The Nirvana Trade July 24, 2013

Doug

Wakefield

“What

the mind can conceive and believe it can achieve” Napoleon Hill

When

one looks at the US stock markets over the last two years, especially since August

2011, it would appear that it has become liberated from entering a bear market

for more than a few days or weeks.

With

each subsequent drop, a rally has ensued. US stock indices seem to move one

step closer to nirvana with each passing “minor correction” in prices. One need

never worry again, as we gain greater confidence in the masters of finance, who

with the mere mention of the words, “a highly accommodative policy”, can

levitate stocks.

But

something is very wrong with this picture.

Outside of the Dow’s value scrolling across the bottom of the daily news

or the values showing up in our monthly online statement, is the every

increasing dependency on more and more debt and “temporary” intervention to

make certain “the recovery” removes all memory of the events of 2008 from our

minds. Outside of the euphoric, “all time highs achieved again” is the nagging

reality that no negative geopolitical or global economic event or data has

phased US stocks for almost 2 years now. A bad day or two for sure, but that is

all that the public has had to experience for almost 22 months.

Have

we really arrived at a world of no pain and all gains, brought to us by the

“highly accommodative policies” of the masters of finance and market

intervention?

As

we head into August, I would like to present you with data I believe supports

the reality that millions of investors are soon to be stunned once again like

they were in 2008. Like the Tsunamis we have watched in the last 10 years, we

must remind ourselves and others that the bursting of global stock bubbles

don’t care about our long term plans, they change the landscape for everyone,

including central bankers.

Lessons 1 – Forget The Real World, Watch the Computer. Power Continues to Concentrate

For

months and months, anyone trying to explain why major technical, fundamental,

or geopolitical risk would impact US stocks has looked like a fool who did not

understand the new paradigm, brought to you by your nearest central banker.

Sadly, this has bred rising complacency along with rising stock prices. Yet

while this rally has gone on much longer than I and many others would have

imagined, anyone willing to examine the evidence through what has ALREADY

occurred, can see that the nirvana rally moves closer each day to a painful

return to reality.

If

you have no understanding of high frequency trading platforms or speed computer

trading, then watch the report released by 60 minutes in June 2011, Wall Street: The Speed

Traders. Anyone who believes this film is solely for those interested in

keeping up with “financial news”, needs to remember that in July 2011, the Dow

topped and lost 2100 points (16.8%) in 13 trading days.

Consider

the following opening remarks from this excellent piece:

“Most

people don't know it, but the majority of the stock trades in the United States

are no longer being made by human beings. They're being made by robot

computers, capable of buying and selling thousands of different securities in

the time it takes you to blink an eye.

These

supercomputers - which actually decide which stocks to buy and sell - are

operating on highly secret instructions programmed into them by math wizards,

who may or may not know anything about the value of the companies that are

being traded.

It's

known as "high frequency trading," a phenomenon that's swept over

much of Wall Street in the past few years and played a supporting role in the

mini market crash last spring that saw the Dow Jones Industrial Average plunge

600 points in 15 minutes.”

Does this sound like

the world of “buy good companies and hold them”, or “don’t try to time when to

get and get out of the markets, invest for the long term?” Anyone who downloads

Scott Patterson’s book, Dark

Pools: The Rise of the Machine Traders and the Rigging of the US Stock Market

(2013), learns the following:

“All of

that turnover was having a real-world impact on stocks. At the end of World War

II, the average holding for a stock was four years. By 2000, it was eight

months. By 2008, it was two months. And by 2011 it was twenty-two seconds,

at least according to one professor’s estimates. One founder of a prominent

high-frequency trading outfit claimed his firm’s average holding period was a

mere eleven seconds.”

“Doug,

I work with very sophisticated investment managers. I am certain they are at

the top of the high speed trading world, even if I am not.” From my own

research, it is clear that those who desire to turnover stocks in seconds

dominate the global markets today. Structures like pensions and mutual funds

that are investing for “the long term” are being forced to follow whatever the

biggest and fastest fish are doing in the global waters.

This

makes investing look easy on the upside while returns that are clearly

unsustainable are being produced, thus lulling the public into a false sense of

security. Risk has grown at ever increasing levels of leverage while prices

have climbed the unsustainable ladder.

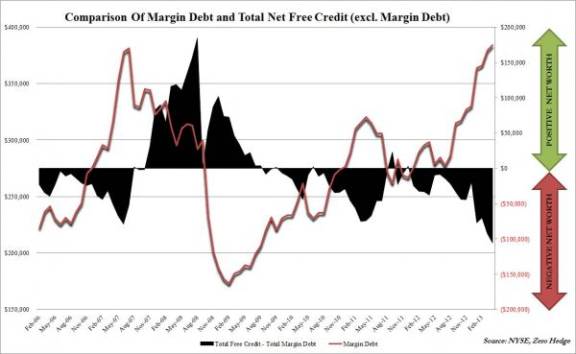

NYSE

Margin Debt Rises To New All Time High As Net Worth Slides To Record Low,

Zero Hedge, 5/28/13

As

history proved two summers ago, when high-speed trading platforms pull back

from stocks to protect their own capital, “long term” investors can be left holding

the bag.

The

problem we have with a world driven by speed computers, is that eventually, the

computers are playing a game, looking for patterns. Whereas humans could have

evaluated economic and geopolitical news in order to PREPARE a portfolio for

rising risk, the computer - unless finding certain terms by which to react in

milliseconds to “the news” by means of artificial intelligence – is solely

focused on finding the pattern and beating its next slowest competitor in the

DAILY scalping game of hyper trading. As long as the rhetoric from central

bankers matches the view of “we have overcome risk and will always bring your

401k statement right back up”, the public at large will remain ignorant and

complacent. However, the reality is

that millions of investors have placed their futures next to a small group who

have left them holding the bag before when markets roll over from extremely

leveraged levels.

Yes,

the world of investing has changed radically.

“In 1933, the number of specialist firm on the NYSE

totaled 230. By 1983, acquisitions and mergers had reduced that number to 59.

By 2001, there were only 10. Today, only four DMMs (Designated Market Maker)

control the trading on the NYSE: Goldman Sachs, Knight, Barclays, and newcomer

GETCO….Most industry professionals we talk to believe these four horsemen are

responsible for 40-50% of all trading on the NYSE. “[Broken

Markets: How High Frequency Trading and Predatory Practices on Wall Street are

Destroying Investor Confidence and Your Portfolio (2012) Sal

Arnuk and Joe Saluzzi, location 621 of 5286 in the Kindle Edition]

Lesson 2 – Is Predictable a Good Thing?

If

you wanted the public to believe that they were watching an economic recovery,

what better way to do it than to have the Dow rise over a long period of time,

totally ignoring negative economic and geopolitical events? If you had the

power to turn markets at certain junctures, then the other smaller computers

and investment fish would eventually see bad news as good news, and buying the

dip would become a “sure thing”. If you think this would be impossible to

accomplish in a market as complex and diverse as the U.S. equity markets, take a

look at the charts below. This is not speculating on what WILL happen; it is

already a piece of history.

Once

the Dow broke above the 200 day moving average in December 2012, it has only

briefly stalled below this level. Did the high-speed trading platforms have

anything to do with this? Could they have helped “lead” the “recovery”?

Now

move forward to 2013. Notice, that once

it was determined that the 200 day MA would hold at the end of 2012, and the

fiscal cliff was a joke – I mean, who ever said we had to have a debt ceiling

again anyway or record

the amount of national debt we were accumulating. The bounce level was

going to be at the 50 or 100 day moving averages, and beyond that, what is

there to know?

Now

think with me. Does history reveal that financial and political leaders desire

the public to be pleased with their progress, when they had little to do with

the progress that was made? Is it possible that the “progress” that has been

made, required loading the system with more and more debt and interfering with

markets to avoid those same markets from producing fear, while on the other

hand rewarding complacency? Does that sound like a free market?

While

the world of investors is still in the nirvana phase, is there anything one can

gain from examining the historical archives? Do you remember a recent period in

market history where SELLING rather than BUYING took place when these same

moving averages were hit?

Lesson 3 – The Faster the Speed, the MORE likely an Accident

We

gain confidence the more we see something working. We lose confidence the more

we see something not working. And yet, this is exactly how great speculative

bubbles are formed. Instead of seeing rising risk as a caution to sell and pare

down, we see the rising prices as a lost opportunity and eventually succumb to

watching individuals purchasing stocks and funds at their highest prices on

record. We saw this in the spring of

2000, the fall of 2007, and are watching in live right now in the summer of

2013.

The

best way to watch the math reveal a trap and not a triumph, we need to look for

a pattern where markets climb faster with each subsequent rise, and declines

become more shallow. Whether we return to the March 2009 bottom – the lowest

this century – or the October 2011, we can see this pattern has already

unfolded quiet clearly.

Looking

at the two charts above, we can see the following:

·

Rally of 13 months;

decline of 14.6% into 2010 low.

·

Rally of 10 months;

decline of 19. 1% into 2011 low.

·

Rally of almost 22

months, no decline beyond 10%.

Eventually,

the bounces become so predictable – both computers and individuals totally

ignoring all real world risk in order to capture the latest and hottest power

rally – we can see price levels achieve the larger gains in shorter periods of

time. The powerful drop that took place between June 19th and June

24th can only be seen in one way…another opportunity to get in, not a warning

sign of a major top.

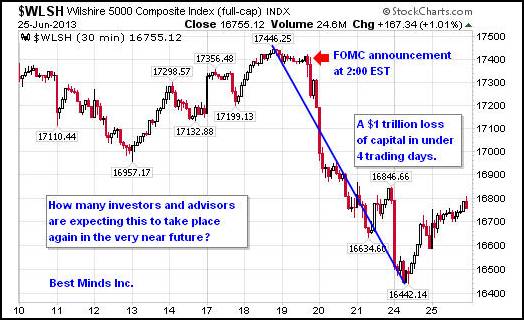

We

can see the same pattern in the larger Wilshire 5,000, the broadest US stock

index. Once the “fiscal cliff” was revealed as another stall in seriously

challenging the status quo on December 31, 2012, US stocks took off. The

Wilshire topped on February 19th. After a pull back to its 50-day

moving average, it took off again, topping on April 11th. Once again

it pulled backed to the 50 day MA, and started rising.

By

the time it reached its high on May 22nd, it had scaled 1622 points

in 23 trading days, averaging 84% more points than the climb into the April 11th

top. More points; shorter timeframe.

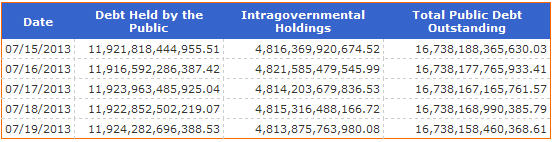

US

stocks had drifted sideways into the June FOMC meeting. When the Federal Open

Market Committee (FOMC), finished their regular scheduled meeting on June 19th,

their press release (2:00 EST) was not well received by investors or more

accurately, the split second artificial intelligence buried in the high frequency

computer trading programs. In less than 4 trading days, the Wilshire had shaved

off $1 trillion in paper wealth.

After

touching its 100-day moving average, the Wilshire 5000 started up again. As of

the close of business on Tuesday, July 23rd, the Wilshire has

reached 18,000 for the first time in the history of American markets. Its climb

between the June 24th low and this price level has taken 20 trading

days, thus producing a daily average price increase faster than its previous

run into its May 22nd high.

2000

and 2013 – Both are Warning US Stock Investors Now

In

case this still appears purely academic, let’s look at four more charts; two of

the NASDAQ 100 - one in March 2000 and the other three years later - and two

different views of the Dow Jones Corporate Bond Index, which on May 3, 2013,

reached its highest level on record.

Even

material written 18 months ago by bankers outside of Wall Street, supports the

fact that the REAL world of finance has not been signaling a nirvana trade for

some time now.

“We currently live in a world of extraordinary

levels of government intervention and manipulation of the global market

economy. Tax credits, credit facilities, foreign currency interventions and

‘voluntary haircuts’ on foreign bonds are government attempts to postpone

inevitable market corrections.” Economic Uncertainty, Texas Banking,

January 2012, pg 9

May

we all remember, when everyone is doing the same trade, then it is time to look

in a different direction. The great trades made by contrarians were never from

following the crowd.

If you are ready to awaken

from the “trust the state, they will save us” theme, come join us. I have and

continue to look for some of the best thinkers around in this extremely deceptive

game in order to keep my own sanity and yours.

If you are challenging your own thinking, and are seeking ideas that are outside those presented by our illustrious central planners, then I would encourage you to subscribe to my most comprehensive research and trading commentary with a 6 month subscription to The Investor's Mind: Anticipating Trends through the Lens of History. Using the logical side of our brains, rather than enjoying the emotional comfort of unlimited mania, has never been more crucial in our markets.

Specific individual and institutional consulting is also available. If you are interested in learning more, send a personal note in an email to info@bestmindsinc.com and place “After 14” in the subject box. Emails with attachments and links will be deleted.

Seven years after its

release, I still refer back to my research paper Riders

on the Storm: Short Selling in Contrary Winds (Jan ’06). I would

encourage you to click

here to download it for free.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a registered investment advisor that looks to

the best minds in the world of finance and economics to seek a direction for

our clients. To be a true advocate to our clients, we have found it necessary

to go well beyond the norms in financial planning today. We are avid readers.

In our study of the markets, we research general history, financial and

economic history, fundamental and technical analysis, and mass and individual

psychology.