10 years of “Why Sell Now?” Dec 11,

2014

Doug Wakefield

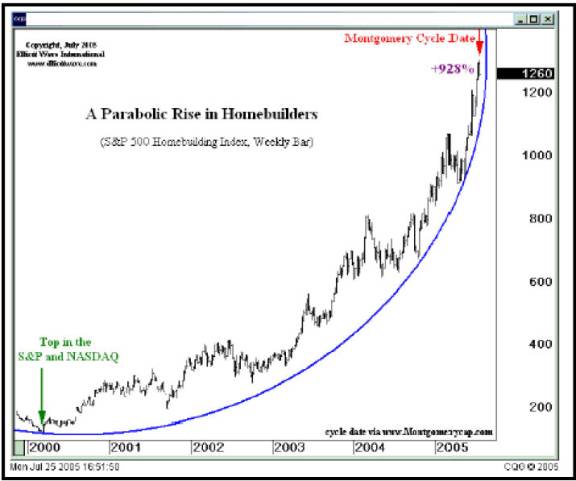

While

finding the end of the largest financial bubble in history has proved very

illusive over the last three years for some of the most seasoned market

technicians in the world, the last fifteen have allowed us to have many

reminders that wild rides to the top have always ended the same.

[Chart produced by www.elliottwave.com, Steve Hochberg’s

Short Term Update, in July 2005. This piece of history, along with many market

technicians and historians, can still be found in a free newsletter I released

in July 2005, called Teenage

Investing.]

Anyone

looking at the historical data at the end of 2014, can see that July 2005 was

the last time an “all time high” was

attained in this housing index. This is not an opinion; it is a fact.

[Source

– My public article, Let the Buyer

Beware, July 27 ‘2007]

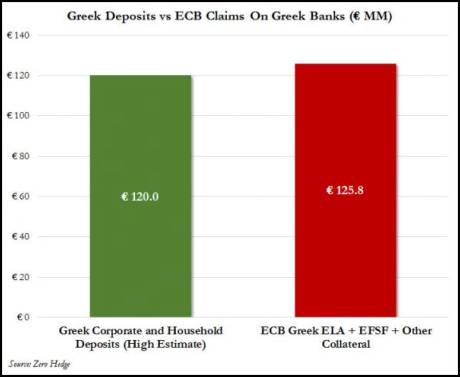

July

2007 wasn’t another period prior to bank stocks soaring to new highs. By that

point, it was an early warning of a depression level collapse.

[Source

– Fear and

Perception, Nov 1, 2007]

“In January of 2006, investors opened an average of 2,708 brokerage accounts per day. By August of 2007, the average had grown to 450,000 individuals accounts opened per day. Is the difference comprised of individuals who are thoroughly investigating companies' economic fundamentals and the sustainability of their stock prices? Are they seeking to understand when these historic leaps will end, or are they looking for any story that supports the view that China's markets will only go up?” [Fear & Perception, Nov 1 ‘07]

[Source

– The

Gallery of Crowd Behavior Returns – May 2, 2011/ Yes, those misspellings

irritate you!]

“Based

on this information, it would seem extremely important for anyone depending on our

global capital markets to pay attention to trends in the US dollar and Euro.

From looking at the charts below, and once again considering the comments of

Mr. Sperandeo earlier, it would appear that a massive change in direction

should be expected for these two aircraft carriers.” [The Gallery of Crowd Behavior Returns, May 2,

2011]

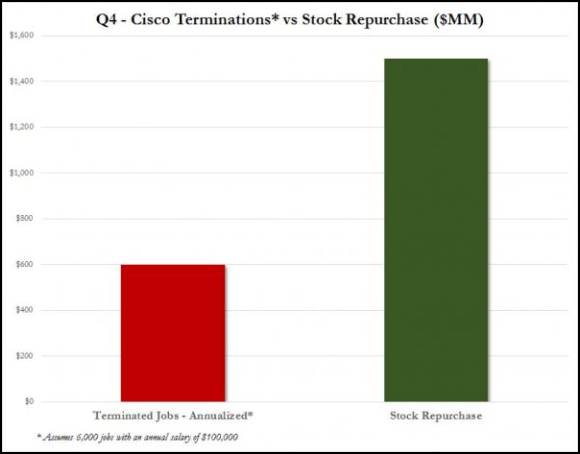

[Source

– The

Gallery of Crowd Behavior: Goodbye All Time Highs, Oct 30 ‘14]

[Source

– The

Gallery of Crowd Behavior: Goodbye All Time Highs, Oct 30 ‘14]

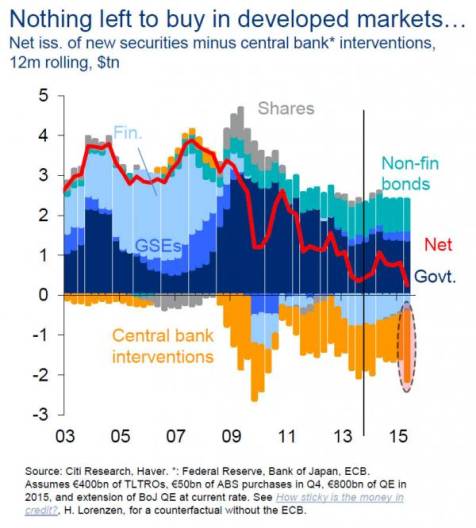

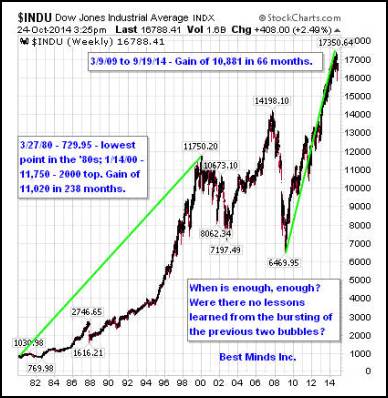

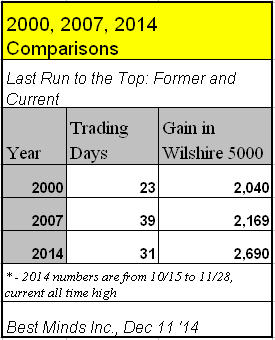

As

we head for the close of 2014, and looking at current and former rapidly rising

price movements, would one really be all that surprised to find 2015 radically

different from the last few years? Considering how much debt has been created

merely to stall this “all time high” bubble, would we not expect the downside

of financial assets globally to be extremely severe?

Global

Debt Exceeds $100 Trillion as Governments Binge, BIS Says, Bloomberg, Mar 9

‘14

“The

amount of debt globally has soared more than 40 percent to $100 trillion

since the first signs of the financial crisis as governments borrowed to

pull their economies out of recession and companies took advantage of record

low interest rates, according to the Bank of International Settlements.

The

$30 trillion increase from $70 trillion between mid-2007 and mid-2013 compares

with a $3.86 trillion decline in the value of equities to $53.8 trillion in the

same period, according to data

compiled by Bloomberg. The jump in debt as measured by the Basel,

Switzerland-based BIS in its quarterly review is almost twice the U.S.’s gross

domestic product.

Borrowing

has soared as central banks suppress benchmark interest rates to spur growth

after the U.S. subprime mortgage market collapsed and Lehman Brothers Holdings

Inc.’s bankruptcy sent the world into its worst financial crisis since the

Great Depression.….

‘Given

the significant expansion in government spending in recent years,

governments (including central, state and local governments) have been the

largest debt issuers,’ according to Branimir Gruic, an analyst, and Andreas

Schrimpf, an economist at the BIS. The organization is owned by 60 central

banks and hosts the Basel Committee on Banking Supervision, a group of

regulators and central bankers that sets global capital standards.” [italics

mine]

Bank for International Settlements warns on riskier

loan deals, Financial Times, Dec 10, 2014

“Top

central bankers have warned that investors are underestimating the risks in

racier “sliced and diced” loans. European sales of such bundled loans have more

than quintupled over the past year to the highest volume since they were blamed

for sparking a global financial crisis.

The

Bank of International Settlements — dubbed “the central bankers’ bank” — said

riskier subordinated, so-called “mezzanine”, portions of asset-backed

securities are subject to “considerable uncertainty” due to a “cliff effect”

whereby only a small error in projecting potential losses would magnify

their risks substantially, according to a research paper.” [italics mine]

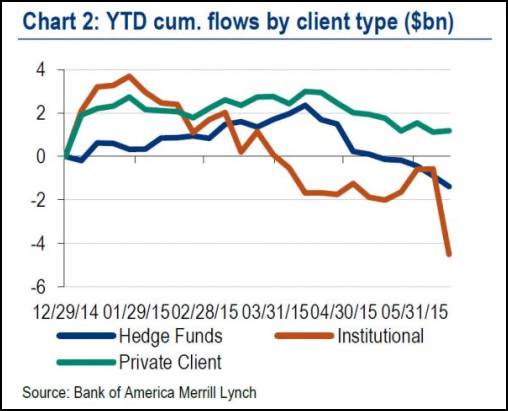

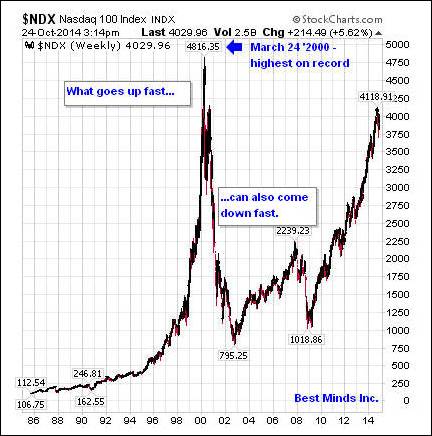

One

thing is for certain. The memory of the 83% decline in the NASDAQ between 2000

and 2002 has long since been forgotten in a world of “money for nothing”.

[Source

– The

Gallery of Crowd Behavior: Goodbye All Time Highs, Oct 30 ‘14]

"So the Fed kept filling up the punch bowl [referring to the period between 2002

and 2005]. And as opposed to going into inflation of goods prices, it went into

an inflation of asset prices.

"So the Fed kept filling up the punch bowl [referring to the period between 2002

and 2005]. And as opposed to going into inflation of goods prices, it went into

an inflation of asset prices.

That's inflation in the same way, but its not

called inflation. So if the stock market goes up we don't say, 'Oh my god,

there has been inflation', or if housing prices double we don't say 'oh my god,

there has been this enormous inflation', we say, 'How much richer we are!' But

the problem is that we are not richer, it is simply an illusion of

richness." Dave Colander -

Professor of Economics at Middlebury College (Money for Nothing: Inside the

Federal Reserve, minute 59:00)

“But

those who want to get rich fall into temptation and a snare and many foolish

and harmful desires which plunge men into ruin and destruction.” I Timothy 6:9

Complacency Time Has Gone

If

you have no experience in growing money on the deflationary side of an inflated

financial bubble, I cannot think of a better time to subscribe to The

Investor’s Mind. Denial and procrastination are not a plan of action. New

strategies will be needed.

Next

week, I release a new thinking newsletter, The Investor’s Mind: Second

Opinion, Lessons from the last 10 years. Each issue will provide questions

and history most individuals never consider, because deflationary periods have

been experienced so rare for most in the West in the last 40 years.

However, deflation changes everything once the illusion of the latest inflated

bubble burst.

The

information is designed to benefit both group and individual planning.

The

issues we are facing are far larger than trading or investing. In each issue, I

will refer back to my public and private writings over the last decade. It has

been quiet a ride, with so much great material from many incredible people and

sources. Based on the many “first in history” events we have seen, and will

continue seeing”, I can not think of a more critical time to challenge the “we

have always done things this way” idea.

Click here to start the

next six months reading both the original version of The Investor’s

Mind (started in Jan ’06),

market sensitive trading reports, and the new version, The Investor’s Mind:

Second Opinion.

Doug

Wakefield

President

Best Minds Inc. a Registered Investment

Advisor

1104

Indian Ridge

Denton,

Texas 76205

Phone

- (940) 591 - 3000

Best Minds,

Inc is a registered investment advisor that looks to the best minds in the

world of finance and economics to seek a direction for our clients. To be a

true advocate to our clients, we have found it necessary to go well beyond the

norms in financial planning today. We are avid readers. In our study of the

markets, we research general history, financial and economic history,

fundamental and technical analysis, and mass and individual psychology.