Who Needs God, We Have Bankers October 30, 2013

Doug Wakefield

The snooze

button; what a great invention. When you

have awakened from a deep sleep, and know you can get ready in less time, just

hit the snooze button. You know it will still awaken you for your test or to

get ready for your 8:00 flight, but in the meantime, you can enjoy a few more

moments of precious sleep.

However, if you

keep hitting snooze and fail to look at the time, you can also awaken to find

that the extra sleep has now placed you in a position where you missed the

final exam or your flight. The rewards for a few extra moments of sleep have suddenly

become very costly.

Since the largest

collapse of financial assets in history in 2008, the major central banks in the

world, the Bank of Japan, The

People’s Bank of China, the European Central Bank,

the Federal Reserve, and the

oldest of this group, the Bank of

England, have worked together to create the largest asset bubbles ever seen

while keeping the public in a perpetual state of blissful sleep. The method is

actually quite simple.

Offer ultra cheap

credit to the global banks by which they can go promote even wilder

speculation. Allow extreme levels of leverage in the system, something the

general investor seems to never be aware of along the way. If things start looking weak, make certain

the standards for collateral against those loans for speculation are LOWERED,

allowing even more reckless behavior into the system. Finally, allow the world

to watch as Russia

and China

send their navies toward Syria at the same time the United States announces

they are preparing for a military strike on Syria over chemical weapons, and a

month later, have the United States shut down its government for the first time

in 17 years while warning of a catastrophe that should it default on its debt

by October 17th…. only to see by the end of October these scary

headlines drift into the background noise as stocks sail once again to all time

highs.

One can see why

consciously or unconsciously, global bankers have become our gods. As has been

repeatedly stated before, we should remove the term “In God We Trust”, and

replace it with “In Debt We Trust”, since this would be a more accurate

reflection of our global view of money.

Yet, like the

alarm clock, we know that the alarm is going off. It is time to get up and stay

awake. It is not time to hit the snooze button toward risk.

“Without

market discipline,” said Nouriel

Roubini, chairman of Roubini Global Economics LLC, “there’s no

pressure to do anything because you can continue to finance yourself cheaply.”

[Is

U.S. Political Bubble About to Burst?, Bloomberg, Oct 10 ‘13]

Snooze Buttons

At this stage,

you are probably saying, “Now Doug, that is a bit over the top.” Yes, but so is

the FACT that today the US

national debt stands at $17,000 billion ($17 trillion), while on December

23, 1913 when the Federal Reserve Act was passed establishing a private

corporation of global bankers to control the US monetary system, the total U.S.

national debt stood at $3 billion. This is not a dream, just cold hard

reality.

So as any good

detective would tell us, let’s look at the evidence, to determine where we ALL

are, as we come to the end of October 2013.

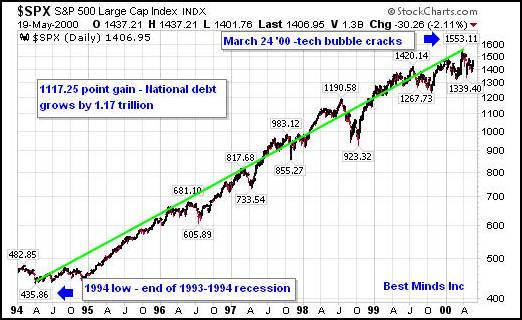

Question – Did cheap credit contribute to the 2007 bubble,

which was the “recovery” from the tech bubble, and is there evidence that ultra

cheap credit is still at the foundation of the now 5-YEAR recovery?

Answer – Look at a chart of the yield on 90-day Treasury

bills. If the world is willing to park cash in 90 day increments to the US.

Government at these rates, do we now understand why earning

any money on cash equivalents like CDs has been so low since 2008?

We should also be

asking the question, “After five years where U.S. stocks have produced the

equivalent of the tech rally in the late ‘90s, why is there so much money still

sitting in cash at rates that are virtually zero? Is there still fear of

another repeat of 2008 or worse?”

Question – Have extreme amounts of leverage been the

iceberg underneath this entire rally?”

Answer – Yes. Once again, the evidence is there for those

interested.

After the largest losses of capital in history in 2008, it was time to

regroup, and rebuild. Neil Barofsky, the Special Inspector General appointed by

Congress as the watchdog over the Treasury Asset Relief Program [TARP], had a

better view of the foundations of “the recovery” than almost anyone in the

world. This is what he watched take place to kick start the “recovery” five

years ago:

After the largest losses of capital in history in 2008, it was time to

regroup, and rebuild. Neil Barofsky, the Special Inspector General appointed by

Congress as the watchdog over the Treasury Asset Relief Program [TARP], had a

better view of the foundations of “the recovery” than almost anyone in the

world. This is what he watched take place to kick start the “recovery” five

years ago:

“The heart of Geithner’s proposal, however, was in

the second part, the ‘legacy securities’ program, which was the realization of

Lee Sach’s goal back in January (2009) to ‘go big’ on the toxic assets still

clogging the bank’s arteries. The program was to be run by Treasury in tandem

with TALF [Term Asset Backed Securities Loan Facility], which was run by the

Fed. It would start with a handful of preselected private fund managers, who

would raise a sum of private funds. Treasury would then match the private

amount raised, dollar for dollar, and then lend additional TARP [Troubled Asset

Relief Program] money through nonrecourse loans to the funds, each of which

would be called a Public-Private Investment Fund.” [Bailout:

An Insider’s Account of How Washington Abandoned Main Street While Rescuing

Wall Street (June 2012) Neil Barofsky, pg 130 of 270 in Kindle Edition]

Doesn’t

this sound like China’s “State Capitalist” System? Barofsky continues:

“Depending on the amount of the loan, Treasury would

put in either two-thirds or three-quarters of the money into the fund but again

would have rights to only half of its profits. Once fully funded with taxpayer

and private money, the private fund manager would be able to use the combined

funds as the ‘haircut’ to acquire a far larger nonrecourse loan from the

Federal Reserve, via TALF, to buy legacy mortgage-backed securities. In other

words, the private fund manager could use one TARP program that was massively

leveraged with taxpayer funds and then leverage it again through another TARP

program that itself was massively leveraged with taxpayer money. That ‘leverage

on leverage’ gave Wall Street a huge potential upside for profits while leaving

the taxpayer on the hook for massive potential losses.”[Ibid]

Author

and journalist, Scott Patterson, reminds us that today’s dominate predator, the

high speed trading machines, continue to foster massive leverage underneath the

markets that both big and small investors are depending on every day.

“Many of

the high-speed firms deployed massive amounts of leverage, or borrowed money,

as much as fifty to one by the late 2000s (for every dollar they owned, they

borrowed another fifty dollars from banks and brokers in the hope of amplifying

their profits). As the financial meltdown of 2008 showed, massive leverage can

quickly unravel and trigger devastating, out-of-control meltdowns.” [Dark

Pools: The Rise of the Machine Traders and the Rigging of the U.S. Stock Market

(June 2013) Scott Patterson, pg 40 of 336 on Kindle Edition]

Even

Alan Greenspan, who did not know what a bubble looked like in April 2000, has

finally awakened to understand them in October 2013.

“…on April 13, 2000 [March 24th being

the all time high that the NASDAQ still holds 13 year later], when the Chairman

was in front of the Senate Banking Committee, he was asked if an interest rate

hike would prick the stock market bubble. He responded: ‘That presupposes I know

that there is a bubble….I don’t think we can know there’s been a bubble until

after the fact. To assume we know it currently presupposes that we have the

capacity to forecast an imminent decline in prices.’” [Greenspan’s

Bubbles: The Age of Ignorance at the Federal Reserve (2008) William

Fleckenstein with Frederick Sheehan, pgs 98-99]

Bubbles

and Leverage Cause Crises: Alan Greenspan, CNBC, Oct 23 ‘13

“‘Asset

bubbles alone don't cause financial crises like the one in 2008’, former

Federal Reserve Chairman Alan Greenspan told CNBC on Wednesday. ‘Instead, the

combination of bubbles and leverage is the problem’, he said.

‘We

missed the timing badly on September the 15th, 2008 [the day Lehman Brothers

filed for bankruptcy]. All of us knew there was a bubble. But a bubble in and

of itself doesn't give you a crisis,’ he said in a ‘ Squawk Box’ interview.

‘It's turning out to be bubbles with leverage.’”

So are we clear?

The “recovery” was kicked started on the same massive leverage that Greenspan

discussed last week! After watching what “bubbles with leverage” did to markets

from “timing badly” the bursting of the global illusion in September 2008,

certainly five years is long enough for global banks and central bankers to

have done something about this problem.

Question – If cheap credit, and the ability to ramp up

returns with more leverage has been at the root of the global banking system

since 2008, are there other warning signs at the INDUSTRY level, that there is

deep concern about risk from herding both big and small players in the same

direction for long periods of time with the promise of “we will not stop

printing until the economy is in full recovery mode”?

Answer – Don’t hit the snooze button. Get a strong coffee

and keep reading.

BIS

Veteran Says Global Credit Excess Worse Then Pre-Lehman, The Telegraph,

Sept 15 ‘13

The

Swiss-based `bank of central banks’ said a hunt for yield was luring

investors en masse into high-risk instruments, “a phenomenon reminiscent of

exuberance prior to the global financial crisis”.

This is happening just as the US Federal Reserve prepares to wind down stimulus and starts to drain dollar liquidity from global markets, an inflexion point that is fraught with danger and could go badly wrong.

“This looks like to me like 2007 all over again,

but even worse,” said William White, the BIS’s former chief economist, famous

for flagging the wild behaviour in the debt markets before the global

storm hit in 2008.

“The

challenge is to be prepared. This means being prudent, limiting

leverage, and avoiding the temptation of believing that the market will remain

liquid under stress, the illusion of liquidity,” he [Claudia Borio,

the BIS research chief] said.

The

BIS enjoys great authority. It was the only major global body that clearly

foresaw the global banking crisis, calling early for a change of policy at a

time when others were being swept along by the euphoria of the era.

[Italics my own, quote also in Oct 2nd article]

US

Treasury Says Money Managers May Pose ‘Herding’ Threat, Bloomberg, Sept 30

‘13

The

Treasury Department said money managers could pose threats to the U.S.

financial system when reaching for higher returns, herding into popular asset

classes or amplifying price movements with leverage.

Companies

overseeing a combined $53 trillion in assets, led by fund giants BlackRock

Inc. (BLK) and Vanguard Group Inc., can contribute to asset price

increases and magnify volatility during sudden shocks, a report by the Treasury

said today. Gaps in data, particularly on investments managed for institutions,

limited the study’s ability to identify additional risk.

“A

certain combination of fund- and firm-level activities within a large, complex

firm, or engagement by a significant number of asset managers in riskier

activities, could pose, amplify or transmit a threat to the financial system,”

the Treasury’s Office of Financial Research said in the report.

The

study was conducted by the OFR to help the Financial

Stability Oversight Council analyze whether asset managers should be

considered systemically important and subject to Federal Reserve supervision.

[Italics mine]

“Quantitative

easing (‘QE’) and uncertainty around tapering of asset purchases by the Federal

Reserve and other central banks is limiting the ability of insurance

companies to generate returns, and driving them to diversify towards riskier

assets, according to new research into the investment strategies of over

200 insurers globally….

Unveiled in a report called Global Insurance: Investment strategy at an Inflection Point?, produced by BlackRock, Inc. (NYSE:BLK) in partnership with The Economist Intelligence Unit (‘EIU’), the results highlight insurers’ changing investment attitudes in response to central bank policy. With last Wednesday’s [Sept 18th Fed press release] decision to continue QE at its current pace, the report suggests insurers need to consider how this uncertainty affects their overall strategic asset allocation and the potential impact on their businesses….

Low yields on investments were identified as the most critical driver of change affecting the industry with 73 per cent of respondents citing this. 80 per cent agreed their business will have to change to produce adequate shareholder returns over the next three years….

In a ‘QE-infinity’ world before potential tapering was discussed by the Fed, insurers said they were highly likely to increase allocations to riskier, higher yielding fixed income instruments such as bank loans and lower rated debt (73 per cent), and illiquid strategies (68 per cent). In an environment where QE tapering was expected, however, insurers changed their investment approaches and risk appetite.

Help me out here. Has the financial world gone mad? How

did we come to a point, where an entire industry has poured money into RISKIER

assets, and is waiting for words from one tiny group of people in the world to

say, “We will slow down the Ponzi scheme” as their predominate signal to start

SELLING the “lower rated debt and illiquid strategies”? How many millions of investors

are piling into fixed rate products thinking that big companies handling their

own funds are being “conservative” with the money backing those “conservative”

investments? Never has it been more important to know who is following the

herd, and who are independent players in this global “all in” card game.

Ok, let’s ask two more questions.

Question – Have global banks and their central

banking private clubs LOWERED the standard on the type of collateral they will

accept as markets risk have INCREASED?

Answer – One only needs to read publicly available information to see that they have done just that. In fact, lowering standards was how we kick started the “recovery”.

Mortgage-Backed Securities Index Surges on Toxic-Asset Plan, MarketWatch, March 23, 2009

An

index that tracks the perceived value of subprime

mortgage-backed securities on Monday jumped 1.09 to 25.29, the biggest one-day

gain since Feb. 9, said Markit, which publishes the index. Markit's ABX.HE.AAA,

series 7-2, which reflects some of the most recent securitized pools of the the

best-quality subprime mortgages, rallied after the Treasury Department

released details of a plan to encourage investors

to buy banks'

illiquid assets, including these types of mortgage-backed securities.

[italics mine. Reread Barofsky’s comments shown earlier]

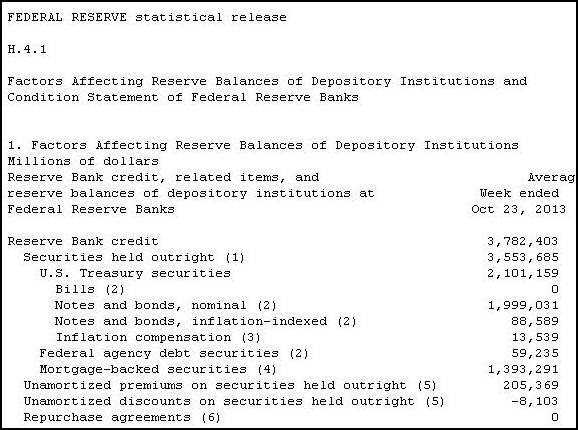

The H.4.1 report

reveals the publicly available balance sheet of the most powerful

central bank in the world outside the Bank of International Settlements in

Switzerland, the Federal Reserve, as of October 24, 2013. How will the Federal

Reserve, the largest holder of mortgage backed securities – an asset the banks

had to sell to the Feds in order to “unfreeze” the credit markets in the spring

of 2009, get rid of the $1.3 trillion worth of mortgage backed securities they

hold on their balance sheet today…while they continue purchasing them today? I

know, kick the can down the road some more.

Hit the snooze button.

Today, we have the

ability to translate articles written in other languages different from our

own. The following article is a translation of an article that appeared in the

German Economic News this summer. It reveals the decision by European and

Chinese central bank leaders to LOWER the requirements for collateral by which

financial institutions could borrow more money to speculate, thus following the

herd to even more unsustainable behavior….

Central

Banks Bring Weapons of Mass Destruction in Position, German Economic News,

July 17, 2013

In

a concerted action, the ECB and China have decided to allow dangerous risk

securities as collateral for loans. So that banks are allowed to open a new casino

table. It is the same where the bomb went off in 2007 that triggered the

financial crisis.

On

Thursday, the Chinese and the ECB decided that the mood in the global

financial casino must be improved. For this purpose, inferior securities

are admitted as collateral for new loans. In the ECB Southern Europeans

- apparently against the wishes of Bundesbank chief Jens Weidmann - enforced

that future risk securities with lower credit ratings may be pledged as

collateral for loans. These are so-called asset-backed securities (ABS).

These are debt securities backed by real assets are: the company's shares,

cars, real estate. Until now, such papers have a Triple A credit rating as, now

have an A., regulators lifted a restriction on such dangerous enough papers in China.

Large banks can now pump a lot more of the toxic assets in the system….

…

the central banks were key sponsors of the documents specified by

Warren Buffet as "weapons of mass destruction." The then head

of the U.S. Federal Reserve and Grand Master of the low interest rate policy,

Alan Greenspan praised the products that should eventually lead to the crash,

as especially valuable because they "spread the risk". And the German

Bundesbank had the presumption to the forecast, that of all the ABS strengthen

the resilience of the financial system would alleviate shocks.

The

bomb exploded as the rating agency

Moody's on 15 June 2007, the rating was reduced from 131 ABS and the papers

downgraded. Standard & Poor's followed in July - the crash was initiated, which

eventually culminated with the collapse of Lehman.

Apparently,

the central banks have learned nothing from history. …

The calculation is: It takes as many individual

papers as possible, to minimize the probability of failure.

The reality: If one assumption is wrong, crashing

the global financial system together. This could be the case for example with the

ABS on cars. The lobby TSI priced cars to be

particularly suitable, because they - in theory - always have a value. However, as the time of the entire U.S. housing market

collapsed in the wake of the crisis of the entire European automotive market, then

the system collapses.

The banks know that too exactly, but are hoping

that the game can drag on for a while. And to those of today meantime it is up to

the crash: This will allow the ABS made billions and bonuses satteste be bagged

easily.

It's about the unrestrained greed of an industry

that makes money at the expense of the public with purely artificial products and without a hint of morality.

[Bold text in original article]

The great libertarian

publication, The Daily Bell, based

out of Canada, reveals that this week, the Bank of England, the second oldest

central bank (1694) in the world after Swedish central bank (1668), has LOWERED

its standards on collateral for fresh new loans, following the same pattern

from Europe and China in July.

Carney

Gets Ready to Blow Up The World, The Daily Bell, Oct 29 ‘13

Today, a new regime has arrived. Central banks need

to "keep up" with financial market developments, Mr Carney said at a

Financial Times event. The BoE is rolling up its sleeves and doing what is

necessary to keep the banking sector humming – in both the normal course of

business and in crisis conditions….

The terms on which the BoE will engage with the private banking sector will be significantly eased under the new governor's framework. Banks will be able to borrow against a broader range of collateral, including portfolios of loans, for longer periods of time and in exchange for fees that in some cases will be halved. "Banks can be confident that, when they want to use our facilities, they will be allowed to access them," the governor said….

Accordingly the BoE's discount window facility,

which banks can approach confidentially when they are facing temporary cash

crunches, will have a lower, flat-rate "entry fee". The BoE will

delay the disclosure of any use of the facility as it seeks to minimise the

risks of banks being punished in the markets for accessing it. The BoE's

indexed long-term repo auction, a standard monthly facility, will also be

cheaper and will be offered against a broader range of collateral and for an

extended term.

So

do we expect central bankers to warn us before a market breakdown from all

their reckless actions? Look back at Greenspan’s testimony just days after the

tech bubble had already burst in 2000? Do we not remember that Hank Paulson told us of

the healthy economy in April 2007, and that “the worst was behind us” in May

2008? If we are counting on these

political/financial leaders to give us “a signal”, we are indeed fools.

Question – Surely a major military confrontation between

Russia and the US over Syria could slow up the global computer lead euphoria?

If not, a shutdown for the first time in 17 years of the US government, as well

as a lack of funds to run the nation by October 17th would certainly bring

about fear, and kick start the selling of the riskiest assets in our global

financial system?

Answer – Nope. It would seem that even the possibility of

a major war in the Middle East and the shutdown of the US government are now to

be viewed as no big deal by all investors. Now, the only thing that seems to

matter, is for the global central banks to keep pouring cheap loans into the

system, continue LOWERING their standards on collateral, - the same behavior

that lead to the start of the credit crisis in August 2007 - and continue

promoting the herding of entire markets and industries globally into riskier

assets.

When Should I Sell?

From

my excellent contacts at the 5 most powerful central banks in the world, and

the granddaddy of them all, the Bank of International Settlements, I must tell

you they are still working on it. Actually, I have not been able to get a

return on any of my calls lately. It would seem they realize that the extremes

in complacency today will turn to extreme anger when the claws of the next

market crash rip through the finances of businesses and individuals worldwide,

and had rather feed the nirvana mania until the dominoes start to fall.

However,

it would appear that the control of crowds of angry people have already been

given some thought by the boys at mission control. Since I am sure you can find

a plethora of information on this topic, let me stick purely to one of the

biggest warnings signals for businesses and individuals today in the financial

world.

First Were Bail Outs, Next Are Bail Ins – Someone is planning for the next Lehman Event, Are You?

Step

One – If you are in the financial industry, or in a position of leadership in a

business, church, or organization where people depend on your knowledge of the

world of finance, you must download and read the document, Resolving Globally Active,

Systemically Important Financial Institutions: A Joint Paper by the FDIC and

the Bank of England, released on December 10, 2012. A copy of the paper

along with other articles about the topic were posted on the Research page of the Best

Minds Inc website in September, and can be accessed for free.

Step

Two- Watch the film, Money

Is Not Safe In The Big Banks, by the Public Banking Institute (posted on

youtube on Aug 28 ’13). As much time as we waste these days trying to keep up

with our busy schedules, this film will take you less than 15 minutes to watch,

and I can assure you, will be an eye opener and more important than 99% of “the

busy” things that consume our day.

Step

Three – Remember, just because we live in a nation larger than Cyprus, don’t

think with the global level of problems revealed in this article, that our

story will turn out different simply because

“this will never happen in our country”.

“I

Went to Sleep a Rich Man. I Woke A Poor Man”, The Sydney Morning National Herald,

March 29, 2013

“‘Very

bad, very, very bad,’ says 65-year-old John Demetriou, rubbing tears from his

lined face with thick fingers. ‘I lost all my money.’

John

now lives in the picturesque fishing village of Liopetri on Cyprus' south

coast. But for 35 years he lived at Bondi Junction and worked days, nights and

weekends in Sydney markets selling jewellery and imitation jewellery.

He

had left Cyprus in the early 1970s at the height of its war with Turkey, taking

his wife and young children to safety in Australia. He built a life from

nothing and, gradually, a substantial nest egg. He retired to Cyprus in 2007

with about $1 million, his life savings.

He

planned to spend it on his grandchildren - some of whom live in Cyprus -

putting them through university and setting them up. There would be medical

bills; he has a heart condition. The interest was paying for a comfortable

retirement, and trips back to Australia. He also toyed with the idea of buying

a boat.

He

wanted to leave any big purchases a few years, to be sure this was where he

would spend his retirement. There was no hurry. But now it is all gone.

‘If

I made the decision to stay, I was going to build a house,’ John says.

‘Unfortunately I didn't make the decision yet’.

‘I

went to sleep Friday as a rich man. I woke up a poor man.’

While John did end up

with money, it was certainly not anything close to what he had saved all his

life. Remember, he was not speculating on higher stock and junk bond prices.

His money was sitting in one of the biggest banks in his country.

“George

says he can start again - if things get worse he and his family might move back

to Australia.

‘But

not my dad. He can't go back to Australia. He is not allowed to fly because of

his heart, and anyway where would he live? He has no house. He will have

€100,000 left to live off. Soon he's not going to have a cent to his name.’

John

has a thin hope. His money was sitting in the bank in Australian dollars

instead of euros, so he wonders if it would be exempt from the bank's collapse.

But the bank's doors are closed, so he doesn't even know to whom he should put

that argument.”

Step Four: Understand that like the chart of the

commercial hedgers revealed in my last public article, The

Easy Money Addiction Exit Plan, there are very powerful players in the

world of money who are set for a powerful drop, and will profit from the

decline. They know where the next trend is headed, and there actions prove it.

The ones that will lose the most in the bursting of the current global bubble,

will be those gullible enough to sit tight and wait for the next blowout debt

bubble to levitate their brokerage statements again.

Since the last major

bottom in 2009 brought with it the expansion of the only international

electronic currency in the world, the Special

Drawing Rights, I believe when we arrive (2014 or 2015) at the next major

bottom in history we will even see a challenge from the China

renminbi over the US dollar inside the global currency, the Special Drawing

Rights. Sounds wild, but I did not find many who thought the Special Drawing

rights would expand rapidly before 2009 either, and yet, like any idea outside

the crowd, there is plenty of information supporting these theories ahead of

time if you looking for change, and do NOT expect things to stay the same. [If

you are unfamiliar with world developments surrounding this global electronic

currency in 2009, read my public article, Power Shift,

Oct 28, 2009]

To Those of You, Who Like Me, Enjoy Your Sleep

In the last two years, the

theme in stocks has been “no pain, all gain, central planners and debt are your

friends”. The true contrarians in the market, shorting overpriced stocks, have

been placed on the endangered species list. Managers who have sat with high

levels of cash for months have lost clients seeking to chase past performance.

Only an “all in, we follow the herd” mentality, fostered by the central bankers

themselves, has paid off. Independent thinking has been crushed. Following

blindly the institution that gave no sell signals to the public at the top of

the two previous bubbles are today worshipped as the one institution that this

time, will be different. This time, they will tell us when it is time to

“taper” our addiction to “get in now”.

It is my belief, that the greatest challenge to the period of time in front of us are our deeply ingrained beliefs, that can easily be proven are false. We don’t want to change, and we especially don’t want to think that we are depending on ideas that cannot possibly be true, such as borrowing our way to success.

We have come to believe that the image of wealth is the same as true wealth; that our material wealth is superior to our human relationships. We are divided along lines of rich and poor, blacks and whites, Americans and Chinese, old and young, etc, etc. Our labeling of others, perfectly normal when we are afraid or our ideas being challenged, has kept us from seeing a much larger evil around us. An evil that is rewarding deception and corruption, and pushing power into fewer hands, while setting up the lives of millions to only seek the next solution presented to them by a small number of individuals at the highest levels of global finance and politics. This is not a conspiracy, it is out in the open for anyone who reads and thinks. This is life and it is our world in 2013!

We are following a big lie, that more debt, and less control over our futures is a good thing. Since we are busy, we go back to sleep, hit the snooze button, and wait for someone to wake us when it is time for the next thing on the schedule.

Are we not being manipulated as crowds

rather than thinking as independent individuals who still today live in free

societies? Are we so afraid of standing outside the crowd that we fear more

rejection from friends and family than kindly standing outside the crowd and

encouraging others to use their own minds?

In the last ten years I have found the comments of

investment newsletter legend Richard Russell, read by many, to be grounded in a

thorough knowledge of the fact that a debt based currency in the hands of a

small number of central bankers is NOT moving us toward more opportunities and

a stronger environment for freedom to flourish.

In the last ten years I have found the comments of

investment newsletter legend Richard Russell, read by many, to be grounded in a

thorough knowledge of the fact that a debt based currency in the hands of a

small number of central bankers is NOT moving us toward more opportunities and

a stronger environment for freedom to flourish.

In the last 50 years, I have found the

comments of philosopher and thinker, Francis Schaeffer (1912-1984) to be widely

influential on church leaders in the West. Consider Russell’s recent comments

and Schaeffer’s. Are these similar themes, one man writing in 2013 and the

other writing in 1970?

“…I believe that the law of

supply and demand is a natural law, and it's a moral law given to the planet by

God. The whole concept of creating money without toil or risk is an

integral province of the Federal Reserve. I believe that one way or

another the Federal Reserve and all it stands for will be eliminated. The

process by which this will occur worries me. I believe it will take a huge

disruption of our current economic system in order to eliminate the Federal

Reserve and its immoral process of money being created out of a computer and

thin air.

The process of creating

money from “nothing” makes a mockery of real work of all kinds. Thus, by

inference, I am calling the Federal Reserve an evil institution.” [Richard

Russell, writer of the Dow

Theory Letters, the oldest continuous investment newsletter in the world

today (started in 1958). These comments were found in an interview

with King World News on Aug 13 ’13]

with King World News on Aug 13 ’13]

“It is obvious: the future

is open to manipulation. Who will do the manipulating? Will it be the new elite

on the side of an establishment authoritarianism or another elite? Whoever

achieves political or cultural (and I would add financial) power in the

future will have at his disposal techniques of manipulation that no

totalitarian ruler in the past ever had. None of these are only future; they

all exist today waiting to be used by the manipulators…

We are surrounded on every

side with the loss of truth, with the possibility of manipulation that would

have made Hitler chuckle, that would have caused the rulers of Assyria to laugh

with glee. And we not only have the possibilities for these manipulations, but

people are trained on the basis of the loss of truth and the loss of the

control of reason to accept them….This is the end – the big lie. Our generation

is more ready to believe the big lie than any in the history of Western man.” [The

Complete Works of Francis A Schaeffer: A Christian Worldview, Volume IV

(1982), from his work, The Church at the End of the Twentieth Century (1970),

pgs 79 & 87]

My hope from writing this lengthy

article is to influence my readers with ideas that make it extremely clear that

the herd is going in the wrong direction, and that the highest authorities in

the world of money are promoting this reckless behavior. I know this is not a

happy story. I know that it is not socially acceptable. I know that reading

this article took a little time from a busy life. But if facing this magnitude

of change, should we not be warning those around us?

Millions today, like 2007 and 2000,

still have no sell signal strategy. This is not only at the individual level,

but the structure of products in the industry.

Is the mania ending as we enter

November? Will it go until the next debt ceiling crisis as we start 2014? Are

there other major issues across Europe, China, Japan, and the rest of the

currency and bond markets that could kick start a global wave of selling in

stocks, pushing investors into the next deep bear market? Since November 9th

will conclude 56 months since this “dot.com” bubble was ignited, it should be clear

to all that the upside has far less time to go than the upside we have already

seen. Expecting change should be the norm, not a continuation of the same.

Spitznagel:

This Distorted market is set up for a Crash, Business Insider, Oct 23 ‘13

Another

Shutdown, Debt Ceiling Fight (Again) and Possible End To Pay Freeze: Debts To

Watch, All Alabama, Oct 28 ‘13

The current Continuing

Resolution funds the government through Jan. 15. The debt limit agreement lasts

until Feb. 7.

Clearly, like many around me warning of

the coming breakdown of the largest debt driven bubble yet to date in history,

all we can do is rely on the plethora of history surrounding major tops that

are today part of the historical records. However, one thing is certain. People

continue to act like people. They want to be a part of a crowd so bad that they

will follow what they will later have to admit was a lie. The religious zeal of

believing that a group of global banking institutions have finally helped us

reach nirvana through unlimited debt and corruption at the root of the

financial system, solely so we will not stand outside the crowd, will in the

future leave the world asking, “Were there not laws and ideas above the laws

and ideas given us by global politicians and bankers?” At that time, I believe

asking deep questions will not be seen as a waste of time in the fast track of

life, but the basis of life itself.

“The rich rule over the poor, and the

borrower is the lenders slave” Proverbs 22:7, Solomon, app. 3,000 years ago

In my humble opinion, we should all be asking the question, “Is there a power greater than global bankers who are playing god, or have they become our gods?”

Don’t hit your snooze button. It’s time

to start waking up.

If you are concerned about the lives of those around you, and are seeking specific ideas regarding how individuals and groups can prepare for the other side of the current state feed debt bubble, please contact my office. Presentations are for all, both non- investors and investors, big as well as small. I am available for public speaking, radio interviews, and consulting.

In the meantime, to follow this incredible period of change through the lens of history, science, and a study of human behavior, subscribe to my most comprehensive research and trading commentary with a 6-month subscription to The Investor's Mind: Anticipating Trends through the Lens of History. Using the logical side of our brains, rather than enjoying the emotional comfort of the “unlimited” mania, has never been more crucial.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

Phone - (940) 591 - 3000

Best

Minds, Inc is a registered investment advisor that looks to the best minds in the

world of finance and economics to seek a direction for our clients. To be a

true advocate to our clients, we have found it necessary to go well beyond the

norms in financial planning today. We are avid readers. In our study of the

markets, we research general history, financial and economic history,

fundamental and technical analysis, and mass and individual psychology.

[next July,

then Today- ECB, China, Bank of England]