The Three Stocketeers: One for All and … August 1, 2014

Doug

Wakefield

Between

October 4, 2011, and July 3, 2014, the broadest measure of publicly traded US

stock wealth climbed $9.9 trillion. When one considers that as of the 2011 low

on October 4th total US stock wealth stood at $11.2 trillion, this

88% gain in under 3 years to produce “highest ever” records repeatedly, have

already been one for the history books, and anything but normal. So is this it?

Time will tell. But like all stock bubbles, EVERYONE WILL know that

“THE” final “all time high” is over, only after trillions in wealth have been

lost…again. Yes, we can all sit around hoping for more central planning, more

debt schemes, and more corruption by the Federal Reserve to purchase high risk

assets from the global banks dumping these assets on the books of the Fed – you

know, the bank whose mission states “provides the nation with a safe, flexible,

and stable monetary and financial system”. But morally and practically, why

would anyone think this would lead to a “stable monetary and financial system”

after looking at the historical record? Just look at the chart found at the end

of my July 15th public article, The Yuan

Stops Here. Does this chart of the Dow over the last 34 years reflect a

“stable financial system”? Why should we always think we need to be in a hurry

to get in, or never get out, when busts always reveal someone certainly

sold…and sold repeatedly.

Time will tell. But like all stock bubbles, EVERYONE WILL know that

“THE” final “all time high” is over, only after trillions in wealth have been

lost…again. Yes, we can all sit around hoping for more central planning, more

debt schemes, and more corruption by the Federal Reserve to purchase high risk

assets from the global banks dumping these assets on the books of the Fed – you

know, the bank whose mission states “provides the nation with a safe, flexible,

and stable monetary and financial system”. But morally and practically, why

would anyone think this would lead to a “stable monetary and financial system”

after looking at the historical record? Just look at the chart found at the end

of my July 15th public article, The Yuan

Stops Here. Does this chart of the Dow over the last 34 years reflect a

“stable financial system”? Why should we always think we need to be in a hurry

to get in, or never get out, when busts always reveal someone certainly

sold…and sold repeatedly.

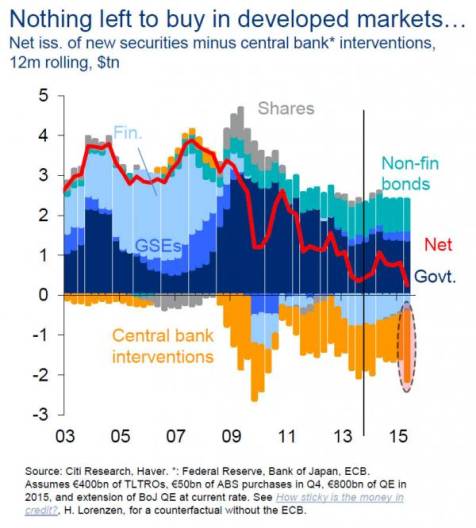

So

today, in a spirit of “one for all and all for one”, where “risk on” has seen

trillions pour into assets all over the world since the fall of 2011, and “risk

off” will see trillions pile out of those same markets in the future, I present

three

of the most watched US stock indices that this week turned from rising up to or

over their latest “1,000” marker, to selling off hard. Since crowds always

chase a rising trend, thousand level markers always prove to be a good way to

seduce investors to chase a market higher. Yet once the level is attained that

we seem so determined to reach, we have to ask the question, “Now what”? Who

will keep buying up these markets to keep pushing our investments higher in

value?

Everyone

should be asking, “What tools grow money during extreme bear markets in

stocks?” The history is there. They have been used for 4 centuries.

All for One….

Two

weeks from today is the end of monthly options for August. As we come through

this period, I would expect volatility to be strong, and the desire to continue

keeping prices elevated for the seduction that markets will once again run to

these thousand level markers and higher. Based on the last three years, the

signs of bullish extremes have shown up for so many months, that leaving this

level has been and will continue to be fought on the way down.

But

let me remind us all. For almost 3 years, these same markets have totally

dismissed incredibly negative geopolitical news and economic data as computer

algos and central bank planners have created what even they call “illusory

riches”.

Central

Bankers, Worried About Bubbles, Rebuke Markets, NY Times, 6/29/14

“An

organization representing the world’s main central banks warned on Sunday that

dangerous new asset bubbles were forming even before the global economy has

finished recovering from the last round of financial excess.

‘During

the boom, resources were misallocated on a huge scale,’ Mr. Caruana said,

according to a text of his speech, ‘and it will take time to

move them to new and more productive uses.’

‘Despite

the euphoria in financial markets, investment remains weak,’ the B.I.S. said.

‘Instead of adding to productive capacity, large firms prefer to buy back

shares or engage in mergers and acquisitions.’

The

overall, somewhat gloomy message from the central bankers was that the world

is drunk on easy money and has already forgotten the lessons of recent years.

‘The

temptation to postpone adjustment can prove irresistible, especially when times

are good and financial booms sprinkle the fairy dust of illusory riches,’

the report said. ‘The consequence is a growth model that relies too much on

debt, both private and public, and which over time sows the seeds of its own

demise.’” [Italics my own. Because of its significance, this same

statement is in my July 15th public article.]

Now

I ask you, whether you are an investor, advisor, or hedge fund manager with

billions, when the granddaddy of all central banks, the Bank of International Settlements, makes a

statement like this merely a month ago, and we see price action like we have

seen this week not only in US stocks, but many other global stock and bond

markets, does it not seem to be time to “swing into action” with our brains?

Does developing an exit plan really seem all that strange at this juncture of

the boom phase?

We

have already seen the last 64 months produce a rally equal in size to one that

took 186 months to achieve between 1984 and 2000. How much more is enough,

before the crowd shifts from greed to fear?

The Fourth Stocketeer

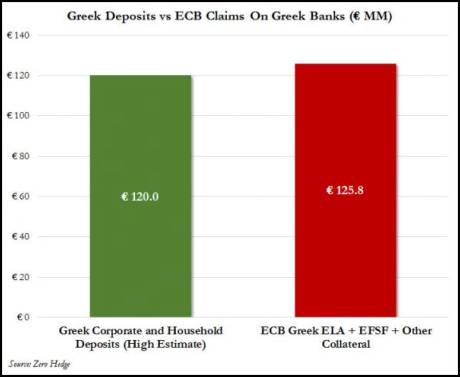

The

last market we look at represents the country that has been Europe’s strongest

economy since we started hearing “European debt crisis” in 2010. Since

Germany’s DAX index has broken down from its 10,000 level, a level it only

achieved for the first time ever in the last 2 months, would this not also be a

warning sign to investors that never selling or reducing exposure to a market

is unwise? It is obvious selling has been picking up since the start of July in

German stocks.

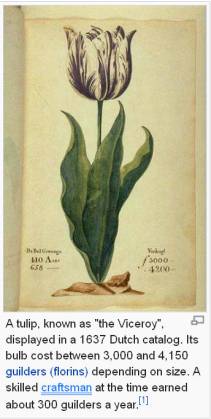

“The seeds of the tulip

mania have been the unattainable lure of fashionable and rare tulips,

combined with the newly accepted practice of substituting more common bulbs to

meet that appetite. But the mania reached full bloom only with the innovation

of forward contracts and the leverage contracts afforded, which allowed traders

to buy and sell commodities they did not own, had no intention of owning, and indeed

did not even have the money to purchase outright.” [A

Demon of Our Own Design: Markets, Hedge Funds, and the Perils of Financial

Innovation (2007) Dr. Richard Bookstaber, pg 177. Bookstaber’s

background includes director of risk management at Ziff Brothers Investments

and Moore Capital Management, one of the largest hedge funds in the world. He

also served as managing director of risk management at Salomon Brothers during

the collapse of Long Term Capital Management in 1998, and was Morgan Stanley’s

first market risk manager during the 1987 collapse.]

“The seeds of the tulip

mania have been the unattainable lure of fashionable and rare tulips,

combined with the newly accepted practice of substituting more common bulbs to

meet that appetite. But the mania reached full bloom only with the innovation

of forward contracts and the leverage contracts afforded, which allowed traders

to buy and sell commodities they did not own, had no intention of owning, and indeed

did not even have the money to purchase outright.” [A

Demon of Our Own Design: Markets, Hedge Funds, and the Perils of Financial

Innovation (2007) Dr. Richard Bookstaber, pg 177. Bookstaber’s

background includes director of risk management at Ziff Brothers Investments

and Moore Capital Management, one of the largest hedge funds in the world. He

also served as managing director of risk management at Salomon Brothers during

the collapse of Long Term Capital Management in 1998, and was Morgan Stanley’s

first market risk manager during the 1987 collapse.]

As

I stated in my last public article, no matter what nation we call home, history

does not bend to our plans, but it is our plans that bend to history.

Have We Just Started the Switch from Boom to Bust?

If

you are not spending hours connecting the dots of these powerful world trends,

I would strongly suggest the paid research newsletters and trading

reports available with a

six month subscription to The Investor’s Mind. Money is always moving. Bulls become bears and bears become

bulls.

When

you consider that the 2002-2007 run took 60 months to produced $8 trillion in

US stock wealth, and then lost it all over the next 13 months, the cost of good

research and critical thinking is about to become extremely small considering

the money that can evaporate in the period ahead.

*

Riders on the Storm: Short Selling in Contrary Winds (Jan ’06) was a

research paper I wrote on how investors are deceived, and contains interviews

with industry famous contrarians. It can still be downloaded

for free today.

Doug Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that

looks to the best minds in the world of finance and economics to seek a

direction for our clients. To be a true advocate to our clients, we have found

it necessary to go well beyond the norms in financial planning today. We are

avid readers. In our study of the markets, we research general history,

financial and economic history, fundamental and technical analysis, and mass

and individual psychology.