Forgetting

the Past

March 16, 2012

Life

is good. Today, Apple’s

new Ipad went on sale, and yesterday, March 15th, its

stock topped $600 a share. The company’s market size is larger than the

entire US retail sector, Exxon (formerly

[Source,

Zero

Hedge, 3/14/12]

Yet,

something appears wrong with this story of “unlimited wealth”. Something seems

familiar about this story from our past. The headlines today, read like ones I

have read before.

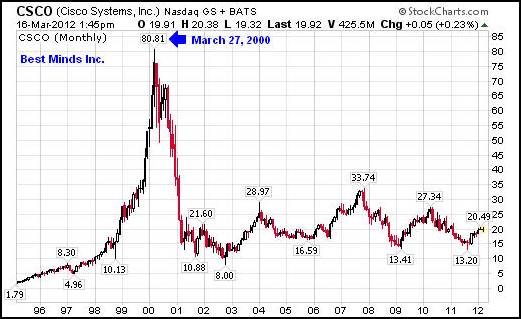

Firm’s

Market Cap Climbing to $1 Trillion, Silicon Valley/San Jose Business

Journal, March 19, 2000

One trillion dollars.

That's how much at least one analyst believes

Cisco Systems Inc.Cisco

Systems Inc.will be worth in a few years--and you'd be hard

pressed to find anyone to disagree.

The San Jose-based networking behemoth's stock

closed March 14 at $131.75 a share, slightly down from its March 10 one-year

high of $141.88 (The entire Nasdaq slid 4 percent on March 14.)

Thirty-seven investment banks recommend either a

"buy" or a "strong buy." None recommend a "sell"

or even a "hold."

On any given day the volume of Cisco shares

traded is the equivalent of every man, woman and child living in

Paul Weinstein, an analyst with Credit Suisse

First Boston, believes a $1 trillion market capitalization (stock price

multiplied by shares outstanding) is within reach in a few years. He said

Cisco's stock has increased 1,000 times, a perfect 100 percent annual return

since it launched its IPO in 1990.

"We humbly submit that over the next two to

three years, Cisco could be the first trillion dollar market cap company--and

don't think they wouldn't love it," Mr. Weinstein wrote in his

"strong buy" recommendation.

As of March 14, Microsoft's market cap stood

about $510 billion, compared with Cisco's $465 billion, which is threefold the

annual revenue of the state of

Cicso,

Apple, and the Race to $1 Trillion Market Cap, Silicon Valley/

Apple’sstock

run-up to $500 earlier this month had some wondering if we may see the first

trillion-dollar public company around the corner.

It's

something that hasn't happened before but a number of analysts insist the

But

those with long memories recall that another Silicon Valley company, CiscoSystems,

appeared on a similar path to trillion-dollarhood back in the days of the dot

com bubble.

So

it's worth remembering that in the stock market, what goes up has a way of also

going down, and it's usually best not to get too far ahead of things. Since

hitting a high of $526.29, Apple has slid back to around $511 a share.

What happens when

one stock is owned by 216

hedge funds, 788

stock mutual funds, and makes up more than 17%

of the NASDAQ 100 index? What if the NASDAQ 100 became too concentrated in

a few stocks, until almost 50% of what an investor owned were only 5 companies?

What happens if the crowd starts to sell this stock, seeking to lock in

parabolic gains?

NASDAQ

100 May Soon Be Held Hostage to Apple, Other Tech Behemoths, Huffington

Post, March 9, 2012

Apple

Inc was cut to 12.3 percent from 20.5 percent of the index in April 2011, but a

surge in price has pushed it back up to 17.2 percent -- and the other big names

have seen their share prices balloon as well.

A rebalance of the index will be triggered if Apple grows to more than 24

percent, or if the collective weight of all components over 4.5 percent exceeds

48 percent.

Along with Apple, the four names dominating the average are Google Inc ,

Microsoft Corp , Intel Corp and Oracle Corp . The growth of the top five

companies increases the likelihood that the biggest names in the average will

soon make up 48 percent of the Nasdaq 100 <NDX>.

"When you construct an index that is supposed to be a market benchmark, it

shouldn't just represent a handful of names," said Bronzo.

When you look at

the information above, does it look like investors, both retail and

professional money managers, have learned anything from what took place in March

12 years ago? Have investors, advisors, and money managers become so confident

in the smooth ride up from a bottom in November that they BELIEVE whatever

story endorses their investment savvy in deciding to get on this rocket? What

will happen if a few managers decide to sell 10% of their holdings in order to

take gains and trim their over weighted positions, or something from the real

world causes investors to become less confident in equities?

As we close out

another options week, we have seen the Dow climb 13 straight weeks over 60

trading days, closing down more than 100 points only twice in this stretch.

Those selling out or going short appear as anything but fools, while those

holding on or buying in appear to be geniuses. Yet we all lived through 2000

and 2007, so why not look at some numbers, as I did in my May 2, 2011 article, The

Gallery of Crowd Behavior Returns, to see if we can discover any patterns

with the two largest stock bubbles in American history.

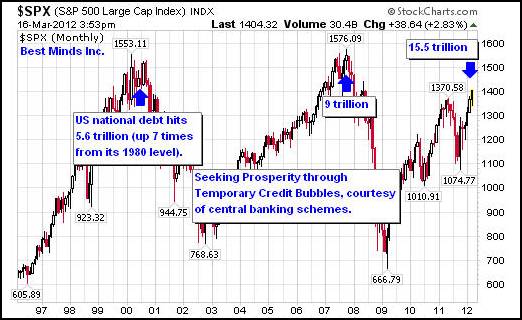

As we can see

from the three charts above, the last 60 days, has produced a smoother ride up

than the final days into the top of 2000 or 2007, thus providing such a

positive emotional experience for investors and traders worldwide, that

preparing for the latest credit bubble to burst is off the radar screen of

millions. However, if we look at debt levels, the greatest lie in modern

history has been and continues to be that by handing our money and lives over

to a small group of individuals to centrally plan a continuous stream of

trillion dollar (or euro or yen) bailouts, that we will continue on the road to

higher “success”.

On November 16,

2011 the US National Debt topped $15 trillion for the first time. On November

25, 2011, Apple stood at $363. On March 16, 2012, the US National debt stands

at $15.5 trillion, and Apple topped the $600 level yesterday. The US national

debt has grown by a half a trillion in 4 months, and Apple has seen its market

cap grow by almost a quarter of a trillion in 4 months. My bet is that one of

these will continue to climb strong, and the other will start descending soon.

But of course, who am I to question the wisdom of “the market” and rising debt

levels.

“If

you go into these offices [stock brokerage offices] when stocks are rising, you

will find a lot of people buying stocks. What I want you to notice is that they

are all buying. And they always buy when stocks are on the upward grade.

Probably one person out of twenty of your people out West play the other side

of the market, and sell short. All the rest buy…..Now remember this thing, when

stocks are moving up, as they now are, it’s the worst sort of time to buy

either for investment or speculation. But you people out West will never learn

that fact, no matter how hard you get hit, no matter how much you may suffer.

You come back again to the game on each rising market, only to be among the

losers when the next bear market comes along, as it inevitably does. …You are

like a flock of sheep following after a bell weather. You never sit down and

think and ask any questions. Now it’s this fact that Wall Street banks on about

once a year. The time to sell is when everybody out West is buying.” [The

Confessions of a Monopolist (1906) Frederic Clemson Howe, pg 54]

The quote on the

banner of the Best Minds Inc website has been the same since going live in

2005. “Those who cannot remember the past are condemned to repeat it,” by

George Santayana. It seems more pertinent today, 7 years later, than it did

then.

If you are interested in our most comprehensive research

and trading commentary, consider a subscription to The Investor's Mind:

Anticipating Trends through the Lens of History.

President

HUBest Minds Inc.UH, a Registered Investment Advisor

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Best

Minds, Inc is a registered investment advisor that looks to the best minds in

the world of finance and economics to seek a direction for our clients. To be a

true advocate to our clients, we have found it necessary to go well beyond the

norms in financial planning today. We are avid readers. In our study of the

markets, we research general history, financial and economic history,

fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as

advice to buy, sell, hold, or sell short. The safest action is to constantly increase

one's knowledge of the money game. To accept the conventional wisdom about the

world of money, without a thorough examination of how that "wisdom"

has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice

from a wide variety of individuals, and at any time may or may not agree with

those individual's advice. Challenging one's thinking is the only way to come

to firm conclusions.

Copyright © 2012 Best

Minds Inc.