Crowds and Credit February 4, 2011

Doug Wakefield

“…now that the recession

is over, we have to face the fact that the government must make cuts.”

“We put rules in place to

prevent another financial crisis…”

President Barack H. Obama,

State of the Union, Tuesday, January 24 ‘11

Manias

are fascinating to study in history, but are hard to accept if you are living

through one. The most memorable ones in history require two elements, crowds

and credit. While today’s global markets are littered with some of the most

complex financial instruments in history, anyone studying the history of

financial markets quickly recognizes that many of today’s tools for speculating

on future price movements can be found as far back as the Amsterdam Exchange,

founded in 1610. This exchange allowed speculators to take out margin loans,

invest in shares of the East India Company, and purchase futures contracts on

tulip bulbs. That’s right; tulip bulbs. 1

“By the later stages of the mania….paper credit created a perfect

symmetry of insubstantiality: most transactions were for tulip bulbs that could

never be delivered because they didn’t exist and were paid for with credit

notes that could never be honored because the money wasn’t there.” 2

Now

we move our time clocks forward almost 400 years. We examine a period that the

vast majority of investors personally experienced; the roaring ‘90s. As the Dow

roared up to it's top of 11,750, margin loans, stock shares, and futures

contracts were still apart of this mania, like the Tulip Bulb mania of the

early 1600s. Credit had exploded over the previous generation, with the belief

that cutting edge ideas would always find money available to make the visionary

rich. As the Dow topped out on January

14, 2000, the US national debt reached $5.7 trillion, a six-fold increase in

just twenty years. How many investors were thinking about the havoc that such a

rapid growth in debt could have on the pricing of not only their investments,

but their daily lives? Listening to the “New Era” stories and watching the

plethora of wealth being created almost overnight was much more emotionally

rewarding. Why should an explosion of debt be a factor for individuals and

institutions to consider when their money managers were boasting of their great

gains, the speed in which wealth increased was seen as a symbol of your

investment prowess, and the media was always there with another story of the

paradigm shift that would take us to an ever higher standard of living?

Today,

11 years later, I still find it amazing to read the works of those who

theorized tremendously higher prices ahead, and a plethora of options to attain

this newfound wealth.

“It is to avoid buying into bubbles that followers

of the Dow 36,000 Theory take the long view and count the cash. There are

hundreds of stocks (and hundreds of mutual funds, if they are your preference)

that offer high rewards at low risk.” 3

Dow 36,000: The New Strategy for Profiting From the

Coming Rise in the Stock Market (1999), James Glassman and Kevin Hassett

Now we come forward to February 4, 2011. The Dow’s

highest level was 12,092, just 342 points above the level hit on January 14,

2000. Millions want to believe the rhetoric that “the recession is behind us”,

and that the “recovery” is gaining steam. However, the crowd, having just lived

through the greatest loss of capital in history just 3 years ago, is awakening

to the alarming pace at which debt and government spending is accelerating.

In order to gain our bearings, with the plethora of

noise about the urgency of today’s hot market news, or the pleasant rhetoric

that says, “don’t worry, leave the investing to us and your dreams will remain

intact”, we need to look at the two prior market tops on the Dow, and gain

perspective on the debt foundation that continues to increase risk throughout

the entire global financial system.

As already mentioned, the Dow finally topped from

the credit/tech bubble on January 14, 2000 when the national debt stood at $5.7

trillion. After watching the Dow fall 4,553 points over 33 months, cheap credit

and the promotion of the next scheme lead the Dow up to 14,198 on October 11,

2007. At this stage, the credit/real estate bubble fueled by massive levels of

debt on top of debt schemes, had pushed the US national debt levels up to $9

trillion. The carnage that would follow would tear 7,729 points off the Dow in

just 17 months.

Now we come to February 4, 2011. Millions went home

today, having watched the Dow move ever upward like a smooth Caribbean cruise

since the Dow closed right below 10,000 on August 26 ‘2010, with yet another

positive emotional fix from repeatedly hearing “market makes new 2 year high”.

However, how many mainstream financial pundits, or major news sources were

warning their viewers that since the October 2007 high, just 39 months ago, the

US national debt has grown by $5 trillion, moving the debt level to $14

trillion?

Look at it another way. It took 81 months between

the completion of the credit/tech bubble and the credit/real estate bubble, and

during that time, the US national debt grew $3.3 trillion. Since its March 2009

bottom, just only 23 months ago, the Dow has climbed faster than it did going

into its historic January 2000 top, and the October 2007 top. If we start at the peak of the credit/real

estate bubble in October 2007, we have also witnessed a $5 trillion growth in

the US national debt in only 39 months; $3.3 trillion in 81 months followed by $5

trillion in 39 months. Let me state that again, …$3.3 trillion in 81 months

followed by $5 trillion in 39 months….Hello? How can any sane financial,

academic, military, spiritual, or political leader look at these numbers and

honestly convince those who are listening to them that “the recovery is

gathering steam”? Simple, because credit gives us the illusion of wealth and

power, until wealth and power are taken from us.

In the spring of 2009, shortly after the market

bottom, I received a call from an institutional manager with 40 years in the

business. His comment still haunts me today and has been a part of several

phone calls since. “Doug, it would

appear that we have learned nothing. We are now starting a Treasury bubble”. Just 5 months before the March 2009 bottom,

the world, and we had watched the Dow drop 3,770 points (32%) in six

weeks.

While a corrective wave would have been in order,

what we have watched since March 2009 is truly remarkable, and will certainly

be included in the Hall of Fame of manias when we look back on this period. In order to place the current Dow rally in

perspective, we must understand some major changes that have taken place at the

foundational level since the 2007 global credit bubble burst.

First, the sentiment among the average American

attitude has changed regarding savings, having lived through the tech and real

estate credit bubbles. Instead of buying everything on credit, the public’s

desire to pay down debt and build savings has changed. The St. Louis branch of

the Federal Reserve makes it clear that the appeal for increased savings

is a change from a trend toward decreased savings that had been in place

since 1981.

“….it s not lower interest rates per se that

improve the economy, rather it is the people’s reaction to lower interest rates

(that is, borrowing money to spend and saving less) that improves the economy.”

4

Richard

Koo, Chief Economist for Nomura Securities, author of Balance Sheet Recession:

Japan’s Struggle with Uncharted Economics and It's Global Implications (2003).

Richard

Koo, Chief Economist for Nomura Securities, author of Balance Sheet Recession:

Japan’s Struggle with Uncharted Economics and It's Global Implications (2003).

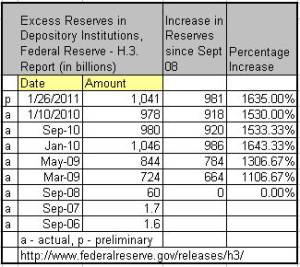

Second, the public was told that the nation’s

largest banks needed capital in order to restore the lending mechanism in the

system. Yet when one looks at the data on excess reserves, we see almost a

trillion still sitting in the banking system today, almost 2 years since the

March 2009 bottom in the Dow. Is there some reason that these banking giants

are still sitting on this level of reserves, even though the “recession is

behind us”?

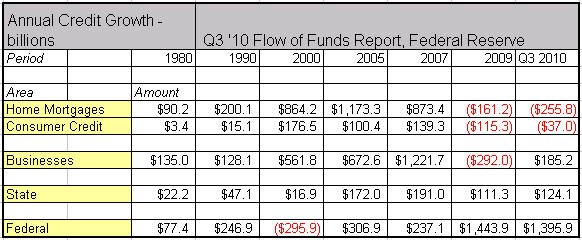

Third, we look at credit growth. Looking at the

chart above, it should lead each of us to ask some hard questions. The Federal

Reserve’s own data reveals that since 2007, home mortgage lending has collapsed

from growing at an annual pace of $1,173 billion to contracting at

a pace of $255 billion, and business lending has fallen from an annual pace of

$1,221 billion to only $185 billion. This massive contraction of credit in the

private sector has occurred during a period where individuals have watched the

Dow recover 72% of its 7,729-point loss. Clearly, there is a massive disconnect

between the economy and the stock market. If we then add the fact that the

federal government, whom our own president recently announced “must make cuts”,

has sought to pick up this massive contraction in credit by expanding it's own

credit growth almost six fold since the 2007, then we are not looking at a true

economic recovery, but a rising dependency on the state, and dependency on the

nations of the world to lend these massive sums to the US. One realizes how

extreme the current mania behavior has become when we compare Federal credit

growth in 2009 and Q3 2010 with the US government deficits of $1.3

trillion in 2010, an improvement from the $1.4

trillion deficit in 2009.

Sadly, Americans would rather believe the lie, and

trust that whoever, and however, their 401k and brokerage statements are

growing in value, is somehow “too complicated” to understand. The reality of

manias always boils down to crowds desiring something that history has already

told them is impossible to sustain.

I asked Bob Lang of Lang Asset Management, if he would make a

comment on crowds and credit, since he has been in investment management more

than 50 years.

“I can recall advice given to me 10 years ago that was prescient. It

was given in an environment where, in my naïve opinion, market optimism was

unsustainable.

It was in 1999, when technology was the unquestioned growth vehicle,

various ratios were so high that they were hard to accept as reality, and debt

accumulation by the government was becoming a concern. I was contemplating

changing our company’s long-term focus from being bullish to bearish since it

was becoming increasingly obvious to me that the prospect of our clients

continuing to profit from maintaining a long strategy in such an environment

appeared to be highly unlikely. This was a major change since I had been

optimistic about the country’s future (and the stock market) from the time I

had entered the business in 1959.

I decided to talk to several members of the investment community that

had already made the transition to the short side. One interview was

particularly troublesome to me since the veteran presented an outcome that I

just could not envision. His comments went like this: One of the most difficult

factors to accept in a period of excessive speculation, where you know reality

has taken its leave, is that the process can continue far longer than you think

remotely possible. In fact, you may begin to question whether your assessment

of the facts is accurate, while your newer clients have already made the

determination that you are inflexible, terribly misguided, and should proceed

immediately to participate in the never ending euphoria.” 5

Bob opened a long/short, and a short only strategy

in January 2000. For those starting at this juncture, he was seen as a savvy

manager 3 years later. For those that rode the next credit bubble up, he was

terribly misguided and inflexible. During the last 11 years, he has now seen

two of the worst market crashes in history, and yet is still perceived as misguided.

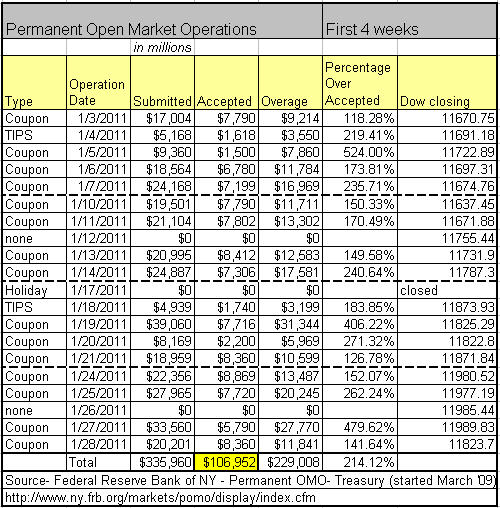

When your own market system allows enormous borrowing to occur daily by Wall

Street banks for “liquidity” through the Permanent Open Market

Operations (a program that just happened to start the same month the Dow

hit its major bottom in March 2009 and available only to a small group of

financial institutions), and the same banks continue to build their excess

reserves to the highest levels in US history, it makes one wonder how long before

this farcical period ends, and a true panic to sell sets in again.

“A crash is a collapse of the prices of assets, or

perhaps the failure of an important firm or bank. A panic, “a sudden fright

without cause”, from the god Pan, may occur in asset markets or involve a rush

from less to more liquid assets. Financial crisis may involve one or both, and

in any order. The collapse of South Sea stock and the Sword Blade Bank almost

brought down the Bank of England. The 1929 crash and panic in the New York

stock market spread liquidation to other asset markets, such as commodities,

and seized up credit to strike a hard blow at output.” 6

Charles Kindleberger, Professor of Economics Emeritus at MIT, and author of Manias, Panics, and Crashes: A History of Financial Crises.

We are told there is plenty of

“liquidity” to help foster “stability” in our markets. Yet history has

always shown that while great ideals like the Declaration of Independence

embrace the concept that “all men are equal”, this has never applied to

financial markets. When one group of participants has the power to attain

hundreds of billions in new reserves by which to “start over”, while others

have no access to this enormous pool of credit, it becomes imperative to watch

for continued changes at the systemic level of our markets….

“Even

as financial markets collapsed last year[2008], high-frequency traders

collectively enjoyed $21 billion in gross profit, according to Tabb Group. On

the NYSE, daily volume surged 43% through June from a year earlier to 6.2

billion shares; high-frequency traders are believed to account for 50% to 70%

of the activity and similar proportions in electronic futures and options

markets… Some high frequency traders are sending out 1,000 orders a

second." 7

…and warning signs that the unsustainable rally is once again coming to

an end.

“Later, CEOs, who sold shortly before the peak [2000] would claim that

they just got lucky. ‘Who knew?’ one told The Wall Street Journal. But it

seemed that many knew. This was not what corporate PR departments dismissed as

‘part of a regular pattern of selling.’ This was a sudden bulge in insider

sales. By February of 2000- just weeks before the Nasdaq would peak – insiders

were selling 23 times as much stock as they bought, compared with the typical

ratio of 10 to 1. In July, they were not fooled by a summer rally; that money

the ratio remained at 22 to 1.” 8

Insiders have officially marked the top of the stock market: last

week's insider selling of all stocks (not just S&P) hit an all time record

of $4.5 billion. This is the biggest weekly number ever recorded by tracking

company InsiderScore.com: as Sentiment Trader highlights no other week before

had more than $2 billion in net selling. Furthermore, selling in just S&P

companies hit a whopping $2.8 billion: over 4 times more than the week prior!

As such the ratio of insider selling to buying is now meaningless. Even

Bloomberg, which traditionally just posts the data without providing commentary

to it, highlighted this ridiculous outlier:

"Insider selling at Standard & Poor’s 500

Index companies reached a record in the past week as executives took advantage

of a two-year high in the stock-market to sell their shares."

We hope those retail investors who dared to

reemerge in the stock market and play some hot potatoes with the big boys,

enjoy their brief profit as they once again end up being the biggest fools. 9

As

I continue to watch markets ignore world events like rioting in Egypt, Jordan,

Yemen, and Tunisia, or the deterioration in sovereign debts across major

European nations as bankers propose more debt to cover yesterday’s debt, or

shortfalls in the tens of billions in state revenues across the US, I

contemplate “the reason” that the public will be given for the start of the

next major decline in prices that far so long have been elevated from reality.

I dare say, I doubt we will hear that the public had grown complacent once

again from the memorizing effect of constantly rising market prices, supported

by beautiful lies from various leaders, solely to avoid living with the painful

reality that we were continuing to ignore the lessons on crowds and credits

from history.

So

when will this ever stop repeating itself we ask? Only when the “unlimited

debt” solution is no longer proposed as the solution, and the public refuses to

listen to any leader who hails it as the latest solution to our problems.

Sources:

1

– Devil Take the Hindmost: A History of Financial Speculation (1999) Edward

Chancellor, pg 10

2

– Ibid, pg 18

3

– Dow 36,000: The New Strategy for Profiting From the Coming Rise in the Stock

Market (1999), James Glassman and Kevin Hassett, pg 36

4 – Balance Sheet Recession: Japan’s Struggle with Uncharted Economics and

It’s Global Implications (2003), Richard Koo, pg 40

5

– Bob Lang is CEO and Chairman of Lang Asset Management. His comments were made

to the author on February 1, 2011. (www.langasset.com)

6

– Manias, Panics, and Crashes: A History of Financial Crises, Fourth Edition

(2000), Charles P. Kindleberger, pg 105

7

– The

New Masters of Wall Street, Forbes, September 21, 2009

8

– Bull: A History of the Boom, 1982-1999 (2003) Maggie Mahar, pgs 317-318

9

–Insider

Selling Hits All Time Record of $4.5 billion in Prior Week as Everyone is

Getting out of the Market, Zero

Hedge, November 11, 2010

Due to the levels we have

reached in this mania, and the manipulation we have watched unfold in the last

2 years, I have decided to place my entire research report, Riders on the

Storm: Short Selling in Contrary Winds (2006), on the web. The document can

be downloaded for free by clicking

this link, or scrolling down to Recent Updates on the Best Minds Inc homepage. 2011 is

setting up to require a totally different view of strategies than the last 2

years, and during this time of enormous deception will require examining a wide

range of markets through a variety of lenses.

If you are interested in our

most comprehensive research, consider a subscription to

The Investor's Mind:

Anticipating Trends through the Lens of History.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

2548 Lillian Miller

Parkway

Suite 110

Denton, Texas 76210

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best Minds, Inc is a registered investment

advisor that looks to the best minds in the world of finance and economics to

seek a direction for our clients. To be a true advocate to our clients, we have

found it necessary to go well beyond the norms in financial planning today. We

are avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.

Disclaimer:

Nothing in this communiqué should be construed as advice to buy, sell, hold, or

sell short. The safest action is to constantly increase one's knowledge of the

money game. To accept the conventional wisdom about the world of money, without

a thorough examination of how that "wisdom" has stood over time, is

to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of

individuals, and at any time may or may not agree with those individual's

advice. Challenging one's thinking is the only way to come to firm conclusions.