Free Money; What Could Go

Wrong? March

13, 2015

Doug Wakefield

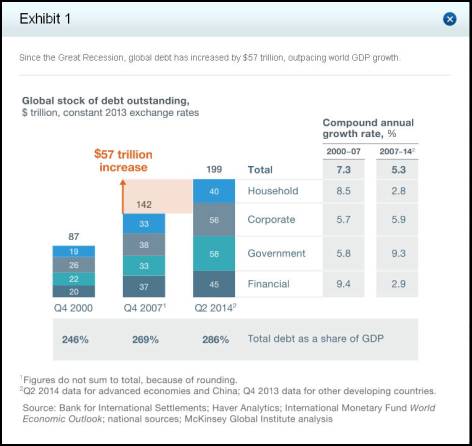

[Source

– Debt

and (not much) deleveraging, McKinsey Global Institute, Feb ‘15]

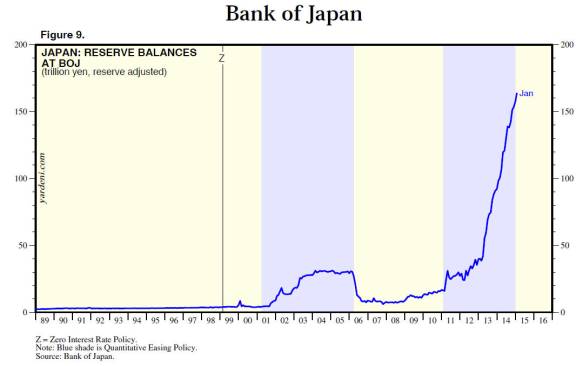

Isn’t

all of this QE (quick and easy) money great? When the Federal Reserve shut down

their latest Quantitative Easing program last October (the largest “free money”

scheme in American history), the Bank of Japan was ready to expand their

largest “free money” scheme, and starting on March 9th this week,

after many attempts to kick start its own “free money” scheme in Europe, the

European Central Bank kicked off its own Quantitative Easing program.

However,

I keep reminding myself of a principal I was taught early in life, “Nothing is

free.”

The

chart at the open is from a recent report by McKinsey Global Institute. Two

things stand out to me from this chart. The first is the $57 trillion increase

in outstanding debt since the fourth quarter of 2007. Merriam Webster’s online

dictionary defines debt as follows:

“the

state of owing money to someone or something” and

“the fact that you have been influenced or helped

by someone or something”

The

second observation from the chart was the reversal in roles between households

and governments. Notice how in the 2007-2014 period, households reduced the

speed of taking on debt, whereas governments increased theirs.

Now

help me out. If you owe someone money, how can it be “free”? If you have been

influenced or helped by someone that you will later “owe money” from a debt,

would you not set out with a plan for how you would pay off that debt?

If

you are an individual, the answer is usually yes. If you are a global

corporation, maybe, unless buying back your own stock could help create the

illusion of strength and the cost of the debt was pushed out into the future,

possibly after you have left the company. If you are a national or

international governing agency, then it would be very tempting to “influence

someone” with the power to hand out that “free money”, even seeing that as part

of your responsibility.

However,

in our world today, the only institution that can kick start the creation of

“free money” or the idea of “unlimited debt is leading us to a recovery” are

the world’s central banks, and primarily, the central banks representing the

largest currencies in circulation in the world.

So

at the end of the day, the chart from McKinsey showing a $57 trillion debt load

increase in 7 years – remember, that is more than three times the entire U.S.

national debt load as we start 2015 ($18 TR) – is a consequence of all the

“debt without future consequences” schemes that have taken place since the

Great Recession.

Default, Restructure, Increase Taxes and Reduce Spending, or Hyper-inflate

At

this stage, in looking around the world, whether president of an international

financial institution or main street investor, we have all become dependent on

global bankers and global politicians to keep the illusion of “free money will

eventually bring recovery”, or put another way, “the faster we create debt

loads worldwide, the faster things can return to ‘normal’”.

Global

bankers and economists know there are only 4 solutions to the obsession of creating

an illusion, rather than the determination of dealing with reality.

The

point of this short article is not to discuss how things could be corrected,

because it has become painfully obvious that the majority view is that we don’t

need to fix it, we just need to keep up the illusion as long as possible.

However, defaulting on debt, restructuring debt, increasing taxes and reducing

spending, and hyperinflating one’s currency, have all been used in the last

century. None are widely embraced. All produce a great deal of pain across a

society.

But

one thing is clear from the McKinsey report and many others showing the growth

of global debt; the largest contributor to this debt has been the “quick and

easy” money that has been created since 2008, and the additional debt created

by using this newly created debt as collateral.

What

Can I Do?

1)

We must stop

accepting experience as a confirmation of where our futures are headed.

There is literally no way that we can cut interest rates any lower in order to

continue the “recovery” myth. This is not a short-term issue, but a structural

one that will impact everything worldwide for years to come. Any strategy based

on “never sell no matter how high” is complete madness. Someone is ALWAYS

selling as well and buying. Markets have proved this over centuries.

2)

Don’t say, “This has

never happened here, and thus is can not”. This is where every American needs

to understand what has taken place in Japan since 1990.

[Source

– Global

Economic Briefings: Central Bank Balance Sheets, Yardeni Research Inc, Dr.

Edward Yardeni and Mali Quintana, Feb 20 ‘15]

3)

Make certain you

understand that without intervention and speed of light computer programs

leading the crowd, there is absolutely no way this many patterns would keep

repeating themselves. The problem is, with more and more intervention, we are

being warned that we have become DEPENDENT on central banks as massive buyers

in world markets, or stated another way, we have come to embrace constant

intervention by the state (i.e. central banks) as a good for our “free

markets”.

Also, since computers are driven by math, not fear and greed, the extremes in the upside are just as prone to the downside. The upside provides an illusion of “a crowd”, thus produces more complacency among traders and investors. The downside hammers them with the reality that “the crowd” has left them “swimming naked when the tide goes out”.

Being a Contrarian

I

have found that using the “nirvana trade”, one has been able to profit from

being a contrarian as volatility has picked up greatly since mid 2014. Yet as

traders say, “When everyone discovers a ‘sure thing’, the pattern loses its

value”. Once the “nirvana line” no longer holds, the entire game and mood will

change, especially since “stability” was built on trillions of additional debt.

Markets

that have been moving lower since the fall of 2011 will change with those who

have been on a rocket ride to the moon. The shorts will be forced to go long in

certain markets and the longs will be forced to go short in others.

The

Investor’s Mind was started in 2006, believing that asking questions was a good

thing. 2015 seems set to prove why this is valuable, like 2008.

The

risk from procrastination continues to rise. The value for good research is

extremely low in comparison to the speed in which wealth can be destroyed. Click here to start the next

six months reading the newsletters and trading reports as we come through

this incredible year.

On a Personal Note

I

have recently started a blog called, Living2024.

It is a personal blog, not business. I wanted to have a place to write some

personal stories about where this entire drama seems to be taking us all. I

hope you will check it out.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that

looks to the best minds in the world of finance and economics to seek a

direction for our clients. To be a true advocate to our clients, we have found

it necessary to go well beyond the norms in financial planning today. We are

avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.