The Four Blind Mice At the Cliff March 15, 2016

Doug Wakefield

“They Keynesian economists urge adoption of a “managed

currency” and various forms of government intervention in the economic life of

its fellow citizens. The idea is that government should supply an economic

wisdom that private enterprise lacks or is unable to use. But even these

economists see the uneconomic results of the government intervention which they

advocate….Can government ever supply private enterprise with an economic wisdom

which it would otherwise lack?” – Away

From Freedom (1952) Vervon Orval Watts, pg 70

“Lenin is said to have declared

that the best way to destroy the Capitalist System was to debauch the currency.

By a continuing process of inflation, governments can confiscate secretly and

unobserved, an important part of the wealth of their citizens….As the inflation

proceeds and the real value of the currency fluctuates wildly from month to

month, all permanent relations between debtors and creditors, which form the

ultimate foundation of capitalism, become so utterly disordered as to be almost

meaningless; and the process of wealth-getting degenerates into a gamble and a

lottery.” – The Economic Consequences of

Peace (1919) John Maynard Keynes, pg 235 & 236

“Lenin is said to have declared

that the best way to destroy the Capitalist System was to debauch the currency.

By a continuing process of inflation, governments can confiscate secretly and

unobserved, an important part of the wealth of their citizens….As the inflation

proceeds and the real value of the currency fluctuates wildly from month to

month, all permanent relations between debtors and creditors, which form the

ultimate foundation of capitalism, become so utterly disordered as to be almost

meaningless; and the process of wealth-getting degenerates into a gamble and a

lottery.” – The Economic Consequences of

Peace (1919) John Maynard Keynes, pg 235 & 236

Do you think of the markets you have your money in as

having degenerated into a gamble and a lottery? Has the constant stream of

comments on centrally planning not only our economic life but the need for

constant intervention into global markets and the world’s currencies left you

with a feeling that the world of 2016 has come a long way from the world of

even 1986?

In Ludwig Von Mises’ work, The Theory of Money and Credit, published the year before the

Federal Reserve was established in 1913, he stated “if one wants to avoid the

occurrence of economic crisis, one must avoid the expansion of credit that

creates the boom and inevitably leads into the slump”.

So simple, and yet ignored for decades. With each debt

fueled boom, came a larger bust, and a need for more intervention by central

bankers (the state) in order to make sure the latest bust could be stalled a

little longer so that public at large eventually ignored such terms as bust,

crash, and collapse as merely marketing terms used by “sensationalists”.

Yet today, March 15th, we are watching as the

four most powerful central banks in world - the People’s Bank of China, the

European Central Bank, the Bank of Japan, and the Federal Reserve – coming to

grips with the reality that “assisting” an illusion of permabull has its

limits.

In this short article, I will share a few thoughts and

charts which I believe reveal we are at a major roadblock for central bankers

and global markets. Since all we are left with is a global casino anymore,

monitoring “the game” has never been more crucial.

Booms Built Reserves, Busts

Liquidate Them

In A Great Leap Forward?, Making Sense of

China’s Cooling Credit Boom (2015) John Mauldin and a collection of

individuals from the private sector with extensive knowledge of the China

economic story, make it painfully clear that what fueled the boom is now

bringing enormous challenges to the leaders and people of China….and thus the

world.

In A Great Leap Forward?, Making Sense of

China’s Cooling Credit Boom (2015) John Mauldin and a collection of

individuals from the private sector with extensive knowledge of the China

economic story, make it painfully clear that what fueled the boom is now

bringing enormous challenges to the leaders and people of China….and thus the

world.

One

statistic that boggles the mind, is that China’s total debt stock tripled

between the years 2000 to 2007, and more than quadrupled between 2007 to 2014

as the private and government sectors added more than $26 trillion in NEW debt.

So if we

compare headlines in 2009 with those in 2016, and follow the simple premise

that Mises left the world over a century ago, we can understand that what we

could have all predicted where this saga would bring us as we came to the end

of the Great Recession in 2008. Quantitative Easing and zero or negative

interest rates could never produce permanent solutions, only a method to create

an even larger boom followed by a larger bust. Eventually the public would

start to catch on, and cash would become king instead of focusing on never

“missing out” on the next “risk on” rally.

WB

Official: China a ‘Bright Spot’ in 2009 World Economy, China Daily, April

21 ‘09

China to buy

more U.S. debt, CNN, March 24, ‘09

China

leads global U.S. debt dump, CNN Money, Feb 17, ‘16

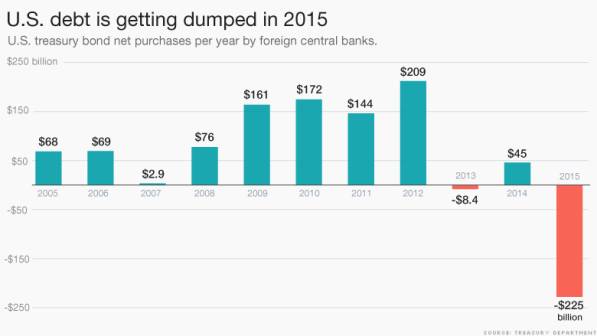

The recent CNN article points out the China sold $18 billion in US

Treasury debt in December alone, and that all central banks alone sold off a

net $225 billion last year, the largest amount in any year since the data

became available in 1978.

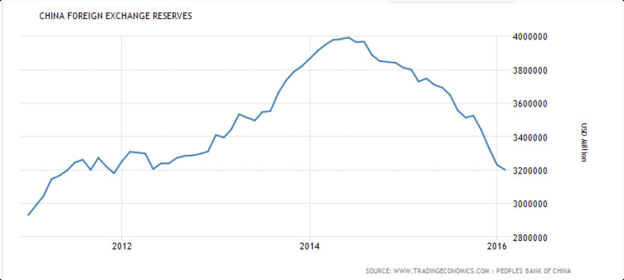

So consider this. As China expanded their debt at skyrocketing speeds

coming out of the 2008 credit collapse, they used this new “money” to then

purchase assets and build up the nation’s reserves. However, for a nation to

quadruple its debt load in 7 years, it is clearly not on a sustainable path. So

as it became time for China to sell US Treasuries as part of its reserves in

order to deal with its own problems at home, we can see that its reserves

started falling and falling sharply.

This is no different from an individual or business that builds up

reserves, and then has to use those reserves to deal with problems that have

arisen.

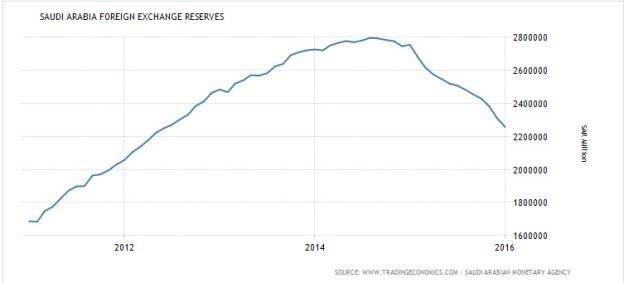

We can see

that China is not the only nation running through its reserves. Even with the

price of a barrel of oil rallying recently into the upper 30s, this is still a

long way from the profits oil producing nations were seeing during early 2014.

Without that income to build reserves, reserves must be depleted…..and like

China, rapidly.

With world

markets and national economies being more dependent on each other than ever

before, it should also be clear that as China, Saudi, and other central banks

sell US Treasuries from their reserves, so also is the US facing a big problem

continuing to run hundreds of billions in deficits annually.

In the near

term, if stocks and junk bonds are sold off, this could provide capital flowing

into US Treasuries, pushing down yields again as a flight from risk on to risk

off takes place again as we go into Q2. However, this, like all central

planning, is not a long term solution. Only a huge reduction in spending by the

governments worldwide, can begin to alleviate the pressure caused by coming to

a point where Keynesian socialist policies have created the illusion among the

public of “free money”, and our financial markets more akin to blackjack and

roulette tables than havens of long term investment capital.

Keeping a Short Term Mindset

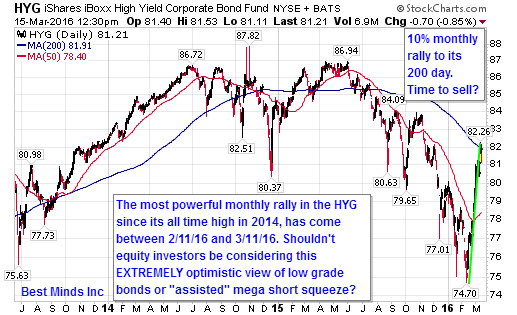

As capital

moves between bond markets, foreign reserves, currencies, and the global

economy, we must also monitor the technical picture across global markets to

understand where pressure points could cause short term “assisted” rallies to

stall, and the reality of the bust hit investors hard.

We must also

watch how currencies react to the four most powerful central banks in the

world. On Thursday, March 10th. Draghi announced that the ECB was

expanding its asset purchases starting April 1st, and lowered its

interest rates on deposits at the ECB to negative 0.4%. On Tuesday. Kurado

announced that the Bank of Japan would hold its rates on deposites at negative

0.1%. Both announcements were greeted with a flight into the euro and into the

yen.

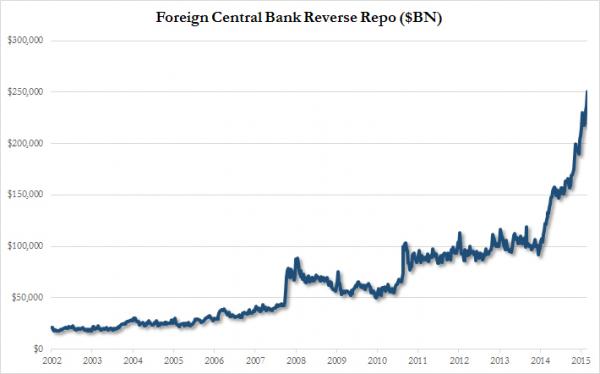

We also know

before the Federal Reserve’s latest press release that over $250 billion is

being parked at the Federal Reserve by foreign central banks who are earning

a POSITIVE 0.5% interest rate on their

deposits. With the ECB and BoJ CHARGING interest on the world’s largest

depositors, and the Federal Reserve PAYING them interest, is there any doubt

that central planners can see they have created a royal mess.

As

Foreign Central Banks Quietly Park $250 Billion in Cash At the Fed, A Mystery

Emerges, Zero Hedge, Feb 22 ‘16

Does this distorted

global picture really produce an image of stability? Does it not seem to

suggest that money will leave dollar backed assets and flow back into the

nations of the world that have their own Keynesian socialists experiements to

deal with at home?

At this

stage in this global bust, denying gravity and history is very foolish.

“Four blind

mice. Four blind mice. See how they scheme. See how they plan. They all seek

rallies to give men life, To keep stocks from falling, creating strife, Did you

ever see such a sight in your life, as four blind mice.”

Be a Contrarian, Remember Your History

If you are reading this article,

you are already aware of the trillions that have been lost in the last 10

months. It is very clear to anyone paying attention to “the game”, that the number of critical

pressure points continues to rise.

Click here to start the next six months reading the paid research found in The Investor’s Mind newsletters and ongoing brief market emails as we continue through this highly volatile year.

On a Personal Note

Check

out the posts at my personal blog, Living2024.

The latest post is A Global Currency:

Peace or Pain.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104 Indian Ridge

Denton, Texas 76205

Phone - (940) 591 - 3000

Best

Minds, Inc is a registered investment advisor that looks to the best minds in

the world of finance and economics to seek a direction for our clients. To be a

true advocate to our clients, we have found it necessary to go well beyond the

norms in financial planning today. We are avid readers. In our study of the

markets, we research general history, financial and economic history,

fundamental and technical analysis, and mass and individual psychology.