Recognizing Bubbles After Creating Them August 22, 2013

Doug

Wakefield

Obama

Focuses on Risk of New Bubble Undermining Broad Recovery, Bloomberg

Businessweek, August 19, 2013

“President

Barack Obama, who took office amid the collapse of the last financial bubble,

wants to make sure his economic recovery doesn’t generate the next one.

Obama this month

spoke four times in five days of the need to avoid what he called ‘artificial

bubbles,’ even in an economy that’s growing at just a 1.7 percent rate and

where employment and factory usage remain below pre-recession highs.

‘We have to turn the

page on the bubble-and-bust mentality that created this mess,’ he said in his

Aug. 10 weekly radio address.”

Bernanke:

There is no stock bubble, CNN Money, February 26, 2013

“Stocks have recently

been hovering near a five-year high, but Federal Reserve Chairman Ben Bernanke

says a stock market bubble is not in the works.

‘I don't see much

evidence of an equity bubble,’ Bernanke told the Senate Banking Committee in

his semi-annual testimony on Tuesday….

Stocks have

recently been hovering near a five-year high, but Federal Reserve Chairman Ben

Bernanke says a stock market bubble is not in the works.

‘I don't see much evidence of an equity

bubble,’ Bernanke told the Senate Banking Committee in his semi-annual

testimony on Tuesday.”

Are these two individuals, holding the

most powerful political and financial offices in the United States, completely

ignorant of the history they have helped create as well as the history that

came before them? Do they have any idea HOW credit bubbles have been created

over the last few centuries? Do the millions of Americans living around me

understand that these quotes, from two publicly available articles, reveal what

can only be described as “The Big Lie”?

For many, my words are not harsh

enough. For others, my words are too extreme. I am not looking for acceptance

or denial from the public, only to use the CURRENT platform of free speech to

write about what I have learned from studying history and from living through

several “first in history” events in the last two decades.

Look at the chart above of the Dow.

Look at the chart below, comparing the value of the Wilshire 5000 - the

broadest measure of US publicly traded stock wealth - and the level of U.S.

National Debt at major tops and bottoms in US stocks.

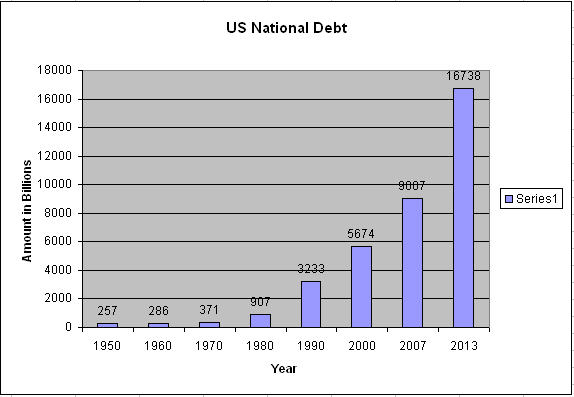

Finally, look at the chart above, which

reflects the growth of the national debt of the United States. How is it

possible that these two men, holding the highest political and financial office

in the United States, can say they either do not SEE a bubble, or they hope we

can AVOID a bubble?

Margin

Lending Hits All Time High, Buy and Hedge, May 28, 2013

A

Housing Bubble Era Loan Makes a Comeback, with a Twist: More and More People

Are Borrowing Against Their Brokerage Accounts to Buy Condos and Expand Their

Businesses, CNN Money, May 29, 2013

Deutsche

Bank Hopes “ Not All Margin Calls Come At Once In Case of A Sell-Off”, Zero

Hedge, August 13, 2013

If you want to avoid a bubble, you do

not provide the fuel, i.e. flood financial markets with cheap credit, and lots

of it for a few years. Otherwise, you have exactly what we are watching today,

yet another bubble – or more accurately, bubbles - in history.

It is too late to AVOID a bubble, but

it is not to late to tell the public that they are living in a bubble. In fact,

anyone watching various markets around the world can see that bubbles have been

bursting for the last few months.

Fed

Announces Unlimited QE3, US News and World Report, Sept 13 ‘12

Junk

Issuance at Record High, Yahoo Financial, Mar 28, ‘13

Record Outflows From US Junk Bond Funds,

CNBC, June 6 ‘13

Corporate

Debt Sales Hit Record, WSJ, December 11 ‘12

US

Fund Redemptions Have A Record $61.7 Billion in Redemptions, Bloomberg,

June 26 ‘13

Japan

Prime Minister Favorite to Push “Unlimited” Easing, The China Post,

Nov 16 ‘12

BOJ

To Pump $1.4 Trillion into Economy in Unprecedented Stimulus, Reuters,

April 4 ’13

The

Nikkei Stock Collapse Sent a Warning, and U.S. Investors Should Beware,

Huffington Post, May 23 ‘13

Housing Stocks Soar As Housing Battles

Back, CNBC, April 9 ’13

Housing

Stocks Fall, Facebook Jumps on Wall Street, Yahoo Financial,

July 25 ‘13

As we head into the fall, and learn

that the Primary Dealers are expecting the Fed to announce bond purchase

reductions to begin in September, Congress is once again facing that nasty

thing called a debt ceiling by the end of September, and the yield on 10 Year

Treasuries has climbed from 1.66 to 2.90 between May 2nd and August

22nd - an increase of 75% in under 4 months,

would it really be all that surprising to hear that the economy was slowing and

that stocks were declining in the weeks and months ahead?

The

Primary Dealers Have Spoken: Taper Begins September With $15 Billion Trim; QE

Ends June 2014, Zero Hedge, Aug 22 ‘13

Treasury

Secretary Calls on Congress to Raise Debt Ceiling, CBS News, Aug 22 ‘13

US

Treasury Yield Climbs to Highest since 2010 Against G-7 Peers, Live Mint,

Aug 19 ‘13

But for this weekend, we can at least

go home knowing that the Nirvana Trade is still in play, and the Dow still sits

above 15,000.

“Bubbles are far more dangerous when they are fueled by debt, as

in the case of the global housing price explosion of the early 2000s.” [This Time Is Different:

Eight Centuries of Financial Folly (2011) Carmen Reinhart and Kenneth

Rogoff]

If you are challenging your own thinking, and are seeking ideas that are outside those presented by our illustrious central planners, then I would encourage you to subscribe to my most comprehensive research and trading commentary with a 6 month subscription to The Investor's Mind: Anticipating Trends through the Lens of History. Using the logical side of our brains, rather than enjoying the emotional comfort of unlimited mania, has never been more crucial in our markets.

Today, I released a special edition of my trading report: Watch the Big Boys, that makes it clear, some very big money is still practicing the lost art of being early. It is available to all current and new subscribers to The Investment Mind.

Seven years after its

release, I still refer back to my research paper Riders

on the Storm: Short Selling in Contrary Winds (Jan ’06). I would

encourage you to click

here to download it for free.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a registered investment advisor that looks to

the best minds in the world of finance and economics to seek a direction for

our clients. To be a true advocate to our clients, we have found it necessary

to go well beyond the norms in financial planning today. We are avid readers.

In our study of the markets, we research general history, financial and

economic history, fundamental and technical analysis, and mass and individual

psychology.