Have Men and Money Schemes Changed? Nov 16, 2015 Doug Wakefield

Week

after week as we have come through 2015, there have been warnings from global

markets and the global economy that our current juncture was unsustainable and

slowing down. Yet the central banking rock stars were regularly plastered

across the “tabloids” as having another interventionist solution, while high

speed computers and stock buybacks created a world of “never fear reality”

presented to the public, thus helping prices soar back up to produce the latest

“all time high” of the day.

But

what if men and money schemes today are really not that different from those

300 years ago? I know, we are certainly far more sophisticated than they, and

have more history and data at our fingertips today than at any time in history,

and certainly more than the early years of the 18th century.

But

humor me for a moment, and rather than speculating on 2016, let’s journey

back

to events leading up to 1720.

Anyone

reading Charles McKay's Extraordinary Popular Delusions and the Madness of

Crowds, knows that there are very specific lessons that can be learned as

we wait to look back on this period in history, and read stories about this

global bubble, one that already has cracks and “all time high” tops in markets

going back more than a year now.

Yes

it is easier to follow the majority view, that with enough debt and central

planning, financial assets will not experience the painful deflating side they

have for centuries. Even more key in this period, is that “always comes back”

has been experienced so strongly by stockholders these last few years and

recently in October, that the experience of the crowd is now the lead tool by

which we measure financial progress, and the way to avoid pain…and yes,

reality.

But

let us not start this story in November 2015, 7 years after the NASDAQ bottomed

in November 2008, and over 15 and a half years from its top in March 2000; let

us start our story almost 300 years ago when the people of England became so

enamored with the "sure thing", that they lost all reason.

The

Allure of “Unlimited” Money

“The dangerous practice of stockjobbing would divert genius the nation from trade and industry. It would hold out a dangerous lure to decoy the unwary to their ruin, but making them part with the earnings of their labour for a prospect of imaginary wealth. The great principal of the project was an evil of first-rate magnitude; it was to raise artificially the value of the stock, by exciting and keeping up a general infatuation, and by promising dividends out of funds which could never be adequate for the purpose.” Statement made by Robert Walpole, British Statesman, during the rise of the South Sea Company. He became Britain’s Prime Minister in 1721, the year after the South Sea scheme collapsed. Quoted from the chapter, The South Sea Bubble, in Mackay’s 1841 work. (1)

Like today's

financial engineering, high frequency trading programs, and “unlimited” central

banker schemes to stop financial assets from deflating, the idea of a

"financial revolution" was growing among the people in the years

leading up to the start of the 1700s. The bond historian Sidney Homer reveals

in his book, A History of Interest Rates, that in 1692 the first English

national debt of long maturity was floated to finance the war with France. The

debt was ₤ 1 million and was secured by duties on beer and liquor as life

annuities paying the lenders 10% to 1700 and 7% annually thereafter. In 1693

another ₤ 1 million was borrowed, secured this time by a duty on salt.

The interest was 10% plus lottery prizes, raising the total costs for the

private loan to 14%. Finally, in 1694, as the cost of the war with France

continued even higher, the government sought the third loan for ₤ 1.2

million, secured by a duty on tonnage (cargo or freight). While the interest was lowered to 8%, there

was an extra incentive given to the private investors who would once again bail

out the British government. Subscribers were given the right to incorporate as

the Governor and Company of the Bank of England. (2)

The year before the

establishment of the South Sea Company, the Chancellor of the Exchequer,

William Harder, brought report after report to the House of Commons until a

committee was established to investigate the debt that had been accumulated by

the young Bank of England in its first 17 years of existence. The committee was

established in the same year (1711) that the British government agreed to sell

their debt in exchange for shares in John Blunt’s South Sea Company. (3)

So what did the South

Sea Company attain from taking over what was now ₤ 10 million of debt

from the British government? They were able to establish a private - public

partnership with the government, whereby the government was able to “convert”

this debt into shares of the South Sea Company, and the company was able to

receive an annual interest payment from the government for taking on this

responsibility and a monopoly of trade with the Spanish colonies in South

America. Like companies in the late

‘90s and today, there are ones that have seen their stock soar while their business

operations have continued to show losses. This too was the story of the South

Sea Company, whose financial schemes and stock went up, while its operations

always showed a loss. (4)

1720, Two Bubbles

Reach Maximum Velocity

By 1719, the British

were competing with the flow of money to France, as people were seeking to get

in on John Law's Mississippi Scheme, who presented his idea of having paper

money backed by land serve as the solution for the enormous debts the French

state had accumulated from after years of war.

In 1716, the Banque Generale was formed by decree of the Duc d’Orleans.

He was the uncle of the 8-year-old successor to the throne, Louis XV. The Duc

required all taxes to be paid with notes issued by Law’s bank. This was another

first in history, as paper money was introduced and officially sanctioned by

the government. (5)

At the same time,

Law’s company, the Compagnie des Indes, was given exclusive rights for all

trading along the Mississippi River, Louisiana, China, East India, and South

America. (6)

In the later part of

1719, Law’s Banque Royale issued 1,000 million new banknotes, increasing the

money supply 16 TIMES its previous amount. (7)

As 1720 opened in

England, more debt was being offered to the South Sea Company in exchange for

more shares of stock. Annuity payments by the government were to pay 5%,

declining to 4% after 7 years. (8)

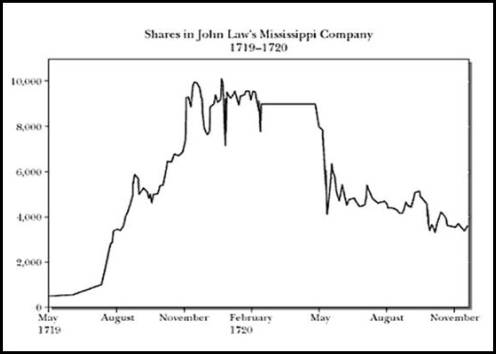

In 1719, shares of

Law’s company in France climbed quickly; by August – 2,830 livres, 6,463 on

October 26, 7,463 on November 18, and 8,975 on November 19. On January 8, 1720,

shares reached their final high of 10,100. (9)

As shares in the

Compagnie des Indes were rolling over in January 1720, shares in the South Sea

Company in England were beginning their final ascent, giving the crowd two more

subscriptions by which to buy into the scheme at the top.

The shares climbed as

follows in 1720: ₤ 128 in January, 175 in February, 330 in March and 550

in May. (10) By June, shares reached 1,050 (an 8 fold increase in six months)

before falling back to 850 that August. Foreign investors sold that summer,

taking their winnings and reinvesting in other bubble companies on the

continent. Yet, like the double-digit gains racked up in one day after earnings

were released in some tech giants this October, by 1 o'clock on August 22, 1720

these news shares were completely sold out.

But momentum was

going quickly, and September began with the stock price below 800. By the end

of the month it had dropped below 200. (11)

As the two charts

above have recorded for history, the prices paid in January 1720 and June 1720

respectively, proved to be the end of the speculative rise in these two

companies. The stories of fast riches with full support of the state were over.

The ones of massive losses would forever be left for history.

Schemes; Alive And

Well?

Today, these stories

have been a part of history for almost 3 centuries, and yet somehow, it would

seem that most of the public has no idea they are even living in the largest

financial bubble on record, built on the highest levels of debt in

history. The term “financial bubble” is

still seen as some scary marketing tactic, and has no relevance to one’s well

laid financial plans. It is like we

have come to believe, that given enough debt and central planning, prices no

longer need return or even repeat the lessons of 2000-2002 and 2007-2009.

And why not? That has

been the experience of the crowd for 7 years in the NASDAQ.

For the tens of

millions that had no exit strategy in 2000 or 2007, have they established one

today? If not, has the individual or institution dismissed 300 years of

history, trusting solely in the central banks and the feeling of success

at the top of yet another mania in history?

I continue to be

encouraged by signs that many are waking up to this giant game of deception of

“you must stay in, because it ALWAYS goes higher” game. And clearly, there are

plenty of warning signs for anyone who is watching this circus.

The

Smart Money Is “Selling Everything That Is Not Nailed Down”, Casey

Research, July 2, 2015

"Smart Money" Sold Stocks For Third

Consecutive Week To Corporate Buybacks, Scrambling Shorts, Zero Hedge, Oct 27,

2015

Why

Are Dealers Liquidating Corporate Bonds At an Unprecedented Rate, Zero

Hedge, Nov 6 , 2015

NASDAQ 100’s Recent

Highs Had Among The Fewest (Stock) Participants in 14 Years, Sentimentrader.com, Nov 5, 2015

So while the tools to

deceive and seduce the last investors into the top of these bubbles is even

more powerful than those used in the 1700s, the end of this story will be the

same.

The downside of the

Mississippi Scheme and the South Sea bubble impacted the entire society in the

1700s. Should we not expect the same when this “assisted” mania ends?

Sources:

(1)

Extraordinary Popular

Delusions and the Madness of Crowds, forward by Andrew Tobias (1980, originally

published in 1841), Charles Mackay, pg 53

(2)

A History of Interest Rates, Third Edition

(1996) Sidney Homer and Richard Sylla, pg 126

(3)

https://en.wikipedia.org/wiki/South_Sea_Company

(4)

Devil Take The Hindmost: A History of

Financial Speculation (1999) Edward Chancellor, pg 59 & 60

(5)

Financial Reckoning Day: Surviving the Soft

Depression of the 21st Century (2003) William Bonner with Addison

Wiggins, pg 77

(6)

Ibid, pg 79

(7)

Ibid, pg 81

(8)

https://en.wikipedia.org/wiki/South_Sea_Company

(9)

Financial Reckoning Day, Bonner, pg 81

(10)

https://en.wikipedia.org/wiki/South_Sea_Company

(11)

Devil Take the

Hindmost, Chancellor, pg 83

Be a Contrarian, Remember Your History

The

big shift from longs to shorts and shorts to longs is underway around the

globe, as every major equity market is now under its 200-day moving average,

and the global deflationary slowdown continues coming ashore. Don’t be mislead

by hope in the “unlimited OZ”. Listen to the lessons from history.

Click here to start the next

six months reading the newsletters, reports, and group emails as the bust

phase grows stronger.

On a Personal Note

Check

out Living2024. It is my personal

blog. I wanted to have a place to write stories about where this entire drama

seems to be taking us all. Check out my latest post, Bridging

The Great Monetary Divide.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.