Making Our Lives Stable March 2, 2012

Over

the last 11 weeks, investors have enjoyed a continuing rising trend in equity

markets. If the news pointed to rising tensions in the

On

October 27th, 2011, I released the article Darwin’s Deceptive and

Dangerous Devices. That day, “European leaders expanded a bailout fund to

stem the region’s debt crisis”, and headlines read “S&P

500 Extends Best Month since ’74, Euro Rises”. In less than 2 months, on December 21st,

the leaders at the European Central Bank hit the electronic switches and handed

out € 489 billion Euros ($639 billion) to hundreds of banks across

Anyone

capable of using the dictionary can find that “stabilize”,

according to Merriam Webster online, means:

“to hold steady as to maintain the stability of (as an airplane) by means of a stabilizer, or to limit fluctuations of (as in prices).

Now

help me out. When a global stock index jumps 20% in 18 trading days in October,

and then climbs 17% in 49 trading days over 11 weeks, have markets “limited fluctuations of prices”, thus

revealing “stability”? When one looks at the same index in 2011, we find that

in 12 trading days the price declined 18%, and in 24 trading days it declined

15%. How can anyone look at these

dramatic price swings, the longest taking place in a couple of months, and come

to the belief that the actions of central bankers and photo opt summits by

world leaders are taking place with the intent of “stabilizing” our lives and

our global financial system?

Evidently,

central bankers do not understand that the creation of billions to bailout

problems that started in the millions, and trillions to bailout problems that

started in the billions, can NEVER lead to stability. This is virtually

impossible. And yet, the brainwashing continues.

“Let

me begin by thanking the Federal Reserve Bank of

During

the two decades preceding the crisis, central bankers and academics achieved a

substantial degree of consensus on the intellectual and institutional framework

for monetary policy. This consensus policy framework was characterized by a

strong commitment to medium-term price stability and a high degree of

transparency about central banks' policy objectives and economic forecasts.”

[Italics mine] Chairman,

Ben Bernanke, 10/18/11, The Effects of the Great

Recession on Central Bank Doctrine and Practice, Boston

“Addressing

a dinner late on Thursday (3/1/12) at an EU summit in Brussels, Draghi (ECB

President) told the leaders of the ECB’s provision of more than 1 trillion

Euros of liquidity via a special loan program had only won them a temporary

reprieve and there could be no let-up in reforms. ‘It was a subdued message,’

said one euro zone diplomat briefed on Draghi’s intervention before the 27

leaders. ‘He said there were timid signs of stabilization but emphasized

that the overall situation was fragile.’” [Italics mine] Draghi

Reportedly Says the ECB has done Its Bit, 3/2/12, CNBC

[Money

Morning Australia, 2/23/12 before the 2/29/12 bailout]

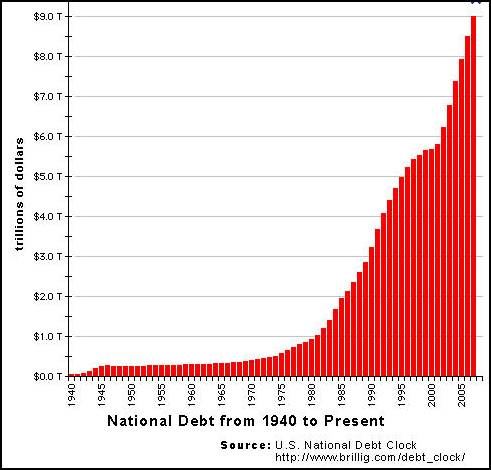

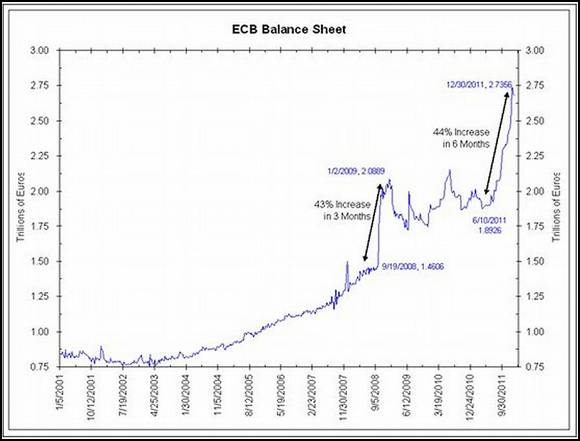

It

is obvious from examining the charts above, that increasing debt and lot’s of

it, has been the long-term objective of central bankers the world over. To

state “central bankers seeking stability” is an oxymoron. The growth of global

debt for decades, and the parabolic growth of debt in the last 4 years to

replace yesterday’s deteriorating collateral from previous debt schemes,

screams at any sane person willing to admit that the emperor’s clothes have

always been nothing more that debt creation to produce more exotic financial

instruments that built a global house of instability. Until our universities,

our politicians, our religious leaders, and our businesses stop treating these

men and women as moral leaders seeking to bring “stability” into our world and

lives, we will only see more instability. The smooth markets over the last 11

weeks have made many believe “more debt leads to higher asset values”, never

even considering the fact that whether prices move rapidly up or rapidly down

over a month or two, the story is still the same…more instability. Until

millions around the world wake up to the reality that a tiny handful of

political and financial leaders are continually telling the rest of us they are

bringing order out of chaos, our silence will only move us toward greater

instability. Our individual lives continue to move away from stability, and

more towards slaves of the state.

Remember,

on Friday, September 19, 2008, the headline, Bush

Asking for $700 billion Bailout stunned the world.

On February 29, 2012, the headline had become, ECB

Pumps a Fresh $700 Billion into Euro Banks, and we go about our daily lives

as if this is the new norm of “stability”.

Could

it be, that we don’t react to headlines regarding more massive debt injections

by central bankers, the only individuals in the world

that can make such an action take place, unless markets are caving in?

“Long

before my election to the Senate I learned two things pretty thoroughly. One

was, if you want to get rich – that is, very rich – in

this world make Society work for you. Not a handful of men, not even such an

army as the Steel Trust employs, but Society itself. The other thing was, that this can only be done by making a business of

politics. The two things run together and cannot be separated. You cannot get

very rich any other way.” The Confessions of a Monopolist (1906) Frederic

Clemson Howe, page 69

If you are interested in our most comprehensive research

and trading commentary, consider a subscription to The Investor's Mind:

Anticipating Trends through the Lens of History.

President

HUBest Minds Inc.U

H, a Registered Investment Advisor