John’s Economic Worldview September 16, 2010

Doug

Wakefield

Today,

we are faced with a period in world history of unprecedented change. Carl Jung, who

worked with Sigmund Freud

and is known today for his work in humanistic-existential psychology, believed

that man perceived change as “death”. Dr. Janice Dorn, who has coached

hundreds of professional traders since the mid ‘90s, stated to me in an

interview for my December 2006 newsletter entitled Mindgames, that we

avoid change because “it is incredibly difficult to shift paradigms, which of

course is the way in which we perceived the world.” To perceive change as

“death” may appear to be an extreme comment if one is forced to deal with a new

job, or take an alternate route to one’s destination because of road

construction. What if, however, the change requires one to understand that

their worldview is being challenged? What if one is told, “the country is going

broke, or we can not continue to destroy the earth’s environment”? Since these

concepts are so far beyond our daily routines, the easiest solution is to avoid

the topic altogether.

Leo Apostel, a Belgium

philosopher, who wrote Freemasonry:

A Philosophical Essay (1985), and was acknowledged for his ideas on

atheistic religiosity, listed the following six traits as part of one’s worldview, otherwise known

as a descriptive model of the world. As you read Apostel’s six premises, I

believe you will agree that these thoughts are common to all men:

- An explanation of

the world.

- A futurology – an

answer to the question, “Where are we headed?”

- Values – The

answer to the ethical question, “What should we do?”

- A methodology –

an answer to the question, “How shall we attain our goals?”

- An epistemology,

or theory of knowledge – “What is true and false?”

- An etiology – The

building blocks of one’s worldview that deal with origins and construction

of the world.

In

case your eyes are beginning to glaze over, and this sounds like another heady

discussion on philosophy, look at the questions above, and consider their

relevance to the public, based on the following comments from an article

released in March:

“Most American voters believe it’s possible the

nation’s economy could collapse, and majorities don’t think elected officials

in Washington have ideas for fixing it.

The latest Fox News poll finds that 79 percent of voters think it’s possible

the economy could collapse, including large majorities of Democrats (72

percent), Republicans (84 percent) and independents (80 percent).

Just 18 percent think the economy is "so big

and strong it could never collapse."

Moreover, 78 percent of voters believe the federal government is "larger and more costly" than it has

ever been before, and by nearly three-to-one more voters think the national

debt (65 percent) is a greater potential threat to the country’s future than

terrorism (23 percent).”

Who has a plan for dealing with the economy? 1

Clearly

the statement above forces each of us to ask the questions Apostel posed;

“Where are we headed?, How shall we attain our own goals?, What can be done?,

and even, What information is true and what information is false?” As long as

our standards of living continue to stay somewhat in tact and our government social

programs continue to provide what we have grown accustom to receiving, our

various worldviews are nothing more than discussions for philosophers paid to

discuss such things at our universities or seminaries.

Yet,

what are we to do when faced with public information like the article above?

Did the financial collapse in 2008 slam the financial life of the atheist as

well as the Christian or Muslim? Have we seen those working for government

entities lose their jobs like those working in the private sector? When

considering the accelerating role of spending at the federal or global level in

order to “stimulate” the economic “recovery”, does it appear that the majority

of political and financial leaders have asked the simple question, “Where are

we headed?”, or are they, like many of us, believing that the dam just will not

break, no matter how much debt is thrown at it?

In

the July

2006 issue of The Investor’s Mind, I released this interesting story, found

in Dr. Jared Diamond’s work, Collapse:

How Societies Chose to Fail or Succeed:

“Consider a narrow river valley below a high dam, such that if the dam burst, the resulting flood of water would drown people for a considerable distance downstream. When attitude pollsters ask people downstream of the dam how concerned they are about the dam’s bursting, it’s not surprising that fear of a dam burst is lowest far downstream, and increases among residents increasingly close to the dam. Surprisingly, though, after you get to just a few miles below the dam, where fear of the dam’s breaking is found to be the highest, the concern then falls off to zero as you approach closer to the dam! That is, the people living immediately under the dam, the ones most certain to be drowned in a dam burst, profess unconcern. That’s because of psychological denial: the only way of preserving one’s sanity while looking up every day at the dam is to deny the possibility that it could burst.

If something that

you perceive arouses in you a painful emotion, you may subconsciously suppress

or deny your perception in order to avoid the unbearable pain, even though the

practical results of ignoring your perception may prove ultimately disastrous.

The emotions most often responsible are terror, anxiety, and grief.” 2

Don’t Worry, Be Happy

Never in world history,

have our daily lives been so dependent on the lives of others around the world.

The oil used to manufacture the gas I placed in my car this week has most

likely come from the Middle East, Nigeria, or Venezuela. When fruit is

purchased from my local grocer, I find items from Columbia and Chile. When it

necessary to pick up a few items for home maintenance, I see that the products

were made in Indonesia, China, and India. When reflecting on my daily life over

the last year, I have helped a family friend with his estate, talked with one

of my son’s former Special Ed teachers, and been assisted by a nurse in the

hospital. The friend grew up in Mexico, the teacher in India, and the nurse in

Jordan. Clearly, the world of “Leave it to Beaver” is not reflective of my

world in 2010.

Each of these various

nations espouse different religions, each of them have different cultures, each

have learned history through the country in which they grew up, and yet all are

connected financially and socially more than anytime in history.

A few years ago, I

talked with a professor who had taught eschatology, known as the

study of end times, at a major American seminary. Dr. J. Dwight Pentecost

was 91 at the time, and had traveled to many parts of the world during his more

than six decades of teaching. One of the nuggets I gleaned from this seasoned

man, was that he had found, no matter what corner of the world he had visited,

most individuals desired three things; peace on their corner of the earth, good

health, and a stable financial life. Ask around. See how many people you find

searching for these same three items. My own anecdotal evidence has found this

to be consistent across cultural and religious lines.

Yet, even with the

majority of people around the globe, seeking the same end, the difference in

how those ends are attained have, and will continue to create great clashes

when discussing these ideas at the worldview level. Rather than write my own

opinion, which frankly by itself has little value, I would like to share with

you what I have learned from studying modern history, as well as the decline of

two empires - ones that existed long before the term “nationality” came into

existence. Rather than approaching these topics strictly from the lens of

philosophy or religion, I will examine them through the area in which I have

focused for the last seven years, how they relate to money.

The Most Influential Religion

The evidence appears to

be very compelling, that the three leading worldviews in existence today, are

Humanist, Islamic, and Judeo-Christian. While we recognize the last two as tied

to religions, most do not consider the humanist view as a religion, but solely

a philosophy. And yet, the Humanist Manifesto I, which was released in 1933, at

the tale end of the greatest stock market collapse in American history,

contains these words:

While this age does owe a vast debt to the

traditional religions, it is none the less obvious that any religion that can

hope to be a synthesizing and dynamic force for today must be shaped for the

needs of this age. To establish such a religion is a major necessity of the

present. It is a responsibility, which rests upon this generation. We therefore

affirm the following.

If

one considers these tenets of Humanism, as stated in the Humanist Manifesto I,

it makes it even clearer that the original signers of this document believed

their worldview to be a religious one:

Tenet One: Religious humanists regard the universe

as self-existing and not created.

Tenet Five: Humanism asserts that the nature of the

universe depicted by modern science makes unacceptable any supernatural or

cosmic guarantees of human values…Religion must formulate its hopes and plans

in the light of the scientific spirit and method.

Tenet Eight: Religious Humanism considers the

complete realization of human personality to be the end of man's life and seeks

its development and fulfillment in the here and now. This is the explanation of

the humanist's social passion.

Tenet Thirteen: Religious humanism maintains that

all associations and institutions exist for the fulfillment of human life.

If

you wish to read an entire copy of the

Humanist Manifesto I, you can find one at the American Humanist

Association.

The

April 2007 issue of The Investor’s Mind: The Crisis of Money and Politics,

quoted these tenets, found in the Humanist

Manifesto II. Once again, the entire document can also be found at the

American Humanist Association.

WORLD

COMMUNITY

TWELFTH: We deplore the division of humankind on nationalistic

grounds. We have reached a turning point in human history where the best

option is to transcend the limits of national sovereignty

and to move toward the building of a world community in which all

sectors of the human family can participate. Thus we look to the development of

a system of world law and a world order based upon transnational federal

government.

HUMANITY AS A WHOLE

IN CLOSING: The

world cannot wait for a reconciliation of competing political or economic

systems to solve its problems. These are the times for men and women of

goodwill to further the building of a peaceful and prosperous world. We urge

that parochial loyalties and inflexible moral and religious ideologies be

transcended. [Italics mine]

One can see from the Humanist

Manifesto 2000: A Call for a New Planetary Humanism, a continuation of the

theme to “transcend the limits of national sovereignty”, thus expanding the

role of government in the lives of individuals worldwide.

THE NEED FOR NEW PLANETARY INSTITUTIONS:

The urgent question in the twenty-first century is whether humankind can develop global institutions to address these problems. Many of the best remedies are those adopted on the local, national, and regional level by voluntary, private, and public efforts. One strategy is to seek solutions through free-market initiatives; another is to use international voluntary foundations and organizations for educational and social development. We believe, however, that there remains a need to develop new global institutions that will deal with the problems directly and will focus on the needs of humanity as a whole. These include the call for a bicameral legislature in the United Nations, with a World Parliament elected by the people, an income tax to help the underdeveloped countries, the end of the veto in the Security Council, an environmental agency, and a world court with powers of enforcement.

No matter what religious views one holds personally, it should be clear to anyone reading these public documents, and examining social and political history since the Great Depression, that humanism is the leading worldview in the West when it comes to answering the question, “Where are we headed”. When we look at trade governed by the World Trade Organization, laws governed by the International Court of Justice, politicians participating in decisions for the globe through the United Nations, and all of them depending on an ever larger amount of debt on a global basis, is there any doubt that if size and scope of control and influence on the lives of people is any measure of “success” that humanism, based on the three Humanist Manifesto documents, have achieved the widest reach on modern society of any religion or worldview? None of this could have been accomplished in modern history without first asking the simple question, “How shall we attain our goals?”

Money-

How We Achieve Our Goals

How many individuals, whether Chinese, British, India or American have even heard of an international currency unit known as the Special Drawing Rights(SDR), whose history and oversight today comes through the International Monetary Fund, headquartered in Washington? How many individuals understand that through a nation’s central bank, this currency unit is already being bought and sold, and that the SDR is used to set the interest rate charged to nations who borrow from the IMF, as well as the payments to reduce the loan? How many individuals understand that this currency, which stood at 21.4 billion units for 30 years, was expanded more than eightfold in August 2009, and was used to back an emergency lending fund that went from $50 billion to $550 billion in April of this year?

When one understands that one of the most famous names in economics, John Maynard Keynes, proposed the idea of a world currency unit in 1944, known as the bancor, and that the Special Drawing Rights was established in 1969 ( just two years before the United States removed it's currency from the gold-exchange standard), I don’t think we find it difficult to understand why Zhou Xiaochuan, Ben Bernanke’s counterparty at the People’s Bank of China, announced that Keynes’ bancor approach was farsighted, and that the IMF’s SDR be adopted as an international currency unit. Is it really “random chance” that explains why the largest communist nation today, through their annual report, Yellow Book of Global Socialism, would make the following statement before the crisis unfolded in the fall of 2008?

“Economic

globalization and the new high-tech revolution can only create

even better

conditions and a foundation in society that will accelerate the

pace of a different

kind of globalization superseding the capitalist system.

Thereby enabling

the ideology of socialism, its theories, movements, and

system to step out

of the shadows on a global scale and upsurge,

facilitating this

historical process of capitalism being replaced with a

higher-level social

form… We deeply understand that Socialism is so far

the most profound

social reform in human history. This final replacement

with another type

of globalization cannot be accomplished in a single

stroke. Struggle –

failure - renewed struggle; climax – ebb– and climax,

this is a necessary

process for the globalization of Socialism to replace that

of capitalism.” 3

It would appear that whether we look back at the 20th century or look forward into the 21st century, when asked the worldview question, ‘How shall we attain our goals?”, the answer within our modern society remains the same; through financial power. Should any of us be surprised? Don’t the lessons learned of empires throughout history show us that a concentration of financial power in the hands of a few give those few the ability to control the decisions of nations and kings?

If you consider your worldview as humanist or secularist, this is your personal right, and freedom of religion is an expression the West holds dear, as do I. However, when a worldview moves from a philosophy, to a religion, to embracing a larger and ever expanding role of government on a global basis, all backed by an ever increasing concentration of monetary authority through global institutions like the IMF or the Bank of International Settlements Group of Ten, or the G7 (a group started just three years after the Humanist Manifesto II was released) then I view the state as a threat to my freedoms, not a resource to protect them. If we as individuals are ever going to see this world turn from it’s current painful juncture, we must first admit that we have been DUPED into the religious belief that DEBT, centrally controlled by a few, is what we need.

Does this

sound like we are moving closer to peace, good health, and financial stability

in our corner of the earth, or further away? Does this New World Order sound

more like an old world empire?

OK, let’s take a breath. If you have made it to this point, you are most likely part of a small group of individuals who has an interest in understanding history, especially as it relates to money and politics. Because of the gravity of this material to our current way of life, you may wish to take a mental break. I would suggest having something soothing to drink, but based on the material presented to this point, I am not sure that is such a wise idea. When you feel ready to continue, let me encourage you to return for the remaining material.

Part

II- Lessons from the Ancient World: Rome and Israel

I believe the most interesting pattern one finds when studying other periods in history, is that man really has not changed that much over the last few thousand years. With the current juncture of America, especially considering it’s business, political, and military reach around the globe, I can think of no better place to start than to ask the question, “What lessons could be learned from studying the Romans?” And since one of the most widely recognized writings in modern history is Edward Gibbons, The Decline and Fall of the Roman Empire (pub between 1776 and 1788), we will examine some aspects of Roman life during the 3rd century AD, which during the second half of the century experienced rapid devaluation of its currency.

“The houses are described as numerous and well built; the manners of the people as polished and liberal. A circus, a theatre, a mint, a palace, baths, which bore the name of their found Maximian; porticoes adorned with statues…4 The system of Diocletian was accomplished with another very material disadvantage, which cannot even be totally overlooked; a more expensive establishment, and consequently an increase of taxes, and the oppression of the people. The number of ministers, or magistrates, or officers, and of servants, who filled the different departments of the state, was multiplied beyond the former times; and ‘when the proportion of those who received exceeded the proportion of those who contributed, the provinces were oppressed by the weight of the tributes…5 The policy of Diocletian, which inspired the councils of his associates, provides for the public tranquility, by encouraging a spirit of dissension among the barbarians, and by strengthening the fortifications of the Roman limit. In the East he fixed a line of camps from Egypt to the Persian dominions, and for every camp, he instituted an adequate number of stationary troops, commanded by their respective officers, and supplied with every kind of arms, from the new arsenals which he had formed at Antioch, Emesa, and Damascus.” 6

If we move

forward 100 years in history, we find similar comments in Dr. Alfred

Edersheim’s work, The Life and Times of Jesus the Messiah (1883),

regarding the Roman Empire at the time of Christ:

“It was felt that the

boundaries of the Empire could be no further extended, and that henceforth the

highest aim must be to preserve what had been conquered.7 …The free

citizens were idle, dissipated, sunken; their chief thoughts of the theatre and

arena; and they were mostly supported at the public cost. While, even in the

time of Augustus, more than two hundred thousand persons were maintained by the

State, what of the old Roman stock was decaying, partly by corruption, but

chiefly from cessation of marriage, and the nameless abominations that

remained.8 …Absolute right did not exist. Might was right. The

social relations exhibited, if possible, even deeper corruption. The sanctity

of marriage had ceased. Abortion, and the exposure and murder of newly-born

children were common and tolerated; unnatural vices, which even the greatest

philosophers practiced, if not advocated, attained proportions which defy

description. 9

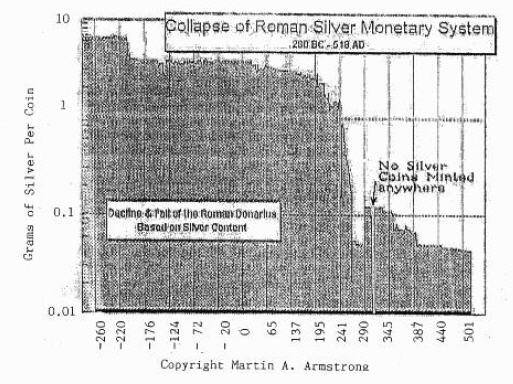

And as we move to our present day, we find former hedge fund manager, Martin Armstrong described how even the empire’s monetary system had to be corrupted in an attempt to postpone the inevitable changes that had been building for generations:

“It was the fall of Rome from the reign of Marcus Aurelius (161-180 AD) that began the suburbanization of civilization. The corruption of the Rule of Law led to a massive exodus. By the third century, the economic decline was in full force.

We can see the collapse of the Roman Monetary System during the third century took an amazingly short period of time to crash- 13 years. Yet during the reign of Gallienus (253-260 AD), the coinage declined by virtually 95% of its value. It was this suburbanization, that truly began in force under the reign of Commodus (180-192 AD), and that led the rich to flee from the cities and with it the tax revenue. The cities became ever more reduced by the rabble and corruption became widespread both in government and the ethical conduct of the people.

As the collapse of order

had begun, this lead to the worst of all Christian persecutions in history,

authorized by the new Roman Emperor Diocletian (284-305 AD), most likely

instigated by Galerius (305-311AD), who had been made a Caesar, second to the

Emperor known as Augustus. We find the contemporary blame for the economic

decline of the third century was placed upon the Christians claiming they

offended Roman gods causing them to punish Rome. The worst of the Christian

persecutions was thus linked to economic depression.” 10

When presented with the comments by these three men about the Roman Empire, separated by a span of a century between each of their writings, we begin to grasp that a great deal of history had to be ignored, manipulated, and forgotten, in order for the public to be so arrogant to believe that man was climbing the evolutionary food chain to greatness on the eternal back of ever increasing bailout schemes. The basic human tendencies of pride, greed, and denial still keep marching on.

If we journey back hundreds of years before the decline of the Roman Empire, we can see that the sons of Israel, who later became known as the Jewish race, watched their own empire collapse. The height of their political and territorial powers was during the reigns of two kings, David and Solomon.

“Although Saul failed as the first king of Israel, his successor David, as a great warrior, was able to conquer much of the territory belonging to the Promised Land.

David’s son Solomon extended his sway until he put under tribute most of the area originally mentioned to Abraham [Gen 15:18] from the river of Egypt to the River Euphrates.” 11

“While the Hebrew judgment of David seems to be ambivalent, his accomplishments in his forty-year reign are undeniable. After centuries of losing conflicts, the Hebrews finally defeat the Philistines unambiguously under the brilliant military leadership of David. His military campaigns transform the New Hebrew kingdom into a Hebrew empire. An empire is a state that rules several more or less independent states. These independent states never fully integrate themselves into the larger state, but under the threat of military retaliation sent tribute and labor to the king of the empire.

Most

importantly, David unites the tribes of Israel under an absolute monarchy. This

monarchical government involved more than just military campaigns, but also

included non-military affairs: building, legislation, judiciaries, etc. He also

built up Jerusalem to look more like the capitals of other kings: rich, large,

and opulently decorated. Centralized government, a standing army, and a wealthy

capital do not come free; the Hebrews found themselves for the first time since

the Egyptian period groaning under heavy taxes and the beginnings of forced

labor.

It

is the third and last king of a united Hebrew state, however, that turned the

Hebrew monarchy into something comparable to the opulent monarchies of the

Middle East and Egypt. The Hebrew account portrays a wise and shrewd king, the

best of all the kings of Israel. The portrait, however, isn't completely

positive and some troubling aspects emerge.

What

emerges from the portrait of Solomon

is that he desired to be a king along the model of Mesopotamian kings. He built

a fabulously wealthy capital in Jerusalem

with a magnificent palace and an enormous temple attached to that palace (this

would become the temple of Jerusalem).

All of this building and wealth involved imported products: gold,

copper, and cedar, which were unavailable in Israel. So Solomon taxed his

people heavily, and what he couldn't pay for in taxes, he paid for in land and

people. He gave twenty towns to foreign powers, and he paid Phoenicia in slave

labor: every three months, 30,000 Hebrews had to perform slave labor for the

King of Tyre. This, it would seem, is what Samuel meant when he said the people

would pay dearly for having a king.

…Groaning

under the oppression of Solomon, the Hebrews became passionately discontent, so

that upon Solomon's death (around 926 to 922 BC) the ten northern tribes

revolted. Unwilling to be ruled by Solomon's son, Rehoboam, these tribes

successfully seceded and established their own kingdom. The great empire of

David and Solomon was gone never to be seen again; in its place were two mighty

kingdoms which lost all the territory of David's once proud empire within [two]

hundred years of Solomon's passing.” 12

Just as

“prophets” warned about a moral decline in the global financial world before

the term credit contraction became public knowledge in the summer of

2007, so also were Micah, Amos, Hosea, Zephaniah, and Jeremiah, warning their

fellow countrymen that a decline of morals would have severe negative

repercussions. As we will see, it impacted their financial affairs. The lessons

were not new having been passed down by their ancestors over hundreds of years.

Now I ask you, do these words, written by Micah, Amos, and Hosea to their

fellow countrymen (ten northern tribes) before the Assyrian king Salmaneser

V crushed

their nation around 722 BC, reveal human behavior similar to the daily

headlines of the last few years?

“Her

leaders judge for a bribe, her priests teach for a price, and her prophets tell

fortunes for money. Yet they lean upon the LORD and say, ‘Is not the LORD among

us? No disaster will come upon us.” Micah 3:11/NIV

“Hear

this you who trample the needy and do away with the poor of the land, saying

‘When will the New Moon be over that we may sell grain, and the Sabbath be

ended, that we may market wheat?’ – skimping the measure, boosting the price

and cheating with dishonest scales, buying the poor with silver, and the needy

for a pair of sandals, selling even the sweeping with the wheat.” Amos

8:4-6/NIV

“The

merchant uses dishonest scales; he loves to defraud. Ephraim boasts, ‘I am very

rich; I have become wealthy. With all my wealth they will not find in me any

iniquity or sin.” Hosea 12: 7-8/NIV

..Or consider

these words, written by Zephaniah and Jeremiah to their countrymen (two

southern tribes) before the Babylonian

ruler Nebuchadnezzar destroyed Jerusalem and Solomon’s temple around 586

BC:

“Their

wealth will be plundered, their houses demolished. They will build houses, but

not live in them; they will plant vineyards, but not drink the wine. Zephaniah 1:13/NIV

“Like

cages full of birds their houses are full of deceit; they have become rich and

powerful and have grown fat and sleek. Their evil deeds have no limit; they do

not plead the case of the fatherless to win it, they do not defend the rights

of the poor.” Jeremiah 5:27-28/NIV

While we may be

tempted to say that this is just a religious

view, I believe there is a strong correlation between ancient history and today

when looking at morality as it relates to finances. I believe that many

cultures and religions, when asked the worldview question, “How shall we attain

our goals?”, would NOT reply, “through financial predatory actions”.

Finding

“prophets” today, who warned of the coming monetary crisis is no longer

difficult. While we have dismissed morality as just part of the financial

jungle for survival as long as we did not get hurt individually, we are

beginning to wake up from the credit slumber in mass. We are starting to

understand why being interconnected globally as never before will bring this

story home to each of us, no matter how often we try to shut it out.

Part III- Back

to the Future

During credit

induced manias over the last 300 years, the crowd becomes so focused on the

ride up and justifying this new found wealth, that the voices which continued

to warn of the pain that would come from the credit collapse were often

ridiculed or ignored. However, as the shift moved from those who made money to

those who lost money, the natural human tendency to cry foul became the

predominant social theme.

Since 2008, we

have been presented with two answers to the worldview question, “What should we

do?” One view is that we continue to expand the role of global governing bodies

and work towards a global currency to make certain the events of 2008 never

happen again. The G 20 assured us of their unlimited powers to respond to a

global crisis, when on April 2, 2009, Fabian Socialist UK leader Gordon Brown made the

statement below,

“I think a New

World Order is emerging and with it, the foundations of a

new and progressive

era of international cooperation. We have resolved,

that from today, we

will together manage the process of globalization, to

secure

responsibility from all and fairness to all, and we have agreed that

in doing so, we will build a more sustainable and more open, and a fairer global society.”

… and the G20

backed up his comments with a commitment to quadruple the financial capacity of

the IMF

with a $1 trillion commitment. Now I ask you, which of you own friends has

this type of financial and political clout?

Another view is

that governments should be under the same requirement as their citizens (what a

concept…). They should stop expanding debt and move the largest role of

governing back to the local/state level rather than the national/ international

level. Ultimately, bigger global businesses lobbying for expanding global

government projects backed by a greater concentration of power by the global

banking giants, while at the same time “protecting this global security order”,

is the wrong direction to go. People first, profits second versus profits

first, and people second.

If you have read

any of my writings over the last five years, including this one, you have no

doubt which view I hold. However, regardless of my views, having a thorough

understanding of history is critical

to understanding our future.

That said, I turn to one of the oldest and most widely published documents in

Western Civilization; the Jewish writings contained in the Old and New

Testament’s of the Bible. We must remember that these writings came from over

40 authors spanning a 1500-year period and six world empires. Considering that

these writings were completed approximately 100 A.D., they certainly are worthy

of examination by any student of history.

John’s book of

Revelations is usually discussed from a theological or philosophical viewpoint;

however, I have examined it repeatedly from a financial/political viewpoint.

Due to the length of this article at this point, we will only examine two

verses. No matter where you place your faith, I hope this will pique your

curiosity to examine more of the Jewish writings as found in the Old and New

Testament.

“When He broke open the third seal, I heard the third living creature call out, Come and look! And I saw, and behold, a black horse, and in his hand the rider had a pair of scales (a balance). And I heard what seemed to be a voice from the midst of the four living creatures, saying, A quart of wheat for a denarius (a whole day’s wages), and three quarts of barley for a denarius; but do not harm the oil and the wine!” Revelations 6:5,6/ Amplified Bible

Since our objective is to focus on the world of

money, we will stay away from speculating on terms like “the third seal” or “a

black horse”. What appears to be more concrete is the term “pair of scales”.

While I am still speculating, the term “pair of scales” does appear to fit

nicely with the long history of money. In my article, Financial

Lessons of the Ages [Jan 8 ‘10], I mentioned the following idea, found in

the Torah, thus written more than three millennium before the financial

“rescue” from the 2008 meltdown:

“You

shall not have in your bag true and false weights, a large and small. You shall

not have in your house true and false measures, a large and a small. But you

shall have a perfect and just weight

and a perfect and just measure, that

your days may be prolonged in the land which the Lord your God gives you.”

Deuteronomy 25:13-15/Amplified [Italics mine]

Anyone, studying the history of fiat currency since

the days of the goldsmiths and the establishment of fractional reserve banking

in the 15th century, can relate to the “pair of scales” representing

a monetary system. Anyone, whose finances have been “blackened” by the credit

collapse that continues to unfold, can certainly see the moral side of money.

The “quart of wheat for a denarius ( a whole day’s

wages), and three quarts of barley for a denarius” doesn’t sound like our world

today, but would have made complete sense economically to the individuals

living under the Roman Empire, which was the period of history from which John

wrote. Mark Hitchcock has been a

passionate student of the Bible and history, as attested by his many books. In

a recent work, Cashless: Bible

Prophecy, Economic Chaos, and the Future Financial Order, he takes events

that have taken place in modern history…

“Hyperinflation

is one of those scary-sounding economic words. It just sounds bad….The most

famous hyperinflation in history occurred in the Weimar Republic (Germany) in

1923, topping out at a whopping 29,525 percent a month with prices doubling

every 3.7 days.” 13

….and relates them to John’s writings regarding a

future time in history, as found in Revelation…

“A

denarius in that day was a silver coin equal to an average day’s wage for a

working man. A measure or ‘quart’ of grain in the first century, was equal to

slightly less than our modern-day quart. And one measure or quart of wheat was

the basic of food for one person for one day.” 14

….or stated another way, John envisioned a time

when a man or woman would work all day for a loaf of bread. Hitchcock brings us

back to John’s economic forecast:

“Food

prices will be so high that it will take everything a person can earn just to

buy enough food for one meal for an average person.” 15

If one has kept up with food inflation in the last

few years, you can understand why hyperinflation is not a religious view, but

an economic principle. Consider the following comment from The Global

Economic Crisis: The Great Depression of the XXI Century:

“These

hikes in food prices are contributing to a very real sense to ‘eliminating the

poor’ through ‘starvation deaths’:

‘The

most popular grade of Thailand rice sold for $198 a ton, five years ago and $

323 a ton a year ago. In April 2008, the price hit $1,000. Increases are even

greater than local markets – in Haiti, the market price of a 50 kilo bag of

rice doubled in one week at the end of March 2008. These increases are

catastrophic for the 2.6 billion people around the world who live on less than

US $ 2 a day and

spend

60% to 80% of their incomes on food. Hundreds of millions cannot afford to

eat.’” 16

….and the same chapter in this work makes it clear

that these events were not “random”:

“

‘Macroeconomic stabilization’ and structural adjustment programs imposed by the

IMF and the World Bank on developing countries (as a condition for the

renegotiation of their external debts) have led to the impoverishment of

hundreds of millions of people.”17

The last monetary idea we find from John’s writing

was “do not damage the oil and wine.” I turn once again to Hitchcock for his

opinion, one I have seen shared by other theologians:

“In

John’s day, oil and wine were more in the categories of luxury than wheat and

barley.” 18

Once again, we find that widening inequality

between the rich and poor around the globe is a very well documented trend, one

that shows up repeatedly in history. Consider the following data about wealth

disparity in the world today, as found in David Rothkopf’s work, Superclass:

The Global Power Elite and the World They are Making:

“According

to the United Nations, despite economic gains in many regions, the world is

less equal than it was even a decade ago. Gaps exist within countries and

between them. For example, the richest countries in the world, such as the

United States, the EU, and Japan, are now on average more than one hundred

times richer than the poorest, such as Ethiopia, Haiti, and Nepal. A hundred

years ago, the ratio was 9 to 1. The world’s billionaires, those roughly one

thousand individuals, have combined wealth greater than that of the poorest 2.5

billion.” 19

And just as the 12th plank in the

Humanist Manifesto II supports a “world community” that “transcends the limits

of national sovereignty”, we have seen today that global wealth, based on a

fiat currency system, is in agreement with this idea:

“A

couple of years after Wriston [former CEO of Citibank and author of The

Twilight of Sovereignty (1992)], Christopher Lasch observed similarly in The

Revolt of the Elites that:

‘The

market in which the new elites operate is now international in scope. Their

fortunes are tied to enterprises that operate across national boundaries. They

are more concerned with the smooth functioning of the system as a whole than

with any of its parts. Their loyalties – if the term is not itself

anachronistic in this context – are international rather than regional,

national or local. They have more in common with their counterparts in Brussels

or Hong Kong than with the masses of Americans not yet plugged into the network

of global communications.’ 20

And as history has shown, as long as wealth

continues to concentrate into a few hands, so also will political clout:

“This

group mirrors elites of the past in that its members posses a hugely

disproportionate share of the power on earth. Indeed, this is what defines them

as member of the superclass. And because they operate globally, with few or no

institutional means of counterbalancing their influence, they are dramatically

unlike past elites who rose up within nation-states and who, when they

overreached, were reined back via traditional mechanisms like the use of force

or the leverage of law. Just as elites occur naturally, so too do

concentrations of power.” 21

Conclusion

In many ways, it seems as though we have learned

very little as a society regarding the role of money in history. Instead, we

have been taught to constantly label others rather than seek to understand our

differences, to vote for the right party while each for decades has espoused a

larger role of government in our lives built on a rising sea of red ink, and to

think solely about our own entertainment and comforts until we are no longer

able to sustain them. We have yet to fully grasp the cyclical aspects of life

and markets. Even now, after living through several bubbles in the last 15

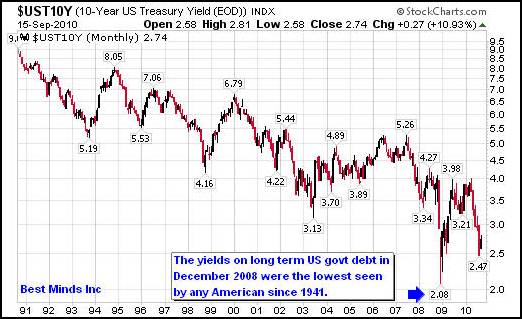

years, it appears that bond investors need to be reminded of these words from

financial historian Sidney Homer:

“The

greatest of all secular bear bond markets, which began in April of 1946, and

probably ended in September 1981, carried prime long American corporate bond

yields from their lowest recorded yields to their highest The yield index rose

from 2.46 to 15.49% for seasoned prime issues…If a constant maturity thirty-year

2 ½% bond had been available throughout this second bear market of the century,

its price would have declined from 101 in 1946 to 17 in 1981, or 83%.” 22

In the next few months, as we wait for the effects

of hyper-debt to kick in globally (remember, the only story the majority of our

political leaders have ever known is to legislate larger government programs

backed by more debt, thus the destruction of one’s underlining paper/electronic

currency, fueling decades of higher prices), will the natural forces of

deflation continue to grind on as credit continues to contract throughout the

system, bringing many prices down very hard until we reach the next “crisis”

bottom?

As we each have our own worldviews challenged in

the days ahead, we must remember that only by returning to some of the most

profound documents that have impacted history, and reading them for ourselves,

will each of us begin to understand how the world we are facing will be

different and yet the same as the one we grew up in.

“The

Communists are further reproached with desiring to abolish countries and

nationality…There are, besides, eternal truths such as Freedom, Justice, etc.,

that are common to all states of society. But Communism abolishes eternal

truths. It abolishes all religion and all morality instead of constituting them

on a new basis; it therefore acts in contradiction to all past historical

experiences.”

[From The Communist

Manifesto (1848) by Karl Marx and Friedrich Engels]

While we may not alter the course of history, we

can learn from it, and alter our worldview. We can seek to find out what

information is true and what information is false. We can seek to have a

positive influence on our fellow man every day.

“We

all have purpose, we all have souls, let’s cherish each other” Joel Wakefield,

one of my sons

Sources:

1. FOX

News Poll: 79% Say U.S. Economy Could Collapse, March 23, 2010

2. Collapse: How Societies Choose to Fail or Succeed

(2004), Dr. Jared Diamond, pages 435 & 436

3. The Investor’s Mind, China: The Next Empire (June

2009), Doug Wakefield w/ Ben Hill, page 26

4. The Decline and Fall of the Roman Empire,

Wordsworth Edition Limited (1998) (original publ. between 1776 and 1788) Edward

Gibbon, page 224

5. Ibid, page 228

6. Ibid, page 212

7. The Life and Times of Jesus the Messiah, McDonald

Publishing Co. (original publ. in 1883), Dr. Alfred Edersheim, page 256

8. Ibid, page 259

9. Ibid

10. Destroying Capital Formation: Economic Suicide, Armstrong Economics, March 23 ’09, Martin

Armstrong

11. Major Bible Themes: Revised Edition (1974) Lewis

Sperry Chafer, revised by John F. Walvoord, page 303 & 304

12. Jewish

Virtual Library, The Monarchy, 1050-920 BC

13. Cashless:

Bible Prophecy, Economic Chaos, & the Future Financial Order (2009), Mark

Hitchcock, page 98

14. Ibid

15. Ibid

16. The Global Economic Crisis: The Great Depression of

the XXI Century (2010) Michael Chossudovsky and Andrew Gavin Marshall, Editors,

page 160

17. Ibid, page 161

18. Cashless, Hitchcock, page 100

19. Superclass: The Global Power Elite and the World

They Are Making (2008), David Rothkopf, page 66

20. Ibid, page

11

21. Ibid, page

200

22. A History

of Interest Rates, Third Edition Revised (1996) Sidney Homer and Richard Sylla,

page 366 & 367

Doug Wakefield

President

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds,

Inc is a registered investment advisor that looks to the best minds in the

world of finance and economics to seek a direction for our clients. To be a

true advocate to our clients, we have found it necessary to go well beyond the

norms in financial planning today. We are avid readers. In our study of the

markets, we research general history, financial and economic history,

fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this

communiqué should be construed as advice to buy, sell, hold, or sell short. The

safest action is to constantly increase one's knowledge of the money game. To

accept the conventional wisdom about the world of money, without a thorough

examination of how that "wisdom" has stood over time, is to take

unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of

individuals, and at any time may or may not agree with those individual's

advice. Challenging one's thinking is the only way to come to firm conclusions.

Copyright

© 2010 Best Minds Inc.