Selling Out: Ignoring Corruption for the Temporary Wealth Image June 16, 2015

Doug

Wakefield

“What

happens to price in a bidless market? It goes off a cliff….

Investors in stocks, bonds, and real estate are being herded off the cliff by the Federal Reserve. The name of the game in the New Normal is to force investors large and small into risk assets. When the risk assets blow up, the herd plunges headlong over the cliff en masse.” [The Fed is Funneling the Investing Herd Off the Cliff, Charles Hugh Smith, June 12, 2015]

We are quickly coming to a point where the global party of “unlimited credit” backstopped by the highest authorities in global finance, central banks, can no longer stop what has already been repeated many times for centuries; the breaking of the stock and bond bubbles. In fact, the current bubble literally is facing the question of who will win in the game of money itself.

As we wait

for the latest Fed press release (June 17) to feed trading algorithms at 2:00

EST, we back away from the near term. Instead of the relentless pursuit of “the

bottom line”, we will examine the question, “Why is this happening again?” from

an ethics point of view.

During bull

markets, when the majority are enjoying the ride up, ethics always takes a back

seat to bottom lines. Only when trillions in losses are racking up across the

landscape, does ethics and the lessons from history become more important than

chasing the temporary wealth illusion.

Join the

Crowd or Flee From It?

Charles Hugh Smith’s book, Why Things Are Falling Apart

and What We Can Do About It (2012), has two ideas that we all should have

considered three years ago, and based on the comments from one of his recent

articles, has become far more critical

this summer:

Charles Hugh Smith’s book, Why Things Are Falling Apart

and What We Can Do About It (2012), has two ideas that we all should have

considered three years ago, and based on the comments from one of his recent

articles, has become far more critical

this summer:

- `”Conformity. Studies have found that the need

to ‘fit in’ leads people to accept blatant falsehoods if the majority of

those around them have already chosen the falsehood. This is the lesson of

‘the Emperor has no clothes.”

- “Overconfidence, also called hubris. This is

the root of the phrase, ‘pride goeth before a fall.’ The individual who is

supremely confident in the superiority of his judgment is an individual who

will ignore evidence that he might be wrong.”

This becomes

even harder, when the Chairman of the Federal Reserve publicly TELLS everyone

that he is artificially inflating assets so everyone FEELS richer. Anyone

thinking about his statement from September 2012 when QEIII was launched

understands he was telling everyone this scheme was only temporary.

Fed

Seeking to Create Wealth, Not Just Cut Rates, Yahoo Finance, Sept 14 ‘12

“The Federal

Reserve wasn’t just trying to drive down interest rates when it announced on a

third round of bond purchases Thursday.

It was wants to make people feel wealthier – and more willing to spend.

‘…if the feel

that their financial situation is better because their 401(k) looks better or

for whatever reason - their house is

worth more – they’re more willing to go out and spend,’ Chairman Bernanke told

reporters. ‘That’s going to provide the demand that firms need in order to be

willing to hire and to invest.’”

How many

people do you know who believe that borrowing lot’s of money to make one’s

“wealth effect” look good, actually changes the fact that they are BORROWING

from their future to have that image today. How could Bernanke

have ignored this basic principle of personal and business finance?

So what

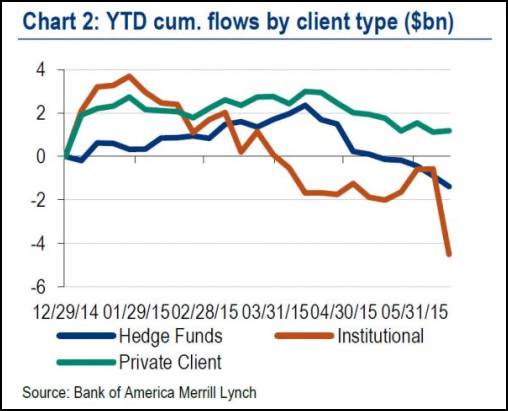

happens when a herd of investors, large and small, want to lock in their gains

from Bernanke’s short-term experiment of “more debt will make you FEEL wealthy”?

Will all of this new debt in the system go away, or will the public’s feelings

change when the latest credit fueled bubble burst, bringing with it far more

than massive financial losses again?

"Vogue editor

Diana Vreeland's motto, 'Fake it, fake it', is now the First Commandment of the

spin-doctor and the commercial maker. As Vreeland advises, 'Never worry about

the facts. Project an image to the public.' The art of success is to create a

world 'as you feel it to be, as you wish it to be, as you wish it into

being.'" When

No One Sees: The Importance of Character in an Age of Image (2000), Os

Guinness, pg 2.2 [Quoted in Destroy a Currency,

Extend a Rally, 11/8/14]

I Want Cash: Who Will Buy My “All Time High” Shares?

“Some investors take

comfort in the fact that spreads (i.e., the price between the bid and ask) have

remained low and healthy. But market depth is far lower than it was, and we

believe it is a precursor of liquidity. …The likely explanation for the lower

depth in almost all bond markets is that inventories of market - makers’

positions are dramatically lower than in the past. For instance, the total

inventory of Treasuries available to market makers today is $1.7 trillion, down

from $2.7 trillion at its peak in 2007.

Meanwhile, the Treasury

market is $12.5 trillion; it was $4.4 trillion in 2007.”

[JP

Morgan Shareholder letter from Jamie Dimon, April 8, 2015, pg 31]

Now are the global banks

and central banks just now figuring out that the Fed’s “wealth effect”, of

buying tens of billions of Treasuries each month since Bernanke’s Sept. 2012

“feel wealthier and keep spending” scheme was announced, has actually been

REDUCING liquidity, thus placing ALL investors in a market environment where

risk is must higher right now than three years ago?

The following is a quote

from UBS’ Michael Schumacher, from a Zero Hedge article that was released a

week before Bernanke’s announcement, and pulled from a Special Edition issue of

The Investor’s Mind released on Sept 21, 2012:

“The Fed owns all but $650 billion of 10-30 year nominal Treasuries. Taking out, say, $300 billion in long term Treasuries almost certainly would put tremendous pressure on liquidity in that market…Ploughing ahead with a large, fixed size QE program could cause liquidity to tank.”

And of course, any central banker reading the December 2008 BIS Quarterly Review right AFTER the collapse of world credit markets in the fall of 2008 would have known this long before 2012:

“The scarcity of US Treasuries for repo transactions also manifested itself in a sharp increase in the number of Treasury settlement fails. Whereas fails to deliver Treasuries had average around $90 billion per week during the two years preceding the crisis, they rose to above $1 trillion during the Bear Stearns episode and then soared to record highs of almost $2.7 trillion following the Lehman default.” [pg 46]

[Source – The Big, the Bull and the Banker, Dec 18 ‘08]

So when it is time to sell, who will buy all of the shares at “all time high” prices?

Stock Buybacks; Focusing

on Casino Wins or Economic Good?

“Your mind thinks

thoughts and the pictures are broadcast back as your life experience. You not

only create your life with your thoughts, but your thoughts add powerfully to

the creation of the world. If you thought that you were insignificant and had

no power in this world, think again. You mind is actually shaping the world

around you." The Secret, Rhonda Byrne, [Quoted at its 82nd week on the top two

"Hardcover Advice" of the NY Times Best Sellers and in The Secret of Retirement

Planning, Aug. 20, 2008]

Blaise Pascal

once said, “Ordinary people have the ability not to think about things they do

not want to think about.” When one

considers the massive levels of debt that corporations have taken on in order

to buy back their own stock, a method which has given the impression to

millions of investors that “the crowd” is buying the market, then millions of

investors and thousands of advisors have a great deal to think about this

summer, even if they do not desire to.

But hey, who can blame

the public, since societies are build around the motto, “We can always borrow

our way to the top”, as central bankers have so firmly endorsed, especially

since 2008.

Yet therein lies

the problem. The last 6 years of massive intervention by central banks, using

the “nuclear money option”, has created a society that is addicted to big daddy

always intervening to “remove risk”, which never will happen.

Delay it rearing

its ugly head, yes. Remove it, no.

Ultimately, like

a person who knows the oil light is on in their car and keeps driving, ignoring

reality will eventually have far more serious consequences.

Stanley

Drunkenmiller, one of the most famous hedge fund managers in the world, was

quoted in a recent article on CNBC (1), for his view the

current record breaking levels of corporate stock buybacks: “I think it’s nuts.

If you’re running a business for the long term, the last thing you should be

doing is borrowing money to buy your own stock.”

The same article

pointed out that April was a record breaking month for stock buybacks being

authorized, reaching $141 billion. If the rest of the year continued at this

pace, we would reach $1.2 trillion, which would be higher than the previous

annual high of $863 billion set in 2007.

If one’s method

for investing is “believe and shape the world around you”, then who cares about

history. If one’s method is based on learning from our past and history, then

we remember that the previous stock buying record year of 2007, was the start

of the largest destruction of wealth, over $60 trillion, in history.

While doing my

own research for this piece, I learned from another article, this one from the

Boston Globe (2), that since the early ‘80s when I

was in my late 20s, that the nation’s top publicly traded companies have gone

from having 70% of their profits available to reinvest in their own business,

to just 2 percent in 2014.

Bevis Longstreth,

was a commissioner for the SEC in 1982 when the rule was changed that launched

the buy back boom. Consider his insights of how distorted our markets have

become:

“It is a terrible thing for the economy because the growth of the

economy and the growth of individual companies depends upon their reinvesting

in their business and expansion into other lines of business, and paying 98

percent of your earnings out as dividends or stock buybacks implies that you

have no future.”

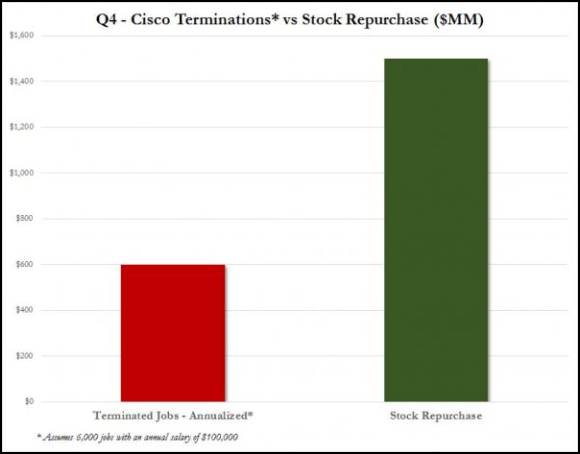

Bob Ordemann’s

team of 80 software developers and engineers were among the 8% or 6,000 workers

that Cisco announced were being laid off last year. These individuals, many of

whom had worked to build the company during their careers, were slammed with

the reality that at the same time they were being laid off to “cut costs”, the

company was continuing to spend billions to buy back its own stock, a move

which would reduce the number of shares on the open market and help “assist”

its price in the financial markets.

If this were an

isolated incident, it would be a moral travesty. Since this data supports that

this has become a national epidemic, every investors trusting in a “comfortable

retirement” while thousands of workers are axed, should understand that their

own financial futures are at risk from these unsustainable schemes. When major

corporations are stuck with declining stock prices and their creative and loyal

workforce is not there to rebuild TRUE long-term growth, how will that impact

the “we” and the “me”?

[Source

– Cisco

Sums It Up: Terminates 8% of Workforce While Buying Back $1.5 Billion in Stock,

Zero Hedge, Aug 13, ‘15]

[Source

– Cisco

Sums It Up: Terminates 8% of Workforce While Buying Back $1.5 Billion in Stock,

Zero Hedge, Aug 13, ‘15]

With David Kostin’s

– Chief Equity Strategist at Goldman Sachs – in May 2013 and November 2014

presenting a 2015 year end value on the S&P 500 of 2100 (3),

the record stock buybacks in April, record corporate debt levels, drastic

reduction in US Treasuries in the hands of market makers to provide liquidity

WHEN the major US stock indices break under their “nirvana lines” (4),

then where will our markets find big money to keep stocks climbing when they

start falling again like last October, when the Dow lost almost 1500 points in

a little over 3 weeks?

Twenty years ago

we might say to someone who said our markets were even “rigged” or

“manipulated” to achieve the “always bull” image, that they were crazy, or one

who believed a conspiracy theory. Well, no one willing to read can say that

today. A “winning at all costs”

attitude in order to continue “feeling wealthier in the short term”, will

ultimately bring severe consequences for us all, no matter who were are, or

where we stand on the socioeconomic ladder.

DOJ

Launches Probe Of Treasury Market Manipulation, Zero Hedge, June 8, '15

Six

Banks Pay $5.8 Billion, Five Guilty of Market Rigging, Bloomberg, May

20,’15

Big

Banks Fined $2.3 Billion Over Illegal Libor Cartels, More Fines on the Way, Forbes,

Dec 4 ‘13

How many times

will tens of millions of investors trust the powers of OZ more than the lessons

from the previous 28 financial bubbles spanning the last four centuries? (5)

Sources:

(1)

Q: Why Do Markets Fall Late In the Day?

A: Buy Backs, CNBC, 6/1/15

(2)

Feast

for Investors Sells Workers Short, The Boston Globe, 5/31/15

(3)

Investment Parachutes:

Do You Have Yours?, Doug Wakefield, 3/27/15

(4)

The Nirvana Trade,

Doug Wakefield, 7/24/13

(5)

“We have in fact

searched through all the data that we can find on currencies, commodities, and

stock markets and have found 27 bubbles. Unlike Chairman Greenspan, we have no

problem defining a bubble: we arbitrarily use a two standard deviation events,

the kind that would normally occur randomly every 40 years. Predictably (at

least for believers in regression to the mean), all 27 bubbles broke and went

all the way back to the preexisting trend. If it does not do this, it will be

the first failure to do so in modern times.” [GMO Quarterly Letter, “The

Countdown Continues” (October 2004) Jeremy Grantham, pg 6, quoted on page 135

in Riders

on the Storm: Short Selling in Contrary Winds (Jan ’06), Doug Wakefield

with Ben Hill]

Being a Contrarian, Remembering 2000

The

big shift from longs to shorts and shorts to longs grows stronger with ever

delay, warning any student of history.

Click here to start the

next six months reading the newsletters and trading reports. It is

extremely dangerous for so many people to place so much faith in the first ever

“six month all time high”, or “Dow 18,000 level”. (12/5/14 – reaches 17,991 for

first time in its history. 131 trading days later on 6/16/15, it closed at

17,903.)

On a Personal Note

Check

out Living2024. It is my personal

blog, not business. I wanted to have a place to write some deeper stories about

where this entire drama seems to be taking us all. Check out my latest post, The Unlimited

Mammon Master.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered

investment advisor that looks to the best minds in the world of finance and

economics to seek a direction for our clients. To be a true advocate to our

clients, we have found it necessary to go well beyond the norms in financial

planning today. We are avid readers. In our study of the markets, we research

general history, financial and economic history, fundamental and technical

analysis, and mass and individual psychology.