Destroy A Currency, Extend A Rally Nov 7, 2014

Doug

Wakefield

What

was I thinking? Goodbye

All Time Highs? I must have lost my mind to have forgotten that central

bankers have unlimited tools to inflate stock bubbles.

Actually,

the last 2 weeks have only shown me even more, how desperate the actions of

central banks, and how passionate the majority of traders just to hear the

words, “all time high” one more time.

But

as always, I encourage you NOT to take my word or my opinion, but to think for

yourself. Is it really worth a few more

days of a power rally, solely at the continued expense of a nation’s currency

and entire economy?

[Source

– Markets

Explode Higher As Bank of Japan Goes All-In-er; Increases QE To JPY 80 Trillion,

Zero Hedge, Oct 31 ‘14]

First,

we can see from the chart above, that an announcement made the Bank of Japan to

increase yet once again their debt load and direct purchases of their own stock

market, contributed to the 1,000 points rally in under a day. That’s right, by

printing up more debt out of thin air, and tripling their purchases of exchange

traded funds based on the Nikkei, we have “victory”. But at what costs?

Considering

the fact that this announcement was made on Oct 31st, and two days

earlier the Federal Reserve’s QE program would go to zero effective November

1st, the next “support” for the stock bubble by the global central bankers

certainly arrived quickly.

Fed

Ends 6 – Year Effort To Stimulate Economy, CNN Money, Oct 29 ‘14

Bank

of Japan Sails Further Into Uncharted Territory, WSJ, Oct 31 ‘14

When

looking at some indicators of “extreme happiness” coming in this last week, it

would seem that the “nirvana effect” for stocks roared back even stronger than

the price movement of US and Japanese stocks.

The

bearish percentage of AAII (American Association of Individual Investors) survey dropped to a multi-year low of 15%,

Investor’s Intelligence reported that newsletter bulls jumped the most in 40

years, and investors poured $17 billion into S&P 500 exchange traded funds

over the two weeks ending on Oct 31st, marking a 4 year high. *

So

how could I have been so foolish two weeks ago, to have stated “Goodbye

All Time High” in the title of an article. Actual, it is simple. I had

believed then, as I do even more now, that time was running out on “all time

high” stock headlines. As of today, since that has already occurred again, the

question now becomes, “So now what?”

Are things once again “back to normal”?

Are

we mad? Do any of these “experts” ever consider the longer-term problem of

selling these ever expanding war chests of assets owned by the Bank of Japan…or

European Central Bank, or Federal Reserve, etc, etc? After six years of these

same tricks, in an attempt to convince the public that wilder speculation is

equal to economic growth, isn’t it time to admit that printing up even MORE

debt, is a negative rather than a positive for the long term success of capital

markets or the economic life of nations?

Of course, who wants to look for long-term solutions, when you can

create the “image” of financial “success” in a day.

For

6 years, the world’s central banks have acted in the role of “purchaser of last

resort”, adding trillions in additional debt to the nation states of the world,

and placing an even larger drag on global economic growth.

While

the last 3 weeks have produced the image of “unstoppable bull”, it has also

followed a great lesson one of my subscribers, a professional trader, shared

with me several years ago. The idea; when you look at where money is going into

or leaving, look at other markets in the world to determine where that money

could be following a totally opposite path.

So

in a world focused on “stocks always go up because central bankers have our

backs”, let me turn to Albert Edwards, Co-Head of Global Strategy at Societe

Generale, and a chart of where money was EXITING.

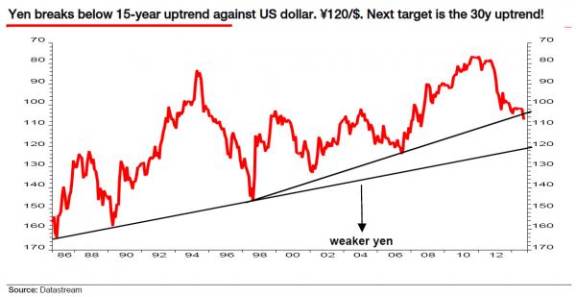

[Source

– Albert

Edwards Presents “The Most Important Chart for Investors”, ZH, Sept 22 ’14,

repeated again in “The

Most Important Chart for Investors” Flashback, and Why USDJPY 120 Is Now Coming

Fast, ZH, Oct 31 ‘14]

The

top price in the strengthening yen trend was attained on Oct 27, 2011. With

this in mind, the big move down in the yen, and up in the Nikkei last Friday,

Oct 31st, must be seen as a desperate attempt to keep “pushing on a

string”, or a trend that has already been in place for 3 years. The holdings by

the commercial hedgers -the very well

financed money – have also been showing extremes in the US dollar, euro, and

yen over the last couple of months, and anyone who understands futures,

understands that when the commercial hedgers are at extremes, it is the crowd

that has managed to find themselves at the total opposite end of the seesaw.

On

Thursday, Oct 30th, the USDJPY stood at 108.73. Today, six trading

days later, it stood at 115.57.

Clearly, if this trend does continue at this pace, the yen would hit its

30-YEAR trendline of 120 in another week or so. Then what?

Either

way, the extreme volatility we have watched since the Sept 19th

high, continues to remind us that it would be very naďve at this stage in a

68-month rally from the March 2009 bottom to expect an ending stream of “all

time high” headlines, with no longer term market consequences. At some point,

central bankers must face the reality of acting as “purchasers of last resort”

for the last six years.

[Source

of two chart of the S&P 500 was Charles Hugh Smith in his recent article, About

that “S&P Will Be 2,150 by Christmas” Call, Nov ‘14.]

“Vogue

editor Diana Vreeland’s motto, ‘Fake it, fake it’, is now the First Commandment

of the spin-doctor and the commercial maker. As Vreeland advises, ‘Never worry

about the facts. Project an image to the public.’ The art of success is to

create a world ‘as you feel it to be, as you wish it to be, as you wish it into

being.’” [When

No One Sees: The Importance of Character in an Age of Image (2000), Os

Guinness, pg 2.2]

Isn’t

it time to “worry about the facts”?

Careful

What You Wish For: Plunging Yen Leads to 140% Surge in Bankruptcies, ZH,

Oct 30 ‘14

*

The stats were pulled from the home page of www.sentimentrader.com.

Complacency Time Has Gone

If

you have no experience in growing money on the downside of a financial

bubble, I cannot think of a better time to subscribe to The Investor’s Mind. It

is amazing with all the hype given “another all time high” since the start of

2013, how little attention has been given to various world markets that have

not returned to that level since reaching it in 2008, 2000, and yes, even 1990.

The

cost for procrastination is rising rapidly, and the value for good research

becoming extremely low in comparison to the speed in which wealth can be

destroyed. Click here

to start the next six months reading the newsletters and trading reports as

we come through this incredible period in market history, and attain my latest

special edition of The Investor’s Mind: At the Top of the World. This issue,

completed on Oct 23rd, will be completely revised two weeks from

today, November 21st, when monthly equity options expire.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that

looks to the best minds in the world of finance and economics to seek a

direction for our clients. To be a true advocate to our clients, we have found

it necessary to go well beyond the norms in financial planning today. We are

avid readers. In our study of the markets, we research general history, financial

and economic history, fundamental and technical analysis, and mass and

individual psychology.