The Investor’s Great Divide;

Crossing the 200

December 11, 2015

Doug

Wakefield

“Reuters,

the British news agency, moved a story on its wire at 11:39 A.M. Tuesday, May 8,

saying that Continental had denied as “totally preposterous” rumors that the

bank was considering bankruptcy….

Ordinarily,

Continental would have refused to comment on the rumor by Reuters. Instead, it

reacted with a quick denial, perhaps in the hope of placating the foreign

depositors….

The

run took hold domestically when, a little more than twenty-four hours after

Continental had said bankruptcy was “totally preposterous,” the Board of Trade

Clearing Corporation (BTCC) just down the street from Continental withdrew $50

million. The BTCC, a clearinghouse for trading on the Chicago Commodity

Exchange, had been a long-standing customer. Word of its defection moved

promptly on the wire services, and the panic was on.” [An account of the 1984 collapse of Continental

Bank in Chicago from Bailout: An Insider’s Account of Bank Failures and

Rescues (1986) by former FDIC Chairman, Irvine Spraque, pg 152 & 153]

In

the summer of 2013, I released the article, The Nirvana

Trade, discussing how relentless the 200-day moving average had been

throughout 2012 and 2013. This was the line in the sand that “the crowd”

refused to cross without almost immediately getting its footing, and moving

right back above it.

This

past August, on the 21st, I released the article, The

Stock Nirvana Has Been Broken. Every investor tracking the S&P 500,

watched as this index fell 10% between August 20th and the close on

August 25th.

Yet,

by the end of October, “the crowd” had managed a rally back above this line,

and the talk of yet another “all time high” was everywhere.

So

while the S&P 500 is back under its 200 as we close out this week, the

larger picture and the American public’s understanding of risk is what is now

foremost on my mind as we head into next week’s Fed “will we raise rates or

will we stall again” release on December 16th.

Since

2012, the American people, looking at the world through our broad equity

markets, have been given the impression by the Federal Reserve that “We have

your back.” When they look at statements and look at the S&P 500,

especially since the 10% four day drop into August 25th, it really

has looked like someone has made sure that US equity investors would not go

below this “nirvana line”.

This

type of obsession to break above 2100 after last November’s

2100 target released by Goldman’s

equity strategist David Kostin took place multiple times this year. Yet

never was there a strong breakout to the upside.

So

as everyone will wait and see if the Federal Reserve will finally raise rates on

December 16th, or yet again kick the decision down the proverbial

road, markets around the globe have certainly produced an extremely volatile

picture far different from US equities.

Volatility, The New Venue

If

there ever was a warning to the American investment community, it is now, and

it has already come from watching the largest markets in the world this year.

Can

millions of investors watch massive swings in the two most traded currencies in

the world over the last 2 years, and not expect something to take place in US

equity markets?

How

can the price of oil drop this much over the last 18 months without having huge

ramifications to the finances of oil producing nations, as well as the oil

industry in the US, which has been a major factor in the growth of the American

economy since 2008?

Can

we watch global investors experience this level of volatility in China, a

nation that has quadrupled their debt load since 2008 (another first in history

event) and not wonder how this would impact American stocks and economy?

The

massive rally (plunge in yields) in German bunds and then sell off (yields

rise) with the turning point being the lowest yields in German history, should

tell us all that central bank planning has NOT made our financial world more

“stable”.

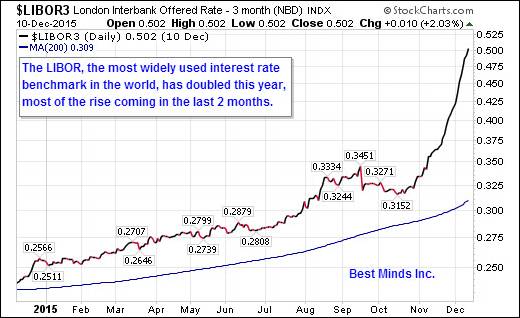

So

while we wait to find out what Chairman Yellen will tell us next week about

interest rates, the short end of the bond markets have already told us they are

certainly expecting her to raise rates for the first time since the Fed

Funds rate was lowered on December 16, 2008.

If

you are reading this article, you are thinking. Never has skeptical thinking been more important. Never stop

trying to influence the thinking of others who think that information like this

is only for those interested in finance.

The

dominant central banks of the world and the unending commentary by the financial

media and industry have lead the average investor to the conclusion that

constant intervention is now the new abnormal. Without them, how could what’s

left of the free markets survive?

“These

breakdowns come about not in spite of our efforts at improving market design,

but because of them….The steps that we have taken to make the markets more

attuned to our investment desires – the ability to trade quickly, the

integration of the financial markets into a global whole, ubiquitous and timely

market information, the array of options and other derivative instruments –

have exaggerated the pace of activity and the complexity of financial

instruments that makes crises inevitable. Complexity cloaks catastrophe.” [Comments by Richard Bookstaber, who served as

managing director of risk at Salomon Brothers during the 1987 crash, and as

Morgan Stanley’s first market risk manager during the meltdown of Long Term

Capital Management in 1998. Comments are from his book, A Demon of Our Own

Design: Markets, Hedge Funds, and the Perils of Financial Innovation (2007)

pg 5]

Be a Contrarian, Remember Your History

The

big shift from longs to shorts and shorts to longs continues pounding global

investors and traders. Calm markets are coming to an end. Whether raising rates

or using NIRP, volatility will be the word for 2016.

Click here to start the

next six months reading the newsletters, reports, and group emails as the

bust phase grows stronger, and thinking becomes more critical.

On a Personal Note

Check

out Living2024, my personal blog. I

wanted to have a place to write stories about how this entire drama is reshaping

our thinking on money. Check out my latest post,

A 4,000 Year Old Lesson: Joseph & the Costs Of A State Rescue.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.