Always Bet On Black March 19, 2014

Doug

Wakefield

Do you remember the

following headline from the fall of 2011?

“In

the Absence of a Credible Plan We Will Have A Global Financial Meltdown in Two

or Three Weeks” [states] Dr. Robert Shapiro, Advisor to the IMF, Zero

Hedge, October 6, 2011

How

about this one from June 2012?

[Spanish]

Bankia Customers Pull Out Over 1 Billion Euros, Reuters,

May 17 ‘12

Or

some of these from December 2012 through December 2013?

Ben

Bernanke: If We Go Over The Fiscal Cliff, The Fed Can’t Help, Huffington

Post, Dec 12, 2012

Wall

Street Drops After Bernanke Hints At Slowing Stimulus, Reuters, June 19,

2013

‘War-Weary’

Obama Says Syria Chemical Attack Requires Response, CNN, August 30, 2013

Standoff

In the Mediterranean: The US vs Russian Navies, Zero Hedge,

Sept 5, 2014

Jack

Lew [US Treasury Secretary] Warns That A Default Could Cause ‘Irrevocable

Damage’, Huffington Post, Oct 10, 2013

Markets

Rally As Traders Take Taper in Stride, The Guardian,

Dec 19, 2013

And

the most recent drama centered on Ukraine, and involving Russia, the EU, and

the US?

Stocks

Hit By Global Worries; Dow’s Worst Session Since Feb 3, CNBC, Mar 13, 2014

Did

Russia Just Move Its Treasuries Offshore?, WSJ, March 14, 2014

US,

G-7 Allies Won’t Recognize Crimea Election Results, The Hill,

March 12, 2014

Crimea

Will Formally Apply To Join Russia Tomorrow After 95.5% Support Referendum; US,

UK, EU Reject Results, Zero Hedge,

March 16, 2014

US,

EU Levy Sanctions on Russia, Ukraine Officials After Crimea Vote, LA Times, March 17, 2014

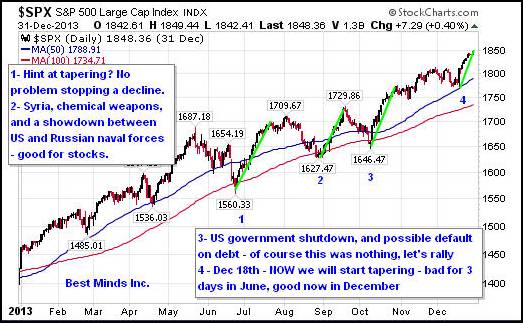

So

what do these “pessimistic” headlines have in common? US stocks bottomed at or

shortly after these headlines. That’s right. None of them lead to a crisis or

hard sell off. All were “signals” to buy stocks.

What

in the old days could be explained as negative news that sent traders and

investors to the sidelines, in the brave new world, for 2 ½ years, has been

seen as a “positive” for buying stocks.

See

for yourself. This is not forecasting the future, but merely examining the

past.

At

this point, the inevitable, “well this could continue much longer” continues to

be the most widely acclaimed investment mantra. Yet I ask you, why do life insurance companies charge higher

premiums to an 80 year old than they do a 50 year old? Is it not because risk

is rising, as we get older?

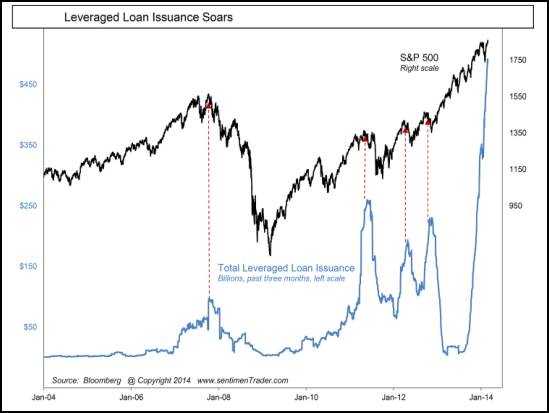

Eventually,

whether consciously or unconsciously, the norm becomes “Buy the dip and EXPECT

there to be another all time high very soon”, or “Why would anyone ever want to

sell?” The longer the money manager or investor bets on black and wins, the

greater the confidence to continue down the exact same path.

Even

the most recent all time high on March 7, 2014 saw only a 2.3% decline in the

S&P 500 during the 5 trading days leading up to last weekend’s vote in

Crimea, which we now know lead to their independence from Ukraine. As one could

find out easily with a little reading, the global impact caused by economic

militant actions that could be taken by Russia, Europe, the US, and possibly

even China, make the stakes higher this week than last. So as markets turn

right back up, so also do risk levels.

Yet

sadly, millions of investors and advisors are receiving a message from watching

US stock prices that is 180 degrees opposite from what anyone considering

global economic and financial risk would attain from looking at factors OUTSIDE

of stock prices. Consider these factors:

“Russia is Europe’s largest natural gas supplier,

supplying one-third of the continent’s natural gas.” [To

Understand What’s Really Happening in the Ukraine, Follow the Gas Lines on This

Map, PolicyMic, March 10, 2014]

“In 2014, EU-Russia overall trade stands at around

360 billion Euros [currently app $500 billion US dollars] per year. …The EU is

also the largest investor in the Russian economy and accounts for 75 percent of

all foreign investments in Russia.” [Ukraine’s

Crisis: Economic Sanctions Could Trigger a Global Depression: News Junkie

Post, March 15, 2014]

“Russian

companies are pulling billions out of western banks, fearful that any US sanctions over

the Crimean crisis could lead to an asset freeze, according to bankers in

Moscow.

Sberbank

and VTB,

Russia’s giant partly state-owned banks, as well as industrial companies, such

as energy group Lukoil,

are among those repatriating cash from western lenders

with operations in the US. VTB has also cancelled a planned US investor summit

next month, according to bankers.” [Russian

Companies withdraw billions from the West, Say Moscow Bankers, Financial

Times, March 14, 2014]

“China's

top envoy to Germany has warned the West against punishing Russia with sanctions

for its intervention in Ukraine, saying such measures could lead to a dangerous

chain reaction that would be difficult to control….

"We

don't see any point in sanctions," [Chinese Ambassador to Germany] Shi

said. "Sanctions could lead to retaliatory action, and that would trigger

a spiral with unforeseeable consequences. We don't want this." [China

Warns of Dangerous Russia Sanctions ‘Spiral’, Reuters, March 13, 2014]

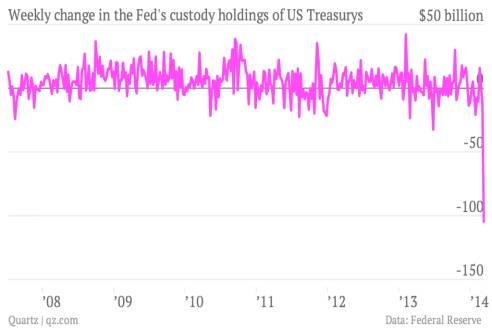

“Somebody just yanked $105

billion dollars worth of US government bonds out of the Federal Reserve,

according to the latest data from the US central bank.”[And

now, it looks like Russia may be messing with the Fed, Quartz, March 15,

2014]

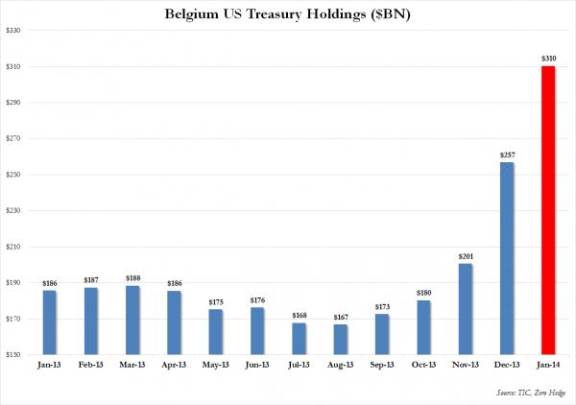

“…as

of January, the US has a brand new third largest holder of US Treasuries, one

which in the past two months has added over $100 billion in US Treasury paper,

bringing its total from $201 billion in November, to $257 billion in December,

to a whopping $310 billion at January 31.

The

country? Belgium”

[Meet

The Brand New, and Shocking, Third Largest Foreign Holder of US Treasuries,

Zero Hedge, March 18, 2014]

If you are

familiar with European politics, you recognize Brussels,

Belgium as the de facto capital of the European Union, home of the

European Commission, the Council of the European Union, and one of two homes

(the other being Strasbourg, France) of the European Parliament.

So

who decided to move $100 billion in the week ending March 12 away from the

Fed’s custody accounts for Foreign Official

and International Accounts? Did the European Central

Bank, home in Brussels, Belgium, have anything to do with the massive

increase in US Treasury holdings over a 2 month time period ending as of

January? If so, why the sudden enormous movement of US Treasury holdings?

Based

on everything we have briefly covered in this short article, can you think of

why all of this information should be dismissed, and we should place all of our

faith on US stock prices going nowhere but up, solely because that is what they

have been doing?

[Source

– Is It A

Bubble Yet?, Zero Hedge, March 12, 2014]

If

the casino let you win over and over and over again by betting on black, would

you really keep pushing all the chips back on black? Worse yet, if you had won

all those times by doing nothing but leaving your chips on the table, would you

really be surprised to wake up some day to find that the last roll landed on

red, and your chips had been taken by the dealer?

“If we were going to conduct a financial war, we needed people who knew how to use financial weapons – such as front running, inside information, rumors, ‘painting the tape’ with misleading price quotes, short squeezes and the rest of the tricks on which Wall Street thrives.” [Currency Wars: The Making of the Next Global Crisis (Aug 2012) James Rickards, pg 9 of 254, Kindle Edition. * - Rickards was one of about 60 experts to take part in the first ever financial war game, sponsored by the Pentagon, and conducted at the Applied Physics Laboratory in 2009.]

·

Starting Friday, March

21st, The

Investor’s Mind will be issuing a second newsletter for the retail investor and

advisor who have little or no experience trading, yet have come to

understand that bubbles always end and time is running out to prepare for the

next major chapter in financial history. This publication will be available

along with the current publication, The Investor’s Mind (began in Jan ’06), at no extra cost. A subscription to The

Investor’s Mind will bring to you the current newsletter and trading

publication, as well as the new newsletter for retail investors and advisors.

As we all saw from 2008, the “buy and never sell” strategy has extreme

consequences. We cannot continue to trust central banks to merely reflate

brokerage statements when global bubbles burst.

·

I am available for

public speaking, radio interviews, and consulting. Presentations are for all,

both non- investors and investors, big as well as small. Please contact my office

for more details.

·

In the meantime, for

those of you seeking a wide range of opinions based on a study of history,

science, and a study of human behavior as we live through this incredible

period of change, subscribe to my most comprehensive research and market

commentary with a 6-month subscription to The Investor's Mind:

Anticipating Trends through the Lens of History, and download my rare

research paper on short selling, Riders

on the Storm: Short Selling in Contrary Winds (Jan ’06), which spells out

major areas of systemic risk that advisors are not taught as part of their own

conventional education, as well as solutions for periods when assets deflate in

value.

Doug Wakefield

President

HUBest Minds Inc.UH, a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

Phone - (940) 591 - 3000

Best

Minds, Inc is a registered investment advisor that looks to the best minds in

the world of finance and economics to seek a direction for our clients. To be a

true advocate to our clients, we have found it necessary to go well beyond the

norms in financial planning today. We are avid readers. In our study of the

markets, we research general history, financial and economic history,

fundamental and technical analysis, and mass and individual psychology.