Powder kegs and Photo Ops September 19, 2012

Doug Wakefield

The

following is a portion of an interview I conducted with Dr. Janice Dorn, as

found in the December 2006 issue of The Investor’s Mind:

Mindgames. Dr. Dorn has not only traded the futures markets for the

past 2 decades, but has coached hundreds of traders in the futures markets. She holds a PhD in neuroanatomy,

and is an M.D., certified by the American Board of Psychiatry and Neurology.

I am confident you will find these comments even more pertinent today, than

when they were originally read in December 2006.

“Doug – What I find

fascinating, in regards to our thinking, is that if we look at a variety of

cultures and nations, we find an enormous group of people living out their

day-to-day lives under the premise that the one of the primary roles of

government is to provide various safety nets. We have even come to believe that

the greater the complexity, the safer the safety net must be. In a world where

our morning fruit comes from one country, our transportation from another, and

our computers from yet another, the elaborateness of our distribution system

has given us a sense of stability and ease, when by the nature of its

complexity, it becomes more difficult to maintain that stability.

So, if I start thinking

about change and the complexity of the system upon which I am relying, and I

realize that I can’t control all of these variables and that based on the level

of spending to support this complexity, the status quo is unsustainable, then I

become afraid.

Dr. Dorn – I agree,

something’s got to give. What happens in a situation like this is very

interesting. When people are not thinking about how something is provided for

their benefit – just expecting it to continue – they come to the conclusion

that somebody else is going to take care of them; somebody else is going to

think for them and tell them what to do, where to go, and what to take on a

plane… So the more the government keeps establishing and/or expanding programs

that will “protect us,” the more people feel this sense of security. Of course,

this sense of security is completely false, and in the process, freedoms are

taken away from us.

This issue is critical

when it comes to making trading and investing decisions, and I’ll tell you why.

Let’s say we’re just moving along; everybody is taking care of us; everything

is just fine; the government is paving our streets as well as providing Social

Security for income and Medicare to cover certain medical cost; we have this

sense of being safe and cozy in this artificial environment that our government

has created. Then suddenly, it is not there.”

The US National Debt

closed out December 2006 at $8.68 trillion, information that any person in the

world can find by searching “Debt to the

Penny, Treasury Direct”. If I visit the same website, I find that on

September 13, 2012, the day the Federal Reserve released its statement that

“further policy accommodation” or Quantitative Easing (of more debt) 3

would start, the US national debt had already risen to $16. 045 trillion.

Now I asked you, what

person or business do you know that would tell you almost 6 years later, AFTER

their debt level had grown by 85%, that they their best financial plan was to

ADD to the speed of debt accumulation, and that without it their “economic

growth might not be strong enough”? Let me state this again.

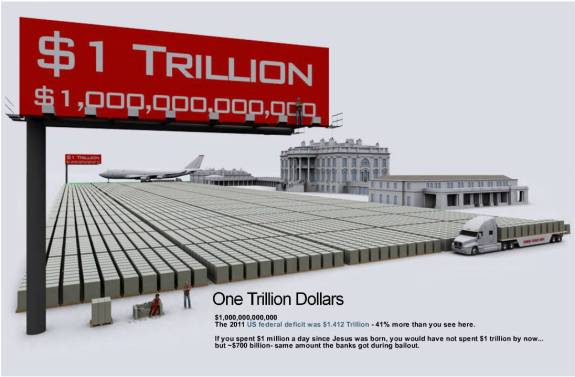

http://demonocracy.info/infographics/usa/us_debt/us_debt.html

After piling up over

$7.365 trillion in additional debt, the BEST advice from the highest

authorities in the U.S. financial system was to ADD to the speed of debt

accumulation, since without this action, “economic growth might not be strong

enough”. If you can find ten people who

honestly believe this is a good LONG-term solution for any person, business, or

nation’s financial problems, please let me know. I cannot fathom how anyone

with the most basic understanding about PERSONAL OR BUSINESS finance, could

endorse this solution for his or her own finances.

Yet as the two headlines

below reveal, the recent “add more gas to the fire” solution received praise by

some?

Cramer Praises Bernanke, Defends QE3,

Sept 13, 2012

Krugman

Praises and Defends Bernanke’s QE3; Everyone Else is Less Enamored, The

Curmudgeon’s Attic, Sept 17, 2012

It would seem that

Cramer and Krugman, and sadly many others, have drunk the debt Kool-Aid lie for

so long, that either they believe it, or they know their own careers are based

on continuing the foster the lie.

Think back to this

comment by Dr. Dorn regarding the way we as humans think when our “safety net”

is challenged:

“When people are not thinking about how something is provided for their benefit – just expecting it to continue – they come to the conclusion that somebody else is going to take care of them.”

Since most investors

pride themselves as people who take care of themselves, and pull themselves up

by their own bootstraps, why is there not a louder outcry every time “the

Committee” reveals another “add more debt” scheme? Does this not assure MORE

instability, not less? Could it be that we have become addicted to the FEELING

of a rising stock market? Clearly, the way we FEEL is of critical importance to

the Federal Reserve.

Fed

Seeking to Create Wealth, Not Just Cut Rates, NewsObserver.com, Sept 13 ‘12

“The

Federal Reserve wasn't just trying to drive down interest rates when it

announced a third round of bond purchases Thursday.

It

also wants to make people feel wealthier

- and more willing to spend.

The

idea is for the Fed's $40 billion-a-month in bond purchases to lower interest

rates and cause stock and home prices to rise, creating a ‘wealth effect’ that

would boost the economy.

And ‘if people feel that their financial situation is better

because their 401(k) looks better or for

whatever reason - their house is worth more - they're more willing to go out

and spend,’ Chairman Ben Bernanke told reporters. ‘That's going to provide the

demand that firms need in order to be willing to hire and to invest.’

And since Bernanke gave a speech Aug. 31 more or less confirming that QE3 was on the way, the Dow Jones industrial average has jumped more than 500 points, about 4 percent.” [italics and font color change my own]

In the 7 weeks leading up to Federal Reserve’s

release about QE3, US Treasuries decline sharply, and US equities rallied

hard. Other than one group “feeling

worse” and one group “feeling better”, was anything constructive done for the

economy?

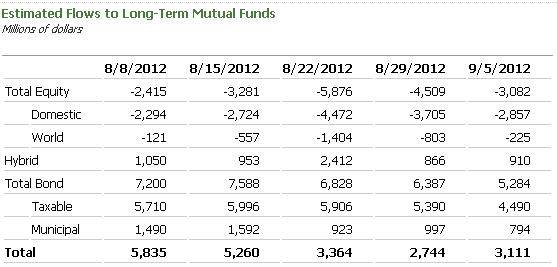

From examining the latest weekly

mutual fund flows from the Investment Company Institute, retail investors

continue to pull billions out of stocks funds and move into bond funds, a

pattern we have seen for 3 YEARS now.

When a nation is so

addicted to debt, that its broadest stock index, the Wilshire 5,000, increases

the nation’s wealth by $1.156 trillion in 19 months, while at the same time

watching its national debt expand by $1.921 trillion in the same period, it

would appear that collectively, our greatest problem is our desire to FEEL

wealthy, thus falling prey to those who fuel this desire, than seeking those

who would speak truthfully about the FACTS, even if they are painful. And of course if anyone were to tell us that

the history of money is fraught with stories of “bait and switch”, well we all

know these are the real fools. These individuals are always theorizing that in

the Darwinian game of finance, the powerful for generations have conspired for

more control, and used the rise and fall of wealth as their primary tool, no

matter who got hurt in the “survival of the fittest” process. Or maybe it is time for ALL Americans to

start doing their own due diligence regarding the history of money and markets,

rather than relying on “the experts”.

“As

recorded by their biographers, one of the most effective devices employed by

the House of Rothschild through the years to destroy their competitors and to

discipline recalcitrant statesmen has been that of artificially creating an

over-extended inflation by extended speculation, then to cash in and let others

hold the bag. This trick was worked by them at intervals through the years….The

fact that the House of Rothschild made its money in the great crashes of

history and the great wars of history, the very period when others lost their

money, IS beyond question.” [The Empire of ‘The City’: The Jekyll/Hyde

Nature of The British Government (1944), E.C. Knuth, pgs 70-71]

By Thanksgiving, I

believe we will look back on the actions of the ECB and the Federal Reserve,

and realize that they did not find a solution in September 2012, but lit a fuse

to the global sovereign debt/stock market powder keg.

If you are already - or ready to start - thinking outside the

“Marxist/Socialist/Keynesian model”, come join The Investor’s Mind. If you are

ready to leave the bubble mentality, you can access research back to January

2006, and weekly reports as history continues to change our world and markets.

This Friday, Sept 21st, I will expand off the

theme that a fuse has been lit, in a special report, “A Thief in the Night”. It

will look at a wide range of markets, and connect dots across a host of experts

in an attempt to prepare our readers for the “surprise” that has been

accelerated based on the ECB and Fed’s recent actions.

To subscribe to my most comprehensive research and trading

commentary, consider a subscription to The Investor's

Mind: Anticipating Trends through the Lens of History.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a registered investment

advisor that looks to the best minds in the world of finance and economics to

seek a direction for our clients. To be a true advocate to our clients, we have

found it necessary to go well beyond the norms in financial planning today. We

are avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.

Disclaimer:

Nothing in this communiqué should be construed as advice to buy, sell, hold, or

sell short. The safest action is to constantly increase one's knowledge of the

money game. To accept the conventional wisdom about the world of money, without

a thorough examination of how that "wisdom" has stood over time, is

to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of

individuals, and at any time may or may not agree with those individual's

advice. Challenging one's thinking is the only way to come to firm conclusions.

Copyright © 2012 Best Minds Inc.