came from

bailout 1 and 2 get reduced?

Answer – No. While the media articles support that the

global banking elites are still working on it, no reduction of debt, either by

haircuts or debt restructuring, has taken place as of the end of July.

IMF

Agrees With Athens That Greece Needs Debt Relief, NY Times, July 2nd

Secret

IMF Report Says Greece’s Debt Problems Are Way Worse Than What Europe Is

Prepared For, Business Insider, July 14th

IMF

Refuses To Join Greek Bailout Until Debt Relief Demands Are Met, The

Guardian, July 30th

Question – Before Greece defaulted on its IMF payments in

June, what did we already know about the impact from the increase in Greece’s

centrally planned economy under bailout 1 and 2 since 2010?

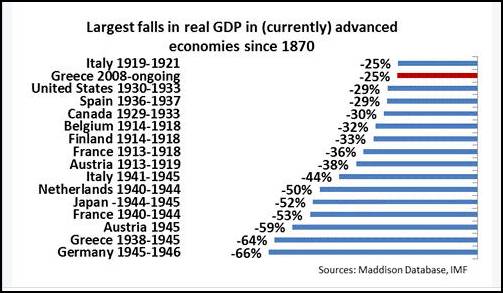

Answer – That since 2008, Greece has undergone one of the

worst periods of economic decline among advanced nations over the last 145

years. Remember, this was BEFORE we started this July, and the “solution” of

more cuts, less income (pension cuts), sell assets, keep capital controls on

the banks, and THEN we will add more debt to this drowning saga.

Help me out. Does

that look like a solution to you?

Question – Did the announcement of a recent third bailout

do anything for the people of Greece? Did it give them more control over their

economic lives and futures or less?

Greek

Capital Controls To Remain For Months As Germany Pushes For Bail-In Of Large

Greek Depositors, ZH, July 26, 2015

Inside

Greece's health care crisis, CNN Money, July 10, 2015

Greek

airports, power plants and roads for sale amid debt crunch, Aljazeera

America, July 15, 2015

Greeks

Are Going To Be Furious When the Government Chops Up The Country For A Fire

Sale, Business Insider, July 13, 2015

Hay

For Cheese? – Barter Booms In Cash-Squeezed Rural Greece, Reuters, July 29

Answer – The articles

listed above reveal these developments.

·

The amount of money

circulating across the Greek economy has plummeted. After the banking system

went under capital controls and restricted cash withdrawals starting June 29th,

non-performing loans – already at € 100 billion out of € 210 billion in loans –

are rising at € 1 billion a day.

·

Since the start of

bailout 1 in 2010, government spending on healthcare has been cut by 25%,

spending on drugs has declined by 32%, and with the nation running out of cash,

international organizations warn that Greece could face medicine shortages in

August.

·

Cash restrictions

from banks in Greece stand at 420 euros a week since the banks reopened on July

20th. Bartering has become a necessity in rural areas. One website

that facilitates bartering has seen their transaction volume double since June

29th.

·

The “EU rescue” rally

in European stocks (actually started before the third bailout solution was

announced early on July 13th) is based on obligating Greece to sell $

55 billion in Greek assets in order to move forward, a loan that would increase

the nation’s debt to GDP above 200%. These state assets would be sold to the

GLOBAL private sector in what are certainly fire sale conditions. The funds

made from selling assets, would first go to paying back the European Stability

Mechanism loan, then recapitalizing the banks so that short term funds loaned

to them by the European Central Bank could be paid back, an amount that has

already reached levels that are higher than all deposits in the banking system. The selling of state assets such

as islands, airports, roads, power plants, schools, and hospitals, is along the

same lines as the IMF’s policies that crushed Russia in the early 1990s.

Lessons From Russia From the 1990s

When Russia subjected itself to the policies of the World Bank and IMF in the early ‘90s, in 1992 alone, consumer prices skyrocketed 100 times those of the previous year. Televisions leaped from 800 rubles to 85,000 rubles. Wages increased by ten times, yet real earnings actually plummeted by 80% because of the rapid devaluation of the ruble.

With

consumer prices coming up to world market levels, salaries in rubles were

barely sufficient for food. Under the IMF-World Bank guidelines, social programs

had to become self-financing: hospitals, schools, and kindergartens were told

to charge user fees, a surgery could be the equivalent of 2-6 months earnings,

something only the new rich could afford. Hospitals, museums, and theatres went

bankrupt.

The

government virtually gave away its valuable state assets, while it was unable

to provide pensions for its elderly or assistance for the poor. At the same

time, the government was borrowing billions from the IMF, which exploded the

nation’s debt levels. Meanwhile, the oligarchs who benefited from these

policies took billions out of the country – [Sources: The

Globalization of Poverty and the New World Order: Second Edition (2003)

by economist Michel Chossudovsky, page 240, 241 and Globalization

And Its Discontents (2002) by Nobel Prize winning economist and former

chief economist for the World Bank, Joseph Stiglitz, page 145]

Greece Today, Russia Yesterday; Why Should Global Equity Investors Be Concerned?

So

I ask you, after the Greek people, in a democratic referendum voted no to

further austerity by the Troika on Sunday, July 5th, only to have

their votes totally dismissed in order to negotiate MORE austerity through the

sale of state assets, further reduction of retirement pensions, tax increases,

and capital controls over their banks….so that negotiations could move forward

toward a third bailout to primarily pay back the debt holders under bailout 1,

2, and now 3….was real financial progress made in July?

Yet

anyone having no knowledge what took place during the month of July in Greece,

would be finishing the month with the feeling that Greece had nothing to do

with their lives and equity markets.

What

I find very interesting is that US stocks (S&P 500), German stocks (DAX),

and Japanese stocks (Nikkei) all bottomed the week BEFORE the third bailout

“solution” with more austerity was made on Monday, July 13th. So why

did all those financial and political leaders spend all weekend hammering out

something into the wee hours of the morning on July 13th, if these

major equity markets had already dismissed it all as a side show the week

before?

I

know, because we have come to believe that with enough “assistance” and central

planning, global elites can make sure that the realities the BIS discussed in

their June 28th 85th Annual Report do not have to be

faced yet.

[August

6th is the 77th month anniversary of the S&P 500’s

low on 3/6/9.]

It is strange

that to rescue Russia from communism, IMF policies almost destroyed the

economic life of the nation in the early 1990s. Now today, we have all been

watching the “rescue” of Greece from democracy by the same IMF policies,

resulting in the same destruction of economic life in a nation. When will we

start learning that hoping for MORE central planning and intervention is

increasing the level of long-term pain.

[Bill

Gross Explains (in 90 Seconds) How Its All A Big Shell Game, ZH, 7/29/15]

Being a Contrarian, Remembering History

The

big shift from longs to shorts and shorts to longs continues moving away from

previous trends, and toward future ones.

Click here to start the next

six months reading the newsletters, reports, and group emails as we move

into the second half of 2015. Click here to review two

amazing charts of the Dow, one back to 1890, developed by Chris Kimble of Kimble Charting Solutions and

posted on Best Minds Inc Weekly

page today.

On a Personal Note

Check out Living2024. It is my personal blog, not business. I wanted to have a place to write some deeper stories about where this entire drama seems to be taking us all. Check out my latest post, Optimism Didn’t Help Greeks or Chinese.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology