The Lost Art of Being

Early March 22, 2013

Doug Wakefield

On October 27, 2011, I

released a public article, Darwin’s Deceptive and Dangerous Devices. At the opening

of that article, I presented a quote from Wikipedia about the Movie the Matrix.

The following is the first part of the quote.

“The film depicts a future in which reality as perceived by humans is actually a simulated reality created by sentiment machines to pacify and subdue the human population.”

When I wrote this article

with its many references, I could not fathom that the concept of preparing for

major risk, whether they be geopolitical or financial, would almost be removed

from the public’s PERCEPTION over the next 16 months. Even after we all read “Dow

Jones Industrial Average Hits All Time High” on Tuesday, March 5, 2013, I

continue to hear more comments about the markets having the ability to continue

higher than fear of what happens AFTER risk returns to this nirvana of debt and

speculation. It is as though we are living in a world of denial that we refuse

to awaken from until risk smashes through the illusory world we have become

accustom to living in for almost a year and a half.

Of course, we have

certainly been groomed by the use of high frequency

computers [see Darwin’s Deceptive and Dangerous Devices] and confident

speeches by central bankers around the world that “unlimited debt” can provide

us a financial experience where REAL risk does not need to be experienced any

longer. Even the Chairman of the Federal Reserve himself sees no correlation

between the fact that the national debt in the U.S. has gone parabolic, growing

more than $7.5 trillion in the last five years, and this just to give the

public the image that October 2007 is back. Did he forget about the two 50+%

declines that took place in the S&P 500 since 2000 when the US national

debt was less than a THIRD of what it is today?

Federal

Reserve Chairman Ben Bernanke Sees No Stock Bubble, The

Washington Times, March 20 ‘13

Hmm, wasn’t there another

Fed Chairman who could not see a bubble when it was staring him in the face?

See if you recognize these comments made to the Senate Banking Committee on

April 13, 2000:

“That

presupposes I know that there is a bubble…I don’t think we can know there’s

been a bubble until after the fact. To assume we know it currently presupposes

that we have the capacity to forecast an imminent decline in prices.” [Greenspan’s Bubbles: The

Age of Ignorance at the Federal Reserve (2008) William A. Fleckenstein with

Frederick Sheehan, pg 99]

Maybe it would be helpful

if Mr. Bernanke were to review these charts of by Chris Kimble of Kimble Charting Solutions.

In fact, why not share them with every Fed member so they can START learning

how to recognize a bubble.

But as I write this

article, on Friday, March 22, 2013, the EXPERIENCE of prices in US equities

only builds more confidence in taking on MORE risk, not LESS. I mean, with the

banks loaning money like crazy to speculate on higher and higher prices, what

could possibly go wrong, right?

[Chart from Bubble on the

Margin, Zero Hedge, March 1, 2013]

Japan has been willing to

destroy their currency in an effort to allow speculators to send the Nikkei up more

than 47% in a four-month period. In Europe, the European Central Bank promised

they would buy any amount of Italian and Spanish bonds needed in order to

“inspire confidence” of their ability to suppress yields and distort reality

until things “stabilized”. In the U.S., Bernanke has continued to inspire

confidence that risk has been obliterated by buying up US Treasuries and

mortgage backed securities to the tune of $85 billion a month, until we find

the crowd at an “all out mentality” in US Treasuries in late January, and an

“all in” view recently in the Dow.

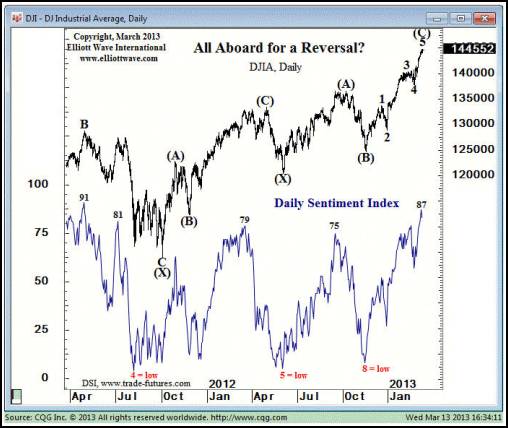

[Chart from Hedging

the Great Unwind – Second Highest Treasury Put Volume On Record Hits The Tape,

Zero Hedge, Jan 29 ‘13]

[Chart from Steve Hochberg’s Short Term

Update, 3/13/13]

In fact, when one reads

the headlines below, what could possibly go wrong with markets at all time

highs and the world’s three most powerful central bankers promising unlimited

debt to keep speculators happy and the general public pacified and subdued.

What could go wrong with a story built on “all the debt you can take on today for

speculation” and the use of better joy sticks for the high speed trading boys

playing financial war games on anyone who even considers preparing for markets

to decline?

NYSE

Short Interest Plunges to March 2012 Levels,

Zero Hedge, Jan 16 ‘13

The

U.S. Can Not Afford A Chinese Economic Collapse,

Reuters, Mar 7 ‘13

Europe’s

Central Bank Issues Cyprus Ultimatum, NPR, Mar 21, ‘13

Obama:

Use of Chemical Weapons Would be a ‘Game-Changer’,

Fox News, Mar 20 ‘13

In 2005, I changed the

name of my business from Generations Advisors to Best Minds Inc. In April of

that year, the www.bestmindsinc.com

educational website went live, the same month I was fortunate enough to attend

a conference put on annually by Altegris, one of the leading hedge fund

consulting firms in the U.S. I pulled the following from my May 2005 newsletter

(still free at that time). It’s content seems extremely important to the sea of

investors and advisors who have been lulled into extreme complacency like Mr.

Bernanke and crew.

“Most

investors look to recent performance as one of the initial steps in choosing a

manager. So the question becomes, in multiple forms: “How has he/she [the

manager] done lately?”

The

trouble with this question is that we may be hiring a manager whose season for

profitability is coming to an end. As such, there is little chance of the

manager making those returns happen again.

In

April, I spent two days in California at a conference co-sponsored by Altegris

and John Mauldin. It was one of the best conferences I have ever attended. This

bias, to depend too much on past returns, was discussed by Mark Finn, who owns

Vantage Consulting and has spent years consulting Fortune 500 companies and

large pension funds and analyzing trading systems. He commented that his

experience has shown that past performance was one of the most misused criteria

in selecting investment managers. Behavioral studies show that we have a

tendency to transfer past numbers into the future performance. If we start with

the managers with the best numbers, then our sampling is skewed. We do not know

where the manager’s performance was based on luck or skill. Additionally, our

focus on ‘good numbers’ overlooks the manager’s amount of experience.

Experience indicates that the manager has successfully navigated more types of

markets and is particularly important if the manager has traded through a bear.

Jon

Sundt, president of Altegris, presented on the three criteria Altegris uses in

seeking managers. They look for skill, opportunity, and size. The first thing

to try to find is a manager that is highly skilled. It is very important to

understand his trading systems and the reasoning behind his trades. Next, the

manager’s opportunity should be in front of him. Being well positioned for what

lies ahead means that he may not have great recent performance numbers.

Finally, if the manager has a smaller amount under management, then he can get

into and out of markets with much greater flexibility, adding to his

profitability.” [Outside the

Belt-Street, Best Minds Inc, May 2005]

[Chart from When

Everyone Sees, released on Jan 23 ‘13]

While I know that the chart

above reflects the fact that I am not clairvoyant and that even now I still do

not know that THE top is finally in, should we really be chasing for the last

dollar in the last hour before the 2008 chapter in history takes place

again…and even worse…especially knowing your competition are high speed

computers that fed the May 2010

flash crash? Maybe Americans should talk with more Japanese who have lived

in Japan over the last 25 years. Their history will show us that they have been

detoxed from viewing “unlimited debt” as the way to riches in their own stock

market.

The following helps us

understand long periods of DEFLATION of assets, even in the midst of massive

INFLATION of debt or credit. It was taken from one of my first public article, The

Nikkei: Raiders of the Lost Ark, released on Dec 20 ’05.

“It

is also apparent that Japan's policy has done little to benefit the Japanese

real estate markets over the last sixteen years.

‘The

asset-price bubble, however, collapsed from the first business day of 1990,

triggering a crash of asset prices. The prices of many shares fell to a

fraction of their peak levels. The price of land, which had been believed to be

absolutely safe, plummeted, with the price of commercial land in the six major

cities tumbling 85%. That is to say, it is now [2001] worth only 15% of its

peak price.’ [The

Balance Sheet Recession: Japan’s Struggle with Uncharted Economics and Its

Global Implication (2003) Dr. Richard Koo, pg 4]

‘[Japanese] national wealth as a whole is now [in 2001] 59% of 1989 levels. With most of the Japanese wealth lost concentrated in the real estate sector, these assets fell to nearly one-tenth of their value.’ [Ibid, pg 13]

I

am a bit amused by those who think this time it is different, while Japan's

fundamental macroeconomic environment is little changed over the last fifteen

years.

So,

the question becomes, "who is buying into the Nikkei?"

Though

we cannot answer this question definitively, a closer look at the Japanese

culture reveals who it is probably not.

‘Although

there is a problem in that its [Japan's] stock market is supported primarily by

foreign investors, Japanese nationals make up 95% of its government bond

market.’ [Ibid, page 73]

The early bird has been

run over for sometime now. Not only did he not get the worm, the worms of debt

and state manipulation have laughed in his face for a long time. When “risk

off” strategies have to be suppressed to produce historic shorting indicators

in the futures and options markets, while “risk on” strategies are fueled to

produce sentiment levels in the last 7 weeks that have only happened a couple

of times in the last 4 years, it we wise to remember, “It’s not nice to fool

mother nature.”…and human nature for short periods of time as well.

Maybe we should also ask

as we watch the Cyprus drama, “If citizens of a nation state can take no risk

in the markets, yet wake up to find that their finance minister has worked out

a deal with the boys and girls ABOVE the national level of finance that would

confiscate 7-10% of their bank accounts for another banking bailout (I know,

this is off the table now), then what are our leaders NOT telling us about

their fears regarding the bursting of yet one more mania they continue to

support?”

If you are ready to awaken from “trust the state, they will save us”, and look as I do for some of the best thinkers around in this extremely deceptive game in order keep your sanity and PREPARE for the next big global shift of assets, then I would encourage you to subscribe to my most comprehensive research and trading commentary with a 6 month subscription to The Investor's Mind: Anticipating Trends through the Lens of History. Using the logical side of our brains, rather than enjoying the emotional comfort of unlimited mania, has never been more crucial in our markets.

Specific individual and institutional consulting is also

available. If you are interested in learning more, send an email to info@bestmindsinc.com and put “After 14” in the subject

box. Emails with attachments and links will be deleted.

Seven years after its release, I still refer back to my

research paper Riders

on the Storm: Short Selling in Contrary Winds (Jan ’06). I would

encourage you to click

here to download it for free.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a registered investment

advisor that looks to the best minds in the world of finance and economics to

seek a direction for our clients. To be a true advocate to our clients, we have

found it necessary to go well beyond the norms in financial planning today. We

are avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.