The Stock Nirvana Has Been

Broken August 21, 2015

Doug

Wakefield

Is

it possible to have a calm and boring market break down quickly in merely two

trading days? Is it possible that THIS is the start of breaking the “stock

nirvana” illusion?

Let’s

examine the evidence.

All Is Calm…Until It Is Not

Anyone

looking back over the trading days of July and August as of Wednesday would

have seen nothing but the illusion of “control” at the 200 day moving average

of the S&P 500.

Four Horses

As

the markets closed today in the U.S., we can see that the four major equity

market indices have now closed two days in a row under their 200 day moving

averages, declining very sharply.

The Global 200

Does

the evidence reveal, that the US equity declines are isolated, or part of a

much larger global drama?

Who Me…Fear?

After

being pushed to its lowest reading since July 2014 in early August, the VIX

finally roared past every top over the last year today, with the exception of

the one we saw last October.

Near

term, this would argue for a bottom very soon in stocks and a top in the VIX.

However, considering the fact that it has taken so long to break underneath the

200 day moving averages of the four U.S. equity indices shown above, the last

two days appear to be a wake up call to global investors, that September could

prove dramatically different from the illusion of “nirvana” that has been

experienced these last few years.

But Where Are the Bulls?

While

there have been stock bulls and gold bears for 4 years, the following are three

reasons that gold should prove welcoming to those looking for a bull trend.

Anyone

reading, “Gold

is ‘Undervalued’ For First Time in 6 Years, BofAML Says, released on Zero

Hedge on August 18th, will learn the following:

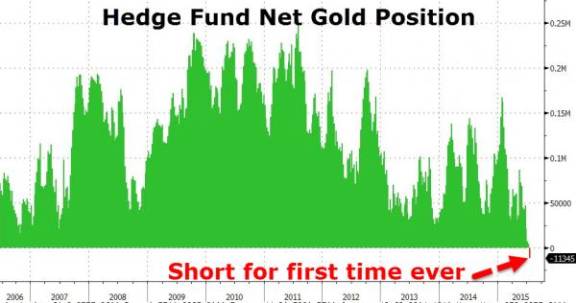

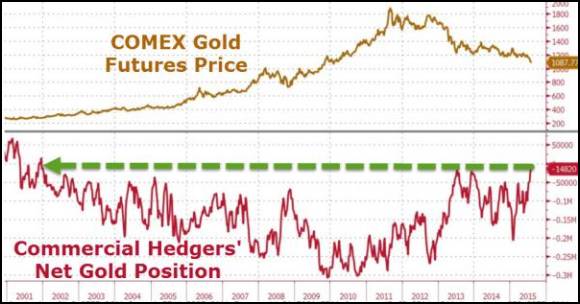

Hedge

Funds just went short for the first time ever. This is a contrarian

signal, when compared with the actions of the commercial hedgers, who were

recently holding their lowest short position since the gold bull started

in 2001.

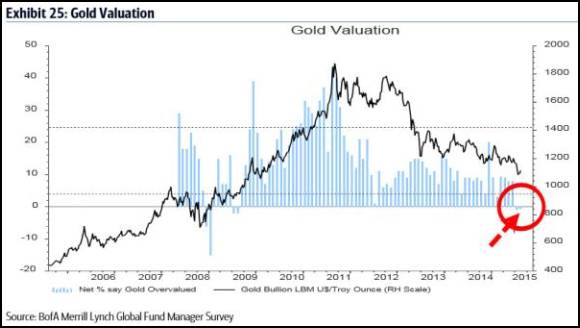

Lastly,

a survey of managers by Bank of America Merrill Lynch recently revealed that

they believed gold was undervalued for the first time since 2009.

For

over a year now, I have been asking readers to look for the big shift, where

bulls become bears and bears become bulls. While we had equity markets like the

Toronto Stock Exchange top last September, followed by the Dow Transports last

December, it took until July this year to see the S&P Biotech Index and the

NASDAQ Composite reach their all time highs.

Yet,

whether we are looking at the bottoming of gold, or the topping of equities and

junk bond worldwide, the move from boom to busts seems to have lunged forward

this week.

Plan of Action

There

are millions of investors and thousands of advisors, who are still following

“buy and never sell” strategies. We have lived through two 50% declines in the

S&P since 2000, and yet because of Greenspan’s cutting rates to 1% by 2003,

and Bernanke and Yellen following a Zero Interest Rate Policy since December

2008, we find ourselves with no chance that central banks can interest rates

BELOW zero to “stimulate” the global slowdown.

QE

has had trillions to sovereign debt levels, adding an enormous drag to the

world economy, so more QE to remove what little top tiered collateral is left

among dealers, is NOT a solution either. Less cash and blowing the financial

bubbles larger was never a long-term economic solution.

Never

over the last 44 years since the US dollar was removed from the gold exchange

standard in August 1971, has the world been facing such enormous problems

caused by the school of thought, “with enough debt and central planning, we can

kick the problem down the road forever”.

Preparing

for the coming busts is not scaremongering; it is common sense when looking

back over the largest financial experiment in history since 2008.

There

are ways to grow one’s money in the period ahead. But it requires changes and

doing things differently for the bust than were done in the last 4 years of the

boom. It also requires admitting that for most, it was just easier not to

think, and leave the planning and artificial levitation schemes to central

bankers, than to think for yourself and admit that the plan was not sustainable

from the start.

There

are also changes that will come, that are much larger than merely the

investment markets. Phillipp Bagus book, The Tragedy of the Euro,

published in 2010 by the Mises Institute, reminds us of how far we have come

down the road of “central planning”. Clearly, it encompasses far more than

investing.

“The

institutional setup for the European Monetary Union has been and economic

disaster. The Euro is a political project; political interest have brought the

European currency forward…economic arguments launched to disguise the true

agenda behind the Euro have failed to convince the general population of its

advantages.

The

logic for interventions propelled the Eurosystem toward a political unification

under a central state in Brussels. As national states are abolished, the market

place of Europe becomes a new soviet union.” [p129]

I

have thought about Bagus comments often in the last few years. How did we ever

become fooled into thinking that with enough debt and central planning, we were

heading back to “normal”? What has taken place since 2008, is that our world

and markets have become more and more concentrated into fewer and fewer hands.

For those who make no plans or changes for the bust phase, they will only feed

that concentration of power, as we look to central bankers for more

“bailouts”…..which this time, they have told us already, are not coming.

Be a Contrarian, Remember Your History

The

big shift from longs to shorts and shorts to longs took a major leap this week

away from previous trends, and toward future ones. Have you made changes?

Click here to start the next

six months reading the newsletters, reports, and group emails as we move

from the boom to the bust phase.

On a Personal Note

Check out Living2024. It is my personal blog, not business. I wanted to have a place to write stories about where this entire drama seems to be taking us all. Check out my latest post, Optimism Didn’t Help Greeks or Chinese.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology