Sell the Announcement November 7, 2012

Doug Wakefield

“By

failing to examine the interplay of powerful economic actors in the ‘real life’

economy, the processes of market rigging, financial manipulation, and fraud, are

overlooked” [The

Global Economic Crisis: The Great Depression of the XXI Century (2010), Michel Chossudovsky and

Andrew Gavin Marshall Editors, pg xviii]

Market

Rigging. Financial Manipulation. Fraud. Are these terms presented to investors by their advisors when disclosing

various risks they will face when placing their funds in various investment

pools or trading strategies? Sadly, in the 4 years since the crash of 2008, we

have seen more debt schemes thrown at capital markets in an attempt to “save”

the markets than every in history, and I would dare say, the three terms above

are rarely discussed between investors and advisors. Whether examining behavior

in European, US, or Chinese capital markets, one can see these immoral behavior

patterns apply worldwide.

The

environment we have lived through since being “rescued” from the crisis in

2008, has pushed the world further from the idea of capitalism than any time on

record. After living through the two largest stock market busts in American

history since the 21st century began, the solution continues to be

to increase the “stimulus” or “quantitative easing”, which are all at the root

level the same; create more debt to deal with yesterday’s debt problems. If we continue repeating the word

“recovery”, millions will continue to live in denial right up until the day the

TV hosts says, “Good Evening, your world has changed.”

If

you are reading this article, I know that you have broken out of this denial,

and are seek to gain an understanding of major signals traders and investors

should consider today when trying to avoid the “they will always print, thus my

account will always go higher” lie. Markets have always had individuals and

powerful players who have sought to sell before the crowd. The trouble with

today’s misinformation culture is that it refuses to warn investors that their

managers are dealing with more market rigging, financial manipulation and fraud

than ever in their careers. This punishes the managers who have planned

for a major economic slowdown and the repercussions of the largest debt

overhang in history, and rewards those who parrot the lie of central

planners that more intervention and debt will eventually lead us back to

“stability”. It really is remarkable to

read commentary week in and week out from individuals managing billions who

repeat “the central banking party” line. Of course, we are all fortunate at

times like these, there are others who see it as their moral duty to warn

investors and the public at large to use their minds, rather than abdicate that

task over to central bankers and their financial industry and media lackeys.

Hypothesis

In

this article, I wish to have you consider the idea that the public is fed

headlines that sound dire (because we ARE facing major negative headwinds),

while at the same time tools are used that push markets up into the “the

announcement”. The result, is that the public is being given the false impression

that without a constant stream of interference by global central bankers and

politicians, their lives would not go on as “normal”.

If

the old adage of buy low, sell high, is still applicable to all investors and

traders today, then a closer look of “announcements” made in the last year

would seem to be the place to start.

Four Charts from Three Previous Articles

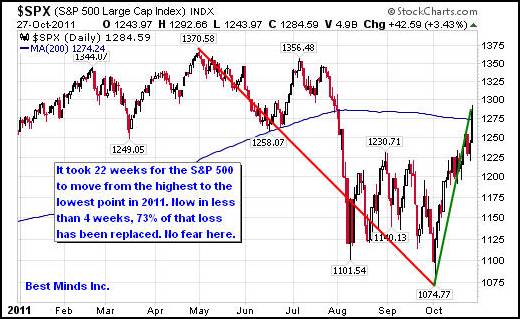

[From Darwin’s Dangerous and Deceptive

Devices, Public Article, 10/27/11]

[From Darwin’s Dangerous and Deceptive

Devices, Public Article, 10/27/11]

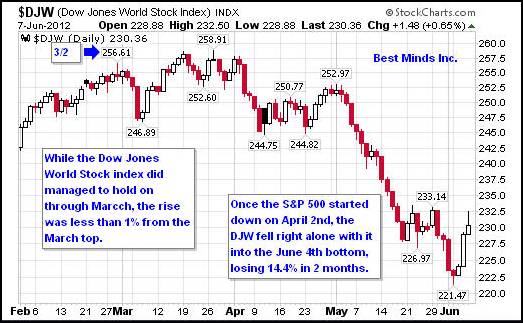

[Making Our Lives

Stable, Public Article, 3/2/12]

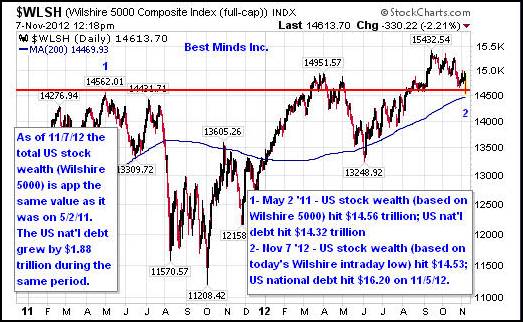

[Two Charts Above From Powder

Kegs and Photo Ops, Public Article, 9/19/12]

I

start with the period since the May 2, 2011 top, since it has been the most

frustrating in my career in the attempt to find “the top” of credit bubble

three. On May 2, 2011, I released the

article, The Gallery of Crowd Behavior Returns. If you look up this

article, you will find that it was my opinion that the US dollar was at a major

bottom and the Euro was at a major top at that time. The charts were produced

on May 2nd, when the Euro hit an intraday high of 149.02, and the US

Dollar hit a low of 72.72. Two days

later, on May 4th, the Euro hit its highest level (149.40) and the

US Dollar hit its lowest level (72.70) since the spring of 2009. 18 months

later, these highs and lows are still in place. However, finding the FINAL top on the current stock market mania

has been exhausting, and yet like any tool used by traders, if you keep

studying and looking at this beast called global markets, you will GAIN

insights the longer information develops around you. Inevitably, you will

discover more insights you can use in the future.

Three “Announcements” between Oct ‘11 and ‘12

The

first chart in the previous section was released on Oct 27, 2011. The following

are my remarks after ALL investors had watched a powerful 18-day global rally.

“In the last month, investors have read headlines

like Europe

has six weeks to find debt crisis solution, warns Chancellor George Osborne

(Sept 23), In

the Absence of a Credible Plan we will have a Global Financial Meltdown in Two

to Three Weeks, [states] IMF Advisor (Oct 6), and G20

Tells Eurozone to fix debt crisis in 8 days (Oct 16). As I release this

article, a headline reads, S&P

500 Extends Best Month Since ’74, Euro Rises on Debt Accord, proving that

the deal completed last night in Europe was “a success”. The worst is now

behind us. I guess the “crisis” was all just hype, right?” [Darwin’s

Deceptive and Dangerous Devices, Oct 27 ‘11]

Let’s

examine what happened in the S&P 500 in the month AFTER the “euro was

saved” announcement on October 27th.

The

second of the four charts in the previous section was released on March 2,

2012. The following reveals the history

leading up to the start of March.

“On October 27th, 2011, I released the article Darwin's

Deceptive and Dangerous Devices. That day, ‘European leaders expanded a

bailout fund to stem the region's debt crisis’, and headlines read "S&P

500 Extends Best Month since '74, Euro Rises". In less than 2 months,

on December 21st, the leaders at the European Central Bank hit the electronic

switches and handed

out € 489 billion Euros ($639 billion) to hundreds of banks across Europe

to ‘shore up the financial system’. This was the largest infusion of credit by

the ECB into the banking system in the 13-year history of the euro currency.

The last day of February, headlines read, "ECB

Hands Out $712 Billion in Loans to Banks" and we learned that in a

little over two months, more than € 1 trillion (€ 489 billion on Dec 21st + €

529.5 billion on Feb 29th) had been "pumped into Europe's financial

system" in an "attempt to stabilize banks, governments and

businesses". [Making Our Lives Stable, 3/2/12]

If

we develop a chart of the Dow Jones World Stock Index around this time period,

we can see a similar pattern. While this event did not produce the actual top,

it was less than 1% from the top that came within the next month.

Now

we come to the last two of the four charts found in the previous section. The

following is a comment of Dr. Janice Dorn, who

has coached hundreds of professional traders spanning 2 decades. (Her

background is listed in Powder Kegs and Photo Ops). Her response was in

conjunction with my comments about how we as individuals get accustom to having

safety nets being provided by the government.

“Dr. Dorn - I agree, something's got to give. What happens in a situation like this is very interesting. When people are not thinking about how something is provided for their benefit - just expecting it to continue - they come to the conclusion that somebody else is going to take care of them; somebody else is going to think for them and tell them what to do, where to go, and what to take on a plane... So the more the government keeps establishing and/or expanding programs that will "protect us," the more people feel this sense of security. Of course, this sense of security is completely false, and in the process, freedoms are taken away from us.”

After Draghi’s announcement of “unlimited bond purchases (with conditions)” on Sept 6th, and Bernanke’s QEIII announcement on Sept 13th, we can see looking back over the last 2 months, the S&P 500 topped and Treasuries bottomed on September 14th, the premise released in my Sept 19, 2012 article.

What is beyond belief, is that living in a country that prides itself on freedom and the free enterprise system, I have seen very little commentary to the fact that worldwide, the public, whether insider or outside of the world of finance, has grown to believe that central banking schemes and a destruction of free markets long-term is good for our own long-term financial goals. It is like we have established a welfare investment class since 2008. We have been willing to give up our long-term freedoms for the short-term pleasure of rising markets on even faster rising debt levels.

If the poor have been groomed to be dependent on the state, and the middle to upper class in the last 4 years has been groomed to believe they will not continue to be wealthy without an ever expanding role of central bankers and debt, is it not possible that once a political objective has been reached, we will start hearing even more rhetoric from these central planners about how they can’t save the system unless government slashes more and more programs in order to pay the “too big to fail” elites at the top of the global debt system?

“They Can Keep It Up

Until the Election”

Now we come to the most recent “announcement”. I have been amazed how this idea has been repeated to me over and over again since the spring, and how right it has proven to be. However, the reaction of the Dow today, November 7, 2012, also seems to support the idea of “sell the announcement”. Look at the chart below of the Wilshire 5000, the most widely used index when seeking to attain an approximate value of publicly traded stock wealth on U.S. exchanges, and the increase in US national debt since the 2011 high on May 2nd.

With US national elections behind us, and the two most powerful central bankers in the world, Draghi at the European Central Bank and Bernanke at the Federal Reserve, recently releasing their “all in” strategies of stimulus before September 14th, and the fiscal cliff (a $600 billion package of tax increases and spending cuts scheduled to take effect at the end of 2012, 54 days from now), I can not think of a more crucial time to wake up to the REAL world of finance, and listen to the “announcement” that capital markets are making today.

In 1987, 25 years ago, there were warnings ahead of time for investors. Recently, I placed the chart below on the Best Minds Inc Weekly page. It would appear that even history is making an announcement to investors willing to awaken from the central banker’s investor welfare state of denial.

“Do not store up for

yourselves treasures on earth, where moth and rust destroy, and where thieves

break in and steal. But store up for yourselves treasures in heaven, where

neither moth nor rust destroys, and where thieves do not break in or steal” [Matthew

6:19,20 – Written in the 1st century AD. Seems very applicable to our world

today, don’t you think?]

To subscribe to my most comprehensive research and trading

commentary, consider a subscription to The

Investor's Mind: Anticipating Trends through the Lens of History. Using our own minds has never been

more crucial. If you have never read my research paper on short selling, Riders

on the Storm: Short Selling in Contrary Winds (Jan ’06), I would

encourage you to click

here to download it for free.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a registered investment

advisor that looks to the best minds in the world of finance and economics to

seek a direction for our clients. To be a true advocate to our clients, we have

found it necessary to go well beyond the norms in financial planning today. We

are avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.